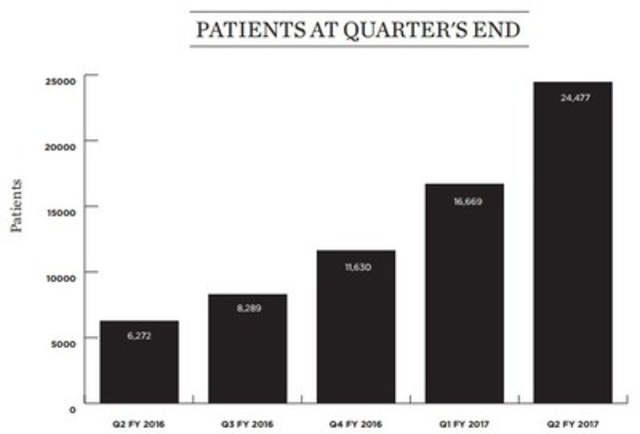

Registered patients increase 47% during quarter to over 24,400

SMITHS FALLS, ON, Nov. 14, 2016 /CNW/ - Canopy Growth Corporation

(TSX: CGC) ("Canopy Growth" or "the Corporation") today released its financial results for the second quarter fiscal 2017 ended

September 30, 2016. All financial information in this press release is reported in Canadian

dollars, unless otherwise indicated.

Consolidated financial results include the accounts of the Company and its wholly‑owned subsidiaries Tweed Inc. ("Tweed"), Tweed

Farms Inc. ("Tweed Farms") and Bedrocan Canada Inc. ("Bedrocan Canada").

Second Quarter Fiscal 2017 Highlights

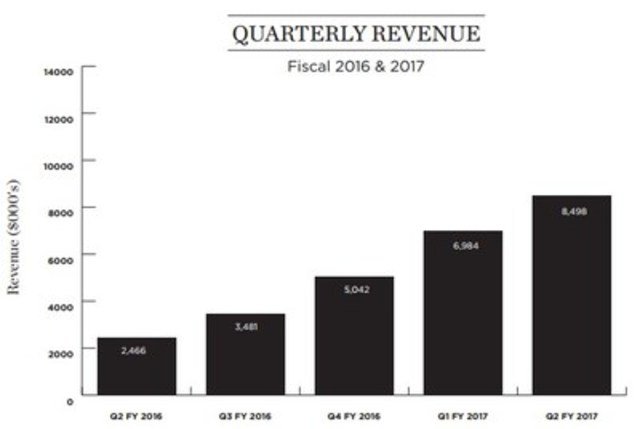

- Revenue of $8.5 million; a 22% increase over first quarter fiscal year 2017 and 245% over the

three-month period ended September 30, 2015

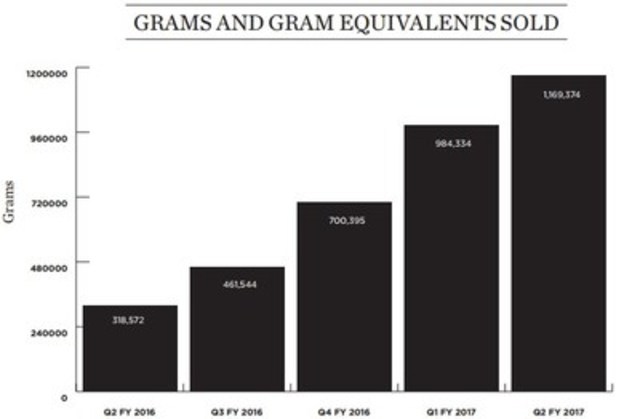

- Over one metric ton sold in the quarter, specifically 1,169 kilograms and kilogram equivalents, representing an increase of

19% over first quarter fiscal year 2017 and an increase of 267% over the second quarter fiscal year 2016

- Harvested 1,711 kilograms during the second quarter ended September 30, 2016

- Net income for the quarter ended September 30, 2016 was $5.4

million, including a non-cash unrealized gain on changes in the fair value of biological assets of $16.1 million, compared to net income of $3.9 million in same period last year,

including a non-cash unrealized gain on the change in fair value of biological assets totaling $12.5

million

- Expenses in the quarter included initial costs to establish Brazil amounting to $0.3 million and related legal expenses of $0.6 million, and $0.3 million related to uplisting to the TSX

- Over 24,400 registered patients at September 30, 2016

- Listed common shares on the Toronto Stock Exchange

- Exported Tweed-branded medical cannabis for sale to German patients for the first time

- Starting with Lemon Skunk available for sale, Tweed launched DNA Certified products, coming with a seal of

approval from the world's most decorated cannabis breeders

- Opened a world-class, first-of-its-kind in Canada, cannabis breeding facility

- Announced partnership with related-party Delivra Inc. to supply Tweed and Bedrocan Canada with cannabis-infused topical

product formulations

- Closed bought deal financing that raised gross proceeds of $34.5 million

- $45.4 million in cash and cash equivalents at quarter end

Subsequent to Second Quarter Fiscal 2017

- Tweed launched three Leafs By Snoop strains for sale, Sunset, Ocean View and Palm Tree CBD, in Canada

- Recent license amendments increased the Corporation's licensed production capacity to over 13,500 kilograms of dried cannabis

and 6,700 kilograms of cannabis oil, representing over 7 million ml of finished cannabis oil.

- The Corporation announced an expansion strategy in partnership with related‑party, The Goldman Group

- Canopy Growth acquired Quebec-based Licensed Producer Applicant, Vert Médical Inc. (renamed

Vert Cannabis Inc.), and majority ownership of Licensed Hemp producer, Groupe Hemp

"Strong growth in registered patients drove our revenues higher during the second quarter," said Bruce

Linton, Chairman & CEO. "We continue to believe that variety, quality and consistency of supply are key to driving

market share in the legal cannabis market."

Added Linton, "These last months have seen Tweed introduce stronger genetics and growing practices into its production

processes, retiring earlier strains and advancing quality to an entire new level. The fruits of this work to expand strain variety

and inventory, as well as harvesting the entire 350,000 square foot Tweed Farms greenhouse for the first time just after quarter's

end, will begin to appear in our store this quarter. Our recent acquisition of Quebec-based

Vert Medical and the expansion strategy we announced with the Goldman Group represent a continuation of our plan to rapidly expand

the largest cannabis production platform in the industry."

Second Quarter Fiscal 2017 Revenue Review

Revenue for the second quarter ended September 30, 2016 was $8.5 million compared to revenue

of $2.5 million in the three months ended September 30, 2015 and $7.0 million for the first quarter of fiscal year 2017. Revenue in the six months ended September 30, 2016 totaled $15.5 million as compared to $4.2

million in the same period last year.

The Corporation had over 24,400 registered patients at September 30, 2016 compared to over 16,600

at June 30, 2016 and over 6,200 at September 30, 2015.

Second Quarter Fiscal 2017 Product Sales Review

The total grams sold during the quarter ended September 30, 2016 was 1,169 kilograms and

kilogram equivalents at an average price of $7.01 per gram, up from 984 kilograms and kilogram

equivalents at an average price of $7.09 per gram in the first quarter of Fiscal 2017 and up from 319

kilograms sold during the three‑month period ended September 30, 2015 at an average price of

$7.54 per gram. Year‑to‑date, the Company has sold 2,153 kilograms and kilogram equivalents at an

average price of $7.05 per gram compared to 535 kilograms at an average price of $7.62 per gram in the six months ended September 30, 2015.

Second Quarter Fiscal 2017 Cost of Sales Review

Plants that are in pre-harvest are considered biological assets and are capitalized on the balance sheet at fair market value

less cost to sell at their point of harvest. Costs to sell include trimming, drying, testing, fulfillment, and shipping costs. As

they continue to grow through the pre-harvest stages, a corresponding non-cash unrealized gain is recognized in income through cost

of sales, reflecting the changes in fair value of the biological assets. At harvest, the biological assets are transferred to

inventory at their fair value, which becomes the deemed cost for inventory. Inventory is later expensed to cost of sales, inclusive

of post-harvest and shipping costs, when sold and offsets against the gain on biological assets. In addition, the cost of

production is expensed through cost of sales and represents overheads and other production costs of growing and selling the plants.

Together, the unrealized gain from changes in the fair value of biological assets, inventory expensed and the cost of production

comprise cost of sales. We expect cost of sales to vary from quarter to quarter based on the number of pre-harvest plants, the

strains being grown, and where the pre-harvest plants are in the grow cycle at the end of the period.

The recovery to cost of sales during the quarter ended September 30, 2016 was comprised of a

non-cash unrealized gain on changes in the fair value of biological assets of $16.1 million which was

partially offset by the inventory expensed of $8.4 million and $0.3

million for other production costs, for a net recovery to cost of sales of $7.3 million.

The changes in the fair value of biological assets recorded during the quarter was due in large part to the full production at the

350,000 square foot Tweed Farms greenhouse, with significantly higher expected yields per plant. The greenhouse moved into

full production during the first quarter of fiscal 2017. The harvest of this first full production growth cycle at

Tweed Farms is expected to be completed within the current quarter.

The recovery to cost of sales during the six-month period ended September 30, 2016 was comprised

of a non-cash unrealized gain on changes in the fair value of biological assets of $22.8 million,

which was partially offset by the inventory expensed of $15.1 million and other production costs

of $3.9 million for a net recovery to cost of sales of $3.8

million.

Second Quarter Fiscal 2017 Gross Margin Review

The gross margin was $15.8 million, or 186% of revenue, for the three-month period ended

September 30, 2016. In the comparative period ended September 30, 2015,

the gross margin on the same basis was $9.4 million or 383% of revenue. In the six-month period ended

September 30, 2016, gross margin was $19.3 million or 124% of revenue,

compared to $13.5 million or 324% of revenue in same period last year. Gross margin includes the

unrealized gains on changes in fair value of biological assets, a non-cash value which is discussed in detail in the Second

Quarter Fiscal 2017 Cost of Sales discussion above.

Second Quarter Fiscal 2017 Adjusted Product Contribution Review

The Company's "Adjusted Product Contribution"1 is a Non-GAAP metric used by management which adjusts the reported

gross margin by excluding the fair value measurements as required by IFRS and measures the cost of sales for the grams actually

sold in the period. Management believes this measure provides useful information as it reflects the gross margin based on the

Company's weighted average cost per gram from seed to sale against the grams sold.

The Adjusted Product Contribution in the second quarter of fiscal 2017 was $5.3 million, or 62% of

revenue. In the comparative period last year, the Adjusted Product Contribution was $1.5 million, or

62% of revenue. Year‑to‑date, the Adjusted Product Contribution was $9.6 million, or 62% of revenue.

In comparison, the Adjusted Product Contribution in the six months ended September 30, 2015 was

$2.6 million or 61% of revenue.

Second Quarter Fiscal 2017 Operating Expense Review

For the three months ended September 30, 2016, sales and marketing expenses were $2.8 million, or 33% of revenue,

compared to $0.9 million or 35% of revenue, in the same period last year. Year-to-date, the

sales and marketing expenses were $5.1 million or 33% of revenue, compared to $1.9 million or 45% of revenue, in the same period last year.

The increase in sales and marketing expenses in the three and six months ended September 30, 2016 over the comparative

periods last year is due in part to a full quarter and six months of Bedrocan operations, whereas the comparative periods included

only one month, amounting to an increase of $0.3 million during the second quarter and $0.4 million year to date, non-cash share-based compensation of $0.3 million during

the second quarter and $0.4 million year to date related to previously issued escrowed shares, and

increased patient support of $0.4 million in the second quarter and $0.7

million year to date directly attributable to patient growth. Since September 30, 2015, the number of patients has

grown from approximately 6,200 to over 24,400 at September 30, 2016. The increase over the comparison

periods is also due to increased staffing in our customer care centre, launching Tweed's Main Street customer engagement locations

and continued positioning of the Tweed brand in preparation for a non-medical market.

General and Administrative ("G&A") expenses were $4.0 million, or 47% of revenue, in the three-month period ended

September 30, 2016 compared to $2.2 million, or 91% of revenue, in the

same period last year. In the six-month period ended September 30, 2016, G&A expenses were $6.9 million or 44% or revenue. In comparison, G&A expenses were $3.7

million or 88% of revenue, in the six-month period ended September 30, 2015.

The increase in G&A expenses over the comparative periods last year is due in part to a full quarter and six months of

Bedrocan operations, whereas the comparative periods included only one month, amounting to an increase of $0.4 million in the second quarter and $0.7 million year to date, fees related

to the Company's graduation to the TSX in the amount of $0.3 million over the quarter and six month

periods, initial expenses in establishing Brazil operations of $0.3

million in the quarter and year to date period, higher audit and professional services fees of $0.2

million in the second quarter and $0.3 million year to date, and higher finance charges such

as credit card payment processing fees of $0.1 million in the second quarter and $0.2 million year to date due to increased sales activity. G&A expenses also include extensive use of

consultants and advisory services while expanding and commercializing the Company's operations, facility costs in Smiths Falls, Tweed Farms and Bedrocan, compliance costs associated with meeting Health Canada requirements,

as well as public company related expenses. Overall, the increase in G&A over the comparison periods reflects the

Company's growth and building of commercial capacity and capability.

Second Quarter Fiscal 2017 Earnings Review

Net income for the quarter ended September 30, 2016 was $5.4 million

or $0.05 per basic and diluted share, including a non-cash unrealized gain on changes in the fair

value of biological assets of $16.1 million. In the comparative period last year, net income was

$3.9 million or $0.06 per basic share and $0.05 per diluted share, including a non-cash unrealized gain on changes in the fair value of biological assets

of $12.5 million.

Year-to-date, the Company recorded net income of $1.5 million or $0.01 per basic and diluted share, including a non-cash unrealized gain on changes in the fair value of

biological assets of $22.8 million. In the comparative period last year, the Company reported net

income $4.9 million or $0.09 per basic share and $0.07 per diluted share, including a non-cash unrealized gain on changes in the fair value of biological assets

of $17.8 million.

Second Quarter Fiscal 2017 Balance Sheet and Year to Date Cash Flow Review

At September 30, 2016, the Corporation's cash, comprised of cash and cash equivalents totaled

$45.4 million, representing an increase of $30.0 million from

March 31, 2016. The increase is attributable to combined net proceeds from the April 2016 and August 2016 "bought deal" common share offerings in the first and

second quarters of the 2017 fiscal year and the exercise of options and warrants together totaling $44.2

million partially offset by cash used to fund operations of $8.9 million and investments in

facility enhancements totaling $8.7 million. Investments in facility enhancements were

primarily improvements at our Smiths Falls facility including the conversion of growing rooms, in

the expansion of cannabis oil extract production capacity and in information technology.

Inventory at September 30, 2016 amounted to $27.6 million

(June 30, 2016 - $24.2 million, March 31,

2016 - $22.2 million) and biological assets amounted to $13.7 million (June 30, 2016 - $4.1 million,

March 31, 2016 - $5.3 million), together totaling $41.3 million (June 30, 2016 - $28.3 million,

March 31, 2016 - $27.5 million). The biological assets increased

from Fiscal 2016 due to higher yielding plants, predominantly at Tweed Farms, in the later stage of their growth cycle.

Harvested plants were added to inventories during the quarter and quantities maintained to meet the continued growth in sales

expected with strain availability, and the expected growing demand for oils.

The Unaudited Condensed Interim Consolidated Financial Statements and Management's Discussion and Analysis documents have been

filed with SEDAR and are available on www.sedar.com. The

basis of financial reporting in the Unaudited Condensed Interim Consolidated Financial Statements and Management's Discussion and

Analysis documents is in thousands of Canadian dollars, unless otherwise indicated.

Note 1: The Adjusted Product Contribution is a non-GAAP financial measure that does not have any standardized meaning

prescribed by IFRS and may not be comparable to similar measures presented by other companies. The Adjusted Product

Contribution is reconciled and explained in Management's Discussion & Analysis under "Adjusted Product Contribution (Non-GAAP

Measure)", a copy of which has been filed today on www.sedar.com.

Webcast and Conference Call Information

Canopy Growth will host a conference call and audio webcast with Bruce Linton, CEO and

Tim Saunders, CFO at 8:30 AM Eastern Time today.

Webcast Information

A live audio webcast will be available at:

http://event.on24.com/r.htm?e=1302342&s=1&k=37DEA54FAEA7DB4510A248A6A3DDF789

Calling Information

Toll Free Dial-In Number: 1-888-231-8191

International Dial-In Number (647) 427-7450

Conference ID: 10218564

Replay Information

A replay of the call will be accessible by telephone until 11:59 PM ET on

December 12, 2016.

Toll Free Dial-in Number: 1-855-859-2056

Replay Password: 10218564

About Canopy Growth Corporation

Canopy Growth is a world-leading diversified cannabis company, offering diverse brands and curated cannabis strain

varieties in dried and oil extract forms. Through its wholly‑owned subsidiaries, Tweed, Tweed Farms, and Bedrocan Canada,

Canopy Growth operates three state-of-the-art production facilities with over half a million square feet of indoor and greenhouse

production capacity. Canopy Growth has established partnerships with leading sector names in Canada and abroad. For more information, www.canopygrowth.com.

Notice Regarding Forward Looking Statements

This news release contains forward-looking statements. Often, but not always, forward-looking statements can be

identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "estimates", "intends",

"anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions,

events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements involve

known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Canopy

Growth Corporation, Tweed Inc., Tweed Farms Inc. or Bedrocan Canada Inc. to be materially different from any future results,

performance or achievements expressed or implied by the forward-looking statements. Examples of such statements include future

operational and production capacity, the impact of enhanced infrastructure and production capabilities, and forecasted available

product selection. The forward-looking statements included in this news release are made as of the date of this news release

and Canopy Growth Corp. does not undertake an obligation to publicly update such forward-looking statements to reflect new

information, subsequent events or otherwise unless required by applicable securities legislation. Neither the TSX Exchange nor its

Regulation Services Provider (as that term is defined in policies of the TSX Exchange) accepts responsibility for the adequacy or

accuracy of this release.

|

|

CANOPY GROWTH CORPORATION

|

|

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF NET INCOME AND COMPREHENSIVE

INCOME

|

|

FOR THE THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2016 AND 2015

|

|

|

Three months ended

|

|

Six months ended

|

|

UNAUDITED

|

|

September 30,

|

|

September 30,

|

|

September 30,

|

|

September 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Expressed in CDN $000's except share amounts)

|

|

|

2016

|

|

|

2015

|

|

|

2016

|

|

|

2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

8,498

|

|

$

|

2,466

|

|

$

|

15,482

|

|

$

|

4,176

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain on changes in fair value of biological assets

|

|

|

(16,076)

|

|

|

(12,480)

|

|

|

(22,760)

|

|

|

(17,755)

|

|

Inventory expensed to cost of sales

|

|

|

8,414

|

|

|

2,678

|

|

|

15,068

|

|

|

4,171

|

|

Other production costs

|

|

|

333

|

|

|

2,820

|

|

|

3,902

|

|

|

4,218

|

|

Recovery to cost of sales, net of the unrealized gain on changes in fair

value of biological assets

|

|

|

(7,329)

|

|

|

(6,982)

|

|

|

(3,790)

|

|

|

(9,366)

|

|

Gross margin

|

|

|

15,827

|

|

|

9,448

|

|

|

19,272

|

|

|

13,542

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing

|

|

|

2,810

|

|

|

873

|

|

|

5,070

|

|

|

1,881

|

|

Research and development

|

|

|

503

|

|

|

210

|

|

|

906

|

|

|

249

|

|

General and administration

|

|

|

4,031

|

|

|

2,239

|

|

|

6,881

|

|

|

3,655

|

|

Acquisition costs

|

|

|

592

|

|

|

1,139

|

|

|

592

|

|

|

1,139

|

|

Share of (income) loss in equity investments

|

|

|

(170)

|

|

|

-

|

|

|

50

|

|

|

-

|

|

Share-based compensation expense

|

|

|

960

|

|

|

574

|

|

|

1,848

|

|

|

945

|

|

Depreciation and amortization

|

|

|

984

|

|

|

452

|

|

|

1,895

|

|

|

720

|

|

|

|

9,710

|

|

|

5,487

|

|

|

17,242

|

|

|

8,589

|

|

Income from operations

|

|

|

6,117

|

|

|

3,961

|

|

|

2,030

|

|

|

4,953

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

(42)

|

|

|

(31)

|

|

|

(89)

|

|

|

(12)

|

|

Increase in fair value of acquisition consideration related

liabilities

|

|

|

(286)

|

|

|

-

|

|

|

(298)

|

|

|

-

|

|

|

|

(328)

|

|

|

(31)

|

|

|

(387)

|

|

|

(12)

|

|

Net income and comprehensive income before income taxes

|

|

|

5,789

|

|

|

3,930

|

|

|

1,643

|

|

|

4,941

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

(359)

|

|

|

-

|

|

|

(162)

|

|

|

-

|

|

Net income and comprehensive income after income taxes

|

|

$

|

5,430

|

|

$

|

3,930

|

|

$

|

1,481

|

|

$

|

4,941

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share, basic:

|

|

$

|

0.05

|

|

$

|

0.06

|

|

$

|

0.01

|

|

$

|

0.09

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of outstanding common shares, basic:

|

|

|

108,872,770

|

|

|

63,838,863

|

|

|

106,248,781

|

|

|

57,357,148

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share, diluted:

|

|

$

|

0.05

|

|

$

|

0.05

|

|

$

|

0.01

|

|

$

|

0.07

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of outstanding common shares,

diluted:

|

|

|

112,254,363

|

|

|

76,057,904

|

|

|

108,879,226

|

|

|

69,576,190

|

|

|

CANOPY GROWTH CORPORATION

|

|

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

|

|

UNAUDITED

|

|

|

September 30,

|

|

|

March 31,

|

|

(Expressed in CDN $000's)

|

|

|

2016

|

|

|

2016

|

|

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

45,379

|

|

$

|

15,397

|

|

Restricted short-term investment

|

|

|

250

|

|

|

-

|

|

Accounts receivable

|

|

|

1,625

|

|

|

1,110

|

|

HST recoverable

|

|

|

277

|

|

|

376

|

|

Biological assets

|

|

|

13,748

|

|

|

5,321

|

|

Inventory

|

|

|

27,579

|

|

|

22,153

|

|

Prepaid expenses and other assets

|

|

|

1,019

|

|

|

489

|

|

|

|

|

89,877

|

|

|

44,846

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment

|

|

|

48,492

|

|

|

44,581

|

|

Assets in process

|

|

|

4,702

|

|

|

403

|

|

Restricted investment

|

|

|

-

|

|

|

246

|

|

Goodwill

|

|

|

20,867

|

|

|

20,867

|

|

Intangible assets

|

|

|

31,713

|

|

|

31,861

|

|

Other assets

|

|

|

553

|

|

|

557

|

|

|

|

$

|

196,204

|

|

$

|

143,361

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$

|

7,492

|

|

$

|

6,107

|

|

Deferred revenue

|

|

|

296

|

|

|

533

|

|

Current portion of long-term debt

|

|

|

1,080

|

|

|

553

|

|

|

|

|

8,868

|

|

|

7,193

|

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

|

6,362

|

|

|

3,469

|

|

Acquisition consideration related liabilities

|

|

|

1,556

|

|

|

1,258

|

|

Deferred tax liability

|

|

|

7,575

|

|

|

7,413

|

|

Other long-term liabilities

|

|

|

224

|

|

|

243

|

|

|

|

|

24,585

|

|

|

19,576

|

|

|

|

|

|

|

|

|

|

Shareholders' equity

|

|

|

|

|

|

|

|

Share capital

|

|

|

175,970

|

|

|

131,080

|

|

Share-based reserve

|

|

|

7,943

|

|

|

5,804

|

|

Warrants

|

|

|

-

|

|

|

676

|

|

Deficit

|

|

|

(12,294)

|

|

|

(13,775)

|

|

|

|

|

171,619

|

|

|

123,785

|

|

|

|

$

|

196,204

|

|

$

|

143,361

|

|

|

|

|

|

|

CANOPY GROWTH CORPORATION

|

|

|

|

|

|

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

|

FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2016 AND 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNAUDITED

|

|

September 30,

|

|

September 30,

|

|

(Expressed in CDN $000's)

|

|

2016

|

|

2015

|

|

Net inflow (outflow) of cash related to the following activities:

|

|

|

|

|

|

|

|

|

|

|

Operating

|

|

|

|

|

|

|

|

Net income

|

|

$

|

1,481

|

|

$

|

4,941

|

|

|

Items not affecting cash:

|

|

|

|

|

|

|

|

|

|

Depreciation of property, plant and equipment

|

|

|

1,747

|

|

|

715

|

|

|

|

Amortization of intangible assets

|

|

|

148

|

|

|

5

|

|

|

|

Share of loss in equity investments

|

|

|

50

|

|

|

-

|

|

|

|

Unrealized gain on change in fair value of biological assets

|

|

|

(22,760)

|

|

|

(17,755)

|

|

|

|

Inventory allowance to net realizeable value

|

|

|

(6,481)

|

|

|

859

|

|

|

|

Net changes in inventory and biological assets

|

|

|

15,388

|

|

|

2,985

|

|

|

|

Share-based compensation

|

|

|

2,232

|

|

|

945

|

|

|

|

Income tax expense

|

|

|

162

|

|

|

-

|

|

|

|

Increase in fair value of acquisition consideration related

liabilities

|

|

|

298

|

|

|

-

|

|

|

Changes in non-cash operating working capital items

|

|

|

(1,190)

|

|

|

334

|

|

Net cash used in operating activities

|

|

|

(8,925)

|

|

|

(6,971)

|

|

|

|

|

|

|

|

|

|

|

|

Financing

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common shares

|

|

|

46,009

|

|

|

-

|

|

|

Proceeds from exercise of stock options

|

|

|

1,128

|

|

|

7

|

|

|

Proceeds from exercise of warrants

|

|

|

126

|

|

|

561

|

|

|

Payment of share issue costs

|

|

|

(3,030)

|

|

|

(189)

|

|

|

Issuance of long-term debt

|

|

|

3,500

|

|

|

-

|

|

|

Increase in capital lease obligations

|

|

|

260

|

|

|

-

|

|

|

Repayment of long-term debt

|

|

|

(339)

|

|

|

(60)

|

|

|

Increase (decrease) in other long-term liabilities

|

|

|

(19)

|

|

|

27

|

|

Net cash provided by financing activities

|

|

|

47,635

|

|

|

346

|

|

|

|

|

|

|

|

|

|

|

|

Investing

|

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment

|

|

|

(4,728)

|

|

|

(3,148)

|

|

|

Purchases of assets in process

|

|

|

(4,000)

|

|

|

(4,561)

|

|

|

Acquisition of Bedrocan

|

|

|

-

|

|

|

900

|

|

|

Purchases of restricted investment

|

|

|

-

|

|

|

(286)

|

|

Net cash used in investing activities

|

|

|

(8,728)

|

|

|

(7,095)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash inflow (outflow)

|

|

|

29,982

|

|

|

(13,720)

|

|

Cash and cash equivalents, beginning of period

|

|

|

15,397

|

|

|

21,446

|

|

Cash and cash equivalents, end of period

|

|

$

|

45,379

|

|

$

|

7,726

|

|

Unaudited Non-GAAP Measure

|

|

Three Months Ended

|

|

Six Months Ended

|

|

(In CDN$000's, except gram amounts)

|

|

September 30,

|

|

September 30,

|

|

September 30,

|

|

September 30,

|

|

|

|

2016

|

|

|

2015

|

|

|

2016

|

|

|

2015

|

|

Adjusted Product Contribution1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighed average cost per gram

|

|

$

|

2.77

|

|

$

|

2.92

|

|

$

|

2.72

|

|

$

|

3.02

|

|

Grams sold in the period

|

|

|

1,169,374

|

|

|

318,572

|

|

|

2,153,708

|

|

|

534,501

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

8,498

|

|

$

|

2,466

|

|

$

|

15,482

|

|

$

|

4,176

|

|

Adjusted cost of sales

|

|

|

(3,239)

|

|

|

(931)

|

|

|

(5,858)

|

|

|

(1,614)

|

|

Adjusted Product Contribution

|

|

$

|

5,259

|

|

$

|

1,535

|

|

$

|

9,624

|

|

$

|

2,562

|

|

Adjusted Product Contribution percentage of sales

|

|

|

62%

|

|

|

62%

|

|

|

62%

|

|

|

61%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As compared to the Gross Margin per IFRS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin

|

|

$

|

15,827

|

|

$

|

9,448

|

|

$

|

19,272

|

|

$

|

13,542

|

|

Gross margin percentage of sales

|

|

|

186.2%

|

|

|

383.1%

|

|

|

124.5%

|

|

|

324.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 - The Adjusted Product Contribution removes the fair value measurements

required under IFRS and recognizes the cost of sales based on the weighted average cost per gram to produce and applied to

the grams sold in the period.

|

SOURCE Canopy Growth Corporation

Image with caption: "Quarterly Revenue - Fiscal 2016 & 2017 (CNW Group/Canopy Growth Corporation)". Image available at:

http://photos.newswire.ca/images/download/20161114_C1051_PHOTO_EN_817036.jpg

Image with caption: "Patients At Quarter's End (CNW Group/Canopy Growth Corporation)". Image available at: http://photos.newswire.ca/images/download/20161114_C1051_PHOTO_EN_817038.jpg

Image with caption: "Grams And Gram Equivalents Sold (CNW Group/Canopy Growth Corporation)". Image available at: http://photos.newswire.ca/images/download/20161114_C1051_PHOTO_EN_817040.jpg