Miners and farmers often find themselves on opposite sides of the fence.

Farmers regard mining companies as dangerous interlopers that represent a threat to their livelihoods. And miners often fail to secure the permits needed to commercialize valuable mineral deposits due to push-back from mistrustful farmers and environmentalists.

But what if miners can actually bridge the great divide between them and farmers? And what if they can even win over environmentalists, too?

This would be a real paradigm shift. Well, guess what? It’s already happening!

Vancouver-based

Centurion Minerals Ltd (TSX.V: CTN) is embracing the agricultural sector by providing a key raw ingredient –– gypsum –– needed to improve farming without the use of expensive synthetic fertilizers.

Not only is this start-up mining operation a shot in the arm for the agricultural industry; it is also devoid of any of the issues that sometimes get mining companies into trouble in the jurisdictions in which they operate.

More specifically, the gypsum is extracted without the use of chemicals or water. And no tailings are produced in the process.

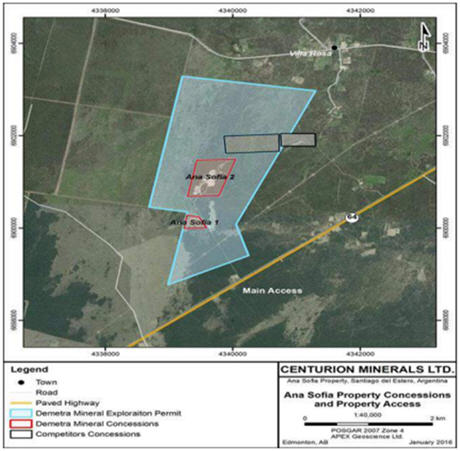

Accordingly, Centurion has formed a joint venture with privately-owned Demetra Minerals to commercialize the Ana Sofia agricultural gypsum project, located in Santiago del Estero, Argentina. The project comprises two mining concessions with exploration rights totalling 500 hectares.

With a commitment to being an environmentally-conscious company, Centurion is developing a near-surface open-pit gypsum mining operation to provide an ideal soil conditioner for Latin America’s agriculture industry.

For agriculture, the appeal is gypsum’s high calcium content along with its sulphur. Depending on regional geography, farmers can require both of these minerals as supplements to maintain soil health and therefore improve yields.

Notably, the soil throughout much of South America tends toward higher levels of salinity. Compounding this issue are pollutants such as aluminum, especially in Brazil, as well as soil depletion issues in some of the more heavily-farmed regions.

A key benefit of agricultural gypsum is that it “flocculates” clay particles (groups them together), increasing soil porosity and reducing compaction. This benefits crop yields because it increases the uptake of other nutrients such as nitrogen, phosphate and potassium.

Due to gypsum’s advantages as a natural fertilizer, demand across South America is very strong. However, supply is still very limited with the industry fragmented among a few small operations with marginal efficiency.

Studies have even shown that this organically-certified soil input can turn non-arable land into soil that is fertile enough to farm crops. To this point, gypsum can even improve the Ph balance in soil.

These are the reasons why management at Centurion saw an opportunity to bring North American mining expertise to this under-developed industry and to consequently become a dominant player in Argentina.

President and CEO David Tafel elaborates: “We are now a producer of high-grade agricultural gypsum, which is comprised of calcium and sulphate –– two minerals that are lacking in the South American soil.”

Currently, Centurion has a 50% interest in Ana Sofia but also has an option to own the project outright.

Centurion’s pilot plant has an annual production capacity of approximately 40,000 tonnes of calcium and sulphates. This is projected to translate into annual revenues of between $4 -$5 million and profits in excess of $1 million.

Given the high margins of at least 25% or better which exist in the production of these soil nutrients, even at this initial production level Ana Sofia’s operation promises to be cash-flow positive.

Of significant note, all necessary exploration, extraction, and environmental permitting are already in-place.

However, this is just the beginning of Centurion’s plans for agricultural gypsum production in South America. Tafel expands on his company’s strategy.

“Our intention is to double or triple the size of this plant later this year once we have the bugs worked out and we are operating at a consistent rate. We think by the end of the year we could be processing and producing at an annualized rate of 150,000 tonnes.”

Of course expanding production is only one half of the equation. It is also necessary for the company to have a market for its products. Here, the market fundamentals have Tafel and his colleagues smiling.

“As we grow our production, the demand is going to increase at a rate that is beyond what we can currently supply. So we have much, much bigger goals. The industry in Argentina and South America is very small at the moment and it is really operated by very small producers –– small scale miners, if you will.

Also, wholesalers aren’t getting the quantity or quality of gypsum that they need. We intend to resolve this problem by acquiring smaller operators and ensuring that distributors get a better quality of product and the volume that they need. In the process, we will be consolidating the industry.”

After raising approximately $750,000 earlier this year, Centurion is presently financed to ramp-up production at its pilot plant, with a view to quickly moving to a cash-flow positive basis.

The tripling of production capacity will require additional financing. However, management is cautiously optimistic that additional capital can be raised through debt rather than equity once the pilot plant is operating on a profitable footing.

In terms of defining the potential market, there are more than 125 million hectares of agricultural land in Argentina and neighbouring jurisdictions which can benefit from the soil conditioning provided by agricultural gypsum.

For South American farmers, this ultimately means higher crop yields. For South American nations, it is an issue of food security.

Reinforcing the robust demand picture, the Company has already reported positive news on the sales front. Earlier this year, Centurion announced that its joint venture partner, Demetra, had successfully negotiated a definitive supply contract with an Argentine distributor of agri-mineral fertilizer products.

The contract stipulates a minimum purchase of 12,500 tonnes of material in 2017, more than one quarter of Ana Sofia’s annual production at the existing rate. This represents a 30% increase in orders above and beyond what had already been contracted between the parties previously.

Centurion has also signed an off-take agreement with a fertilizer distributor in Paraguay for up to 50,000 tonnes per year at a price of approximately CDN $100 a tonne.

The off-take agreement is essentially a turnkey operation as all transportation logistics to get the product to market are managed by the distributor.

Management is confident that Ana Sofia can help to meet this agricultural demand for many years to come. The project currently hosts an inferred NI 43-101 compliant resource of 1.47 million tonnes of high-grade gypsum.

This constitutes a mere 10% of the property, with all the mineralization located within 10 metres of the surface. In fact, mineralization remains open (continuous) in several directions, thereby providing considerable expansion potential.

So the scalability of this project is what offers considerable upside for investors.

Once production is expanded later this year, the initial portion of the deposit that has been outlined so far is sufficient to sustain a ten-year mine life.

Over the next 12 months, Centurion aims to increase capacity to 150,000 tonnes per year with the build-out of a full-scale plant. Its cost will be no more than around $2.5-3 million dollars, which could conceivably be recovered within the first year of operation via sales of up to $15 million.

Investment Summary

All in all, the company’s greatest value proposition is that it has a relatively simple but dynamic business model. And once it begins to scale-up, Centurion stands to benefit from a steady, lucrative revenue stream that promises to grow exponentially.

Centurion has approximately 60 million shares outstanding with a large block of outstanding warrants that could add as much as $4 million to the company’s treasury if they are exercised.

It’s very interesting to note that Centurion’s current market capitalization is only about $4 million. With annual revenues from the pilot plant alone exceeding this figure, and with a pending tripling of output on the horizon, it should be easy for investors to see the potential for profit and an ascendant share price.

About the Author: Marc Davis has a deep background in the capital markets spanning 25 years. He is also a longstanding financial journalist, having worked for leading digital financial news agencies in North America and in London’s financial centre. Additionally, he is a former on-camera business reporter for CBC Television.

Over the years, his articles have also appeared in dozens of digital publications worldwide. They include USA Today, CBS Money Watch, Investors’ Business Daily, the Financial Post, Reuters, National Post, Google News, Barron’s, China Daily, Huffington Post and AOL.