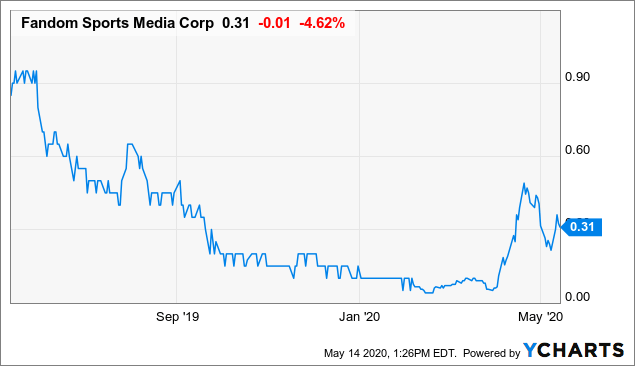

Fandom Sports Media Corp. (OTCQB:FDMSF) (FDM.CN) has been a walking corpse occupying the bottom of the barrel of the CSE for months. It bottomed out at a $600,000 market cap, less than a shell valuation. While the rest of the market has been shaky, FDM has gone on an incredible run. That, along with a recent capital raise at $0.05, has caused the market cap to increase to about $10 million as the stock price is now over $0.30 in Canada. Even with that run, risk tolerant investors might like the entry point as the eSports market has been hot while everyone is stuck at home during the pandemic.

Data by YCharts

Data by YCharts New management sparks my interest in Fandom

In a previous article of mine titled "7 Stocks For A Degenerate Millennial Economy And The Caillou Generation", I mentioned eSports as one trend that I was quite bullish on and mentioned Fandom as possible play at a $12 million market cap. Though I have been lukewarm on it because the company could not concisely explain a coherent business plan and path to profitability to my satisfaction.

19 months later and at a 20% discount to the market cap seen at that time, I see Fandom in a similar spot with a platform projected to be weeks away from release. The big difference now is who is managing it and what they plan to do with the technology. Fandom is developing two eSports verticals. One is an "all ages" cryptocoin model where users can engage in wager-like activities while the company is able to avoid regulatory hurdles. The other platform will be a fully regulated betting model. The former can be released as soon as the company is ready while the latter will depend on how Fandom proceeds through the regulations. But both platforms have the potential to be engaging for users and profitable for investors.

Over the last month Fandom has appointed Philip Chen as Chairman of the Board and David Vinokurov as CEO. I personally know both Philip and David and have done business with them in the past. A lot of people reading this will probably take a few guesses as to where and when our paths have intersected. I know Philip as a trustworthy, no-nonsense and effective business developer with key contacts in China. David is an experienced capital markets professional with a skillset that is well suited to be the spokesperson of a start up penny stock on the CSE like Fandom. The first private placement check I ever wrote went through David. A big complaint I have seen from long-time Fandom investors is that past "faces" of the company absolutely bombed when it came to telling the Fandom story. That won't happen with David.

Just like myself, both Philip and David have gone through investments or business deals that didn't pan out. Or they initially panned out very well but didn't last. While those instances have been painful to everybody, based on what I have witnessed, these two men upheld their end of the deal. Most startups don't pan out. So being deeply immersed in the penny stock game is not one meant for percentages. You're out there looking for one or a handful of massive home runs amid a series of strikeouts. Some investors don't understand this and are purchasing stocks for a quick flip when in reality those investments were never appropriate for their risk tolerance or financial situation. The one to blame in that situation is the one looking back at them in the mirror. Or their financial advisor if they have one.

Henri Holm is a tech mastermind, but he was not the right man for the role of CEO of a Canadian penny stock company. So the large investors with backing by the Board of Directors decided to put their own men in charge. If you want something done right, you have to do it yourself. Those who are banking on Fandom being a success are doing so with their own people in charge and no longer have an outsider CEO to blame for an investment that is spinning its wheels.

I believe that Dave and Philip have the ability and are highly motivated to prove that they can make Fandom a success. Now they hold the ultimate decision making power to prove it. I haven't been the biggest fan of Fandom. Now with the right people in charge who I know personally and trust, I have warmed up to this stock. With a platform FINALLY ready to be launched in a few weeks, I look forward to seeing how Dave and Philip steer this ship.

Should investors buy Fandom by looking at my past history?

With Dave and Philip joining Fandom and the message board trolls working their meager brain cells at full capacity to find hidden past and present associations, I can only imagine this will get worse with my name in the picture now. Even though I am one of the top ranked bloggers out there according to third party investment tracking service TipRanks, I still get it wrong 45% of the time:

The fact that a 55% success rate has me in the top 5% of ALL talking heads out there should tell you how HARD investing is. But anonymous message board trolls with no accountability and no one auditing their performance hold everyone to a standard of perfection.

The most famous or infamous attachment that myself, David, Philip or anyone else banking on Fandom being a big win are the two brotherly love companies. When I first mentioned those two stocks, they ran heavily for months and hit my initial personal price targets. My major mistake was increasing those targets in my own arrogant giddiness. Really, my major mistake was publicizing personal price targets at all on Canadian penny stocks. Not because I didn't think they were possible, but because I have now learned that Canadian small cap investors are looking for easy answers and someone to blame when things don't work out. I don't need that stress again. My private price target on Fandom is somewhere between $0.00 and $100,000.

Fandom is a startup company with no revenues. It recently raised cash in an equity financing at $0.05 that will become free trading in a couple of months. It will likely have to raise more cash in the future to fund its growth. Therefore it is by definition a high risk stock. It's going to be volatile. So if I say something positive about the stock after it runs 1,000%, don't blame me if it comes back down 50%. Investors need to make their own investment decisions.

So the answer is no should you NOT buy Fandom based on my words or anyone else's. If you're interested in the company, you SHOULD review statements on SEDAR, financial statements, recent press releases and familiarize yourself with general trends in the eSports industry. You may be able to use my words as one small part of your due diligence process.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in FDMSF over the next 72 hours.

Additional disclosure: I may hold positions in securities as disclosed in this article and may make purchases or sales of these securities at any time. I have not received any compensation for this article and all opinions reflected herein are my own. The information provided herein is strictly for informational purposes only and should not be construed as a recommendation to buy or sell, or as a solicitation of an offer to buy or sell any securities. There is no guarantee that any estimate, forecast or forward looking statement presented herein will materialize and actual results may vary. Investors are encouraged to do their own research and due diligence before making any investment decision with respect to any securities discussed herein, including, but not limited to, the suitability of any transaction to their risk tolerance and investment objectives.