you can check this article below to find the answers:

Seeking Alpha: Chinook Energy Is A Montney Gem That Has The Potential To Triple

I quote the excerpts that answer your question:

-----------------------------------------------------------------

The non-Tournament Part

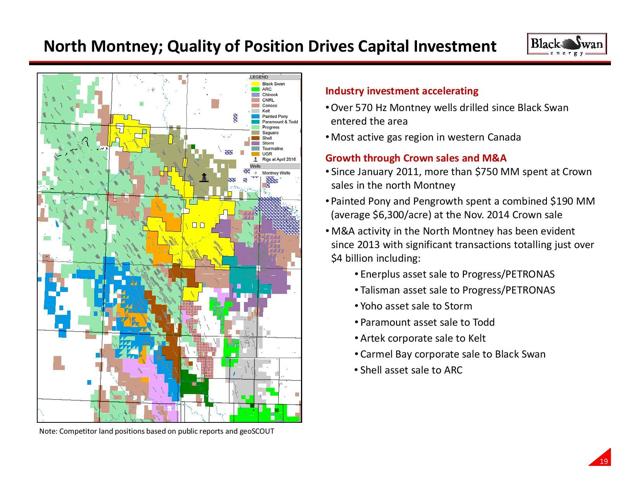

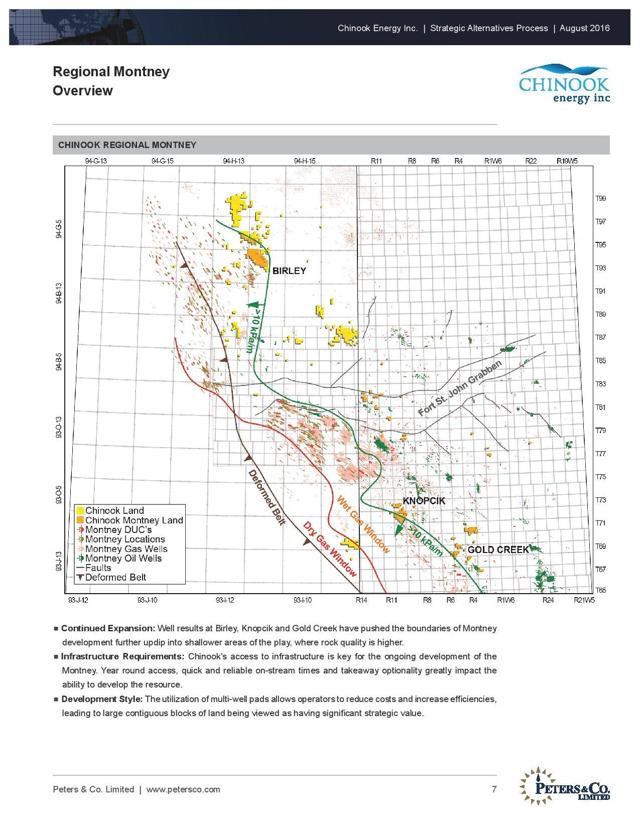

I'm not going to deepen into the Montney formation. Market participants know well that the land rush at Montney quietly began in the mid-to-late 2000s, and the Montney play has rapidly evolved into one of the hottest plays in the world, attracting billions of dollars in investment thanks to its key characteristics such as massive thickness, superior lithology and "fracability", high permeability, over-pressured and repeatable performance. On top of that, the Montney play isn't too shallow and isn't too deep. The Montney play is just right and this is why, it has become the rock star of the Canadian oilpatch making for some really very economic wells in today's challenging commodity environment.

As with any unconventional resource play, the financial success of a producer is directly linked to its acreage being located in the core of the play. The sweet spot and the acreage close to it are the places where all of the economic wells are located. And I will show in this paragraph why Chinook Energy is an exceptionally well-positioned Montney producer, while its drilling results (in the next paragraphs) prove that its Montney wells are equal or better than those from the offset operators.

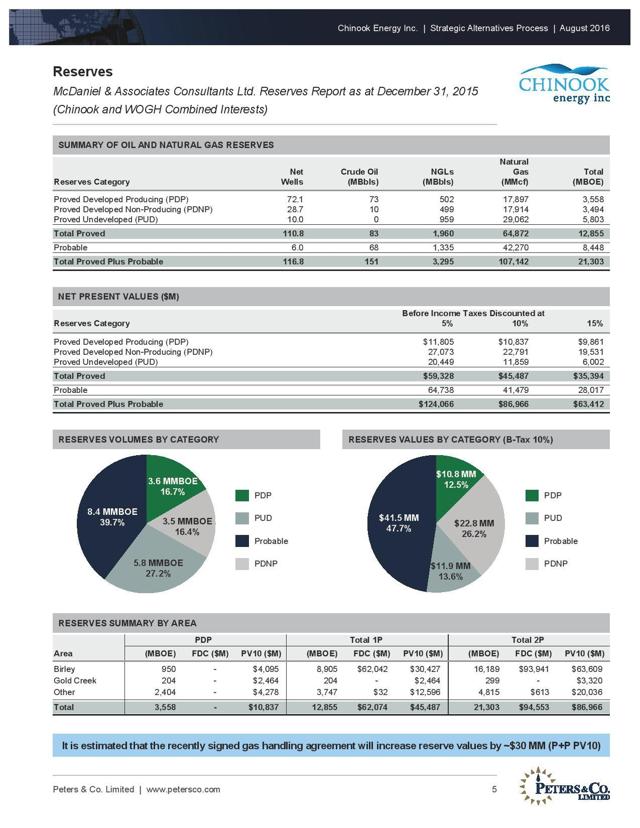

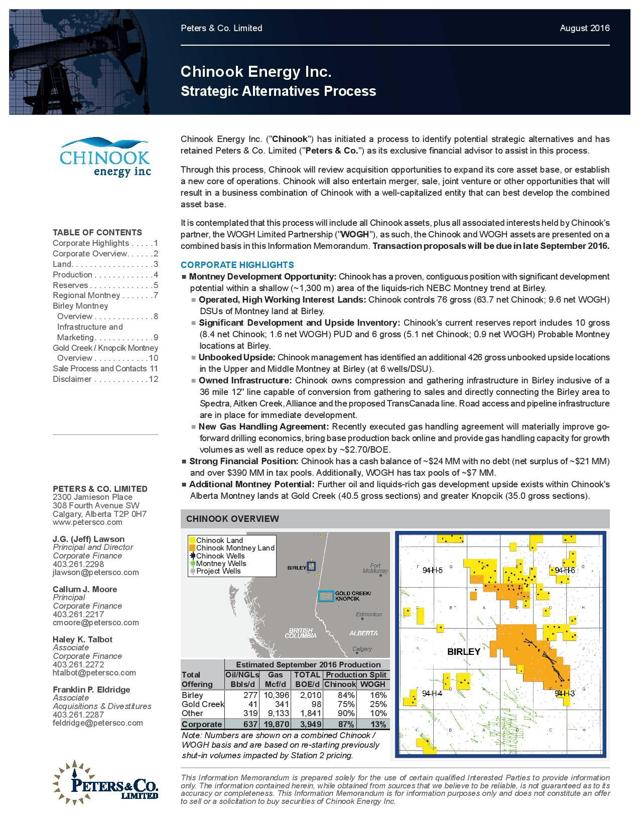

That said, pro-forma the Tournament deal, the non-Tournament part owns 18.29 MMboe of 2P Reserves (24% oil/liquids) with NPV10 of C$74 million. However, Chinook announced in August that it signed a new gas handling agreement in NEBC impacting the majority of its British Columbia natural gas production that reduces the operating cost while increasing netback by C$2.70/boe.

As a result, Chinook Energy estimates that this new gas handling agreement effective Sept. 1, 2016, increases reserve values (2P NPV10) by approximately C$30 million, as illustrated below:

In other words, the 2P NPV10 for the non-Tournament part currently is approximately C$100 million. And again, this figure refers to the non-Tournament part alone.

Additionally, the non-Tournament part consists of the following three subparts:

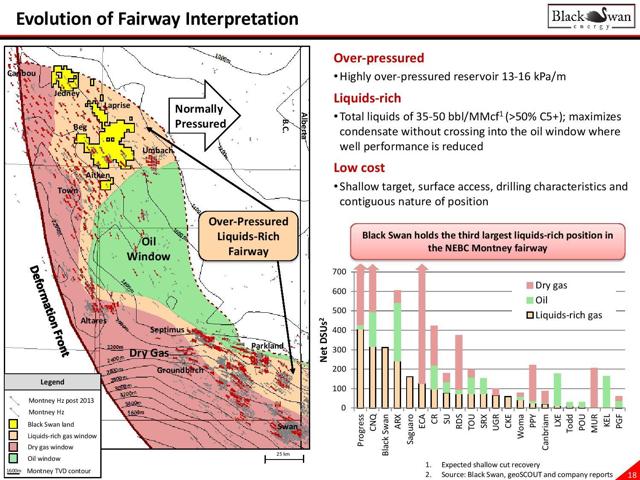

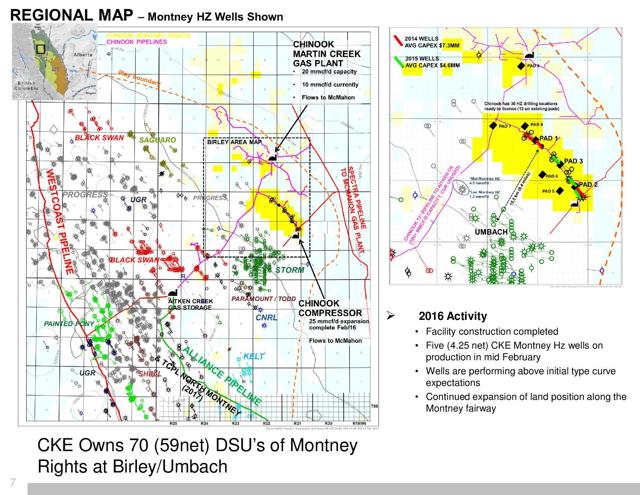

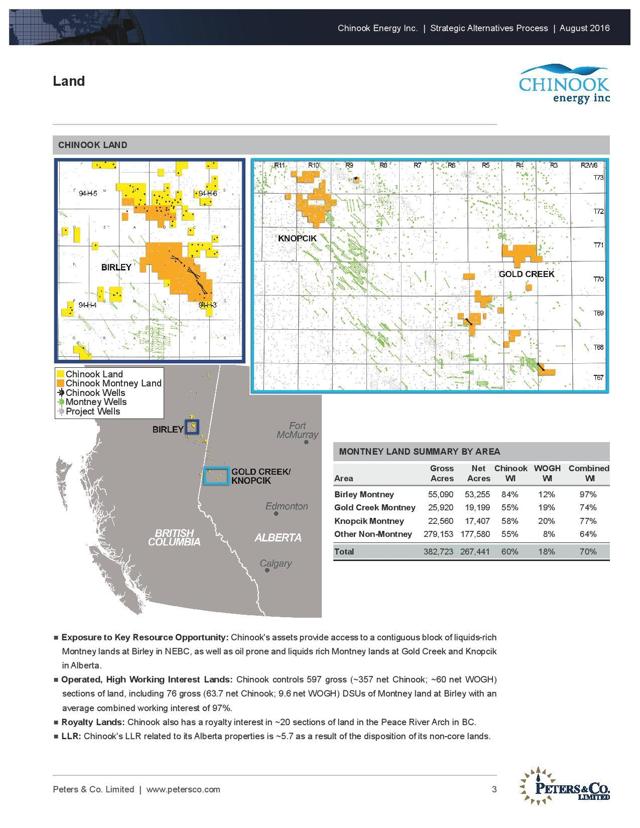

1) Operated Montney acreage in British Columbia (Birley/Umbach): Chinook currently produces 1,690 boepd (14% oil and liquids) from this acreage that covers ~44,700 net acres, as illustrated below:

And below:

And below:

And the first map above from Black Swan Energy's presentation speaks volumes. As clearly illustrated in that map, Chinook's entire acreage in Birley/Umbach in British Columbia is located in the over-pressured, liquids-rich fairway which has delivered thus far the best wells in the area, as expected of course. Chinook's acreage in Birley/Umbach is NOT crossing into the oil window (green area) where well performance is reduced, according to Black Swan Energy.

For instance, Leucrotta Exploration's (OTC:LCRTF) acreage is located in the oil window. And Leucrotta's drilling results to-date clearly confirm that well performance in the oil window is reduced. I will detail on Leucrotta's results in the next paragraph.

As also shown above, M&A activity in the North Montney has been evident since 2013 with significant transactions totaling just over $4 billion, including Enerplus' (NYSE:ERF) asset sale to Petronas, Talisman's (NYSE:TLM) asset sale to Petronas, Yoho's asset sale to Storm Resources (OTC:SRMLF), Paramount's (OTCPK:PRMRF) asset sale to Todd, Artek Exploration's (OTCPK:ARKXF) sale to Kelt Exploration (OTC:KELTF), Carmel Bay's sale to Black Swan Energy and Shell (NYSE:RDS.A) (NYSE:RDS.B) to ARC Resources (OTCPK:AETUF).

And I will present in detail the key metrics for these North Montney deals in my next article, proving Chinook Energy's irrational undervaluation from an acquisition standpoint.

2) Operated Montney acreage in Alberta (Gold Creek and Knopcik):Chinook currently produces 75 boepd (42% oil and liquids) from this acreage that covers ~22,000 net acres, as illustrated below:

Chinook owns 35 net sections in this area next to privately-held CIOC, Canadian Natural Resources Limited (NYSE:CNQ), Apache (NYSE:APA), ConocoPhillips (NYSE:COP), Encana (NYSE:ECA), Shell, Birchcliff Energy (OTCPK:BIREF), Husky Energy (OTCPK:HUSKF), Blackbird Energy (OTC:BKBEF) and privately-held Inception Exploration.

3) Operated acreage in the Peace River Arch District (~98,000 net acres): Chinook Energy has retained producing assets that are located in the Peace River Arch District on the BC/Alberta border, as illustrated below:

Specifically, these assets are mainly lands north of Birley at Martin/Black/Conroy and Boundary Lake that are currently producing 1,657 boepd (18% oil and liquids), based on re-starting previously shut-in volumes impacted by Station 2 pricing, as illustrated below:

Production in the Boundary Lake area is primarily from Mississippian, Jurassic and Cretaceous aged formations, while the assets in the Martin Creek and Black-Conroy areas primarily produce from Baldonnel, Halfway and Gething formations.

Other producers in the area are Centrica PLC (OTCPK:CPYYY), Enercapita Energy Trust, Whitecap Resources, Qatar Petroleum International, Canadian Natural Resources Limited, etc.

The Balance Sheet For The Non-Tournament Part Is Pristine

All the bankruptcies in the energy sector over the last two years should teach us that the strength of the balance sheet is of the utmost importance. And when it comes to Chinook Energy's fundamentals, the balance sheet is stellar.

But before presenting some key points from the balance sheet, I have to point out that Chinook Energy's results are consolidated and currently include Tournament Exploration's results, because Chinook Energy currently owns a 70% stake in Tournament Exploration. And things will remain like this until the Tournament Exploration shares are distributed to Chinook Energy's shareholders by year end.

That said, this is what we know about Chinook's non-Tournament part that includes its Montney assets, based on the latest quarterly report (Q2 2016) and Peters' Information Memorandum linked above:

1) As of September 2016, it remains debt-free and holds approximately C$24 million in cash.

2) As of September 2016, it produces 3,436 boepd (~17% oil and liquids) thanks to re-starting previously shut-in volumes impacted by Station 2 pricing.

3) As of September 2016, NPV10 (P+P) is approximately C$100 million, thanks to the new gas handling agreement effective Sep 1, 2016, that increases reserve values (2P NPV10) by approximately C$30 million, according to the corporate news above.

And pro-forma the Tournament deal, Chinook Energy's LLR (Liability Management Rating) in Alberta stands at 4.92, which is significantly higher than its Montney peers:

|

Chinook

Energy

|

Leucrotta

Exploration

|

Blackbird

Energy

|

Storm

Resources

|

Front

Range

Resources

|

Painted

Pony

Petroleum

|

Crew

Energy

|

|

LLR

|

4.92

|

0.93

|

1.13

|

1

|

1.84

|

2.16

|

2.55

|

Given also that most investors are backward-looking, I have to underline the following facts that will affect positively Chinook's balance sheet (the non-Tournament part) in Q3 2016 and the coming quarters:

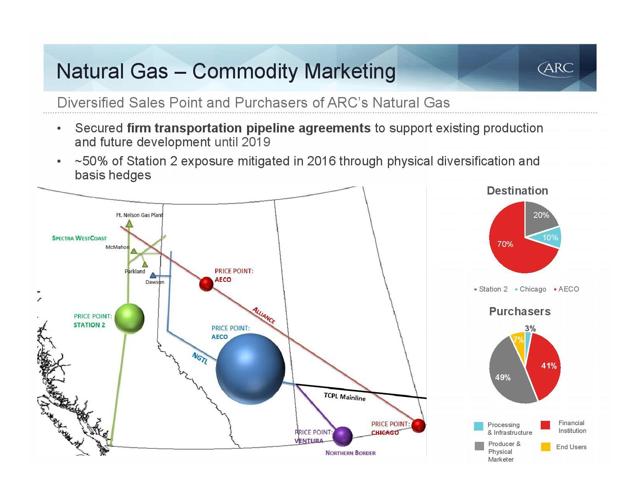

1) Diversified natural gas sales thanks to the Alliance contract (effective May 1, 2016): Since May 1st, 2016, Chinook Energy has diversified away from weak Station 2 prices by securing firm transportation on Alliance to the Chicago market for approximately 1/3 of its Birley/Umbach volumes.

Therefore, since late Q2 2016, the company has been receiving for a part of its production Henry Hub pricing that currently is about $3/MMbtu or C$3.90/MMbtu, which is a huge price difference compared to just C$1.39/GJ (average realized price for AECO and Station 2) that Chinook received in the first half of this year, when it didn't have the contract with Alliance pipeline.

2) Netback increases by C$2.70/boe effective September 1, 2016:Subsequent to the end of the second quarter, Chinook announced that it executed a new gas handling agreement impacting the majority of its British Columbia natural gas production.

According to Chinook, this agreement will significantly improve go-forward drilling economics, bring base production back online and provide gas handling capacity for growth volumes as well as reduce operating costs by approximately C$2.70/boe on Chinook properties not held by Tournament Exploration.

Actually, Chinook's agreement is the same like Storm's recent agreement in Birley/Umbach with Spectra Energy (NYSE:SE) that is expected to result in Storm's corporate operating cost declining by approximately 15% to 20%.

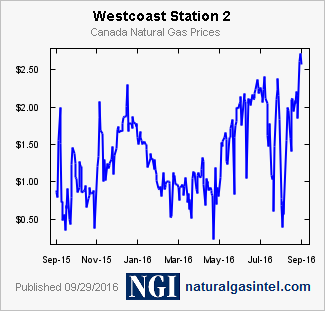

3) Natural gas disruption in Canada in H1 2016 because of one-time, non-recurring events:Constraints and maintenance outages on the Spectra and TransCanada sales pipelines that began in late 2015 continued in the first half of 2016, and impacted negatively Station 2 pricing.

And due to the forest fires, this problematic situation became even worse in Q2 2016 when a lot of heavy oil production in western Canada was shut down for weeks as a precaution and because of disruptions to regional pipelines, further reducing natural gas demand and weighing heavily on AECO pricing.

4) Rising natural gas prices: Natural gas prices (Henry Hub, AECO and Station 2) in Q3 2016 have risen significantly relative to the first half of 2016. And the trend is upward thanks to the fundamental reasons presented in detail in my article here.

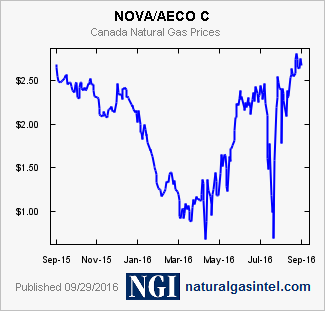

On that front, Chinook Energy currently receives for a significant part of its natural gas production Chicago Citygates price (Henry Hub price) that currently is about $3/MMbtu or C$3.90/MMbtu, while AECO and Station 2 prices have reached or exceeded C$2.50/GJ, which translates into a 70% increase compared to their average prices in the first half of 2016, as illustrated below:

And below:

To get a better idea about the specific locations associated with these three different prices, please take a look at the map below: