On December 9, 2002, Cosmos Health (COSM) announced that it had retained ShareIntel (Shareholder Intelligence Services LLC) to review the trading patterns of the company's common stock for the past two years and going forward. The company stated that it:

values its shareholders and wants to have all available data at its disposal to act in its fiduciary capacity

Despite extensive discussion at the time, the matter was ultimately overshadowed by broader market turbulence. But things have now changed. A couple of days ago, Genius Group (GNS), an edtech and education group, approved an action plan to address "alleged illegal short selling of its stock" at a meeting of the Board held on January 18, 2023. GNS stated in its press release:

This action plan includes creating a Board-led ‘Illegal Trading Task Force’ to actively pursue all possible actions together with the regulators in their discovery and prosecution of persons engaging in market manipulation involving the ordinary shares of Genius Group. This Task Force will be led by Timothy Murphy, a Genius Group Director and former Deputy Director of the F.B.I., Richard Berman, also a Genius Group Director and chair of the Company’s Audit Committee, and Roger Hamilton, the CEO of Genius Group. The Company has been in communication with government regulatory authorities and is sharing information with these authorities to assist them.

This bold move to combat illegal short selling has even garnered attention from mainstream media sources and has also inspired other companies to take similar actions. MarketWatch published an article about this topic entitled "Genius Group CEO on why his company is fighting back against naked short sellers — and it’s not alone". The opening part of the article quotes GNS's CEO stating:

“It’s like being robbed in a library, but you can’t shout ‘Thief!’ because there are ‘Silence, please’ signs everywhere.”

On Friday, January 20th, 2023, Helbiz (HLBZ), a New York-based maker of e-scooters and e-bicycles, announced that it is following Genius Group's example and evaluating options to address the potential short selling issue. Helbiz stated:

The Company believes that certain individuals and/or companies may have engaged in illegal short selling practices that have artificially depressed the stock price. As a result, Helbiz is evaluating its options and following the example of companies like the Genius Group (NYSE American: GNS) in creating a comprehensive action plan to address this issue. Salvatore Palella, CEO of Helbiz, has disclosed that he will meet with third parties that have indicated interest in working with Helbiz to resolve the potential short selling issue.

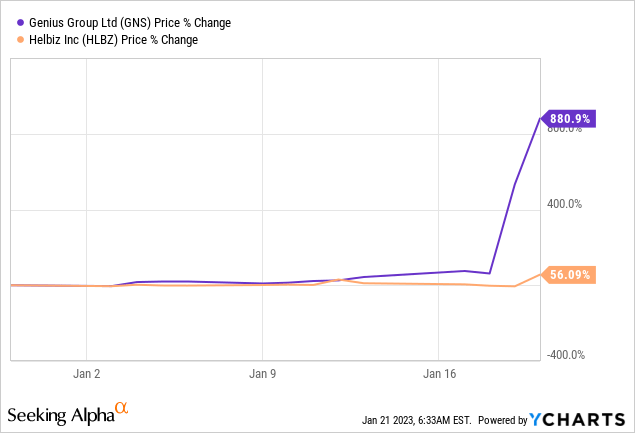

This generated significant excitement and, as a result, both GNS and HLBZ have seen substantial gains year to date:

Data by YCharts

Data by YCharts Specifically, GNS has seen an astronomical increase of almost 900% and HLBZ has seen an increase of more than 50%.

On the same day as HLBZ's announcement, Cosmos also signalled its determination to address this issue. It is my belief that Cosmos is financially stronger and way more undervalued compared to the aforementioned companies. Cosmos provided an update regarding its acquisition of ZipDoctor, and also addressed the ongoing review of COSM trading patterns. Cosmos stated the following:

Update on the ongoing review of COSM trading patterns: Cosmos would like to inform investors that it has recently received trading activity data from Shareholder Intelligence Services, LLC. Management is carefully reviewing the data in order to develop its next course of action.

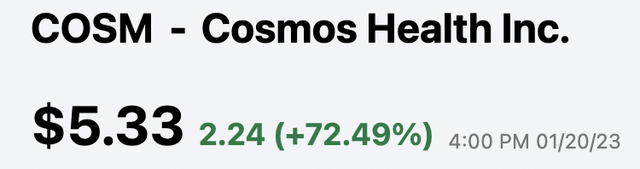

This was well-received by investors, resulting in a significant increase in the share price of more than 70%!

Seeking Alpha

This action by the management team of Cosmos was another clear indication of their commitment to the best interests of their shareholders. However, it is not just the positive momentum and resurgence of optimism resulting from addressing illegal short selling that is driving the company forward. Cosmos is making significant progress on multiple fronts that will ultimately lead to a revaluation of the stock.

Specifically, on January 17th, 2023, Cosmos provided a very positive update regarding its debt balance and projected interest expenses for 2023.

- Cosmos ended 2022 with long-term debt of approximately $4.6M, a decrease of $16.6M compared to the company's 2021 debt balance of $21.2M.

- This represents a 78% YoY reduction in debt, surpassing the company's previously announced guidance of a 50% YoY reduction by the end of 2022.

- As a result of this reduced debt balance, Cosmos expects its interest expense in 2023 to be reduced by 72%, approximately $0.6M, a decrease of approximately $1.6M compared to the $2.2M interest expense expected in 2022.

As stated by the CEO, Greg Siokas:

We are happy to have achieved our goal of strengthening our balance sheet, by substantially reducing our debt. Our new capital structure not only decreases our risk profile, but also lowers our interest expense. Furthermore, our recently strengthened balance sheet allows us the ability to execute on our multi layered growth strategy which is now underway. We continue to enter into strategic agreements with partners which we expect to lead to revenue growth for many years to come.

The substantial reduction in debt was facilitated by a transformative $32.5 million offering, and Cosmos is now in the advantageous position of having having completely de-risked its balance sheet. The company is now flush with cash, is virtually debt-free, and possesses significant growth prospects in the future.

In fact, Cosmos is steadily moving towards a high-quality business model that will allow it to generate significant positive operating cash flowgoing forward. This is partly aided by the reduction in interest payments, as previously discussed, and will primarily be fueled by various organic initiatives (driven by its premium nutraceutical brands such as "Sky Premium Life" and "Mediterranation") as well as strategic acquisitions. In addition to securing favorable terms for the ZipDoctor acquisition, the company did the same for the strategic acquisition of the nearly century-old Cana Laboratories, a European Pharmaceutical Company established in 1928. These moves alone will pave the way for annual revenue to surpass the $100 million mark. Exciting times ahead and I am confident that the share price will follow to reflect the company's true value which indicates significant multi bagger potential.