A marketing guru might cringe at that headline but I write what I think and am not going to be a showman in an article. Here are my thoughts on Fiore Gold $F-v. This is a producer of 40k-45k ounces via heap leach in Nevada. Market cap is $42m CAD at market close yesterday. It has shares outstanding of 97.8m. Warrants ($1.70 strike and above) of 22m, CAD options of 4.9m (about half with strike above $1) and USD options of 3.9m (strike of 80 cents and above). The fully diluted share count then is likely in the low 100m range for the effective future.

I spent some time in Vancouver recently and met up with a lot of different people known to the community. One of them was talking about Fiore with a friend and honestly, I mentally shut off my mind to the conversation for about 30 seconds to begin with and thought about the past. I wasn’t really invested in Fiore in 2018 but did have very small exposure to it for a matter of weeks before seeing the chart break down. I took a small loss and moved on. I do recall around that time though that a few friends probably took bigger losses than I did on it and that was that and few people really brought up Fiore afterwards. It happens - we've all got a list of trading mistakes in the past. So that was the first thing that jumped into my brain. But, I will listen to any stock idea and I filed it away and did some work later that night – and I was surprised enough that I wanted to talk about it and see what others thought.

What follows is a bit of a rundown of the chart and recent trading then I will swing into my thoughts on Fiore.

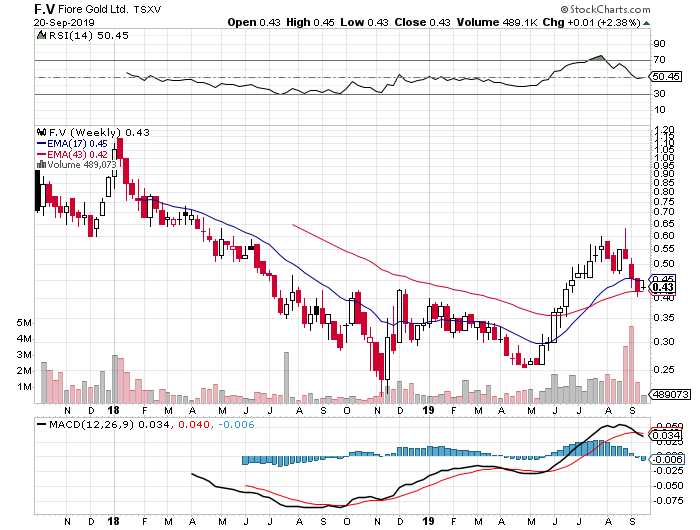

The first thing I did was run a chart of the past couple years to just set the scene in my mind. I was immediately drawn to the 42-43 cent area as an area that has mostly served resistance in the past. The stock was currently trading right around that level with the RSI in low 30s after dropping a lot the past month. Interesting. Current chart attached with line drawn through former resistance. The initial questions I had last weekend were, what has caused the dip and will the current area hold?

I ran a weekly chart as well after this week’s close which follows below. So far, it looks like the 42-43 cent area is holding up nicely. The stock is mostly staying above the 43 week EMA to this point. It did briefly dip below this level once during intraday trading a couple weeks ago. I can tell you that my broker sat on the bid at $0.425 on Monday the 16th and Tuesday the 17th and GMP finally obliged near the end of each day after hitting the 43 cents and higher bids earlier each day. I bought 43 cent shares myself on Thursday being satisfied that any and all bids weren’t immediately getting hit. I of course do not know if the GMP client(s) is out of shares to sell now.

Why is knowing that maybe there was limited supply down around these levels important? Well, I don’t really want to see the chart breakdown much further, even if I feel there is an ace in the hole if it does. What has been responsible for the drop in share price the past month? GMP’s trading is interesting – in the past month, they have sold 800k shares and bought….0 shares. Anonymous has sold ~3.5 million shares while buying ~2.5m. Net -980k. Not typically a great sign that Anon and GMP would be selling. Haywood, on the other hand, has bought ~720k while selling ~50k..net 670k. Okay, that is better. Now, if a big holder still wants to go and blow up the chart they can do so. As one notable non-retail investor once said here “I don’t read charts, I make them.” But, I think this stock is very cheap so let’s file this chart and trading stuff away for now and talk about the story.

I mentioned an ace in the hole. Fiore Gold is not an explorer with a one way downhill path on cash flows. F has working capital of $22.3m USD at the end of June 2019. That is $29.7m CAD when converted. So this producer of 43-44k ounces is trading for $12m CAD above its working capital position. On paper, that further interested me when coupled with my look at the chart.

When you dive into the Pan mine, you quickly realize this isn’t a ultra low cost producer by any means. The produced ore grade is reported as .015 oz/t in the first 9 months of 2019. I think most of us operate mentally in grams per tonne. That is approximately .47 g/t. I’m sure a few people are reading right now and going, wait, you can make money mining at that level of grade? I guess my answer is that you can do okay if your deposit is amenable to heap leach if gold is $1300. But, what if you think $1500 gold might be around for a while? Higher gold prices really benefit those companies that were making $0-$100 an ounce at say, $1300 gold. Their profit per ounce jumps a lot as you move up the gold price food chain. Let’s pretend for a minute that $1500 gold is here now and nothing else changes. Let’s peg 2019 production at 43,000 ounces and say that is the norm. Let’s call that $1500 level a $200 increase over the realized price of $1,287 per ounce in 2019. 43,000 * $200 = $8.6m USD which is ~$11.4m CAD. Note: while financials are USD, I am bringing some numbers back to CAD on occasion to compare to the $42m CAD market capitalization. $11.4m CAD in additional annual revenue would be quite helpful for Fiore.

Sidebar: This would be a good time to discuss Note 10 of the financials for June 30, 2019. Fiore has a gold collar in place which will see them deliver 8,400 ounces from July 1, 2019 to November 25, 2019 at a ceiling of $1,350 per ounce. (Floor is a non-relevant $1300 per ounce) So roughly half the ounces sold during those 5 months will be sold at $1,350 an ounce. Some will not love that and I’m sure no one likes their company to sell at ~$175 below the current gold price. That ends in two months and if the company enters into another collar, at least it would be it would be at much higher terms if $1500 gold has staying power. If I prorate the collar over the days in each fiscal year, then I believe only 3,178 ounces from the collar will affect the 2019-20 fiscal year.

When I look at cash and cash equivalents I am comforted by the fact that in periods of $1300 gold prices and typical strip ratios, that Fiore has increased their cash and cash equivalents by $2.6m over the past year, to $9.7m. The strip ratio this year is 1.6. The LOM strip ratio is 1.6. So the results to date this year could probably be considered to neither be aided not harmed by strip ratios that fall outside the norm. That is comforting to me if gold drops from current levels. Note: Tim Warman (the CEO) has publicly stated that the strip ratio will be closer to 2:1 in the next couple quarters.

What other improvements might Fiore be able to make? There is one that stands out in a very good way, if they execute. Fiore commissioned their primary crushing circuit at Pan at the end of June 2019 which should aid results going forward. This means going from run of mine to running material through the circuit before heading to the pads. If you look at recoveries, the run of mine gold from north pit is only 50% recovered while south pit is 75% recovered. Really low numbers that are worth attempting to improve, right? So what will the crushing circuit do? As they say, “at the present ore mining rate of 14,000 tons per day, the crushing circuit will produce an estimated 6,000-7,000 additional gold ounces per year.” Let’s pretend it does add 6,000 ounces of gold to production – with no changes . At $1,500 gold, that is $9m USD in additional revenue or $12m CAD. Yes, there was a cost of $3.5m to add this circuit and related equipment. Of that, $2.3m was leased over 36 months. Let’s call it $800k USD or $1,100 CAD in annual lease payments versus additional cash flow as noted above. That’s a really good tradeoff if executed properly. Net $10.9m CAD in this crude example. I am impressed but let’s keep in mind there will be expenses associated with running the crushing circuit. I don't know what to peg them at and would have to ask the company. Halve the Net $10.9m CAD advantage for now? I don’t know enough on this specific point. Your comments are welcome on that and anything else I’ve said. $5m Net CAD? The existence of the primary crushing circuit definitely aids management’s goal of getting to 50,000 ounces production in FY 2020.

So if I’m keeping score in my mind of the most obvious details (in my opinion) that’s:

Keep in mind that the last number of $5m is a big unknown to me, right now. But why am I interested in numbers like these? Really, it gives me comfort that my downside is limited. I look at every position through the prism of what is my downside versus upside? If the upside is favoured by enough, I am likely to invest. I think I have that here. Let's pretend the market cap over working capital is all that matters in the world and let's divide it by shares o/s. Result is 12.6 cents. Let's pretend current EPS is $0. Now add $16.4m in additional revenue on a yearly basis and divide into shares o/s. That results in 16.7 cents additional earnings pre-tax. I will just say that gives me comfort that my downside is pretty limited if $1500 gold is the norm, and you can read between the lines if I am happy with that or not. What if annual earnings were say, 15 cents a year? What do you think happens to the share price? This is why I've done this exercise.

I am trying to be clear that those latter two numbers in the table above might not be completely accurate, but they are positives. Anonymous and GMP could sell this stock lower at any time and I want to know, what is my plan if that happens? If I had one in place and my stop loss hit, would it be see ya later? Or, would I dig in and keep adding. I know what my answer is. I’d add. When I read the financials, I don’t view every single thing I read positively. But I see enough that my gut likes here. I mean, I don’t love that the labour market is tight in Nevada for miners right now and that utilization was a bit lower than ideal in the last quarter given Ledcor simply didn’t have enough staff every day. Yet, I don’t think it had a massive impact at the same time.

I need to look at the ounces in the ground, of course.

Pan

The mine life at Pan is top of mind. My table above has two numbers at the bottom that result in a significant shift in earnings capabilities if added to the financials. But that means nothing if your mine life is short. Proven and Probable reserves are 275,600 ounces at Pan. That is 6 years if producing ~45k ounces per year. If we expand this to look at Measured, Indicated & Inferred, we are looking at 532,000 ounces. So it looks like they could expand Proven and Probable with further drilling. Gold grade in that resource is similar at around .014 oz/t to ore grade mined this year. (That is around .44 g/t)

Gold Rock

There was a mine at this location in the early 90s that produced 75,000 ounces at a grade of 0.89 grams per tonne before shutting down. 8 miles from Pan. The idea might be to truck loaded carbon to Pan. A July 2018 Resource Statement said there were 240,000 ounces Indicated at 0.82 g/t and 180,000 ounces Inferred at 0.72 g/t. Fiore announced a $2m program of met work and resource expansion drilling in July 2019, having hit a point where they were comfortable with how Pan was operating. They hope to produce a PEA for Gold Rock later this year. It’s all their ground. All federal permits are in place. Upon producing a PEA they will then proceed to Feasibility. They want to make their construction decision by 2021. Conceptually, they see it as a 50k-75k ounce per year producer. Grades are 60% higher than Pan and any Met work they’ve done thus far has been positive. It will have a higher strip ratio than Pan so let’s not think of it as a relative cash cow.

Overall, that’s 670k ounces M&I at Pan and Gold Rock and a further 290k ounces Inferred.

Summary:

I think there is an opportunity for Fiore to do fairly well over the next 5-10 years. Their stated goal is to get to 150,000 ounces per year production with both operations. We will see. I am a one step at a time person. The above discussion is solely my findings from taking a spin through the financials, MD&A, corporate presentation and watching Tim’s Beaver Creek presentation, over the past week. I am encouraged by what I have read so far. No one has approached me to write these thoughts down. I just felt like doing it once I dove into the story given I was jotting them down on paper as I went and I can barely read my own writing/context weeks later. I am a totally independent speculator. I will post here if I sell any or all of my shares. I think that’s reasonable if I’m going to tell you guys I bought it and write up why I like it.

One question I have not answered is what caused the dip from the 60s to the low 40s in the past month. I don’t know. I mean, I know which houses sold it but I don’t know why they sold it. Sometimes people have to move on from a story. Maybe some people just don’t like that strip ratio might supposedly be closer to 2:1 for a couple quarters. I feel that is advantage to me, in this case, given what I’ve listed. That is especially true if the gold price is higher to help absorb the effects of the extra strip. I had a fleeting thought that maybe Gold Rock drilling wasn’t going well but drilling so far is producing some very nice grades – see August 12th and September 10th news releases.

Thanks for reading if you made it this far.