About: I joined Gate City Capital Management as a research analyst three years ago after spending one and a half years writing full time on Seeking Alpha. I haven’t written for Seeking Alpha in over three years, since my last article titled Farewell Seeking Alpha. My time these days is spent researching deep value, micro-cap companies for Gate City Capital Management. For those who don’t know, Gate City Capital Management is an investment firm that runs a concentrated, micro-cap, deep value strategy. I have decided to return to Seeking Alpha to showcase my top idea for 2020. My top idea for 2020 is Macro Enterprises (OTC:MCESF) (MCR.V). I believe Macro is significantly undervalued and overlooked. Utilizing a DCF analysis, my price target for Macro is $7.19 per share, which equates to approximately 90% upside. My research process on Macro includes meeting with the management team, touring facilities in Northern Canada, attending the past two annual shareholder meetings, and speaking with industry experts. I hope the information I have gathered is informative and helpful to my former followers and supporters.

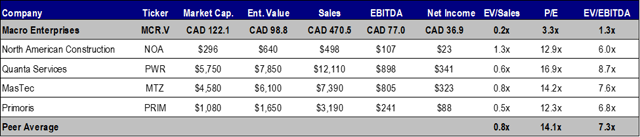

Mispricing: Macro trades at a significant discount to peers. I believe the discount is due to three reasons: the Canadian energy market has been in a multi-year downturn and Macro has been grouped with the broader energy market, Macro is an illiquid and thinly traded security, and Macro trades on the Toronto Venture Exchange ("TSX") as a micro-cap security. If Macro executes on the two large projects in their backlog, the Company will generate a significant amount of free cash flow over the next two years. Successful execution on these two projects should help close the current value discount and re-rate the security. An additional large project announcement would provide investors with added conviction in Macro’s long-term prospects.

Business Overview: Macro Enterprises Inc. constructs oil and gas pipelines for companies in Western Canada. In addition to oil and gas pipeline construction, Macro constructs compressor stations and other energy pipeline infrastructure and provides maintenance and integrity services on existing pipelines. Macro has completed construction projects for some of the biggest names in the business including TC Energy Corporation, Pembina Pipeline Corporation, Enbridge Inc., Seven Generations Energy Ltd., AltaGas, and Fortis Inc. In addition, Macro Enterprises has Master Service Agreements (“MSAs”) with TC Energy, Pembina Pipeline, Enbridge and NorthRiver Midstream. The Company’s headquarters in Fort St. John, British Columbia are strategically located within the Montney Formation which has large deposits of low-cost natural gas. Fort St. John is also situated between the oil sands of Alberta and the port cities of Western British Columbia. Macro’s shares are traded on the Toronto Venture Exchange and all figures in this presentation are in Canadian Dollars unless otherwise noted.

Construction Services: Macro constructs oil and natural gas pipelines and energy related infrastructure in Western Canada. The Company began operations focusing on small diameter pipelines but has since expanded its capabilities to build all sizes of pipeline. The Company does not provide any engineering services but rather focuses its operations on the actual construction process. The pipeline construction process consists of the following steps: clearing and grading a right-of-way, digging a ditch to lay the pipe, fabricating the pipeline together, bending the pipe to fit the terrain, testing the pipeline, burying the pipeline, and restoring the right-of-way. The process requires a large amount of construction equipment including pipelayers, excavators, bulldozers, and trenchers. The Company is compensated either on a time and materials or a fixed price basis and is generally not responsible for the purchase of the pipe. The cost to install a pipeline varies dramatically depending on the location of the pipeline and the terrain that must be navigated.

Oil and gas pipelines require a significant amount of infrastructure including compressor stations. Compressor stations are facilities located along a natural gas pipeline which compresses gas to a certain pressure allowing gas to be moved along the pipeline. Macro is typically compensated on a fixed price basis when constructing facilities projects. Over time, Macro has developed a strong reputation for delivering projects on-time and on-budget with an expertise in challenging areas such as mountainous terrain.

Maintenance and Integrity Services: Completed pipelines require regular maintenance work to ensure the integrity of the pipeline and make any necessary repairs. Many pipeline owners choose to enter into Master Service Agreements to provide a framework for expected future service work along with pre-negotiated pricing. Macro has MSAs with TC Energy, Enbridge, Pembina and NorthRiver Midstream. The TC Energy MSA is for the Nova Gas Transmission Line (“NGTL”). The Nova Gas Transmission Line is a system of pipelines that stretch across Alberta and British Columbia. The Enbridge MSA is for the B.C. Pipeline, consisting of 2,858 kilometers of pipeline, stretching from Fort Nelson in Northeast British Columbia to the Southern Canada-United States border. The Pembina MSA covers the Northeastern British Columbia Pipeline (“NEBC”), a pipeline system in British Columbia. The NorthRiver Midstream MSA is for 3,550 kilometers of natural gas pipeline across the Montney region of British Columbia and Alberta. Maintenance and integrity services work is completed on a time and materials basis with gross margins generally in the mid-twenties. Macro has historically generated between $40 and $50 million of revenue annually from its MSAs, providing Macro with a recurring base of high margin revenue. I have provided pictures of each of the MSA pipelines below to show the massive infrastructure Macro helps maintain.

Management and projects executed: Macro Enterprises is led by Frank Miles, the President, Chief Executive Officer and Chief Operating Officer. Mr. Miles worked in the pipeline industry his entire career before founding Macro in 1994. Mr. Miles owns over 30% of Macro through 9.1 million shares of common stock and 2,100 shares of preferred stock. During the market downturn of 2015-2017, Mr. Miles was selective when bidding on projects. Mr. Miles is fond of saying he “did not sweat his iron” for low margin work and choose to preserve Macro’s owned equipment base. Mr. Miles has also made sure the Company has had a strong balance sheet, giving Macro the ability to bid on economically attractive projects. The unlevered balance sheet (excluding equipment financing) speaks clearly of the conservative nature of Mr. Miles. I take comfort knowing the CEO owns over 30% of the Company and has his capital on the line with ours. Mr. Miles has acted as a true owner/operator focused on maximizing Macro’s free cash flow.

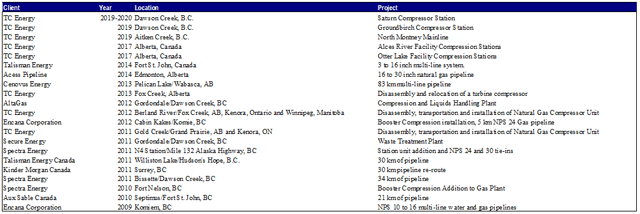

Under Mr. Miles’ leadership, Macro has a long history of completing projects on time and on budget. In 2018, Macro started work on the North Montney Mainline Expansion. The project was for the construction of 67 kilometer stretch of pipeline that connected the growing Montney natural gas production to North American markets. The project was originally $200 million but ended up being over $250 million by the time Macro finished the project. This was the largest project Macro has executed to date. There is a video of Macro building the North Montney Mainline Expansion project you can view here. Macro’s successful execution on the North Montney Mainline Expansion has already manifested in additional work for Macro. Macro was awarded two compressor stations on the North Montney Mainline Expansion. The Groundbirch Compressor Station was a $37 million project that was completed in the third quarter of 2019. The Saturn Compressor Station is a $30 million project expected to be complete in the second quarter of 2020. Successful execution on multiple projects shows pipeline companies that Macro can execute and perform on multiple large projects at the same time. Macro’s industry-leading safety record that includes 25 consecutive quarters and over five million manhours without a lost time incident is a positive factor for winning additional work. Past performance on construction projects will be helpful for Macro’s resume when bidding on future projects. I have provided a table below of past projects Macro has successfully completed.

Source: Macro Enterprises financials filings & company website

Source: Macro Enterprises financials filings & company website

Current Backlog: Even with the success Macro achieved in 2018 and 2019, I believe the best is yet to come. Macro has a record project backlog that I expect them to execute through 2022. The two largest projects in Macro’s backlog are the Trans Mountain Pipeline Expansion and the Coastal GasLink Project. I have provided details of these two major projects below.

Trans Mountain Expansion: The Trans Mountain Expansion project (“TMX”) is a $9.3 billion proposed expansion or twinning, of the existing Trans Mountain pipeline system, running between Edmonton, Alberta and Burnaby, British Columbia. The original Trans Mountain Pipeline was constructed in 1953 and carries crude oil through 1,150 kilometers of pipeline. The Trans Mountain Expansion would increase the capacity from 300,000 barrels of oil per day to 890,000 barrels of oil per day. At full buildout, the project will add 980 kilometers of pipeline, 12 new pump stations, 19 new storage tank terminals and three new berths. In May of 2016, the NEB recommended to approve of the expansion. In November 2016, the Trans Mountain project was approved by the Canadian government.

The approval of the pipeline attracted protests from environmentalists and First Nation groups resulting in delays. On May 29, 2018, the Canadian Government purchased the pipeline from Kinder Morgan for $4.5 billion. In August 2018, the Trans Mountain Pipeline Expansion was temporarily delayed after officials concluded the pipeline was approved without fully consulting with First Nations. In June 2019, after completing additional consultation, the Canadian government approved the expansion project for the second time, promising to have shovels in the ground for the 2019 construction season. The total project size for the Trans Mountain Pipeline Expansion was upsized from $7.4 billion to $9.3 billion.

Source: Trans Mountain Route

Macro was awarded a 50% stake of a $375 million contract (along with JV partner Spiecapag) for the construction of Spread 5B of the Trans Mountain Pipeline Expansion. Spread 5B includes the construction of 85 kilometers of 36-inch pipeline along the Coquihalla-Hope corridor in British Columbia. This section of the pipeline is one of the most technical sections of the project, as such Spread 5B was structured as a cost-plus contract, greatly reducing the execution risk. Spread 5B was also structured where Macro would get upfront working capital payments. The recent increase in estimated project costs from $7.4 billion to $9.3 billion suggests that total size for the Macro Spiecapag Joint Venture could be over $500 million. I estimate project margins on the Trans Mountain Expansion to be 15%. Spread 5B of the Trans Mountain Expansion is estimated to begin in Q2 2020 and run through 2022. While I recognize the project has been delayed in the past, there are positive indicators the pipeline will be built. Work has already started on a portion of the Trans Mountain pipeline with an estimated 2,200 contractors working and pipeline in the ground. The pipeline is also now owned by the Canadian government. Following Prime Minster Trudeau’s election in 2019, Trudeau reiterated his support for the project.

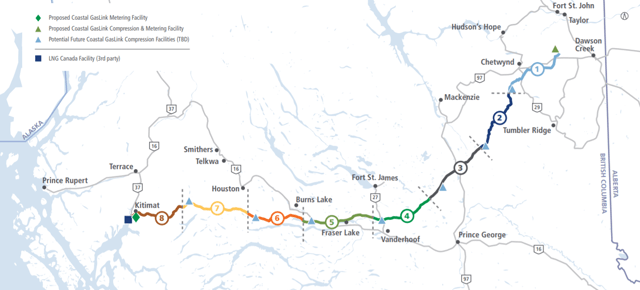

Coastal GasLink: The Coastal GasLink pipeline project is a 670 kilometer pipeline that will deliver natural gas from Dawson Creek, Canada to a new LNG export facility in the port of Kitimat, Canada called LNG Canada. LNG Canada will be the first major LNG export facility in Canada with a total estimated cost of $40 billion. The Coastal GasLink project will be built and operated by TC Energy. The pipeline is expected to have an initial capacity of 2.1 billion cubic feet per day with a potential expansion of up to 5.0 billion cubic feet per day. Original estimated project costs for Coastal GasLink were $6.2 billion. In November 2019, the estimated costs of Coastal GasLink increased to $6.6 billion due to additional meter stations and increased costs for rock work and water crossings. On December 26th, 2019, KKR (a global investment firm) along with Alberta Investment Management Corporation (“AIMCo”) announced an agreement to buy a 65% equity interest in the Coastal GasLink Pipeline project from TC Energy. On October 1st, 2018, the final investment decision was approved by the project’s partners (Shell, PETRONAS, PetroChina, Mitsubishi Corporation, and KOGAS) of LNG Canada.

On June 19th, 2018, TC Energy awarded Macro Enterprises a 40% share in a $900 million contract to construct Spread 5 and Spread 8 of the Coastal GasLink Pipeline. Spiecapag Canada Corp. shares the other 60% of the contract. Civil work (clearing, logging, managing camps and setting up equipment) will be performed under a reimbursable contract model, while the mechanical scope (trenching and welding) will be performed under unit rates. There are upfront working capital mechanisms that will reduce working capital requirements for Macro and Spiecapag.

Source: Coastal GasLink Construction Update

Macro began work on Spread 5 and 8 of Coastal GasLink in the first quarter of 2019, with work expected to run through the fourth quarter of 2021. Macro and Spiecapag have already completed a meaningful portion of the preconstruction and clearing. Readers can find updates on the Coastal GasLink project website for each of the spreads. As of January 16th, 2020, 28% of Spread 5 has been cleared. Pipeline is expected to arrive at the storage site in the beginning of April. Spread 8 has 52% of its 84 kilometer route cleared and 11,000 meters of pipe have been stockpiled at storage sites.

I estimate in fiscal years 2020 and 2021 Macro will realize $150 million in annual revenues from the Coastal GasLink Project. My estimated project margins are 15%. It is likely there will be scope changes to the project, potentially increasing the entire contract size well above the $900 million project estimate. Similar to the North Montney Mainline pipeline project Macro completed in 2019, Macro has potential to win additional facility contracts. Only one compressor station out of eight has been awarded so far, with each compression station costing $30-40 million. One of the seven remaining compressor stations is located within Spread 5 of the pipeline route. I find Macro’s successful history of working with TC Energy a positive datapoint for the potential award of an additional compressor station.

Spiecapag Joint Venture: Macro’s joint venture partner for both the Trans Mountain Expansion and Coastal GasLink is French-based, Spiecapag, a subsidiary of VINCI. Spiecapag is one of the world’s leading oil and gas pipeline system companies with over 90 years of experience and has completed pipeline projects around the world. VINCI is a billion-dollar, global infrastructure company employing over 200,000 people in over 10 countries. Having Spiecapag as a partner has enabled Macro to take its operations to the next level. With Spiecapag as a joint venture partner, Macro can now utilize a billion-dollar company to bid and execute on future projects that would have previously been considered too large. The joint venture has been successful so far allowing Macro to punch above its weight class, landing impressively sized contracts with the backing of a global infrastructure company. Macro provides Spiecapag with local expertise, a large base of owned equipment, and the right zip code for winning Canadian pipeline construction projects. I am optimistic that Macro will continue to utilize Spiecapag to bid and potentially win additional large-scale projects.

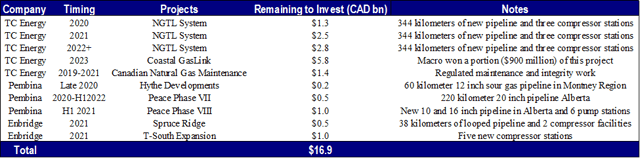

Potential Future Projects: Having Trans Mountain and Coastal GasLink in the current backlog is exciting, but there is a substantial amount of additional work for Macro to win. I have gone through the recent investor presentations for TC Energy, Pembina and Enbridge, Macro’s MSA partners. Macro’s MSA partners plan to spend over $16.9 billion in Western Canada over the next three years. While Macro will not win all this work, Macro has established itself as a reliable partner in the industry. I am confident Macro will win their fair amount of project work. Potential projects Macro could win are depicted below.

Source: TC Energy, Pembina and Enbridge Investor Presentations

Source: TC Energy, Pembina and Enbridge Investor Presentations

Competition: Macro operates in a competitive industry. Companies in the pipeline industry compete on reputation, safety record, geographic location, and price. Competitive advantages for Macro include, a pristine safety record, a strong balance sheet, a history of successful execution on projects, and a strategic geographic location. Competitors consist of Surerus Pipeline, Quanta Services, Ledcor Group, Midwest Pipelines, Waschuk Pipeline Construction Company, Robert B. Sommerville Co., and Michels Canada. From my research pipeline construction companies in this environment are exceptionally busy. If demand for contractors continues to increase there is potential for project margins to increase. This type of environment should be favorable for Macro given their large base of owned assets, geographic location, and reputation in the industry. The partnership with Spiecapag is another feather in the cap which should give Macro the ability and opportunity to bid on projects in the future. Given the major capital investments Macro’s three Master Service Agreement partners have announced, Macro has the potential to compete effectively for work. Finally, Macro has a clean balance sheet and equipment base of owned assets that will allow Macro to selectively bid on profitable contracts.

Balance Sheet and owned assets: Macro’s balance sheet is strong, with $50.9 million in cash and $27.5 million of equipment financing debt. Macro has net working capital of $51.9 million and nearly $75 million in property, plant, and equipment. Macro has valuable real estate holdings in Fort St. John including the Company’s corporate headquarters on 4.3 acres of land, a 23,000 square foot mechanics shop, a 10,800 square foot truck stop on 3.72 acres, and three other parcels of land in Fort St. John, Canada on 20 acres. Book value of the land and buildings is $17.9 million. Macro has made the strategic decision to own most of its equipment. As of the December 2018 Annual Information Form, Macro reported owning 96 light duty trucks, 31 heavy duty trucks, 51 trailers, 4 trenchers, 33 dozers, 49 excavators and 101 pipelayers. In the past three years Macro has spent over $50 million upgrading its fleet of equipment. Gross value of the Company’s construction equipment as of the last quarter was $96 million. Furthermore, the gross value of the Company’s automotive equipment as of the last quarter was $22 million. Net book value of the equipment ($56 million) is likely understated given the recent high grading of the equipment base. I visited Macro’s yard in 2017 and saw firsthand the massive equipment base Macro owns. My contacts in Fort St. John say the yard is now empty as equipment has been deployed.

| Macro’s Corporate Headquarters | Pipe-Layers and Excavators | Macro Pipe-Layer |

|  |  |  |

| Source: Equipment pictures taken by Nick, and headquarter picture sourced from Pipeline News North |

In addition to its large cash balance, Macro has several other sources of liquidity. Macro has a large credit facility, including an undrawn $65 million revolver and a $80 million secured letter of credit facility. Macro also has two standby letters of credit for $40.7 million in value which is guaranteed by Export Development of Canada (“EDC”). The large credit facilities and letters of credit are advantageous to Macro Enterprises for contract bidding. In addition to 30.2 million shares of common stock, Macro’s capital structure includes 2,564 shares of preferred stock convertible at a rate of 666.67 for each preferred share, for a total diluted share count of 31.9 million. Frank Miles owns 2,100 shares of the preferred stock. The preferred stock pays an annual dividend of $65 per share.

Income Statement: Macro has guided for revenues in excess of $400 million for 2019. Macro forecasted 2020 project revenues to exceed $300 million which does not include potential MSA revenues. I expect project work of $300 million in 2020 and $330 million in 2021. I am forecasting maintenance work of $45 million annually for 2020 and 2021 as maintenance spending continues across Canada. I estimate construction projects to have gross margins of 15% and maintenance revenues to generate gross margins of 25% as these cost-plus contracts typically have higher margins. With annual SG&A costs of $8-8.5 million, I forecast Macro to generate $58.5 million in EBITDA for 2020 and $66.8 million in EBITDA for 2021. I have assumed the Company pays the full corporate tax rate of 26% for companies in British Columbia.

Cash Flow: I expect Macro to generate a significant amount of free cash flow in 2020 and 2021. Macro increased capital expenditures spending for 2019 to an estimated $35 million in preparation for the Coastal GasLink and the Trans Mountain Expansion. Unless Macro wins another significant project, capital expenditure spending will fall to maintenance levels, which match depreciation and amortization of $20 million for 2020 and 2021. Historically, Macro has estimated that the Company will need to invest $25 million in working capital for every $100 million in project revenue. Trans Mountain and Coastal Gaslink have upfront working capital mechanisms that will reduce Macro’s working capital needs for the next two years. I estimate minimal working capital needs given the scope of these two large projects. In my DCF analysis, I expect Macro to generate $22 million and $32 million in free cash flow for 2020 and 2021. Macro has $23 million of net cash, has a history of repurchasing shares and does not pay a common stock dividend. The Company repurchased 244,000 shares at $4.14/share in the third quarter of 2019 and recently announced a renewal of their normal course issuer bid to repurchase up to 1,500,000 shares of common stock. I expect Macro will continue to repurchase shares while also preserving their cash balance for working capital and capital expenditure purposes.

Valuation: I utilized a DCF analysis to obtain a price target of $7.19 per share. The DCF utilizes a 12.5% discount rate and 3.0% terminal growth rate. This represents approximately 90% upside. I am forecasting Macro to generate over $50 million in free cash flow over the next two years. If Macro does not win any additional projects, which I would find unlikely, Macro will have a significant amount of cash on its balance sheet from the successful execution of Trans Mountain and Coastal GasLink. The downside is limited due to the net cash position, the large base of owned assets and current “deep value” valuation. Macro’s valuation is also attractive on a relative basis. Macro is trading at a P/E ratio of 3.3x, and EV/EBITDA ratio of 1.3x. Macro’s peers trade at an average P/E of 14.1x and EV/EBITDA of 7.3x.

Source: Yahoo Finance. Macro in CAD and other comparable companies in USD. Figures in millions.

Source: Yahoo Finance. Macro in CAD and other comparable companies in USD. Figures in millions.

Floor Value Analysis: I utilized a floor value analysis to understand Macro's margin of safety under an extreme tail event. I utilized book value of Macro's assets and liabilities and then haircut these by certain percentages for additional conservatism. Based on this analysis I obtained a floor value for Macro of $87 million or $2.70 per share. This floor value analysis represents a -28% downside to Macro's current market capitalization. Macro’s net cash value of $23 million and $75 million of net property, plant, and equipment support our floor value analysis.

Risks: There are several notable risks to the Company’s business that should be highlighted:

- Pipeline projects are complicated, and Macro may be responsible for execution risk and potential cost overruns.

- Pipeline projects are subject to significant regulations and may be delayed or cancelled by government entities.

- Canadian pipeline projects may be subject to protests by environmental groups or First Nations groups.

- Demand for the Company’s services is indirectly driven by energy prices which are volatile in nature.

- Macro operates in Canada and U.S. investors are subject to currency risks should the Canadian dollar depreciate.

Conclusion: I am excited to return to Seeking Alpha and share my top idea for 2020 with my followers. My price target is $7.19 per share, representing an upside of approximately +90%. Macro stands to benefit from a significant backlog of planned Canadian pipeline construction projects. The company’s large cash balance and asset base helps to provide a margin of safety should expectations not be met. Thanks for reading my write-up on Macro Enterprises. Please feel free to comment below or reach out if you have any questions.

Gate City Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. This research report expresses our research opinions. Any information contained in this report may include forward looking statements, expectations, pro forma analyses, estimates, and projections. These types of statements, expectations, pro forma analyses, estimates, and projections may turn out to be incorrect for reasons beyond Gate City Capital Management, LLC’s control. Be sure to first consult with a qualified financial adviser and/or tax professional before making any investment decision with respect to securities covered herein. Following publication of any presentation, report or letter, we intend to continue transacting in the securities covered therein, including any purchases or sales, for any time hereafter regardless of our initial recommendation. All expressions of opinion are subject to change without notice, and Gate City Capital Management, LLC does not undertake to update this report or any information contained herein. Past performance is not indicative of future results.