Sprott Inc. (OTCPK:SPOXD) is the legacy of Canadian billionaire Eric Sprott who made a fortune in gold and gold mining speculation. Sprott is now the largest natural resource focused asset manager in the world. And it will soon be included in my ETFs.

Drivers of revenue

Sprott is primarily a fund management company. Its revenue is thus derived as a fee on Assets Under Management "AUM". There are a number of important funds that Sprott operates including:

Sprott Physical Gold & Silver Trust (CEF), a fund that represents fractional holdings of physical gold and silver stored in Canadian vaults. Sprott Physical Gold Trust (NYSEARCA:PHYS), a fund that represents fractional holdings of gold bullion stored in Canadian vaults. Sprott Physical Silver Trust (PSLV), a fund that represents fractional holdings of silver bullion stored in Canadian vaults. Sprott Physical Platinum and Palladium Trust (SPPP)">SPPP), a fund that represents fractional holdings of platinum and palladium bullion stored in Canadian vaults. Sprott Gold Miners Fund (SGDM), an ETF composed of gold miners. ALPS Sprott Junior Gold Miners Fund (SGDJ), an ETF composed of small cap gold miners. Sprott Focus Trust (FUND), a value fund run by investing legend Whitney George.

Running physical bullion trusts is a pretty boring business. But it is a profitable one. Revenue for 2019 was C$96 million. This is almost entirely from AUM. Sprott has US$10.7 billion in AUM (please forgive the change from Canadian currency to US. The underlying company switched reporting currencies in all official documents in 2020).

Moat

Most of Sprott's AUM is in the physical bullion trusts. These holdings tend to be very sticky among those who hold them with your typical gold bug wanting to hold precious metals "forever". The result is a revenue stream that has qualities similar to a precious metals streaming company. As of the end of March 2020, Sprott has approximately 150,000 customers in its bullion trusts. Over 90,000 have been with the company since it acquired CEF in 2017.

Every month these 150,000 customers get a statement from Sprott detailing the performance of these holdings. The company doesn't miss the marketing opportunity to use that communication to up-sell customers on new Sprott products.

Private Resource Lending

Another private resource lending effort by Sprott is Sprott Resource Lending. With this arm, Sprott lends based on collateral it knows well such as ore. There are few lenders in this space and Sprott regularly gets 17-20% yield on collateralized loans. Sprott expects to have a $1 billion plus portfolio in this space by year end. If they get only 12% yield, thats another $120 million in cash flow.

Sprott Capital Partners "SCP" is an advisory service that provides consulting on merger, acquisition, divestitures, and more for natural resource companies. This business was founded in 2016 and almost immediately became profitable and represent a future growth opportunity.

After the bullion trusts and ETFs, Sprott has a good deal of AUM coming from private resource lending. Sprott Global Resource Investments is a hedge fund like partnership with commodity trading legend Rick Rule. Mr. Rule generally takes 9.9% of the partnership interest and the remaining 90.1% go to the highest bidders. To bid into the partnership means paying a 2% annual maintenance fee and 20% of profits. The original 1998 partnership compounded at 55% a year after fees. The follow up 2000 partnership compounded at 69% a year after fees. A 2006 partnership fell by 50% and was liquidated at 8 years. The most recent 2014 partnership has so far compounded at 30% a year after fees and is still active.

Balance Sheet

This company has a fortress balance sheet as should be expected for a highly capital efficient business. According to the latest public reporting, Sprott has $45 million in cash and short-term investments and under $20 million in debt. Your capital is safe with this company as management is very conservative.

Historical returns

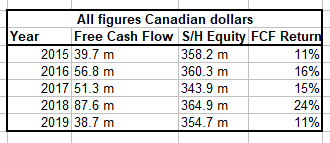

Sprott has generated great Free Cash Flow returns as compared to shareholder equity.

Source: Author calculations, Sprott annual reports

This is a big opportunity

AUM could easily grow at this company by five to ten fold. With its other premium lines of business, revenue could balloon from the $200 million range to over $1 billion by the next peak of the resource cycle. The company's market cap is a mere 1.16 billion as of this writing. It could soon be much larger.

The catalyst

Sprott has been positioning itself to transform from a company based in Canada with primarily Canadian interests to an American company. Central to that was a recent 1:10 reverse split. This was to gain eligibility to the NYSE, where the company plans to list in the near future (the new ticker will be "SII"). Listing on a major US exchange with a price over $10 will allow a large number of ETFs to add this to their holdings. The company will probably join small cap and resource indexes among others. Millions of dollars of new capital will be flowing into this name as a result of the announcement. As of this writing, shares already jumped 24.12% on the news today. It isn't too late as I expect today's 45.75 price to soon be $80 a share or higher.

Action to take

Buy Sprott Inc. (OTCPK:SPOXD) up to $40 per share. (You can also buy in Canadian dollars on the Toronto exchange with ticker SII). Hold with a 25% hard stop to protect your downside. Sell half when you are up 100% and remove the stop on the remaining holdings.

Disclosure: I am/we are long SPOXD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Have been a happy shareholder since May 2018.