NicoElNino

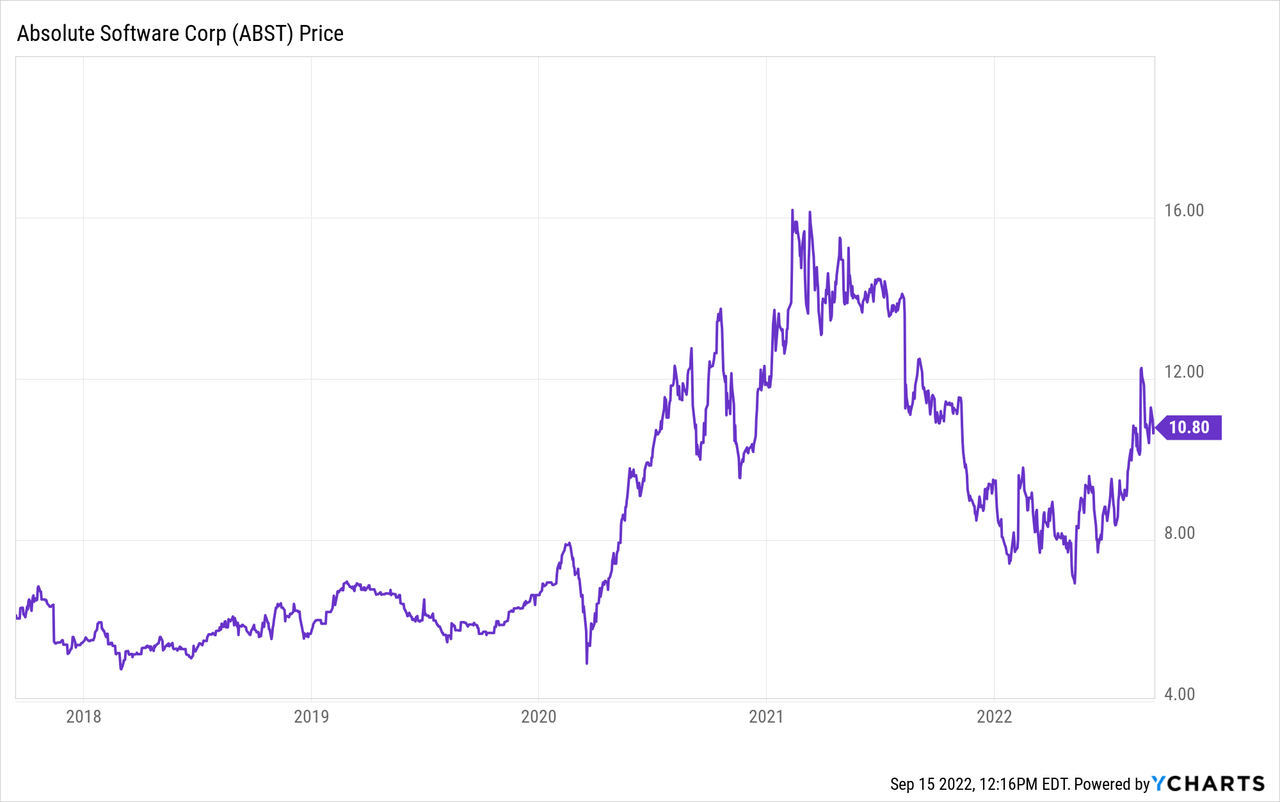

Absolute Software (NASDAQ:ABST) is a cybersecurity company that is a leader in the monitoring of employee PCs for enterprises and governments. The company has recently produced strong financials for Q4 '22 and beat analyst expectations for revenue and profit. The stock price has popped by 55% over the past few months on strong momentum. In this post I'm going to break down the company's patent-protected business model, its financials, and valuation, let's dive in.

ABST data by YCharts

ABST data by YCharts

Tech Business Model

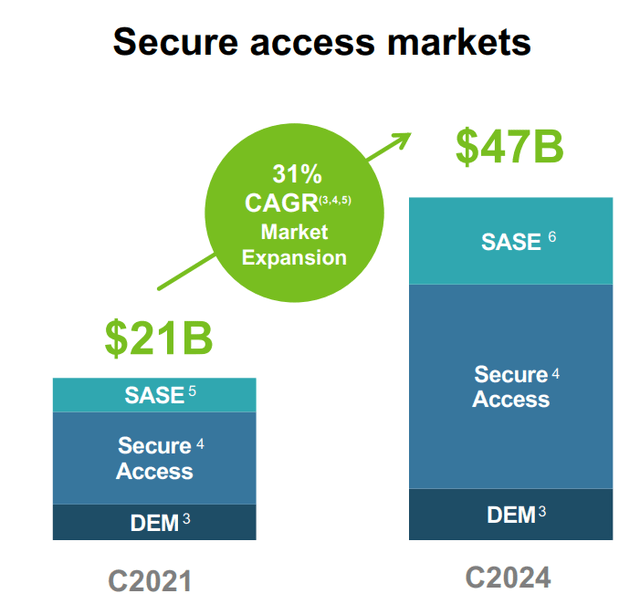

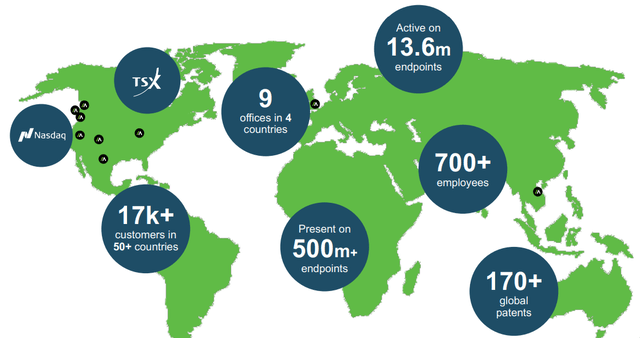

Absolute Software is a leading cybersecurity company that has created unique management software for endpoint visibility and security. An "endpoint" is basically the device that sits at the "end" of a network. This could be a PC, a laptop, tablet, or even a mobile phone. The global lockdown 2020 has caused a surge in remote working and this trend is set to continue. This is great for knowledge workers, but for IT administrators it can be a nightmare. These admins usually have full control of their network security and "endpoints" when inside the corporate office. However, as more employees work remotely the "attack surface" has widened and these admins have less control. Thus it's no surprise that the Secure Access market which consists of Virtual Private Networks [VPN] and Zero Trust Networks [ZTNA] is expected to expand. This industry is forecasted to grow at a rapid 31% compounded annual growth rate between 2021 and 2024, reaching $47 billion by the end of the period.

TAM (Investor Presentation 2022)

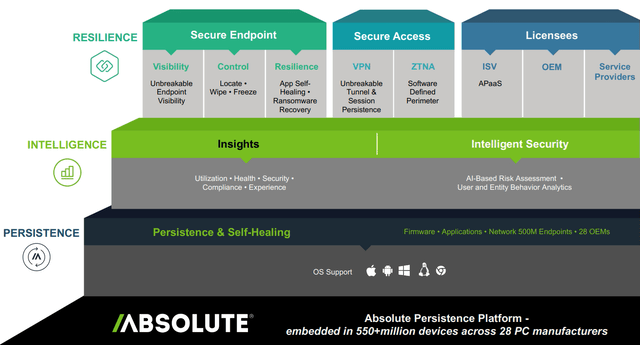

Absolute Software offers Secure Access solutions such as a VPN and ZTNA. However, its flagship software focuses on "secure endpoint" technology. This software enables the visibility, control, and "resilience" of endpoint devices.

The "visibility" part of the platform is similar to "find my iPhone" by Apple, but more advanced. This enables employee PCs to be tracked if lost and gives the admin the control to lock them down and delete files remotely. Absolute even has its own "investigations team" which can recover a device if it falls into the wrong hands. Absolute Software is ideal for IT administrators who manage more than 50 end-point devices and want full visibility, which is more essential than ever given the remote working environment.

Its patented technology called "Persistence" is unique from competitors. This software enables the platform to "self-heal" even if the hard drive is wiped or swapped by a hacker or thief.

Absolute Software (Analyst Presentation Aug 2022)

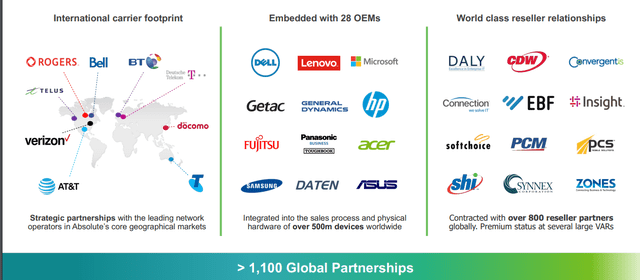

The second unique thing about Absolute is its software is built into many major PC types from Dell to HP and Samsung at the factory level, this gives them a significant advantage over competitors. The software is installed on most computers but just "asleep" and thus customers must buy a license to wake it up. The company also has a network of over 800 reseller partners and strategic partnerships with major carriers from Verizon and AT&T in the US, to BT in the UK.

Commercial Ecosystem (Investor Presentation)

Its solutions are popular in industry verticals that include government, schools, professional and financial services. At the time of writing, the software is active on over 13.6 million endpoints, across over 17,000 customers internationally. In addition, the company has over 170 patents which give them a competitive advantage over the competition.

Absolute Software (Investor presentation)

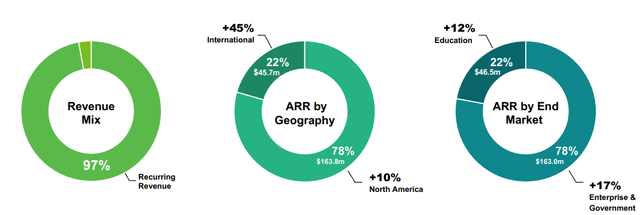

Growing Financials

Absolute Software generated strong financial results for what the company refers to as Q4,2022. Revenue was $52.5 million, which beat analyst expectations by $903k and increased by a rapid 65% year over year. 97% of the company's revenue is recurring, which gives strong predictability overall. Total Annual Recurring Revenue was $209.5 million for the year, which increased by a blistering 70% year over year. This was driven by strong growth in the Enterprise and Government sector, whose ARR increased by 99% year over year for that vertical. Education makes up a smaller segment (22%) of its ARR, and this increased by 12% year over year. It was also fantastic to see Absolute Software makes 78% of its ARR from North America, which should help to shield them from the FX headwinds many global companies are facing due to a strong dollar.

Finances (Earnings Report Q4,22)

Net Dollar Retention Rate [NDR] was a solid 108% for Q4 '22 which means customers are finding the product "sticky" and spending more. This was also a 2% increase from the 106% NDR in the prior year.

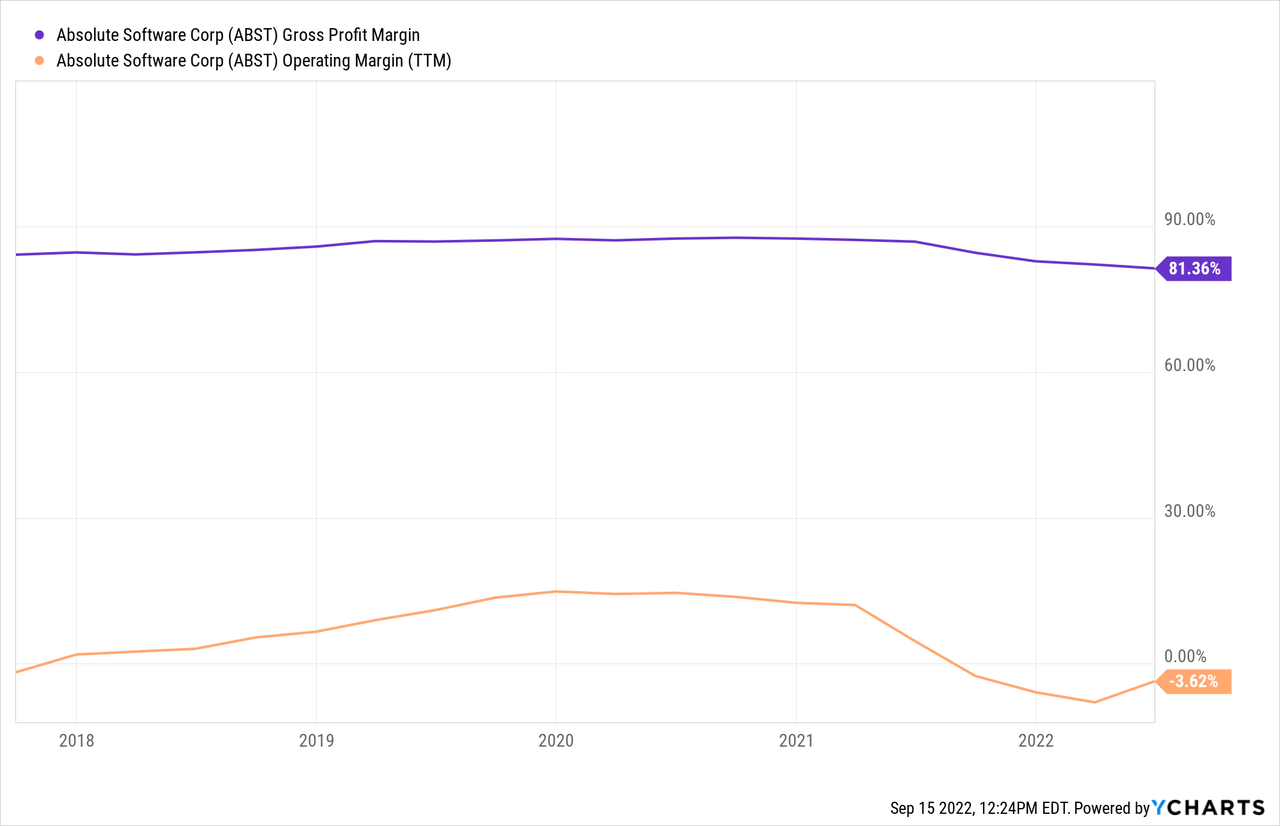

It should be noted that as Absolute Software is investing aggressively for growth and thus did produce a loss of $5.3 million in Q4 '22. The good news is the company is demonstrating high operating leverage as the revenue is growing faster than losses. For example, the Operating loss for Q4 '21 was $3 million, and thus the greater losses is not vastly more in the equivalent quarter this year.

Adjusted EBITDA was $15.4 million, or 29% of Adjusted Revenue in Q4 '22. This was slightly more than the $8 million or 25% of adjusted Revenue for Q4 '21. This is also a positive sign as these adjusted earnings are making up a larger portion of total revenue, which is a positive correlation.

ABST Gross Profit Margin data by YCharts

ABST Gross Profit Margin data by YCharts

Absolute Software did see a sharp 24% decline in cash from operations which came in at $8.7 million. At first glance, this may look terrible, but when I dive under the hood I see this was driven by one of its largest partners going through a payment system migration which delayed the payment for the quarter. This was a one-off issue and the company has now received the payment, thus it is not an alarm bell.

Despite being a growth company, Absolute Software still pays a healthy forward dividend yield of 2.35%. The company has a robust balance sheet with $64 million in cash and short-term investments, with just $1.6 million in current debt. Total debt is $277 million but given cash flow is strong and short-term debt is low, the balance sheet is solid overall.

Moving forward, Absolute expects $241.5m to $246.5m in FY'23 which demonstrates an increase of 14.8% to 17.1% year over year.

Advanced Valuation

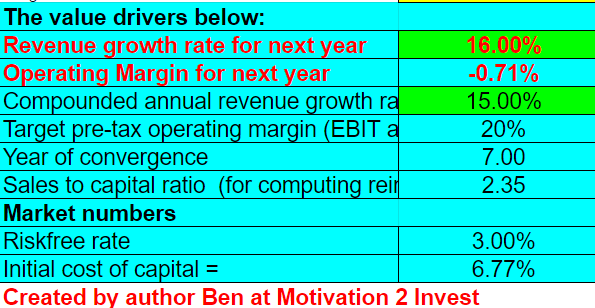

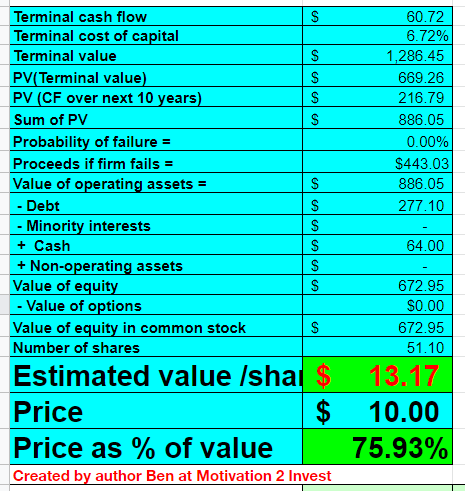

In order to value Absolute Software, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 16% revenue growth for next year and 15% growth per year for the next 2 to 5 years. This is in line with management and analyst expectations.

Absolute Stock Valuation (created by author Ben at Motivation 2 Invest)

I have also forecasted the company's investments in growth to pay off and its operating margin to increase to 20% over the next 7 years. This is below the 23% average of the software industry, and thus is achievable.

Absolute stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $13/share, the stock is trading at ~$10/share at the time of writing and thus is ~24% undervalued.

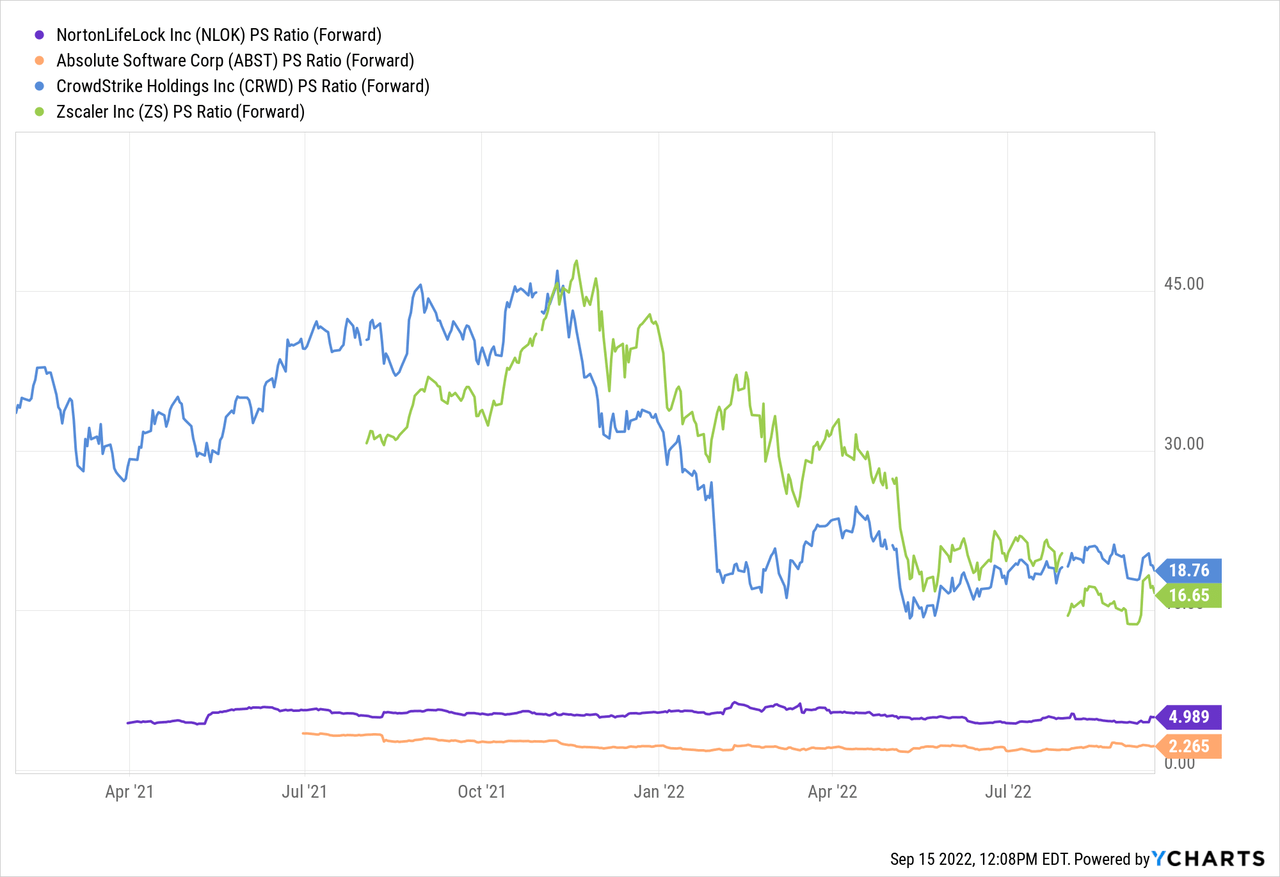

As an extra data point, Absolute Software is one of the cheapest cybersecurity stocks on the market with a Price to Sales Ratio = 2.26. For example, Zscaler (ZS) which is a leader in Zero Trust exchanges for remote workers trades at an eye-watering P/S Ratio = 16.65.

NLOK P/S Ratio (Forward) data by YCharts

NLOK P/S Ratio (Forward) data by YCharts

Risks

Recession/IT spending reduction

Many analysts are forecasting a recession due to high inflation, high-interest rate environment and thus this may cause a temporary slowdown in IT spending. However, I believe long term the trend is up, and the market opportunity is huge.

Final Thoughts

Absolute Software is a leading cybersecurity company that truly does offer a fantastic solution for IT admins. Its patents act as a protective moat, while its already installed technology gives it a head start against the competition. ABST stock is currently undervalued despite the recent pop in price, and thus could be a great long-term investment.