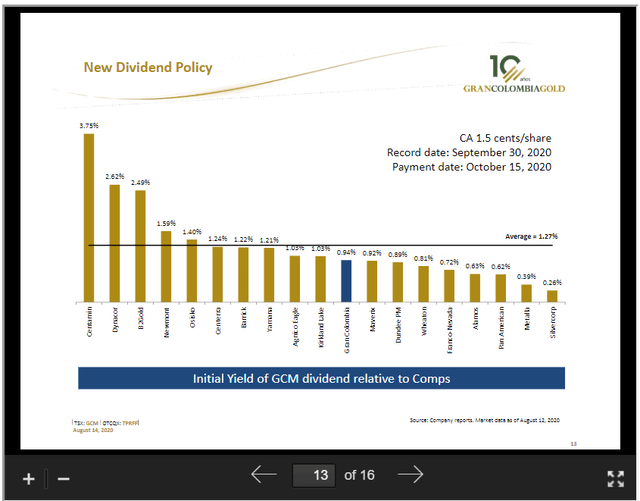

The next company I decided to write about is Gran Colombia Corp. (OTCPK:TPRFF). The most recent news regarding this company, is that they instituted a new quarterly dividend. This dividend is a .91 percent yield. I am unable to calculate a payout ratio, due to the fact that it hasn't paid out any dividends at the moment.

(Gran Colombia's Quarter 2 Year 2020 Presentation, see source here)

(Gran Colombia's Quarter 2 Year 2020 Presentation, see source here)

According to the company's presentation chart above, this dividend is in line with its peers. However, I personally do not buy gold stocks for its dividend. The main reason I believe that the dividend is relevant, is because management seems more confident in not only current cash flow numbers, but future cash flows prospects as well. That is why I believe this dividend is good news for shareholders.

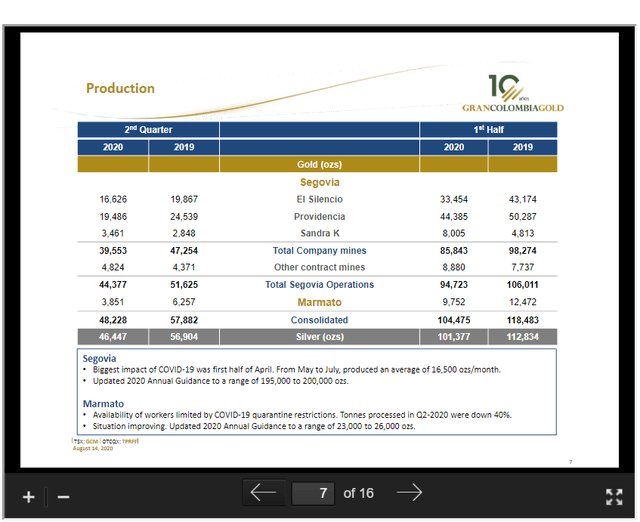

At the moment, Gran Colombia's main operating production comes from its Segovia operations. See Chart below:

(Gran Colombia's Quarter 2 Year 2020 Presentation, see source here)

(Gran Colombia's Quarter 2 Year 2020 Presentation, see source here)

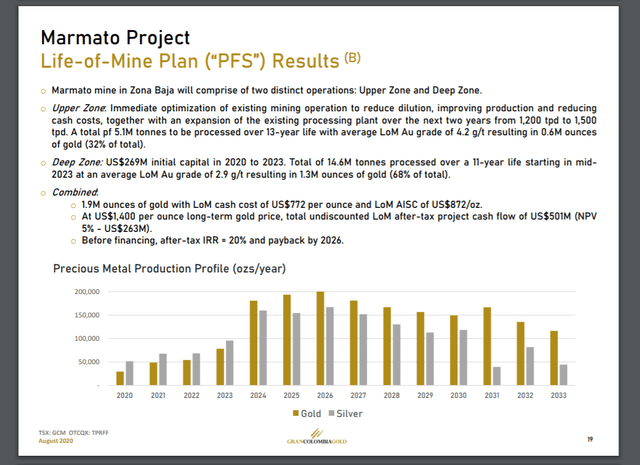

Based on the chart above, one can see that Gran Colombia's Segovia's operations, comprises roughly 92 percent of its total production. But despite that, what has me optimistic about its growth is its Marmato project. According to the company's August 2020 corporate presentation, a significant increase in production is estimated to occur in the year 2024. See chart below: (Gran Colombia's Corporate Presentation August 2020, see source here)

(Gran Colombia's Corporate Presentation August 2020, see source here)

If you look at the chart above, one can see that by the year 2024, Gran Colombia is expecting this project to produce over 150,000 ounces of both gold and silver from its Marmato project, this would generate a significant increase in revenues, earnings, and cash flow to shareholders. However, Gran Colombia doesn't own this project outright, as Gran Colombia owns 74.4 percent of this project. Even though it isn't an outright ownership, I believe they own a material amount to rapidly increase its earnings, revenues, and cash flow.

In terms of the company's financials, last quarter I calculated that Gran Colombia was able to generate $13.456 million dollars in free cash flow, which is a very good sign, and with gold hitting all-time highs I expect this trend to continue. In terms of the company's net income, it was reported to be a loss of roughly $18.578 million dollars. Even though I would like to see a positive net income, at the moment this does not concern me, as its biggest loss came from a loss on financial instruments, which, is a non-cash loss. In terms of the company's balance sheet, its current ratio was calculated to be 2.75, and its total assets to total liabilities ratio was calculated to be 1.71. Their total assets to total liabilities ratio isn't a ratio I like to see; I do hope that Gran Colombia starts using its free cash flow to start paying down its liabilities. However, I believe that its current ratio for short term solvency is very healthy. In terms of the company's valuation, Gran Colombia is trading at roughly 2.8 times cash flow, a price to sales ratio of .75, and a price to book of 2.14. I left out the EV/EBITDA ratio due to the fact that Gran Colombia had negative EBITDA for the quarter. I do think that this company is trading at cheap valuations. Another aspect of the company that stood out to me was its share structure. Currently, Gran Colombia has 61.9 million shares trading on the market, however, on a fully diluted basis it has 89.4 million shares, and most of these convertible debentures, stock options, and warrants are expected to expire around 2024. I do believe this over hang will keep a lid on any type of rapid share price acceleration in the near future.

The risks pertaining to this company are the over hang of warrants, stock options, and convertible debentures that could come to market around 2023-2024. However, once these options, warrants, or debentures are exercised, I still think that Gran Colombia has a solid share structure containing only 89.4 million shares. Another risk pertaining to this company is its low total assets to total liabilities ratio. Generally speaking, a low ratio such as this, could mean potential asset liquidations in the future. What I would like to see them do going forward is to pay down some of their liabilities, so that their total assets to total liabilities ratio reaches a ratio of 2 asset to 1 liability in the near future.

I also want to add, that due to the fact that Warren Buffett is now buying gold stocks, I do think that a significant rerating of this sector will most likely occur in the future, which will benefit not only the senior producers, but the junior and mid-tier gold producers as well. I think Gran Colombia will be a major beneficiary when this happens due to the low valuations the company is currently trading at.

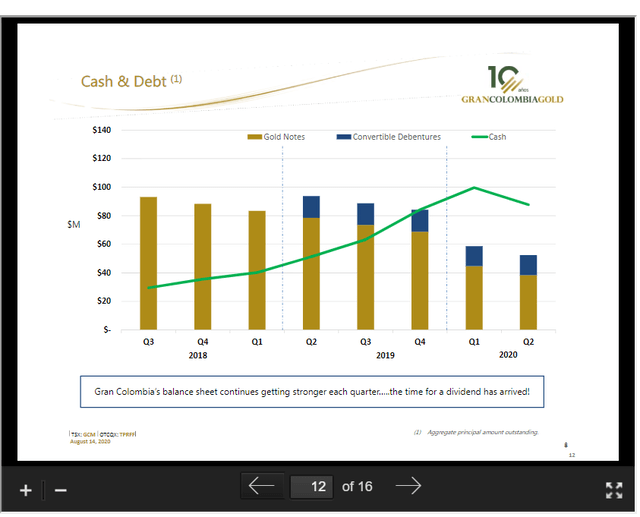

In conclusion, what I do like about Gran Colombia is its ability to generate cash flow, the growth that will occur from its Marmato project, and its cheap valuations mentioned above. I would like to see Gran Colombia starting paying down its liabilities, and make strengthening the balance sheet the company's top priority, due to its low total assets to total liabilities ratio. Looking at the chart below one might conclude that strengthening the balance sheet seems to be one of the company's main objectives as its cash balance seems to be growing by the quarter and its gold notes and convertible debentures are decreasing as well.