The Gold Miners Index (NYSEARCA:GDX) has seen a massive resurgence the past few weeks, catapulting itself 25% off its December lows. Many of my readers have expressed how difficult it is to buy miners that are up more than 40% over the past 6 weeks. For this reason, I've decided to see if there are any opportunities left that still provide value. My quest to find gold juniors still trading at attractive valuations has led me to Avnel Mining (OTC:AVNZF), a Mali explorer with plans for a high-grade open pit mine at their Kalana Main Project. There has been a flurry of M&A activity among African juniors the past 18 months, and Avnel looks like it could be the next to be scooped up.

The Project

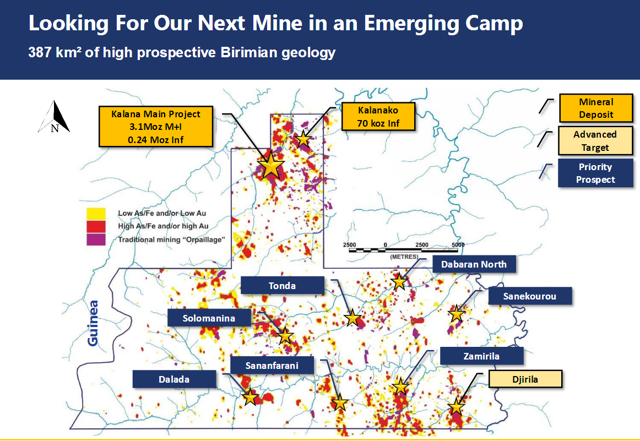

Avnel Mining is a gold explorer that is currently exploring financing opportunities to move their 80% owned Kalana Main project towards production. The project sits on a 387 square kilometer land package, and is fully permitted with the ESIA approval received in 2016. The project currently hosts 3.1 million ounces of gold at an average grade of 4.1 grams per tonne (g/t). While this grade may not seem that exceptional at first glance, it is industry leading when it comes to open-pit mines. To put this grade in perspective, Guyana Goldfields (OTCPK:GUYFF) and Torex Gold (OTCPK:TORXF) both operate open-pit mines, and have average grades of 2.94 g/t, and 2.62 g/t respectively.

(Source: Company Presentation)

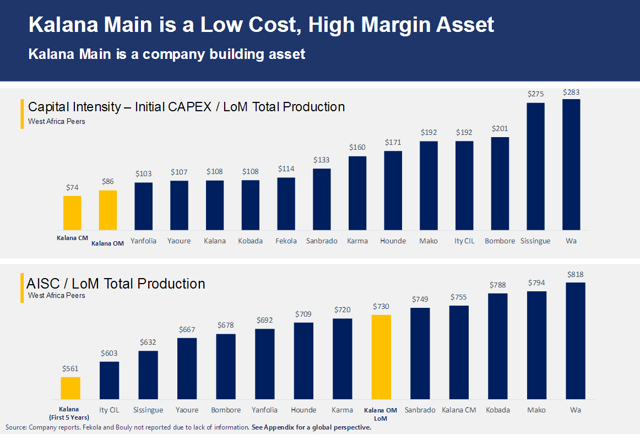

With high-grades come low all-in sustaining cash costs, and in this respect Avnel could be an industry leader. The optimized feasibility study has outlined the potential for all-in sustaining cash costs of $560/oz for the first five years, and $730/oz for the remainder of the mine life. Compared to the industry's average all-in sustaining cash costs of $875 - $900/oz, these metrics are quite impressive. In addition to industry leading cash costs, the feasibility study envisions the potential for annual production of 148,000 ounces for the first five years, with life of mine average production of 101,000 ounces. Mines producing over 100,000 ounces annually are very attractive to mid-tier gold producers, and we need to look no further than True Gold Mining and Orbis Gold for proof of this. Semafo Gold (OTCPK:SEMFF) took over Orbis Gold to acquire their Natougou Mine in 2015, while Endeavor Mining (OTCQX:EDVMF) took over True Gold to gain control of their Karma Mine last year. Both of these projects were similar in size to Avnel's Kalana Main Project, and were both located in Africa.

(Source: Company Presentation)

Exploration Potential

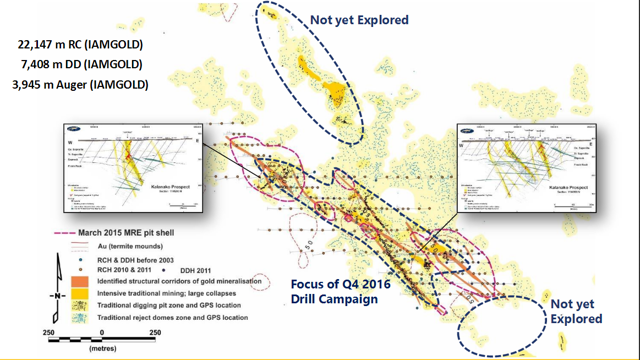

Avnel's Kalana Main Project is already home to over 3 million ounces of high-grade gold, but there is significant potential to expand on these resources. The company has been aggressively drilling their Kalanako target 2.8 kilometers to the northeast of their main deposit. The Kalanako target has a current inferred resource of 70,000 ounces at 5.33 grams per tonne, and has all the makings of a potential satellite deposit. Thus far the project has been delineated over a 600 meter strike length, with widths of up to 200 meters. Not only does the deposit remain open to the southeast, it also remains open to the north.

(Source: Company Presentation)

If the company is able to build upon the resource at Kalanako, the company could easily add more high-grade ounces to their mine life at little to no extra cost. This is because the Kalanako target is in such close proximity to Kalana Main, and most added costs to transport the material would be off-set by higher grades at Kalanako.

(Source: Company Presentation)

I could easily see Kalanako holding a resource of 600,000 ounces at 4.5 plus grams per tonne gold based on the current resources and recent drilling. This would push Avnel's global gold resources over 3.7 million ounces, and allow for closer to a 20-year mine life.

Valuation

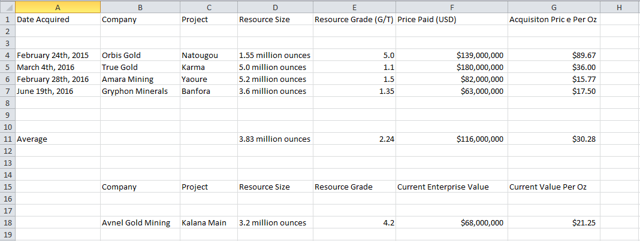

Avnel currently has 413 million shares outstanding and a share price of $0.20 cents. This gives the company a market capitalization of $82 million dollars (US). Subtracting for the company's $14 million in cash, this gives the company an enterprise value of $68 million dollars. In attempting to put a valuation on Avnel Mining from a potential takeover perspective, I will compare the company to recent acquisitions in the mining space in similar jurisdictions.

Source: Author's Table)

As we can see from the above table I've built, there have been 4 acquisitions in West Africa over the past two years. All of these acquisitions were similar to Avnel Mining as they were all in Africa, and were all nearing the development stage in their life cycle. Taking a look at the table, we can see that the average price paid for these companies was $116 million dollars US. There is quite a large disparity in the acquisition price per ounce for these companies, but that's because no two resources are the same. While the average acquisition price per ounce was $30.28/oz, I only believe one company to be truly comparable to Avnel Mining.

Looking at the resource grade for the above 4 projects, only Orbis Gold's Natougou had similar grades to Avnel Mining's current project. All of the other projects were under 2.0 grams per tonne gold, and were less than half the grade of Avnel's current resources. This can be attributed to why Semafo forked over so much for Natougou, while the other intermediate producers seemingly stole the other projects.

Based on the above table, I believe Avnel's fair price per ounce is closer to $53.00/oz. I have placed a 40% discount on Avnel's ounces compared to Natougou's for 2 reasons.

1) The all-in sustaining cash costs at Natougou are estimated at under $400/oz, 30% below Avnel's estimated all-in sustaining cash costs for the first 5 years of production.

2) The resource grade at Natougou is 20% higher than Avnel's average resource grade.

Based on my fair valuation of $53.00/oz on Avnel's ounces, the company has the potential for a significant re-rating if they can move forward towards a production decision. Based on a resource of 3.1 million ounces, a valuation of $53.00/oz would give them a market capitalization of $164.3 million. Based on their fully diluted share count this would result in a share price of $0.395, a double from current levels. Unfortunately Avnel only owns 80% of its project, therefore an extra 20% discount must be placed on this valuation. This would result in a market capitalization of $131.4 million dollars, and a share price of roughly $0.32 cents. This is still a 70% increase from the current share price, therefore the company sits at an attractive valuation currently. If the company is able to continue with its exploration success at Kalanako, this valuation should move closer to $0.35 - $0.38 cents (US).

Risks associated with my thesis

There are always risks when investing in junior gold companies, especially those with market capitalizations under $100 million dollars. I will discuss 3 of them below:

- The price of gold is a huge factor in driving junior gold companies share prices, as it affects the commodity they are planning to produce. Fortunately for Avnel the company's feasibility study has shown a potential to produce gold at $561/oz for the first 5 years, and $730/oz for the life of the mine. The company can remain profitable even at sub $1,000/oz, and I see no reason for a correction in gold to deter mine construction.

- Financing is a huge issue for gold juniors, and insufficient cash balances are always a worry when investing. Fortunately for Avnel they have over $14 M in cash, and have no need to finance or dilute currently. It is inevitable that they are going to need to finance construction of their mine, but this financing may be done in different ways. I suspect that Avnel will consider selling forward some gold to finance as to not dilute shareholders too badly. Having said that, I don't see Avnel in a rush to dilute and think they can do so at a higher share price. The capex for Kalana Main to move into production is estimated at $140 million, much lower than the industry average for mines of this size.

- Finally, there is the risk that the company's drilling comes up blank and there are no more discoveries to be made. This is not a problem for Avnel as they have already delineated a deposit with over 3 million ounces of high-grade gold. This is enough to support a mine life of nearly 15 years, and makes the company feasible even if they are unable to find any more gold on their properties.

Summary

As my followers likely know, I typically avoid gold companies with market capitalizations under $100 million. I find them to be very risky, and not worth the potential reward if the story does play out. In terms of Avnel Mining, I am willing to stick my neck out. I feel that the company is undervalued at current levels, and do not see much downside at all. The company is currently trading below the average acquisition cost per ounce of 4 other African juniors, despite the company having an average grade more than double the average of these companies. In addition to this, the company is a takeover target at this valuation, and I expect an African intermediate producer to jump on this opportunity sooner than later.

Based on what I see from Avnel, I have begun a small starter position in the company which represents 3% of my main account, and 1% of my total assets. In comparison to my typical positions I take in the mining space, this is roughly half the size. I will decide whether to add to my position based on the company's decision on how to finance their project in the coming months. My average cost on this position is $0.20 (US).

Disclosure: I am/we are long AVNZF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: If you liked this article and found it useful, please feel free to follow me by clicking on my name next to my avatar at the top of this article. I also invite you to follow me at www.twitter.com/TaylorDart01 where I routinely share my entries, exits, and stops on new positions, as well as updating followers on sentiment data on markets I am following.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.