imaginima/E+ via Getty Images

Baytex Energy (OTCPK:BTEGF) was hamstrung for years with a very high debt load. The oil price crash of 2015 hit this company very hard. To the benefit of shareholders, this management has persisted to the point where the company has recovered from that high debt load. The forward prospects look very good for the first time in a long time.

Management has also aided those future prospects with a very profitable heavy oil discovery. This discovery could completely remake the characteristics of the company's heavy oil business.

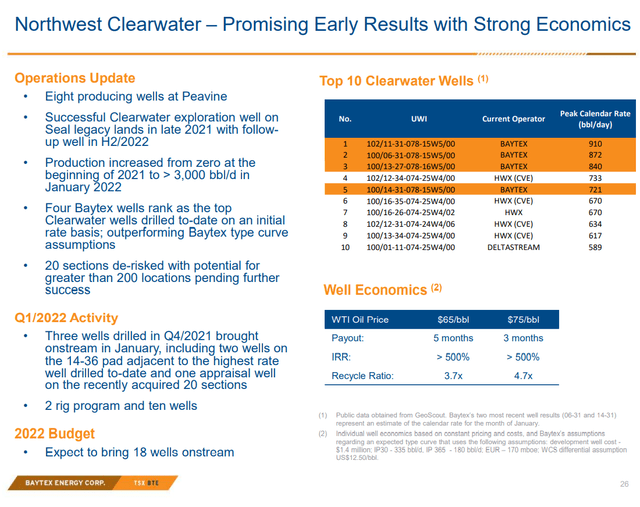

Baytex Energy Presentation Of Northwest Clearwater Well Profit Characteristics (Baytex Energy March 2022, Corporate Presentation)

The latest discovery has some extremely attractive characteristics. First, it is far more profitable than the typical heavy oil deposit. This means the company makes more money at every pricing point than is the case for the legacy heavy oil business. This discovery is in the early stages of development. But if the characteristics of this discovery remain throughout the acreage, then this group of leases may receive a priority call in the future over the legacy acreage. That would be a major change in future procedures for this company.

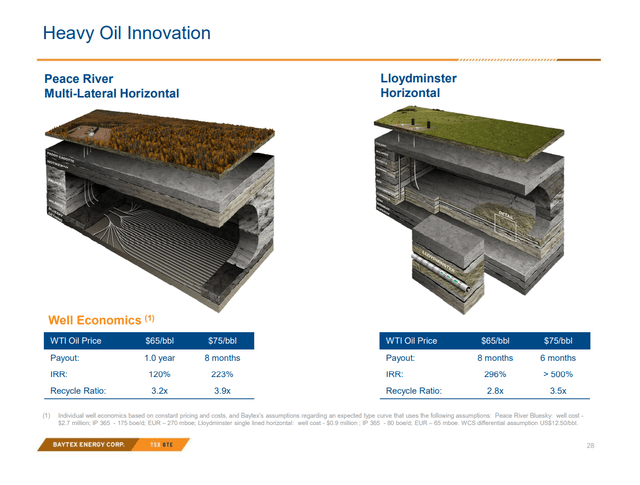

Baytex Energy Heavy Oil Profit Characteristics Not Including Clearwater (Baytex Energy March 2022, Corporate Presentation)

Clearly, the original business is not as profitable as the new heavy oil find shown before. Both are doing well in the strong commodity pricing market. But, usually, a higher profitability property has a lower breakeven point. In this case, the recycle ratio is so different in the current environment (and the payback period in both cases is materially longer) that one can conclude the breakeven for the Clearwater project is a good deal lower than is the case for the two sets of leases shown above.

That is extremely good news for a company that has often shut-in heavy oil production during periods of weak commodity pricing. Clearly, the Clearwater project will cash flow under a larger portion of the industry cycle than will the two shown above.

Management has mentioned from time to time that Clearwater appears to break even at a price about $10 in the WTI lower than the two projects shown above. Now, whether that is still the case with all the continuing improvements is something I would like to hear about in the future. Right now, the difference in returns does point to a big difference in breakeven points.

What is very likely to happen is that more heavy oil production will come from Clearwater at the expense of these two projects. That would give the company time to take advantage of improving technology that would make these two projects comparable to the returns shown on the Clearwater project.

This also means that the company will cash flow larger amounts without having to grow production at various commodity prices as the Clearwater production increases. Shareholders are likely to see earnings growth without needing production growth to accompany that earnings growth for a while.

As an investment, this company has an advantage over other opportunities with the ability to grow cash flow without production growth. When combined with the continuing priority of lowering debt reduction, this company is a very different company than past history would indicate.

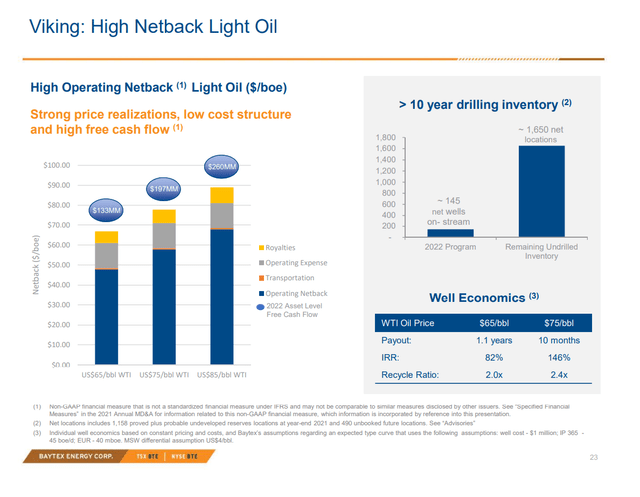

Baytex Energy Viking Light Oil Profit Characteristics (Baytex Energy March 2022, Corporate Presentation)

Note that the Clearwater Heavy Oil project is more profitable than the light oil project shown above. This company had unusually high costs for a light oil project. Clearly, the project was profitable, and light oil prices usually are stronger during periods of weak pricing, but the company was at a clear competitive disadvantage when it came to light oil. That would mean that the debt ratio needs to be a lower number to account for the lower profitability of this project.

This also points out the unusually high profitability of the Clearwater heavy oil project. Normally heavy oil is sold at a discount to light oil. Therefore, the higher profitability of the Clearwater project (shown first) points to some extremely low production costs.

The only reason that the light oil project like this one successfully competes for some capital dollars would be due to the relative strength of light oil pricing during industry downturns. Many times, the discount paid for heavy oil widens during a downturn. That would mean that company assumptions about future heavy oil pricing would "go out the window" during a downturn because pricing relationships are exceedingly hard to predict in a cyclical downturn. By maintaining the light oil production, the company minimizes the risk of a widening heavy oil discount.

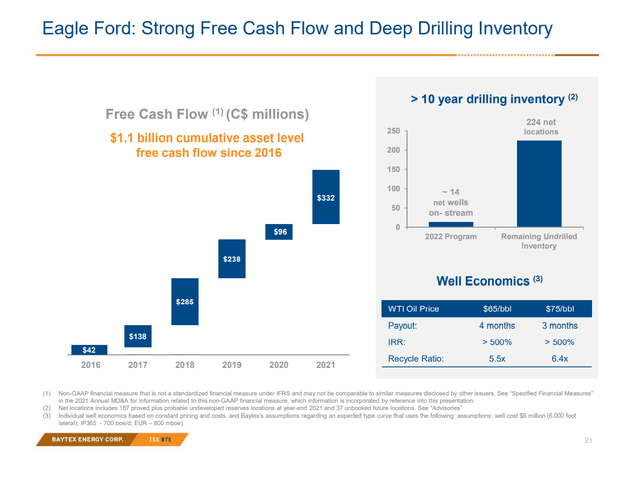

Baytex Energy Eagle Ford Profit Characteristics (Baytex Energy Corporate Presentation March 2022)

The Clearwater properties actually show profitability characteristics that are very similar to the Eagle Ford leases. That remarkable accomplishment is really only diminished by the weak pricing characteristics of heavy oil during an industry downturn. Otherwise, Clearwater would successfully compete with the Eagle Ford for first call on capital dollars.

The development of the Clearwater properties will likely decrease the corporate breakeven as the Clearwater volume climbs at the expense of the legacy heavy oil projects. This company has needed a lower breakeven point for some time. The Canadian dollar does help somewhat with North American competitiveness (until it strengthens). But really not much helps significantly other than very low costs in a commodity industry.

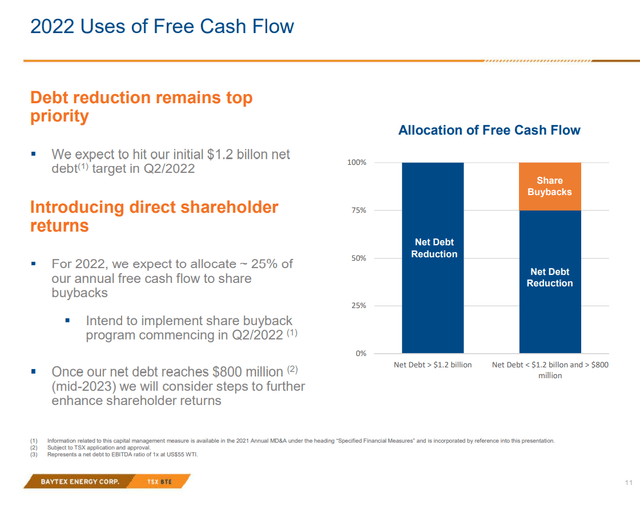

Baytex Energy Free Cash Flow Strategy (Baytex Energy Corporate Presentation March 2022.)

Clearly, the free cash flow outlook has improved with the strengthening of commodity pricing. Nearly every oil company in the industry is projecting robust cash flow by assuming that oil and natural gas prices remain strong for the foreseeable future. That remains to be seen as this industry has notoriously low visibility in addition to being very volatile.

The recently announced results of course resulted in unexpected debt progress due to more cash flow. Many companies, including this one, have given far more optimistic guidance as a result. Readers need to keep in mind that the optimism can fade very fast in this industry. Remember that the coronavirus challenges appeared to come out of nowhere. Right now, the optimism appears justified even for a relatively long-term outlook. So, progress towards an optimal balance sheet appears to have an excellent chance even if that chance needs protection by using hedging.

However, the Clearwater development gives this company an additional reason to report improved cash flow that many other companies do not have. Any time a major discovery lowers the corporate breakeven point, an investment in that company is likely to outperform other industry investments in the long term.

Instead, it is far more likely that the market will swing between concerns about the coronavirus challenges and ebullience about the price of oil and natural gas going forward. This stock is therefore only for investors that can stomach a lot of volatility.

There appears to be the slow start of a long-expected market correction. That at some point may lead to a "throw them all out" mentality where all stocks decline for a little while. But the outlook for the oil and gas industry appears to be good enough that this industry will again follow the tradition of outperforming the market during the coming downturn. This stock is likely to do even better than the industry does.