Today's CXB Trivia As the first half of 2024 concludes, Canadian markets have shown resilience with a solid performance, particularly benefiting from sectors like technology and utilities. Despite a more muted gain compared to the S&P 500 due to lesser exposure to high-growth tech stocks, the TSX has maintained steady growth. In this context, identifying undervalued stocks becomes crucial as they may present opportunities for investors looking for potential in areas that are not in the limelight but are poised for recovery or have been overlooked in broader market rallies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisura Group (TSX:TSU) | CA$41.71 | CA$80.18 | 48% |

| Calibre Mining (TSX:CXB) | CA$1.94 | CA$3.58 | 45.8% |

| Kinaxis (TSX:KXS) | CA$160.80 | CA$263.18 | 38.9% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Kraken Robotics (TSXV:PNG) | CA$1.15 | CA$2.21 | 48% |

| Endeavour Mining (TSX:EDV) | CA$30.17 | CA$52.33 | 42.3% |

| Green Thumb Industries (CNSX:GTII) | CA$15.71 | CA$28.03 | 43.9% |

| Jamieson Wellness (TSX:JWEL) | CA$29.10 | CA$50.47 | 42.3% |

| Kits Eyecare (TSX:KITS) | CA$8.85 | CA$15.45 | 42.7% |

| Capstone Copper (TSX:CS) | CA$10.23 | CA$17.50 | 41.5% |

Let's review some notable picks from our screened stocks

Overview: Calibre Mining Corp. operates in the exploration, development, and mining of gold properties across Nicaragua, the United States, and Canada with a market capitalization of approximately CA$1.43 billion.

Operations: The company generates its revenue primarily from the refined gold segment, totaling CA$566.68 million.

Estimated Discount To Fair Value: 45.8%

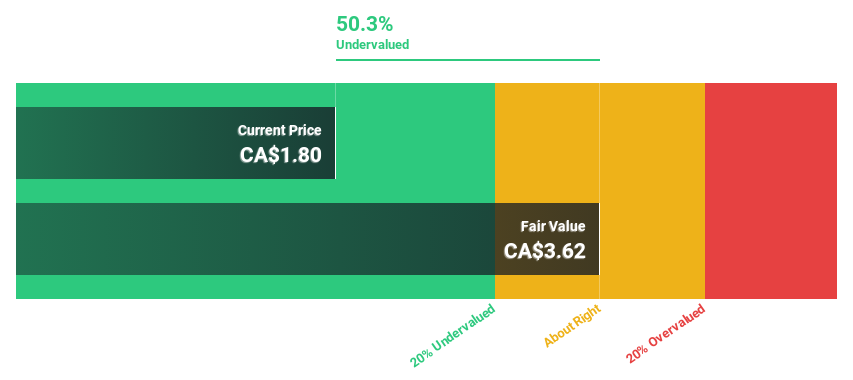

Calibre Mining, priced at CA$1.81, is significantly undervalued with its market price 49.8% below the estimated fair value of CA$3.61. Despite substantial insider selling recently, the company's financial outlook remains robust with earnings expected to grow by 45.22% annually, outpacing the Canadian market forecast of 14.6%. Revenue growth is also strong at 15.8% annually compared to the market's 7.3%, indicating potential underappreciation by the market despite recent executive board enhancements and index inclusions which could stabilize governance and increase exposure.

TSX:CXB Discounted Cash Flow as at Jul 2024

TSX:CXB Discounted Cash Flow as at Jul 2024