bjdlzx

Energy stocks are having an excellent 2022 in terms of cash flow generation. However, some companies have barely seen their share prices move to the upside or even are slightly down YTD, despite the strong performance. One such case is Frontera Energy Corporation (OTCPK:FECCF)(TSX:FEC:CA) – the company has generated over US$496M of operating EBITDA for the first nine months of the year at an EV of below US$950M, maintains a resilient balance sheet with a manageable debt and has reduced substantially its share count, yet its share price is slightly down YTD. I think that companies like this provide an attractive opportunity if an investor is willing and able to bear the risk that comes with the particular investment.

Company overview

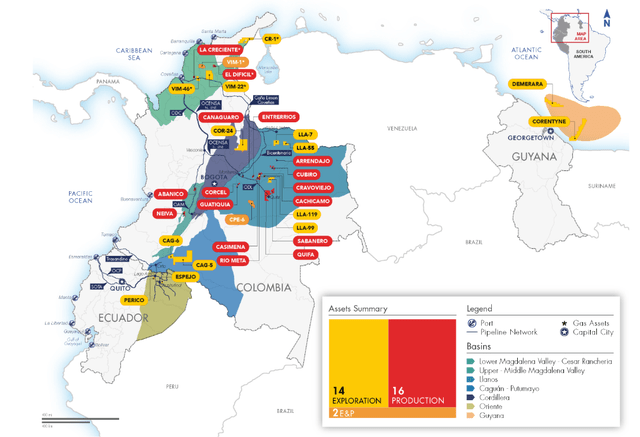

Frontera Energy is a Canadian oil and gas company with a primary production focus on Colombia, but with ambitions to diversify its portfolio through exploration activity in Ecuador and Guyana. The company also hold equity stakes in port and pipeline facilities in Colombia.

Frontera's asset portfolio (Frontera Energy)

Institutional investors dominate the ownership structure, with the Catalyst Capital Group Inc having the biggest stake – 36.8% as of 2021 year-end. In 2022, the company has been aggressively buying up its shares, which has reduced the number of shares outstanding from 94.7M in the beginning of the year to 86.6M as of 30 Sept. YTD, Frontera has bought 5.4M shares under a substantial issuer bid (SIB) and 3.2M shares under a normal course issuer bid (NCIB), while 0.5M shares were issued as stock-based compensation. As a result, the share count has shrunk 8.6% YTD. Frontera has already reached the limit and completed its SIB purchases and has about 1.6M shares until it reached the limit of the NCIB plan, so I expect lowering of the share repurchases in Q4’22.

2022 so far

Total daily production in 2022 so far has averaged at 41.2kboe, which is 9.8% higher YoY. However, the increase is primarily due to base effects, as the company had to shut down some of its Colombian operations for a period of time in 2021, because of civil unrest in the country.

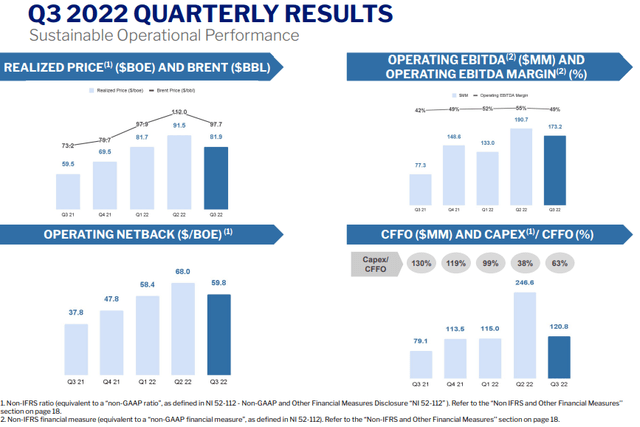

Frontera's operating performance (Frontera Energy)

In the first nine months of the year, Frontera generated US$482.2M (US$ 120.8M in Q3’22 alone) operating cash flow, which more than doubles the result of the comparable period of last year – US$213.9M. Consequently, CAPEX spending was increased rapidly as the net cash outflow from investing activities reached US$334.9M YTD (x5 YoY). A strong emphasis was put on returning value to shareholders as more than US$83.5M were spent in share repurchases YTD, compared to US$15.3M in the corresponding period of last year. 9mo operating EBITDA amounted to US$496.9M (+116.5% YoY).

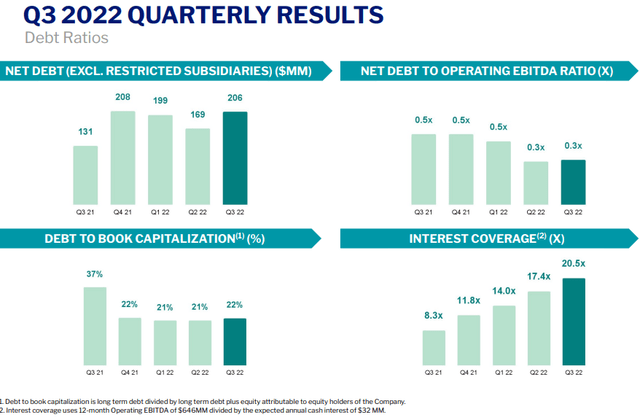

Frontera's indebtedness (Frontera Energy)

On the balance sheet, Frontera has US$413M of total indebtedness, excluding the liabilities of the company’s unrestricted subsidiaries. The debt consists of primarily US$400M of 7.875% Senior Unsecured Notes, due in 2028. When accounting for the US$207M of cash and equivalents, net debt comes at around US$206M, which is more than manageable, given the substantial cash flow generating abilities of the company in the current environment and the maturity profile of the debt.

Assuming that international oil prices remain strong and production is within guidance (41-43kboe/day), I expect the company to generate operating EBITDA north of US$150M in Q4’22, which will put the 2022 EV/EBITDA ratio at around 1.35.

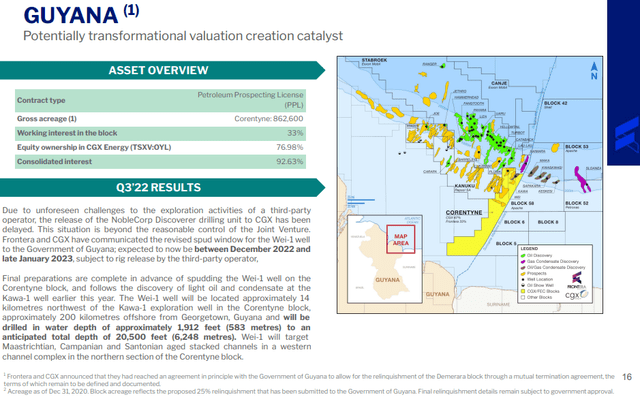

Exploration in Guyana (Frontera Energy)

Regarding the exploration activities of the company, there has been some delays to the initial timeline, particularly in Guyana. Due to operational problems of the third-party operator, contracted for the drilling of the Wei-1 well, the spudding is now expected to take place between the end of this year and the end of January 2023. Consequently, some of the CAPEX outlined for the project in the 2022 guidance will likely be pushed into next year.

Share price and valuation

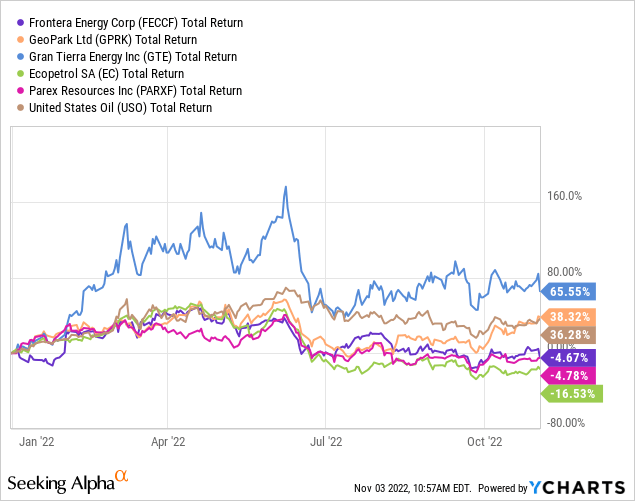

Data by YCharts

Data by YCharts

Looking at the company’s performance in terms of total shareholder return, compared to its Colombian peers – Ecopetrol (EC), GeoPark (GPRK), Parex Resources (OTCPK:PARXF) and Gran Tierra Energy (GTE) as well as the United States Oil ETF (USO), Frontera’s YTD performance is disappointing. And political risk in Colombia couldn’t be the reason, since both GTE and GPRK, which are not state-owned have outperformed Frontera considerably.

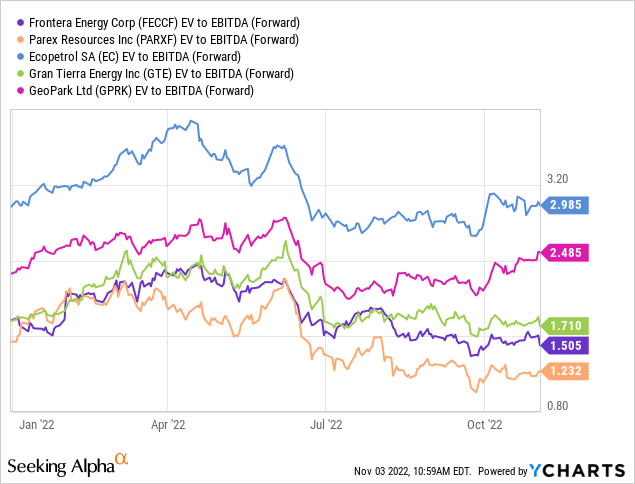

Data by YCharts

Data by YCharts

Looking at the Forward EV/EBITDA of the four companies could give us a better understanding as to whether the underperformance of Frontera is justified by this widely used financial ratio. As it can be seen on the graph, Frontera is trading at the second lowest multiple with GTE slightly above and GPRK and EC well above. Other than the fact, that EC and GTE are paying dividends, while Frontera and GTE are not, I couldn’t think of other major reason for such discrepancy.

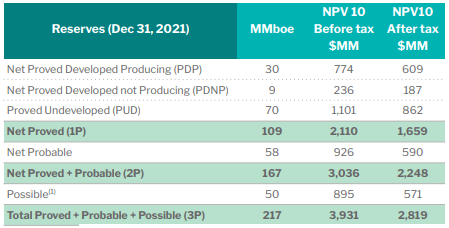

Turning to the estimated NPV of Frontera’s reserves could offer another perspective of the company’s fair value. Taking into account the current EV of US$877.4M, which includes US$205.6M of net debt, I get 116.3% upside of the share price in order to reach the value implied by the 1P (Proven) reserves. The implied upside to 2P (Proven + Probable) and 3P (Proven + Probable + Possible) jumps to 204.0% and 289.0%, respectively. Note, that the company has used Brent prices in the low US$70s for deriving the NPV.

Frontera's reserves estimated NPV (Frontera Energy)

As far as potential near-term catalysts for reducing the valuation gap nothing imminent stands out at first glance. The aggressive buyback was not enough to lift the share price and the company is close to reaching the maximum amount of shares it can buy under the SIB. However, management could be creative with the free cash flow and approach the shareholder return program through the introduction of dividends. This could potentially be a significant trigger, given that the dividend paying GPRK and EC are trading at almost double forward EV/EBITDA ratios. Another alternative use of the free cash flow could be found in the 7.875% Senior Unsecured Notes, due in 2028. They are currently trading at below 76 cents on the dollar, which puts the yield to maturity at above 15.4%. The company could take advantage of the high yield and repurchase some of its debt. The notes could also be attractive to investors, if they have access to Euro MTF of the Luxembourg Stock Exchange.

Political risk

While there are risks that are common for every oil stock, such as a potential collapse in prices, the possibility of which I discussed in more detail here, political risk seems to be very relevant in the context of the Colombian energy sector. The recently elected president of Colombia – Gustavo Petro has made many anti-oil remarks during the campaign and has vowed to ban future exploration contracts and honor only the existing ones. This could be a major blow for a Colombia-centered company like Frontera, but the effects on Colombia’s budget won’t be pretty as well since oil exports are a major source of revenue. There are signs that the government may soften its stance of the ban on new exploration. The proposal of additional taxes on oil companies was also watered down and the changes to the initial proposal were hailed by the industry.

Conclusion

Frontera Energy offers investors exposure to oil and gas in Colombia at an attractive valuation. The aggressive share repurchases will likely slow down in Q4, but may be substituted by debt repurchases and/or dividends. The political risk in Colombia is a drag on the stock price, but there are signs that the government is softening its hard stance on the oil industry. For more risk-averse investors, the 7.875% Senior Unsecured Notes, due in 2028, may be an alternative way to get exposure to Frontera, as the notes are currently trading at YTM of 15.4%.