bjdlzx

Parex Resources (OTCPK:PARXF) is a Canadian company that operates in Colombia while reporting in United States dollars. For a long time, Colombia had a rightward tilt that supported the industry. But recent elections saw this country join much of the continent in turning left along with promises that were hostile to the industry. Now that same government is taking a look at the money brought in by the industry and backpedaling. Since money talks more than anything else, the industry is likely to continue to receive the support it always has from the government.

Colombia often has issues that the industry must deal with that are not related to the industry itself. There is a natural conflict with farmers as the very influential cocaine industry has long been associated with guerrillas. Farmland and oil leases unfortunately have overlapping interests. The result of this has been periodic farmers strikes with blockades that affect the industry and other issues. It turns out that the central government is not particularly strong.

In addition to social issues the new administration effectively passed something along the lines of an excess profits tax. So the company definitely has to watch its step.

Even so, there are companies like Parex Resources that have long been successful with the oil and gas business in the country. Still the unique issues of the country will often determine that a debt free balance sheet with a lot of cash is essential to doing business. This same conservative balance sheet strategy also spills over to a low market evaluation of the company that will not likely change until the central government of Colombia strengthens.

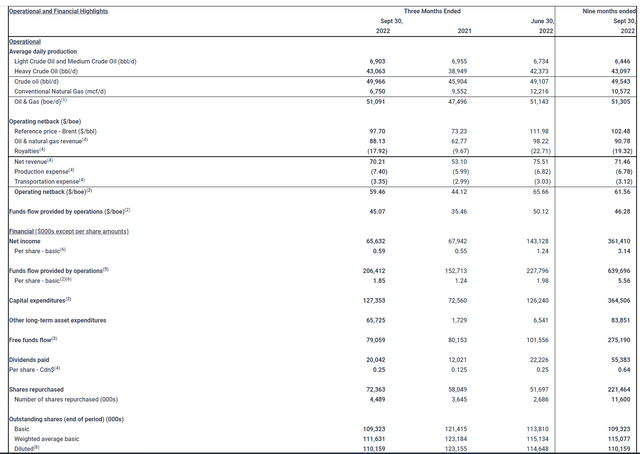

Parex Resources Summary Of Third Quarter Results (Parex Resources Third Quarter 2022, Earnings Press Release)

Management reported in excess of $350 million cash on hand. There has been a periodic repurchase of shares that would indicate that management thinks the shares are cheap. Production is clearly growing so there is still a management strategy to grow the business. However, the capital budget is reduced from fiscal year 2022 for the time being.

The government realizes that natural gas supplies need some augmentation. So, there is likely to be a push from the government to pursue more natural gas production. The high world prices of natural gas are not exactly a real popular political issue. So, the more natural gas that the country can produce would mean the less exposure to potential future imports of natural gas.

This alone was enough to stop the new leftist leader in his tracks. He appears to be smart enough to realize that the profits generated by the industry also help bring in cash to the country. Any politician loves to spend cash and this one is no exception.

It also helps for the Colombian political establishment to view neighboring Venezuela because they see the real mess that can result when politicians interfere too much in an industry. The sad part is that Venezuela has far more resources that can be developed and exported. Yet the country is for all intents practically bankrupt. Colombia appears to be smart enough to try and avoid that fate even with a government that has turned left.

Parex Resources Summary Of Business Strategy Overview (Parex Resources Third Quarter 2022, Earnings Conference Call Slides)

Clearly, management is taking a very conservative move towards the business at this point. Management clearly has the ability to expand the business materially without going into debt. But management is also looking for guidance from the country for more reliability and consistency. The central government appears to be likely to oblige.

The question is really the guerrillas and their stance. The guerrillas seem to be wedded to the cocaine industry which is also lucrative. This has long been source of inconsistency and really risk for the oil and gas industry. Stock price valuations in the future will likely depend upon more consistency throughout the country as a sign of less risk to do business in the country.

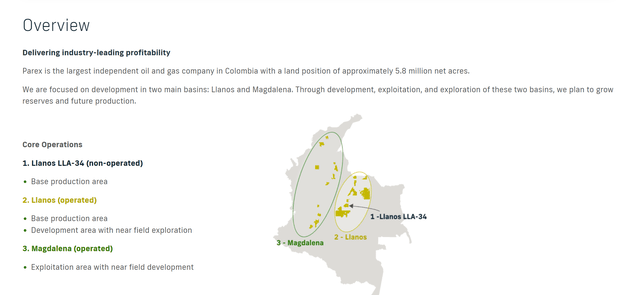

Parex Resources Area Of Operations (Parex Resources Company Website December 4, 2022)

Parex has the leases and really knows where the resources are. Exploration here is not as risky as typical exploration because the industry has been here a while and there is a lot of information available to reduce exploration risk.

As is typical for the industry, most of the companies involved have considerable interests in supporting infrastructure. This is not like the United States where midstream companies, for example, can transport the oil to market. So, the upstream industry has more investment in the oil production and marketing process than would be the case in the United States.

Breakeven prices on the wells drilled appear to be very reasonable. A company like Parex can stop all but maintenance activity when commodity prices are low while simply "cashing checks" for established production. Management clearly has the cash to re-establish production when prices begin to recover.

The Future

If one is going to consider an investment in a country like Colombia, then one must review the risks of doing business there thoroughly. Colombia has a history of supporting the oil and gas industry far better than many of the South American neighbors. Nonetheless, the current government needs to establish that the history will continue into the future.

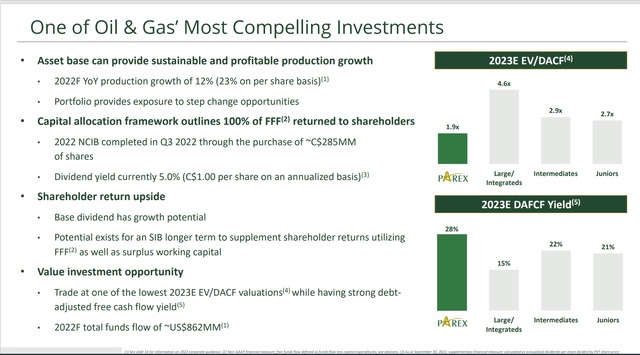

Parex Resources Relative Value Presentation (Parex Resources Third Quarter 2022, Earnings Conference Call Slides)

Even with a more favorable government in power, the business of this company was generally heavily discounted due to the location in comparison to either United States or Canadian companies. That is very likely to continue into the future.

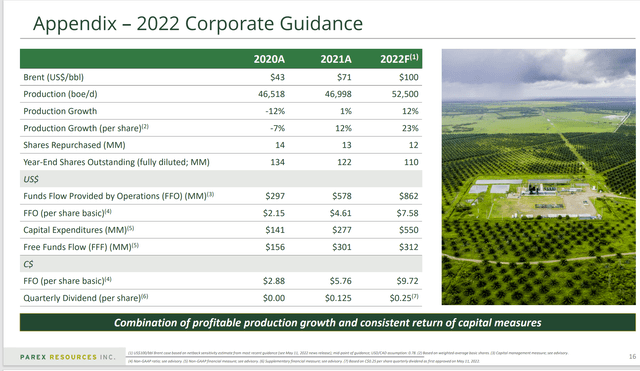

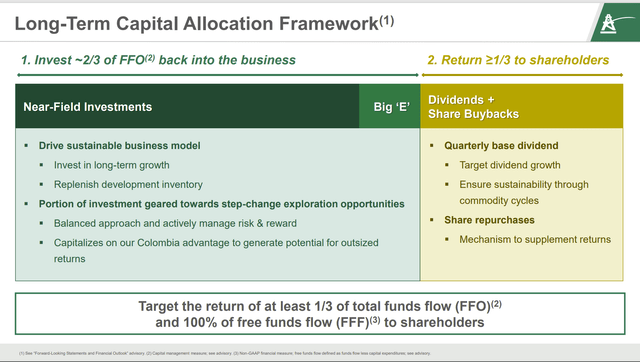

Parex Resources Long-Term Capital Allocation Framework (Parex Resources December 2022, Investor Day Presentation)

The business itself appears to have a very reasonable breakeven point compared to many competitors. The cash balance points to decent profits over the years. The debt free balance sheet is probably very necessary given the location of the business.

The stock price is cyclical as is the whole upstream industry. It is just that the whole cycle is based upon a lower valuation. Nonetheless, this is the kind of strategy that is needed for doing business in South America. The perceived stability and consistency are just not the same as it is in the United States and Canada.

Even in the United States, the perceived instability and inconsistency that persisted between 2015-2020 resulted in a price-earnings ratio crash that was the worst I had seen since the 1980's when Saudi Arabia pushed the oil prices down to $10 at the time in an effort to re-enter the market. The industry is just now beginning to recover the valuations that it had before. It is going to take some years for the price-earnings ratios to hit historical levels.

Colombia would not experience a change any faster once that all important consistency is assured. So, any investor in a stock like this would need to be very patient because valuations are not going to change "overnight".

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.