Corentyne Block as a Cluster Asset? The first Quote is from the last operational news release from FEC dated 6/28/23. The 2nd is taken from an arother sameo sameo article on the Hess-Chevron deal but the last highlighted sentence is hopefully in play as the various models of the Northern Corentyne block should be done or enough data available that potential buyers should know wheither there is significant potential in the block or not to warrant significant bids as a cluster asset or for the entire company before years end if not by the upcoming Q3 (11/8) news and conference call.

"The joint venture's data acquisition program included wireline logging, MDT fluid samples and sidewall cores throughout the various intervals. Over the next few months, results will be integrated into the geologic and geophysical models to form an updated view of the entire northern portion of the Corentyne block. The northern portion of the Corentyne block includes the channel complexes discovered by the Kawa-1 and Wei-1 wells, and a prospective central channel complex, which is yet to be evaluated. The joint venture is excited by the definitive presence of oil in the Maastrichtian and Campanian, and the presence of hydrocarbons in the Santonian, and believes there is significant potential in the block." "At this time, Hess Corporation, which has a 30% stake in what's estimated to be over 11 billion boe (barrels of oil equivalent) worth of reserves, is believed to be sitting on a tremendous amount of wealth. There have been multiple developments in that region in recent years. In fact, the operator of the 6.6 million acre Strabroek Block that Hess Corporation has ownership over has made more than 30 discoveries since 2015. The potential for that area is so significant that management believes that it could eventually have 10 floating production, storage, and offloading vessels dedicated specifically to that block. At present, the first six are estimated to be able to grow output to 1.2 million boe per day in 2027. That's triple the 400,000 boe per day currently estimated. There's also potential for the Kaieteur Block, which Hess owns 20% of. The reason why I say there's potential here is because it's adjacent to the Strabroek Block and the company is still in the process of evaluating those assets and planning for them.

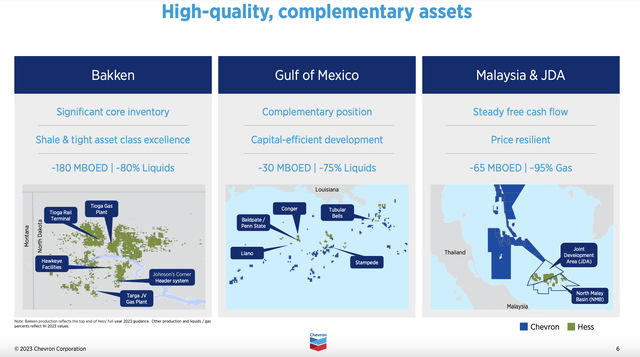

Chevron

There's some overlap here when it comes to Chevron. In Suriname, the company has a 40% interest in Block 5, a 33.3% non-operated working interest in the deepwater Block 42 area, and an 80% owned and operated working interest for the shallow water Block 7. Any chance to cluster assets opens the door to generating synergies."

https://seekingalpha.com/article/4643408-mr-market-not-happy-with-chevronhess-deal#comments