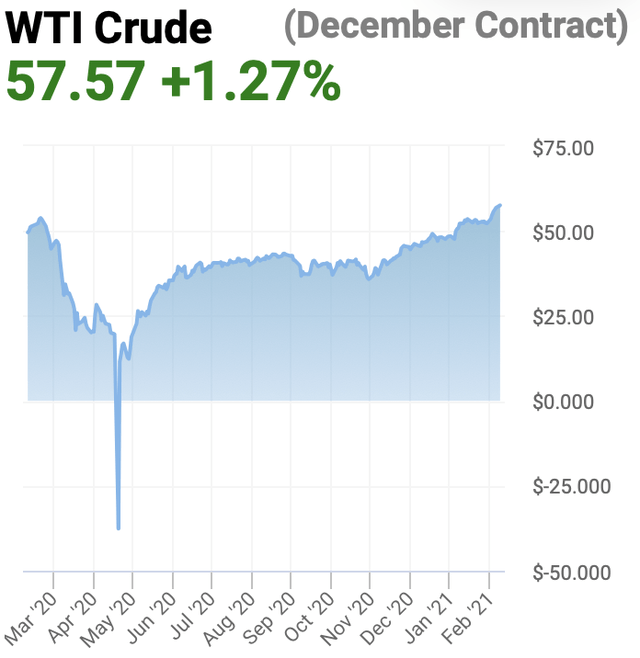

Oil Heading Up? Oil - WTI Crude has come a long way since dipping into negative territory during the height of the coronavirus panic. At roughly -$40 a barrel it was quite surreal. Oil stocks were melting, traders were unloading barrels at sub-zero prices, this was an unprecedented time indeed. Nevertheless, fast forward less than 1-year, and oil is closing in on $60 again.

Source

OPEC + oil producers are likely to stick to their production cuts. This should limit the supply of oil coming to market. Moreover, oil demand is likely to rise, as the coronavirus pandemic begins to ease into the second half of this year and into 2022. Furthermore, inflation is likely to rise as well going into year-end and next year. Therefore, oil is likely headed higher from here, possibly into the $70-80 range by the end of this year.

The Supply Demand Dynamic

Oil's supply and demand dynamic is likely the single most important driver for oil prices. We saw oil prices crash into negative territory during the height of the coronavirus meltdown. This was in part due to an extremely strong shock to the global demand side of the equation. However, on the other side, while demand fell off a cliff, major oil producers kept pumping, essentially overflowing the market with oil.

Source

Source

However, things are much different now. Saudi Arabia and Russia agreed to extend their oil cut outputs. This move puts pressure on other OPEC + nations to comply with their output cuts as well. Also, we are seeing the supply demand dynamic play out in markets, as we see larger than expected declines in U.S. oil inventories in much of the recent economic data.

An important factor to consider is that many of the top oil producers in OPEC + like Saudi Arabia, Russia, as well as many other nations are developing, or are essentially third world countries. Thus, oil revenues account for large portions of these countries' GDPs, as well as their budgets. For the sake of stability, and a certain level of prosperity, it is essential to keep oil at "an acceptable" price for these nations.

An acceptable price is around $55-65, in my view, however, a preferable price is notably higher. Naturally, the higher the price the better (within reason), but a likely lower range for a "preferable oil price" is probably around $70-80, and I think the this is where oil is headed by the end of 2021.

As the Coronavirus Weakens

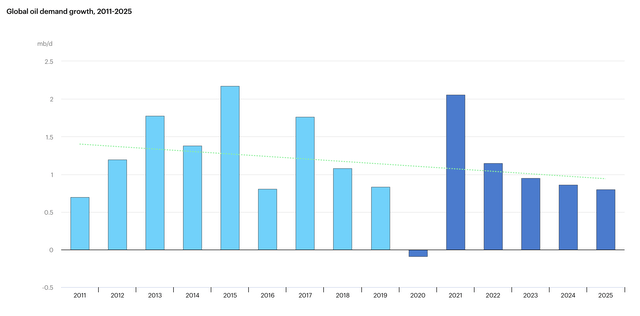

As the coronavirus loosens its grip on the global economy, oil demand is likely to rise. We see that 2020's demand fell off a bit, but growth seems to have dipped just marginally into negative territory. In fact, I was expecting a larger decline due to the coronavirus pandemic.

Source

Now, the good news is that we are likely to see robust growth this year, and possibly in future years as well. Global oil demand is expected to jump by around 2% this year, illustrating one of the best growth years for oil over the last decade. Also, despite future years' growth declining slightly, I don't expect this to impact price negatively.

The Key Word is Inflation Here

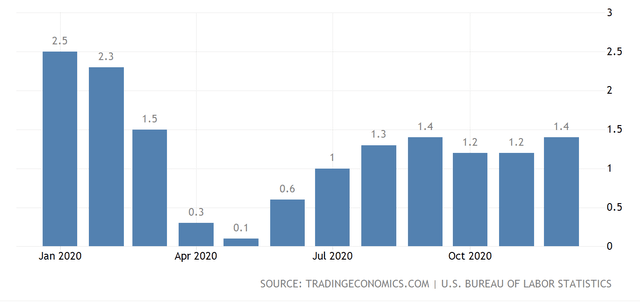

Yes inflation, which seems to be rather tame right now is not likely to remain so for long. So, CPI inflation has been running at about 1.2-1.4% in recent months.

Source

Some may say "wow, that is pretty low". Indeed, it is not very high, but let us put this in context. So, CPI inflation is essentially telling us that a lot of the prices surrounding us are higher now than they were a year ago. In fact, this has been constant throughout the coronavirus pandemic.

This is astounding. Portions of global economies were shut down, some parts came to a halt, countless people lost their jobs, GDP fell off a cliff for a while, and all this time we see prices around us increasing. In a "normal" scenario we would likely see deflation occur, but we are seeing the opposite instead.

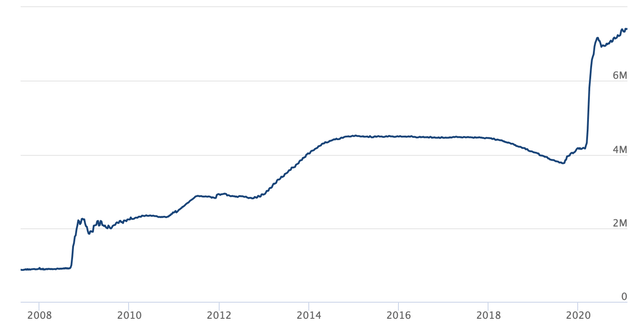

Well, this is largely due to the Fed and other major central banks around the globe. For the sake of simplicity, let's focus on the Fed, the most influential central bank in the world. Perpetual zero rate policy, multi-trillion dollar backstops and bailouts, coupled with "QE unlimited" are causing the Fed's balance sheet to explode. We see that the Fed's balance sheet is nearly 10 times higher than where it was before the financial crisis of 2008, and it has nearly doubled just over the past 18-months alone.

Source

This is unprecedented, and it makes 2008's easing look like a blip in comparison to what is going on now. Furthermore, while there were expectations that the Fed could eventually "normalize" rates and unload its balance sheet post the 2008 crisis, this was proved to be wishful thinking in late 2018. The economy was not able to function effectively and grow in a rising rate and quantitative tightening/QT environment.

Therefore, I expect the Fed's balance sheet to continue to expand further from here. Moreover, I don't believe that the Fed will be able to shrink its balance sheet notably in the future, nor will the U.S. economy be able to withstand noticeably higher interest rates going forward.

Source

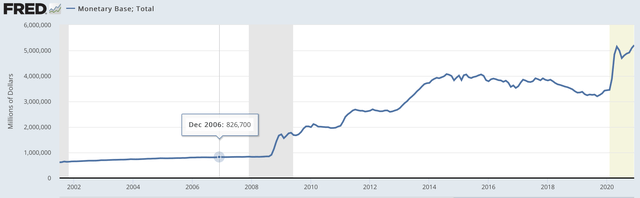

Here we see the Fed's balance sheet expansion translating into the expansion of the U.S.'s monetary base. The underlying phenomenon creates a perfect storm for inflation to materialize going forward. If we are seeing inflation when we should normally see deflation, what is going to happen when the economy starts to expand notably in the H2 2021, and in 2022?

I think it is clear, inflation is likely to run quite hot, and I don't think that the Fed is going to be able to implement its usual tools to cool it down any time soon. If easy money stops flowing the economy could stall again. If interest rates tick higher economic activity will slow. Additionally, the enormous debt loads in every segment of the economy, consumer, and government may become unmanageable, and too costly to service.

The Bottom Line

There really is not much that the Fed can do to cool down inflation going forward without damaging the economy in my view. Thus, inflation is likely to run hot in future years. This is very bullish for oil and other real assets. Furthermore, once we consider the stronger demand picture coupled with constrained supply, oil is likely headed notably higher from here. I expect that we can see oil prices in the $70-80 range by the end of this year, and possibly in the $100 plus range sometime in 2022.