Key Insights

- Significantly high institutional ownership implies Galiano Gold's stock price is sensitive to their trading actions

- A total of 5 investors have a majority stake in the company with 53% ownership

- Insiders have bought recently

If you want to know who really controls Galiano Gold Inc. (TSE:GAU), then you'll have to look at the makeup of its share registry. With 32% stake, institutions possess the maximum shares in the company. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

And things are looking up for institutional investors after the company gained CA$40m in market cap last week. One-year return to shareholders is currently 86% and last week’s gain was the icing on the cake.

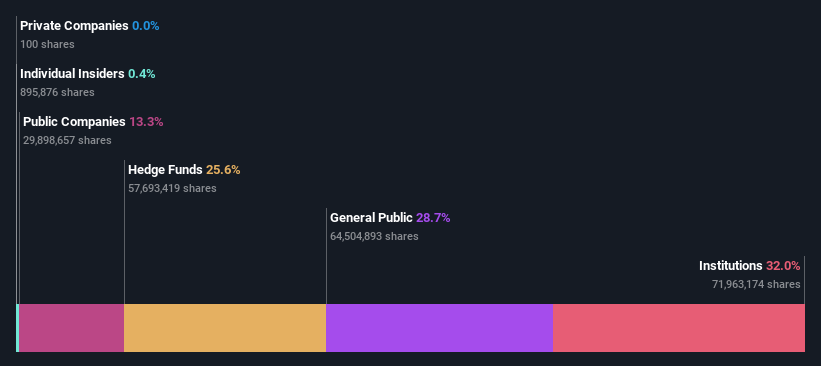

In the chart below, we zoom in on the different ownership groups of Galiano Gold.

See our latest analysis for Galiano Gold

TSX:GAU Ownership Breakdown January 9th 2024

TSX:GAU Ownership Breakdown January 9th 2024 What Does The Institutional Ownership Tell Us About Galiano Gold?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

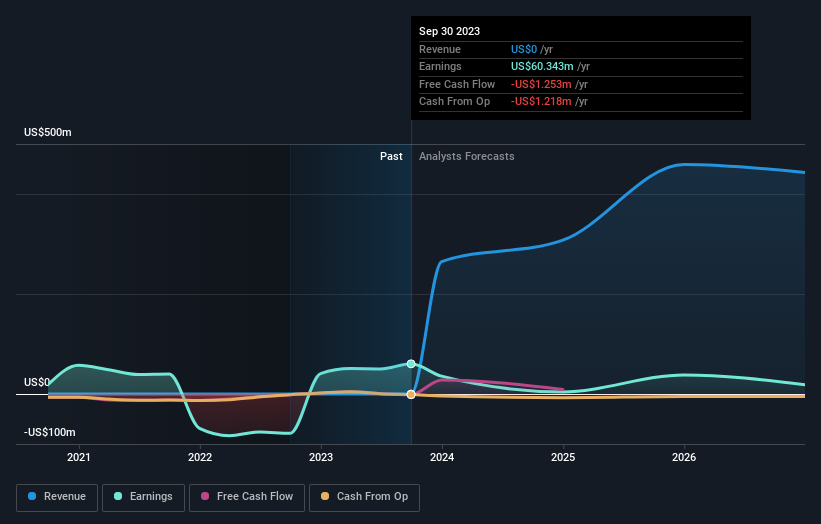

We can see that Galiano Gold does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Galiano Gold's earnings history below. Of course, the future is what really matters.

TSX:GAU Earnings and Revenue Growth January 9th 2024

TSX:GAU Earnings and Revenue Growth January 9th 2024 It looks like hedge funds own 26% of Galiano Gold shares. That worth noting, since hedge funds are often quite active investors, who may try to influence management. Many want to see value creation (and a higher share price) in the short term or medium term. The company's largest shareholder is Equinox Partners Investment Management LLC, with ownership of 16%. Ruffer LLP is the second largest shareholder owning 12% of common stock, and Sun Valley Gold LLC holds about 9.8% of the company stock.

On looking further, we found that 53% of the shares are owned by the top 5 shareholders. In other words, these shareholders have a meaningful say in the decisions of the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There is some analyst coverage of the stock, but it could still become more well known, with time.

Insider Ownership Of Galiano Gold

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our data suggests that insiders own under 1% of Galiano Gold Inc. in their own names. It appears that the board holds about CA$1.2m worth of stock. This compares to a market capitalization of CA$295m. Many investors in smaller companies prefer to see the board more heavily invested. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 29% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Galiano Gold. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies

Source: Shutterstock

Source: Shutterstock Key Insights

- Significantly high institutional ownership implies Galiano Gold's stock price is sensitive to their trading actions

- A total of 5 investors have a majority stake in the company with 53% ownership

- Insiders have bought recently

If you want to know who really controls Galiano Gold Inc. (TSE:GAU), then you'll have to look at the makeup of its share registry. With 32% stake, institutions possess the maximum shares in the company. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

And things are looking up for institutional investors after the company gained CA$40m in market cap last week. One-year return to shareholders is currently 86% and last week’s gain was the icing on the cake.

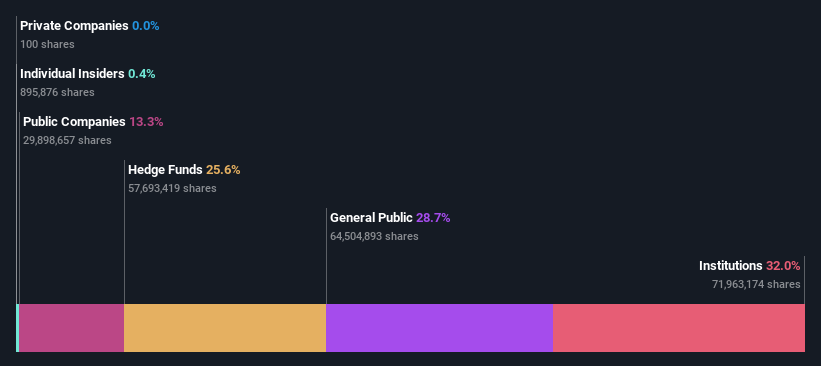

In the chart below, we zoom in on the different ownership groups of Galiano Gold.

See our latest analysis for Galiano Gold

TSX:GAU Ownership Breakdown January 9th 2024

TSX:GAU Ownership Breakdown January 9th 2024 What Does The Institutional Ownership Tell Us About Galiano Gold?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

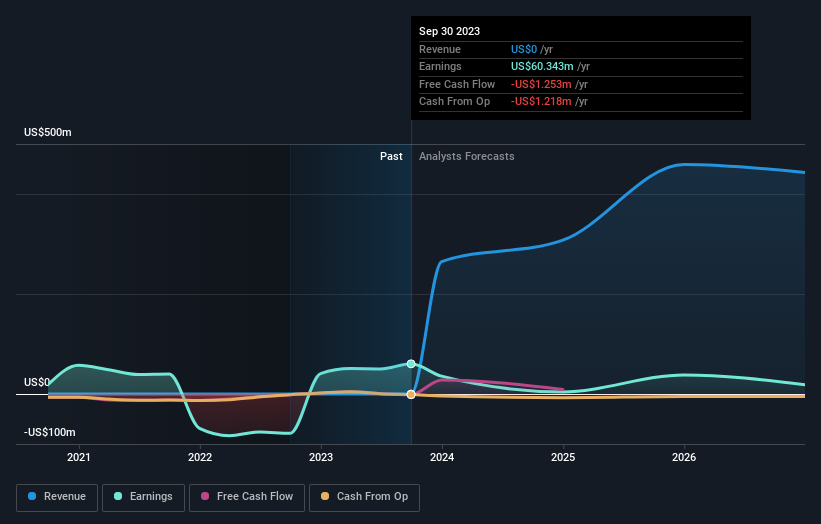

We can see that Galiano Gold does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Galiano Gold's earnings history below. Of course, the future is what really matters.

TSX:GAU Earnings and Revenue Growth January 9th 2024

TSX:GAU Earnings and Revenue Growth January 9th 2024 It looks like hedge funds own 26% of Galiano Gold shares. That worth noting, since hedge funds are often quite active investors, who may try to influence management. Many want to see value creation (and a higher share price) in the short term or medium term. The company's largest shareholder is Equinox Partners Investment Management LLC, with ownership of 16%. Ruffer LLP is the second largest shareholder owning 12% of common stock, and Sun Valley Gold LLC holds about 9.8% of the company stock.

On looking further, we found that 53% of the shares are owned by the top 5 shareholders. In other words, these shareholders have a meaningful say in the decisions of the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There is some analyst coverage of the stock, but it could still become more well known, with time.

Insider Ownership Of Galiano Gold

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our data suggests that insiders own under 1% of Galiano Gold Inc. in their own names. It appears that the board holds about CA$1.2m worth of stock. This compares to a market capitalization of CA$295m. Many investors in smaller companies prefer to see the board more heavily invested. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 29% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Galiano Gold. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies