gchapel

While the general market has been battered, with its correction exceeding 27% from peak to trough, the Gold Juniors Index (GDXJ) has suffered the real bear market. This is evidenced by a 61% correction from its 2020 highs. Given that bear markets take time and damage to eradicate bullish sentiment, the more fertile ground for looking for new ideas is in the gold sector, where the 22-month cyclical bear market has ground any remaining optimism to fine dust. However, the key is to focus on quality, not high-risk, high-reward names that could lead to zeroes in one's portfolio, like Pure Gold (OTCPK:LRTNF) and Great Panther (OTC:GPLDF).

Fortunately, the selling has been indiscriminate due to the bear market environment, and there are a couple of massive valuation disconnects out there currently. The most extreme, in my view, is that of i-80 Gold, which continues to release phenomenal drill results across both of its flagship properties yet continues to shed value in a market where tax-loss selling is abundant, and positive news releases are liquidity events. Based on what I believe to be over 180% upside to fair value from a share price of US$1.65, I see this recent correction in the stock as a gift.

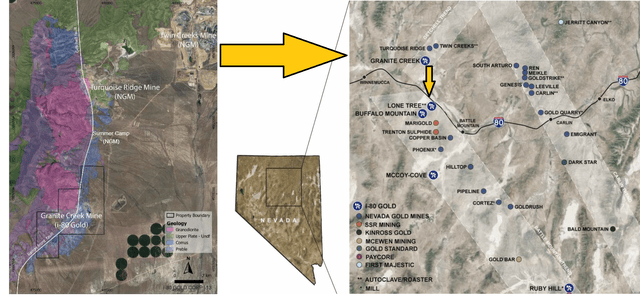

Granite Creek Mine - i-80 Gold (i-80 Gold Presentation)

Granite Creek Introduction & History

i-80 Gold's Granite Creek Project is located 43 kilometers northwest of Winnemucca, Nevada. It sits on the eastern flank of the Osgood Mountains, with the mine occurring on a northeast-trending structural corridor known as the Getchell Gold Trend. Other deposits on the trend outside of the property include Preble, Getchell, Turquoise Ridge, and Twin Creeks, with Turquoise Ridge being the breadwinner of the four. In fact, the Turquoise Ridge Complex produced 543,000 ounces last year (100% basis) at industry-leading all-in-sustaining costs of $892/oz.

Turquoise Ridge Complex - Barrick (Barrick Gold Presentation)

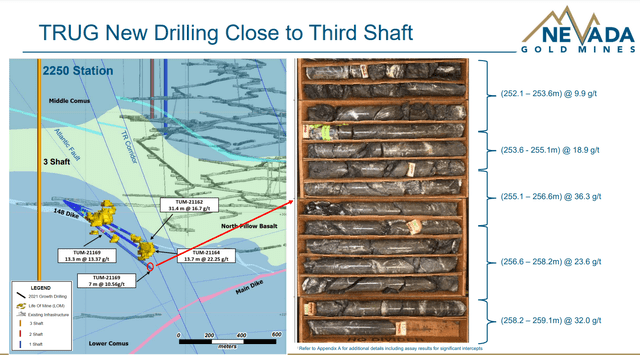

From a mineral endowment standpoint, Nevada Gold Mines' Turquoise Ridge Complex is a behemoth, hosting over 20.4 million ounces of gold resources. The underground deposit alone hosts 14.2 million ounces at 9.0+ grams per tonne of gold. Having a neighboring property (same stratigraphy) with this kind of mineral endowment certainly doesn't hurt if you're looking for a monster-sized deposit. Still, the Granite Creek Mine has a successful history of gold production on its own. This includes initial production at Ogee and Pinson in 1949-1950 of 9,100 tonnes at 4.8 grams per tonne of gold, followed up by production from Pinson Mining Company from 1971 through to 1999, with over 990,000 ounces of gold produced from multiple pits at sub 4.0 grams per tonne of gold.

It's worth noting that while the Turquoise Ridge Complex is home to over 12.5 million ounces of gold currently, it's one of the most productive gold operations in North America, with historical production of 7.0+ million ounces (solely Turquoise Ridge Underground) and 26.0+ million ounces for the Complex as a whole.

Following the acquisition of the property by Atna, the company ramped up the underground mine in late 2012, completed over 1,800 meters of primary and secondary development, and mined ~27,200 tonnes or ~8,000 ounces of gold, sending the ore to Newmont's (NEM) Twin Creeks autoclave. The autoclave recoveries ranged from 69.2% to 92.6% on high-grade material from the Ogee deposit, which is good news for i-80 Gold which has a toll-processing agreement in place with Nevada Gold Mines for Granite Creek refractory ore in the interim. Once its Lone Tree Facility is refurbished, it plans to ship material to this facility which sits less than 40 kilometers south of Granite Creek.

Granite Creek Project & Nevada Map With i-80's Newly Acquired Lone Tree Facility (Company Presentation)

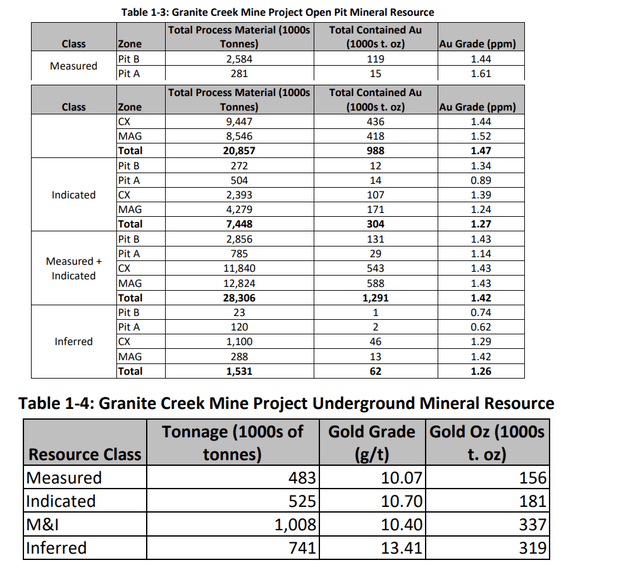

As the map above shows, the northern border of i-80's Granite Creek Project is an Olympian stone's throw from the massive Turquoise Ridge Mine and shares very similar geology. To date, the project is host to a very high-grade open-pit resource of ~1.35 million ounces of gold (~1.29 million ounces in M&I categories) at an average grade of 1.40 grams per tonne of gold. In fact, its grades are among the highest in the United States projects amenable to open-pit mining. The focus of this update will be on Granite Creek Underground, and this deposit is home to an M&I resource of 1.0 million tonnes at 10.40 grams per tonne of gold (337,000 ounces) and an inferred resource of 741,000 tonnes at 13.41 grams per tonne of gold (319,000 ounces).

Granite Creek Resource (i-80 Gold Technical Report)

Currently, i-80 Gold is focused on mineralization within 500-meter depths at its Granite Creek Mine, but mineralization at Turquoise Ridge goes down to ~1,500 meters, and grades improve at depth. This suggests grade upside and significant down-dip potential for i-80 as it continues to explore deeper at the mine. However, even within the current plan, i-80's drilling results at Granite Creek have been exceptional, with the company hitting some of the most impressive intercepts across the mining sector to date. Most importantly, the hit rate has been over 90%, and new drilling results are over very impressive widths.

Turquoise Ridge Underground & Third Shaft - Barrick (Barrick Gold Presentation)

This is a crucial differentiator for i-80 relative to much of the junior mining sector because these highlight intercepts are not shown at the top of a release, with a table of mediocre or even non-significant intercepts buried at the bottom of the news release. Instead, i-80s are all over solid grades and widths; true width is provided and is over 60%, and this drilling success is being achieved on a property that i-80 has been drilling for less than a year, meaning that it's drilling blind to some degree, making this even more impressive. Overall, these results suggest that Barrick, Homestake, and Atna left a lot of ounces behind. Let's take a closer look below:

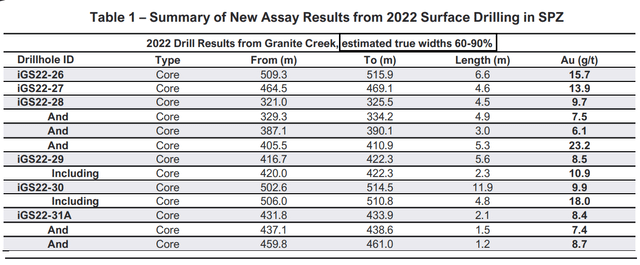

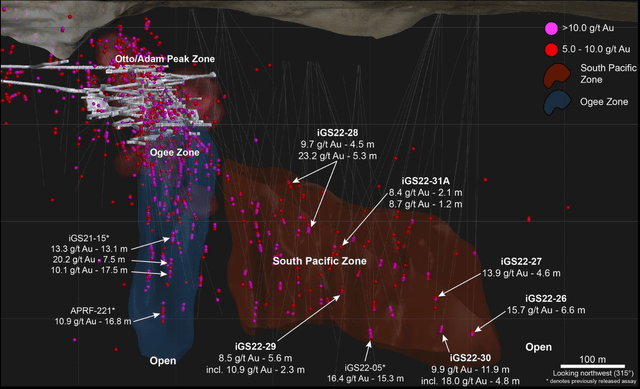

South Pacific Zone - Recent Drill Results (Company News Release)

Recent Drilling

Looking at the long section below, we can see the Otto, Adam Peak, and Ogee zones to the south, with considerable underground development and relatively tightly spaced drilling. However, the major news since i-80 acquired the project is the extremely thick intercepts coming out of the Ogee Zone at depth and the discovery of the South Pacific Zone, which lies to the north and dwarfs the previous mineralized footprint in size. This is based on the South Pacific Zone having a 600-meter strike, a minimum 250-meter dip length, and 5-meter widths, with the potential for the strike length to increase to 1,000+ meters. In fact, a historical hole drilled by Homestake (HPC-175) 400 meters north of the existing mineralized footprint intersected grades well over 10.0 grams per tonne of gold.

Long Section Granite Creek (Company News Release)

This is a big deal for i-80 Gold and cannot be overstated. The reason is that the South Pacific Zone appears to have better ground conditions, better mining widths, and grades, significantly de-risking the Granite Creek mine plan with five levels planned here, each capable of yielding 100 tonnes per day of ore. Most importantly, this zone is not in the middle of nowhere - it's right next to the existing underground workings at depth. This means that i-80 Gold could drift into this zone by next year, which would also allow for more effective underground drilling, and it could be mining the South Pacific Zone by this time next year.

So, with what looks to be 1.0+ million ounces of 10.0+ grams per tonne material sitting right next door to existing infrastructure and a toll-milling agreement in place to process the material, investors should be very pleased with the drilling success at South Pacific. However, longer-term, this material will go to i-80's Lone Tree processing facility and contribute upwards of 100,000 ounces per annum based on ~1,000 tonne per day mining rates. From a big-picture standpoint, if Granite Creek Underground can grow to 2.0 million ounces at slightly better grades with more competent ground conditions, the previous ~5-year mine life looks like 15+ years, and that doesn't even factor in additional potential at depth.

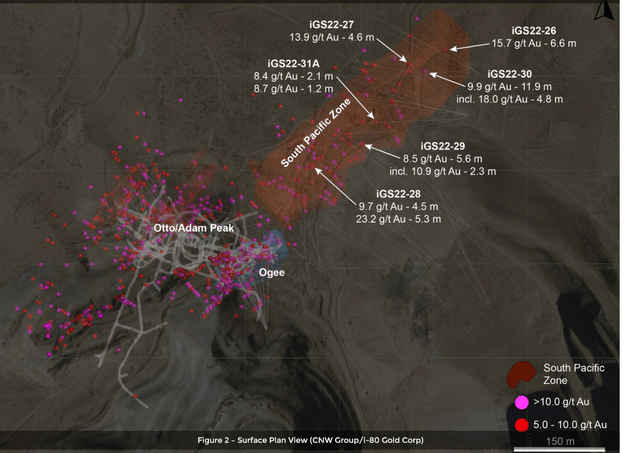

Granite Creek Drilling - Surface Plan View (Company News Release)

If we look at the most recent drilling update, i-80's hole IGS22-26 was the deepest and most northern drilled hole and hit 6.6 meters at 15.7 grams per tonne of gold 170 meters north of the impressive intercept delivered from IGS22-05, which intersected 15.3 meters of 16.4 grams per tonne gold. Not only does this potentially expand the strike of the deposit (once confirmed with more drilling), but it suggests that the high-grade hits coming out of the South Pacific aren't flukes, and this is a deposit with grades consistently coming in above 8.0+ grams per tonne gold, with the odd 15.0+ gram per tonne intercept.

Meanwhile, at the Ogee Zone, the company hit multiple incredible intercepts at depth, with IGS-21-15 intersecting 13.1 meters at 13.3 grams per tonne of gold and 7.5 meters at 20.2 grams per tonne and 17.5 meters at 10.1 grams per tonne of gold. These are world-class drill results and point to potential resource growth at this zone as well. In short, the drilling here is easily justifying the purchase price for Granite Creek of less than $100 million, with this valuation being justified by Granite Creek Open Pit alone ($245 million After-Tax NPV (5%) at $1,650/oz gold), with i-80 picking up the massive underground potential as a cherry on top.

Current Valuation

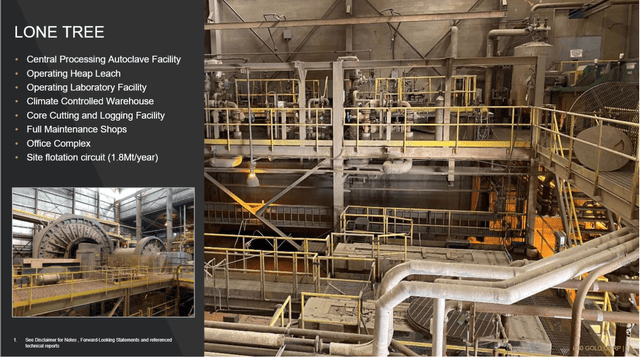

i-80 Gold currently has ~290 million fully-diluted shares and a share price of US$1.65, giving it a market cap of ~$478 million. This is a dirt-cheap valuation for a company with a global gold resource of 14.6 million ounces of gold and 180 million ounces of silver or ~17.0 million gold-equivalent ounces, especially with all these ounces located in arguably the best mining jurisdiction globally: Nevada. On top of this, the company has an autoclave facility (Lone Tree), operating heap leach pads at two projects, a lab facility and core-cutting/logging facility, plus full maintenance shops and an on-site CIL plant (Ruby Hill). Replacing this infrastructure in today's inflationary environment would likely cost well over $1.0 billion.

Lone Tree Facility (Company Presentation)

If we divide i-80 Gold's market cap by 17.0 million gold-equivalent ounces, it's currently valued at $28.12/oz, a valuation typically reserved for an explorer in a non-Tier-1 jurisdiction. One could argue that this valuation method is less conservative given that it assigns a value for mines that may not be developed over the next five years (Mineral Point and Lone Tree Open-Pit). However, even if we exclude Mineral Point and Lone Tree Open-Pit (lower grade) and focus only on the highest-grade resources, i-80's resource base comes in at ~5.50 million ounces, with all these deposits being among the highest-grade relative to their peers (shown below). The valuation comes in at $86.90/oz using solely the resources present at these deposits.

The issue with this figure is that these mineral resource estimates are extremely stale, with significant growth likely at Ruby Hill (Ruby Deeps) and material resource growth likely at Granite Creek Underground in their upcoming resource estimates. In fact, the South Pacific appears to have better ground conditions at depth and looks to have at least a 600-meter strike, with a minimum 250-meter dip length and 5-meter widths, with the possibility for this strike to increase to 1,000 meters. This suggests the potential for Granite Creek Underground to nearly triple in size, with its resource increasing to over 1.8 million ounces (~660,000 ounces currently). Meanwhile, Ruby Hill Underground looks like it could increase to over 2.8 million ounces medium-term (~1.8 million ounces currently), with these resources easily accessible with a decline from the Archimedes Pit.

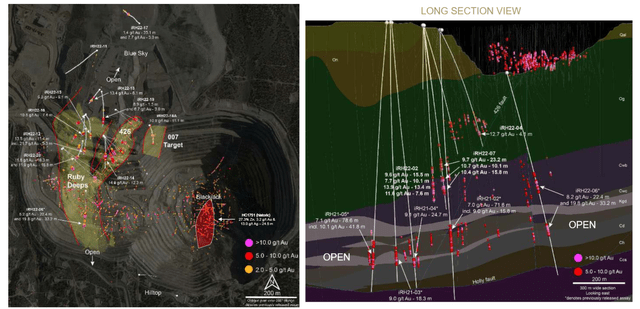

Ruby Deeps/426 (i-80 Gold Company Presentation)

Based on my outlook for i-80's core resource base (defined as highest-priority deposits for its Hub & Spoke model with current mineral resources) to grow to a minimum of 7.6 million ounces, i-80 is valued at just $62.90/oz. This is a ridiculous valuation when these ounces are all at industry-leading grades; i-80 has the infrastructure to support processing at all of these projects (excluding Granite Creek Open Pit), and these ounces are all in a Tier-1 ranked jurisdiction. In fact, if we look at world-class development-stage and semi-world-class projects, the price suitors are willing to pay has historically been well over $140.00/oz. I have excluded i-80 Gold's ~$100 million in cash to be conservative, but its enterprise value per ounce would be much lower if I included its cash position in the valuation.

For starters, Richfield Ventures was acquired for over $140.00/oz by New Gold (NGD) in British Columbia, with a sub 5.0 million-ounce resource base, and Integra Resources was acquired by Eldorado (EGO) for over $170.00/oz with ~2.5 million high-grade ounces in Quebec. More recently, Great Bear was acquired for $1.40 billion with no resources, and even if we assume 8.0 million ounces are proven up there by Q1 2024, Kinross will have paid $175.00/oz. Looking solely at Nevada and world-class projects, the most recent major acquisition ($500+ million) was Fronteer Gold [FRG] which was acquired for ~$2.3 billion based on Fronteer's Northumberland, Sandman, and Long Canyon deposits. The total resource base at the time was 6.1 million ounces of gold, with Newmont paying ~$377.00/oz.

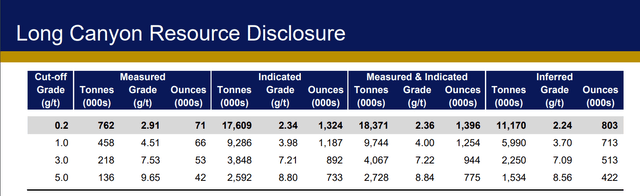

Long Canyon Resource (Newmont Acquisition Presentation)

Newmont noted at the time of its acquisition that it believed Long Canyon could triple in size, and when it comes to high-grade deposits in the best mining jurisdiction globally, it's no surprise that Newmont paid a premium price. However, even if we bake in Newmont's assumption that it would triple Long Canyon's resource base through further drilling (~6.6 million ounces vs. ~2.2 million ounces), it still paid over $219.00/oz on forward projected ounces. I would argue that i-80's core projects can stand up against Great Bear and Long Canyon from an attractiveness standpoint (high-margin ounces in a Tier-1 jurisdiction, even if they are very different deposits), but its ounces are trading at one-third the value.

The major differentiator worth pointing out is that i-80's ounces and what I believe it can ultimately prove up (~18+ million ounces of gold or 7.5+ million ounces at core deposits) are trading at one-third the value with infrastructure. In Great Bear's case, Kinross likely has five years of infill and grade control drilling ahead of it, five years of permitting work, and an $800+ million capex bill for a 15,000+ tonne per day operation in Red Lake. In i-80's case, I expect Lone Tree refurbishment costs to come in below $260 million or a fraction of the cost and time to get these ounces in production. So, from a total acquisition cost standpoint (price paid for the project + capex needed to get it into production), i-80 has a massive valuation disconnect currently.

To summarize, not only is i-80 Gold deeply undervalued based on its current project portfolio and infrastructure, but at these levels, it's a highly attractive takeover target in my view.

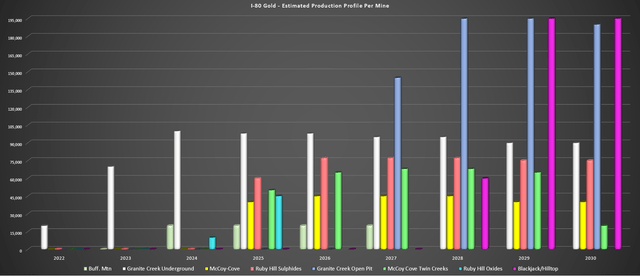

The Upside Case

While I think i-80's base case is very exciting, and I'm shocked that the stock is trading at a sub $800 million valuation (US$2.75) given its long-term potential, the upside case seems grossly ignored. As the chart below shows, i-80 has the potential to increase production from ~10,000 ounces this year to a stated goal of 250,000 ounces by 2025, representing an industry-leading organic growth profile. However, the upside case to this production profile (initial Hub & Spoke model) is bringing Granite Creek Open-Pit online, a project with a planned 11,000 tonne per day throughput rate, ~$150 million in capex (adjusted for inflation), and a first five-year production profile of 195,000+ ounces at sub $900/oz all-in sustaining costs.

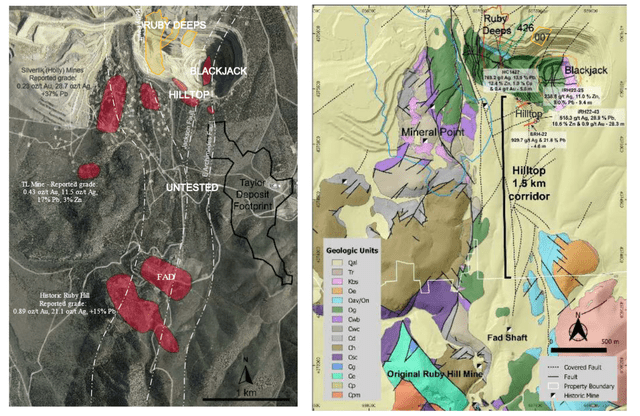

Elsewhere, if i-80 can grow its polymetallic resource (it's currently working on a resource for Blackjack and drilling Hilltop and the untested 1.5-kilometer corridor to the south), i-80 could have significant and high-margin polymetallic production as well. The important takeaway here is that the rock value could dwarf anything i-80 has in its portfolio currently, with its initial drill results from Hilltop having rock values north of $1,100/tonne. For those unfamiliar, the highlight intercept drilled at Hilltop was 28 meters at 515 grams per tonne of silver, 29.0% zinc, 10.5% lead, and 0.90 grams per tonne of gold. Hilltop is zinc-lead rich with high silver credits.

Blackjack & Hilltop & Untested Corridor (i-80 Gold Company Presentation)

Based on the potential to retrofit the current Ruby Hill CIL Plant to process base metals once oxide production is complete at 426 and increasing throughput to 2,000 tonnes per day (it has a crushing capacity of closer to 3,000 tonnes per day), this could generate annual revenue of ~$360 million from the base metals opportunity alone. That is the equivalent of ~205,000 ounces of gold at a $1,750/oz gold price, totally separate from Lone Tree, which caps out at 2,500 tonnes per day, or around 250,000 to 300,000 ounces per annum, depending on head grades and recovery rates.

If this is a much bigger CRD system at Ruby Hill, Hilltop and Blackjack alone could justify i-80's current market cap. However, I have assumed just 3.0 - 5.0 million tonnes to be conservative.

This could provide a significant increase to consolidated production in 2027 if the polymetallic opportunity comes to fruition, and it's very margin accretive, given that there should be a profit of at least $300/tonne at what looks to be conservative grades. At 2,500 tonnes per day, if this has enough scale, the production profile could come in north of 250,000 GEOs. To summarize, a path to becoming a 550,000-ounce+ producer status for i-80 Gold is looking more achievable long term, and this production profile should be coupled with industry-leading margins. A look at the potential production profile is shown below, with Hilltop/Blackjack (pink bar) being the upside carbonate replacement deposit [CRD] case which could push production well over 600,000 ounces by the end of the decade when coupled with Granite Creek Open Pit (light blue bar).

i-80 Gold - Conceptual Production Profile (Company Filings, Author's Chart & Estimates)

Before moving on, it's worth noting that the potential to the south of Hilltop for additional CRD mineralization is not a pie-in-the-sky hope or some crazy assumption. For those unfamiliar, the Eureka District has a 100-year history of base metal production (1864-1966), and it's one of the highest-grade CRD districts globally. Meanwhile, Paycore Minerals (OTCPK:PYCMF) is hitting phenomenal grades to the south at its FAD deposit, with a step-out hole intersecting 22% zinc, 150 grams per tonne of silver, and 1.0+ grams per tonne of gold over 12.5 meters. Normally, CRD deposits are silver-rich, and it's rare to see gold involved, but this is likely due to its proximity to a Carlin system in Nevada.

While it's early to suggest that this project could match Arizona Mining's Taylor deposit in size, the grades are coming in well above Taylor deposit grades, and South32 (OTCPK:SOUHY) acquired the company for $1.3 billion in 2018. This was based on a massive 100 million-tonne resource at 10.4% zinc, and I would be elated if i-80 Gold proved up 10.0 million tonnes here. Still, the Taylor deposit footprint is shown for scale. With the i-80 Gold base case scenario (Hub & Spoke model) already supporting a US$4.70+ share price, this is certainly a nice bonus to the story that isn't even being modeled currently, given that the company is in the early stages of defining the CRD potential at its Ruby Hill Project.

Fair Value

i-80 Gold currently has ~240 million shares outstanding (~290 million fully diluted). I have purposely modeled ~310 million shares to be ultra-conservative, which assumes 7% share dilution at some point in the next two years, and assumes all warrants/options are exercised. I do not see share dilution as likely nor full warrant exercise as likely (warrants are priced over 50% above current prices), but I have chosen to use this figure to be conservative. Based on a fair multiple of 1.0x P/NAV for high-grade projects in a top-3 mining jurisdiction globally and an estimated net asset value of $1.45 billion, I see a fair value for i-80 Gold of US$4.68 [2-year target price], representing 190% upside from current levels.

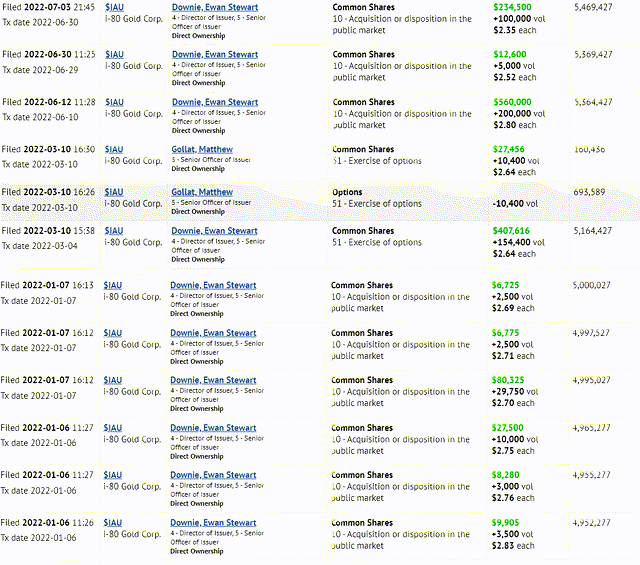

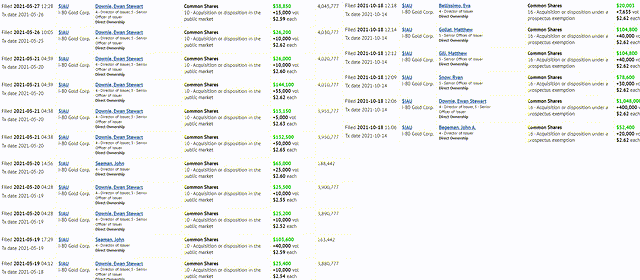

i-80 Gold - Insider Buying (SEDI Insider Filings)

i-80 Gold Insider Buying (SEDI Insider Filings)

While this might seem like a stretch, management is aligned with shareholders and has been actively buying shares over the past year, with i-80 Gold's CEO Ewan Downie purchasing 1.0 million shares over the past 18 months at prices ranging from US$1.50 to US$2.11. We've also seen buying from the Chief Financial Officer, Ryan Snow (30,000 shares), and the Chief Operating Officer, Matt Gili, with 40,000 shares purchased. So, while this upside case and story might appear too good to be true, I take the strong insider buying as a vote of confidence that they also believe very strongly in their story enough to add to their positions in the stock. For more information on the management team, which are ex-Barrick and ex-Premier Gold, and a more in-depth review of the story, see my most recent update:

Summary

In a market where fundamentals have gone out the window, many gold producers are trading at a fraction of where they should be due to depressed sentiment in the sector. However, while there are some clear valuation disconnects, i-80 Gold's valuation disconnect is one of the most extreme ones I've seen in years, especially given that this is a company with the potential to be a 500,000+ ounce Nevada producer, supporting a $2.50+ billion market cap later this decade (US$7.50+ per share). Of course, this target won't be realized overnight. Still, with the violent pullback leaving the stock trading at ~0.30x P/NAV, even at conservative gold prices, this has certainly opened up a very attractive buying opportunity.

From a big-picture standpoint, Ruby Deeps looks like a mini Goldrush deposit (7.0+ million ounces at 7.3 grams per tonne of gold), Granite Creek looks like a mini Turquoise Ridge from the continued drilling success, and the company has another high-grade project in McCoy Cove with ~1.5 million ounces of high-grade gold. Meanwhile, the company has a potential game-changer at Ruby Hill from a polymetallic standpoint, where the company has only scratched the surface to date on its true potential. So, with what I believe will be consistent production, cash flow, and reserve growth per share over the next several years, I continue to see i-80 Gold as a top-5 producer, and I plan to continue accumulating on any share-price weakness.