i-80 Gold Corp. (NYSE:IAUX) was one of my largest winners last year after it trounced the performance of its peer group for a second straight year. However, 2023 has been tough, and there's no sugar-coating that. I've clearly been wrong on the stock, expecting a floor near the US$1.80 to US$1.90 area. This is because the stock has plunged another 30% to make a new low and has found itself down over 50% year-to-date, erasing its streak of outperformance.

On a positive note, the company has a new bonanza grade discovery at Tyche (Ruby Hill) and continued to confirm impressive grades at the South Pacific Zone while also releasing some of the best holes drilled sector-wide in the gold space at Cove among small-cap producers. Unfortunately, this has been overshadowed by share dilution related to the acquisition of Paycore (consolidated land package at its flagship Ruby Hill Property), and an August equity raise which killed the stock's momentum. However, while this is discouraging, I think the story has actually improved materially, especially with a vote of confidence from an unnamed party with a non-binding joint-venture agreement this week.

In this update, we'll dig into recent developments, the updated valuation, and whether this i-80 Gold Corp. stock dip is worth buying.

Granite Creek Producing Mine - Company Website

All figures are in United States Dollars unless otherwise noted.

Share Dilution & Perspective

Obviously, with cash burn and a small-scale production profile, dilution and creative financings (gold prepays) are inevitable, but there are a couple of points worth making. For starters, i-80 is not the only company diluting shareholders in the sector. In fact, even producers like Avino (ASM), Coeur (CDE), First Majestic (AG), Eldorado Gold (EGO), and Wesdome (OTCQX:WDOFF) have had to issue shares, but some of this isn't noticed as it's coming through At-The-Market offerings buried in their financials.

In addition, there's no shortage of financings among developers, with many of them including half or full warrants and resulting in significant dilution. i-80 has actually obtained better terms than most of its developer peers without warrants in recent share offerings or minimal potential if warrants included (just over 1% of shares in last gold pre-pay financing but ~80% out of the money at ~US$2.38).

Given concerns raised by some investors, I thought it would be helpful to put things in perspective. While some investors might believe that only the worst companies dilute shareholders or do multiple financings, even the best companies in the sector have to dilute or have had to do creative financings in their infancy. And one company that has similarities to i-80 Gold is the Agnico Eagle (AEM) of 1996-2004, which had its work cut out for it and was constantly doubted by the market with aspirations to grow its one mine, LaRonde, into a much larger operation.

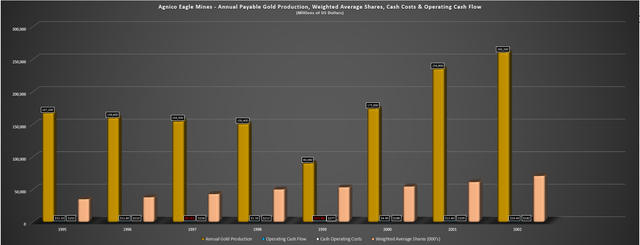

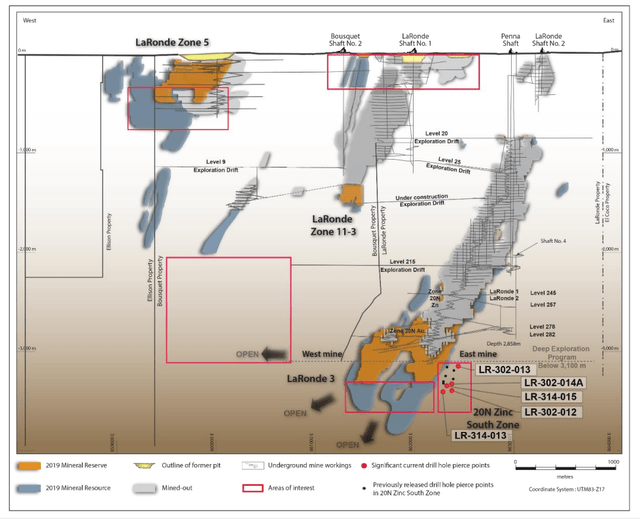

As the charts below highlight, Agnico Eagle spent heavily on exploration drilling at LaRonde in 1995 through 2002 while generating minimal or negative operating cash flow, but this drilling and significant development led to the discovery of Zone 20 North, a zinc-rich resource that significantly grew its overall reserves. New discoveries ultimately resulted in growing LaRonde from a 2,000 ton per day operation at its existing shafts to a much larger operation (7,000 tons per day) with the Penna Shaft (formerly called Shaft #3), which supported higher underground production and lower costs.

Agnico Eagle - Cash Flow, Cash Costs, Payable Production & Shares - Company Filings, Author's Chart

LaRonde Complex 2021 - Agnico Presentation

If successful, LaRonde would grow into a 350,000+ ounce per year operation, but it would not be a cheap endeavor. However, all the hard work paid off, and this one polymetallic underground mine in Quebec would end up supporting over two decades of production, and cash flow from this operation would help to kick off the next phase of growth for the company, with the company scooping up Riddarhyttan Resources (Kittila Mine), acquiring Pinos Altos, acquiring Cumberland (Meadowbank), constructing its second mine at Goldex, and starting production at a third and fourth mine in 2009 (Pinos Altos, and Kittila).

The key to this growth plan was focusing on a Tier-1 jurisdiction asset that wouldn't run into any major issues to prevent its development or make the mine less economic, such as what Kinross (KGC) ran into when it acquired Aurelian Resources in 2008, which, while an incredible asset, the asset did not head into production due to high proposed windfall tax profits.

The other key was significant exploration upside with LaRonde ultimately growing into a multi-million ounce resource with reserves at LaRonde growing from ~1.03 million ounces of gold to ~4.02 million ounces of gold (1996-2002) at an average grade of 3.42 grams per ton of gold, 69 grams per ton of silver, and 0.37% copper and 3.32% zinc. Plus, Agnico's future growth was from solid assets also in Tier-1 jurisdictions, with Goldex being east of LaRonde in Quebec. This is also similar to i-80, which hopes to grow to a 400,000 ounce producer later this decade, with a polymetallic asset and a Gold Hub & Spoke model in the same state producing ~250,000 ounces of gold.

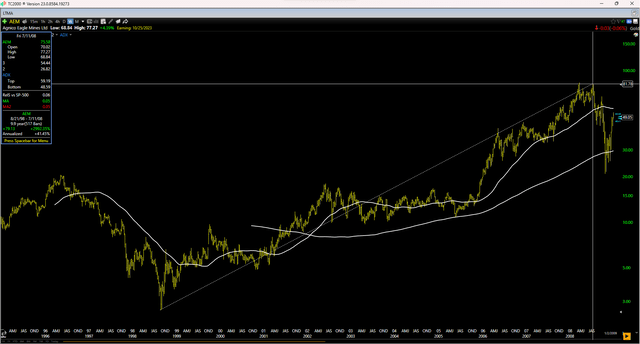

Agnico Eagle - Share Price & Financings - Worden.com, Company Filings

As shown above, this higher-capex period for AEM led to ~100% share dilution with multiple different forms of financings (most at below market prices), including $41 million raised in 1997 through equity, $73 million raised in 1998, a $100 million revolving credit facility in 1999, $100 million raised in 2001 from equity, a $144 million convertible debenture in early 2002, and $192 million raised with half warrants in 2002 in later October. This timeline is shown on the chart of Agnico Eagle below, and after achieving this growth, Agnico Eagle would go on to outperform other senior producers by over 7x on average on average from its 1998/1999 lows to its 2009 peak.

AEM Share Price Performance (1996-2009)- Worden.com

The interesting part is that i-80's current model and Agnico Eagle's model of the late 1990s to early 2000s is similar (polymetallic asset used to fund future growth in gold), but LaRonde also shares some similarities to Ruby Hill. This is because both flagship assets are polymetallic with industry-leading grades, with both having meaningful zinc credits and silver credits, in addition to gold.

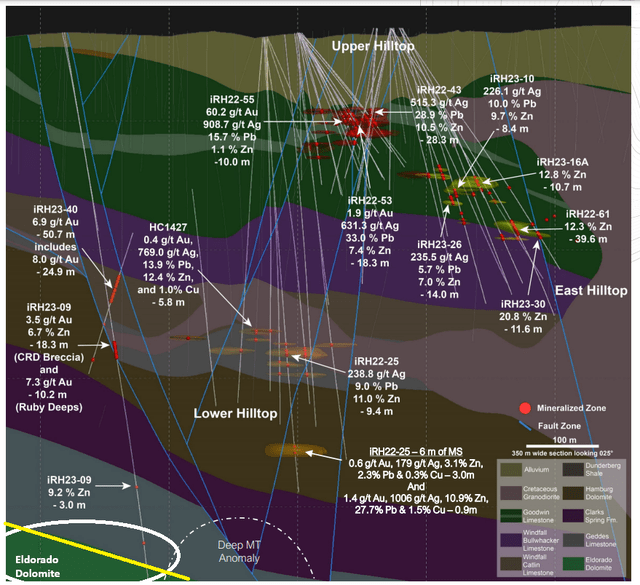

However, the polymetallic opportunity could significantly exceed grades at LaRonde, with LaRonde's 2001 reserves boasting an average grade of ~3.0 grams per ton of gold and ~4.0% zinc with additional silver and copper credits or closer to 6.0 grams per ton gold-equivalent, while recent hits from Blackjack (zinc-rich skarn) are showing higher grades, including 16.4 meters at 17.8% zinc, 0.9 grams per tonne of gold, and ~60 grams per ton silver (~9.0 grams per ton gold-equivalent), 40.4 meters at 24.3% lead/zinc, 0.60 grams per ton of gold and 420 grams per ton of silver at the Blackjack CRD, and an impressive 7.2 meters at 15.9% zinc, 280 grams per ton of silver, and 4.3 grams per ton of gold at East Hilltop.

Obviously, highlight holes do not equal average grade. However, i-80 has enjoyed a very high hit rate at all of its deposits (including Ruby Hill), and the results from Upper and Lower Hilltop have been even more impressive with a highlight of 10 meters at ~78 grams per ton gold-equivalent (including 60 grams per ton of gold).

Hence, I think i-80 should ultimately be able to delineate a 12+ million ton resource with an average gold-equivalent grade of 11+ grams per ton (higher grades at Upper Hilltop to boost cash flow) or ~3.5 million gold-equivalent ounces between Blackjack/Lowerjack, FAD, and the Hilltop zones. Plus, the company hasn't even scratched the surface further at depth which should tag the Eldorado dolomite which hosts the Ruby Hill/FAD host unit) or to the south in the untested Hilltop Corridor.

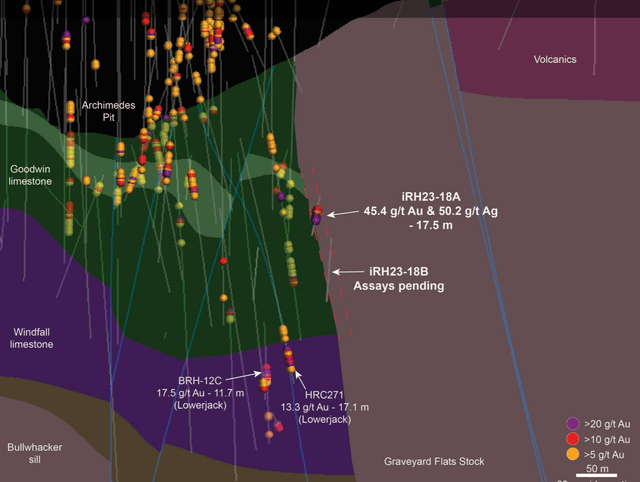

The Technical Report on FAD noted that the middle and late Cambrian Eldorado Dolomite (shown in dark green below) and Hamburg dolomite were important host rocks for CRD and gold deposits, with the Eldorado dolomite being the primary host rock (slightly deeper than what i-80 has drilled to date). "The Eldorado dolomite in the upper plate of the thrust zone is the principal host for the replacement mineralization bodies at Ruby Hill, and is the important host rock unit in the FAD-Locan area."

Ruby Hill Drilling & Eldorado Dolomite - Company Website

Driving home the point, Agnico's LaRonde Mine would help the company to acquire the high-grade Lapa deposit in 2000, acquire Riddarhyttan Resources AB to expand into Finland, acquire Pinos Altos to expand into Mexico, acquire Cumberland Resources to expand into Nunavut (now known as Meadowbank) and ultimately bring Goldex, Kittila and Meadowbank into production over the next decade. And in hindsight, this was actually a more aggressive plan than what i-80 Gold envisions building in Nevada. This is because these were all stand-alone assets built from scratch in new jurisdictions, while i-80 Gold has the sunk costs in place already and only needs to refurbish two of its processing facilities and fund underground mine development.

I am not making this point and the comparison to Agnico Eagle to suggest that i-80 Gold's share price is going to 10x from current levels like Agnico Eagle did from its lows, and Agnico Eagle got some help from the gold price in the period. However, high-grade gold developers and producers in Tier-1 ranked jurisdictions that are making new discoveries is generally a great breeding ground for investment, with past examples of massive winners being American Barrick in the 1980's (chart shown below) with Goldstrike, Wesdome Mines with Eagle River, and Kiena, Karora with Beta Hunt and, of course, Kirkland Lake Gold (Macassa and Fosterville). So, while i-80 Gold may carry higher risk as a developer, the point here is:

a) share dilution is not unusual for developers and smaller producers, but the key is that resources, reserves, and production grow on a per share basis, and the company is making new high-grade discoveries. I would argue that i-80 Gold passes the test here with flying colors, with new discoveries including Tyche (high-grade gold), East Hilltop (mid-grade CRD), West Hilltop (mid-grade CRD), Upper Hilltop (bonanza grade CRD), Lower Hilltop (high-grade CRD), South Pacific Zone (high-grade gold), Ruby Deeps extensions (high-grade gold).

b) i-80 fits the mold of the largest winners in the sector with a high-grade resource base with new discoveries in a Tier-1 ranked jurisdiction with considerable exploration upside/industry-leading production growth.

American Barrick Share Price (1985-1993) - StockCharts.com

Recent Developments

Q3 Results

i-80 Gold released its Q3 results earlier this month, reporting ~4,600 ounces sold at an average realized gold price of $1,895/oz, up from ~4,300 ounces in the most recent quarter. The increased production translated to $13.2 million in revenue when combined with oxide material sold to a third party for ~$4.5 million, and the company ended the quarter with $38 million in cash. Granite Creek continues to make solid progress, with a record 592 tons mined in August which is well above the 420 ton per day mining rate in Q3, and over 1,000 meters of horizontal development completed in the quarter.

Meanwhile, the 6th level is now under development with positive grade reconciliation in the first two levels mined to date, and the company continues to target first stope ore in Q1 2024 at the South Pacific Zone [SPZ], with the South Pacific Zone having favorable ground conditions, 10.0+ gram per ton grades, and being primarily sulfide. And assuming a successful ramp-up to 700 ton per day mining rates by H2-24, we should see up 50,000+ ounces produced next year company-wide, improving to 75,000+ ounces in 2025 (full year of higher mining rates).

For some new to the story, the current production profile may seem insignificant, but as noted we should see a material increase in production, sales, and revenue next year as mining rates ramp up (higher proportion of sulfide material and higher mining rates means more batch shipments to Twin Creeks facility for toll-milling).

Hence, the company will be in a much better position as of next year ($90+ million in revenue) to reduce cash burn and will based on the imminent ramp up to higher production rates at Granite Creek, ultimately helping help to fund exploration, drilling and development across its properties, where $10.0 million was spent in Q3 ($5.0 million of this at Ruby Hill and FAD).

Plus, it's important to note that the final payment for the Ruby Hill deferred payments was made in the quarter ($50+ million had to be paid out to complete the deferred acquisition costs), which has been a further drag on cash this year but no further payments need to be made. Hence, while this has been a high-cost quarter with more share dilution than I anticipated, this will be a weight off of i-80 from a financial standpoint at the same time as production is increasing materially.

Granite Creek Portal & Gold Mineralization - Company Presentation

Finally, it's worth noting that drilling at Granite Creek, Cove, and Ruby Hill continues to yield impressive intercepts and I would expect a very attractive discovery cost, with 500+ gram meter intercepts at Cove which continue to confirm the geological model and grades (best hit of 29.3 meters at 18.9 grams per ton of gold), exceptional intercepts at the South Pacific Zone (19.7 meters at 15.5 grams per ton of gold, 5.7 meters at 26.1 grams per ton of gold, 10.6 meters at 14.1 grams per ton of gold), and a world-class intercept of 17.5 meters at 46.1 grams per ton gold-equivalent at the newly discovered sulfide zone at Ruby Hill: Tyche.

The exciting takeaway about the Tyche discovery is that i-80 noted that this was the first intercept of this style of mineralization on the property (Graveyard Flats stock was mostly untested by previous operators at depth), suggesting that there could be considerable upside here at grades in excess of current resource grades (Ruby Deeps).

New Tyche Zone (Ruby Hill) & Lowerjack - Company Website

While on the topic of drill results, some have expressed concern about whether Ruby Deeps is all that economic with it carrying an average grade of ~6.60 grams per ton of gold for ~1.59 million ounces (2021 TR). And while this might be on the lower end for underground mines in Nevada where mining costs can easily exceed $130/ton, it's important to note that i-80's drilling has consistently been well above the ~6.60 gram per ton mark with drill results including the following intercepts:

- 5.8 meters at 9.9 grams per ton of gold

- 10.7 meters at 12.3 grams per ton of gold

- 6.4 meters at 13.3 grams per ton of gold

- 14.2 meters at 14.4 grams per ton of gold

- 9.9 meters at 11.1 grams per ton of gold

- 51.2 meters at 9.0 grams per ton of gold

- 41.8 meters at 10.1 grams per ton of gold

- 8.1 meters at 12.2 grams per ton of gold

- 11.0 meters at 8.3 grams per ton of gold

- 15.8 meters at 9.0 grams per ton of gold

- 22.4 meters at 8.2 grams per ton of gold

- 33.2 meters at 19.8 grams per ton of gold

- 6.4 meters at 10.7 grams per ton of gold.

Hence, between bonanza grades to the east at Tyche (yet to be confirmed by additional intercepts), and significantly higher grades at Ruby Deeps, I think Ruby Deeps could easily see an upgrade to 8.0 - 8.5 grams per ton of gold, adding an additional ~$84 to ~$112 in rock value. And if we assume a rock value of ~$460/ton at Ruby Deeps and even assume more conservative costs of $210/ton (mining, processing, haulage, G&A combined), this would translate to ~54% margins for this material which is quite attractive and is certainly economic.

Plus, it's important to note that Ruby Deeps is the lowest-grade top-up material that will be fed to the autoclave as part of the Hub & Spoke plan given that Granite Creek and Cove carry grades closer to 11.0 grams per ton of gold. To summarize, when the top-up feed for a Hub & Spoke model has ~40% margins, I don't think there's any argument about whether this material is economic or not. And in the big picture, a blended grade of 10.0 grams per ton of gold at ~1.1 million tons per annum and 82% recoveries would translate to 260,000 ounces of gold per annum once the autoclave is refurbished and these mines are developed.

Cove Mineralization - Company Website

It's also important to note that there's production upside on top of this Hub & Spoke model with the 750 ton/day processing agreement at NGM's roaster facilities (Goldstrike, Gold Quarry) which would suit double-refractory ore from Cove, which could support an incremental 60,000+ ounces of attributable annual gold production depending on recoveries, grades, mining rates, and the cost of toll-milling.

Non-Binding Term Sheet For Joint Venture at Ruby Hill

i-80 Gold announced a non-binding term sheet for a joint venture at the Ruby Hill Property which has grown into its most exciting asset with high-grade polymetallic mineralization (Hilltop, FAD), high-grade skarn mineralization (Blackjack), high-grade gold mineralization (Ruby Deeps + Tyche), and low to mid-grade oxide mineralization at Mineral Point and the 426 Zone. The non-binding term sheet with an unnamed potential JV partner could result in the partner gaining a minority interest down the road (I would assume something along lines of 40% partner, 60% i-80), and the term sheet allows the partner exclusivity for 120 days (with an additional 60 day extension period) during which this potential partner will complete their own drill campaign (funded by them) to look at the asset's potential and metallurgy.

Overall, I see this as a positive, as this is exactly the direction I wanted to see the company go in given that even if i-80 may be able to fund these assets on its own with significant debt, the market has been less forgiving when it comes to companies not generating free cash flow and those without strong cash balances. That said, the key will be whether the unnamed party goes ahead with the deal and we'll have to see what the terms look like.

However, given the track record of i-80 Gold's CEO Ewan Downie in negotiating deals in the past, I think investors can be comfortable that this will be a favorable deal and in the best interest of shareholders. With Ewan Downie owning over 6.0+ million shares, he's certainly aligned with shareholders in regards to generating shareholder value and ultimately seeing i-80 valued appropriately - not at the depressed levels it trades at today. In fact, we've seen ~$90,000 worth of share purchases this week alone from EVP of Business & Corporate Development Matt Gollat, and Ewan Downie.

i-80 Gold Insider Buying - SEDI Insider Filings

Finally, it's important to note that while no money has been received up front, the company has an accordion option on its gold pre-pay agreement at its disposal and cash available, which should buy it time to get through the exclusivity period with minimal share dilution when combined with a ramp up in cash flow at Granite Creek starting in Q1 2024. And as for what this means for the project medium-term (assuming the party likes what they see), this means an accelerated path to a Feasibility Study (better-financed), added expertise, and ultimately a quicker path to production.

These are all positives and cash flow from Granite Creek (70,000+ ounces in 2025) and the polymetallic potential should help i-80 to achieve its ultimate goal of becoming the second largest gold producer in Nevada with this aiding in funding its planned autoclave refurbishment ($260+ million).

Valuation

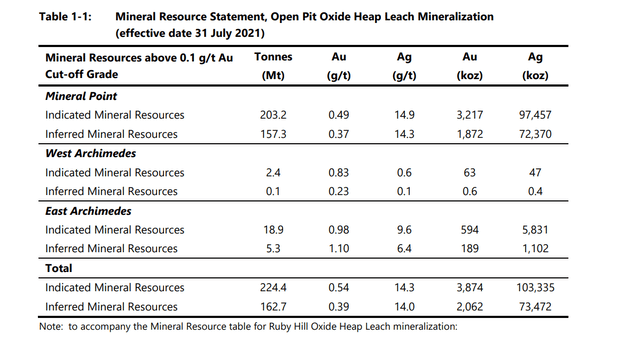

Based on an estimated ~385 million fully diluted shares and a share price of US$1.27, i-80 Gold trades at a market cap of ~$490 million despite the fact that it has a portfolio capable of producing 400,000+ gold-equivalent ounces [GEOs] per annum even ignoring optionality like the lower-grade Mineral Point (potential for ~180,000 ounces per annum assuming 50,000 tons per day at 0.50 grams per ton of gold and a 68% recovery rate.

In fact, the current market cap is supported by Granite Creek alone at this price (one of its three assets), with an estimated net asset value of $560 million. And given that Ruby Hill's NPV (8%) dwarfs Granite Creek even when adjusting for a potential 55/45 or 60/40 ownership structure (assumes a successful joint-venture agreement), and it has another high-grade deposit with a ~$300 million NPV (8%) in Cove, I see IAUX trading at a massive discount to fair value here.

Mineral Point Resources - 2021 Ruby Hill TR

Using what I believe to be a fair multiple of 1.0x P/NAV using 8% discount rates (5% for Granite Creek) given that i-80 Gold is already producing, has brownfields sites with over $1.2 billion in sunk costs (autoclave, floatation circuit, CIL plant, heap leach pads, maintenance shops, assay labs), and an estimated net asset value of ~$1.49 billion (value of assets [-] G&A and autoclave refurbishment costs), I see a fair value for the stock of US$3.70 [190% upside to fair value).

This makes i-80 Gold the most undervalued name among the sub $800 million market cap names I track, and I would argue that there's room to grow its net asset value given that it's been focused primarily on infill drilling at sites other than Ruby Hill to ensure it's careful with its cash balance until a larger and more permanent financing solution is in place (potential joint-venture proceeds, lower-cost bank debt, ramping up cash flow from Granite Creek beginning in Q2-24).

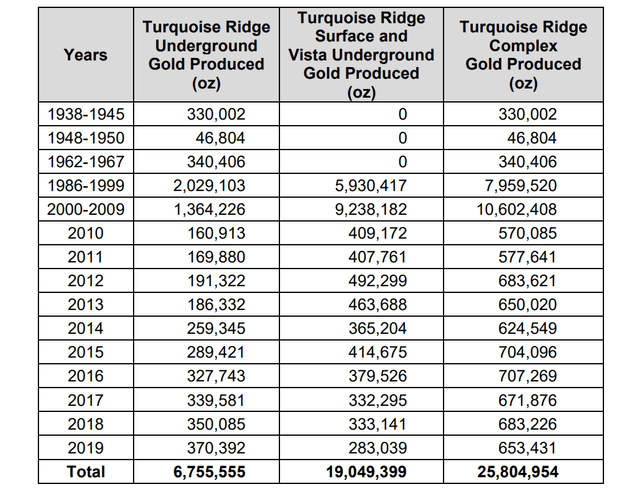

Turquoise Ridge Historical Production (Mine Northeast of Granite Creek) - 2020 TR

Expanding on the latter point, i-80 looks to have considerable exploration upside to the north at the South Pacific Zone and if the company can even delineate a fraction of what's been uncovered to the northeast at the TRUG Mine (produced over 7.0 million ounces to date with 11.0+ million ounces of gold reserves), this asset could grow to 2.0+ million ounces of high-grade resources (excludes resources at Granite Creek Open Pit). Meanwhile, minimal drilling has been completed at FAD which is home to a nearly 4.0 million ton resource base at industry-leading grades, and the company is just coming off a major discovery at the Tyche Zone, and has yet to follow up on the high-grade 428 Zone (300 meters of southern portion of Ruby Deeps Zone).

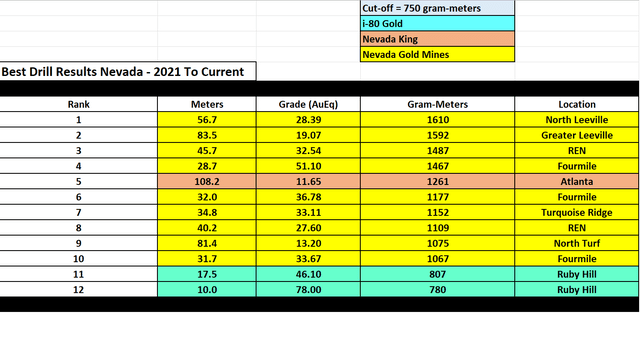

These are not average discoveries, with intercepts that include 10.7 meters at 12.3 grams per ton of gold (428) and 17.5 meters at 45.4 grams per ton of gold and 50.2 grams per ton of silver (Tyche). In fact, the hit at Tyche was a top-12 intercept drilled in Nevada in the past three years, and when we compare i-80's more modest drilling budget to that of Nevada Gold Mines (joint-venture with two largest gold producers), the fact they've logged two of the top 12 hits (gram-meter basis) is even more impressive.

The above statistics for Turquoise Ridge Underground [TRUG] are based on solely Turquoise Ridge and not the mining complex as a whole, with the total mining complex having produced over 26 million ounces of gold to date, giving i-80 the right address at Granite Creek next to a very productive and high-grade asset.

Top Drill Results Nevada by Deposit/Company (2021-Current) - Company Filings, Author's Chart

Finally, there's further exploration upside that could potentially include a porphyry at depth (all ingredients in place including distal zinc-lead rich skarns, CRD mineralization), the possibility of additional CRD deposits in the untested Hilltop Corridor or further south near FAD (missed by old-timers due to being under alluvial cover) and upside at its Cove Project in the largely untested area between the CSD and Gap deposits below the Cove Pit.

Hence, I don't think it's unreasonable to believe that i-80 could ultimately proven up 10+ million ounces of gold-equivalent resources (FAD, Blackjack, Hilltop Zones, Ruby Deeps, Cove, Granite Creek), leaving the stock trading at ~$50/oz on resources vs. other high-grade Tier-1 producers currently trading at over $300/oz on resources/reserves like Wesdome and pointing to where i-80 could trade if it executes successfully later this decade.

So, how does the stock achieve a re-rating?

Despite incredible results, all eyes have been on a financing solution given the company's ambitious plans and its cash balance (~$38 million, but we finally have some progress here. This is because i-80 recently announced a non-binding term sheet for a joint venture at the Ruby Hill Property with an unnamed party that could lead to a nice cash infusion and ultimately shared development at this asset that continues to churn out new discoveries. The result is that it should allow i-80 to reduce its cash burn and give the market confidence that we’ve seen the worst of the share dilution and help to put a floor under the stock.

Simultaneously, i-80 Gold is being treated like a pre-revenue developer today, and understandably so as its production is less than 25,000 ounces per annum. However, this will change next year as it ramps up production to 50,000+ ounces and ~75,000 ounces in 2025 assuming a full year of mining rates at 700+ tons per day from Granite Creek. Hence, I think we’re near a turning point here for sentiment, and the valuation has certainly stacked the odds in one's favor. So, if the goal is to buy when there’s blood in the streets, it’s hard to argue that there’s a more attractive reward/risk opportunity among juniors in the precious metals sector today, hence why I recently added to my position at US$1.26.

Finally, there's no shortage of catalysts over the next twelve months that include:

- Preliminary Economic Assessment at Ruby Deeps

- maiden reserve at Granite Creek and maiden resource at South Pacific Zone

- maiden resource at Blackjack, FAD, Hilltop

- backlog of pending results from Tyche, FAD, and Hilltop zones

- new drilling results from the prospective Hilltop Corridor

So, what's the opportunity here?

If i-80 can execute successfully (which it's done a great job of to date regardless of where its share price sits with multiple new discoveries and its first mine online and meeting/beating expected grades), i-80 Gold could become a ~400,000 ounce producer on a gold-equivalent basis (~250,000 ounce Gold Hub & Spoke Model, ~100,000+ ounce polymetallic opportunity, 60,000+ ounces sent to roasters).

In my view, a producer of this size that's a top-10 exploration story (consistently making new discoveries) in a top-3 ranked mining jurisdiction could command a valuation of $2.8+ billion (~$490 million today), and much higher in a stronger gold price environment. However, the key to driving the share price higher will be keeping share dilution to a minimum. That said, while financing was more of a worry previously, the recent non-binding agreement is a nice vote of confidence and a step towards helping to fund its ambitious goals, and a positive development for the investment thesis overall.

Risks

The major risks here are timing to secure permits, the ability to finance development of its assets, and the fact that i-80 does not have reserves in place yet. On the first point, permitting can take time, but the company has toll-milling agreements in place and is permitted at Granite Creek which has allowed it to graduate to producer status while it awaits full permits at Ruby Hill and Cove.

On the second point, there are multiple financing options available (joint-venture at Ruby Hill, gold pre-pays, debt, equity), but the key will be limiting share dilution and once Feasibility studies are in place, lower-cost bank debt will be an option.

Finally, i-80 Gold may not have reserves today, but it has an abundance of resources and is completing the work to upgrade ounces across all categories. Plus, these are some of the highest-grade ounces globally at brownfields sites. Hence, I do not see declaring reserves as a risk, but i-80 is obviously a riskier bet than a fully permitted producer with a large reserve base that already has all boxes checked.

That said, I see these risks as more than priced into the stock with it trading at less than 0.32x P/NAV (8% development assets, 5% Granite Creek).

Summary

i-80 Gold is one of the worst-performing juniors year-to-date with a [-] 50% return, and while it was a sanctuary from the sector-wide selling pressure among developers last year due to its impressive Hilltop discovery, its outperformance has come to a harsh end this year.

However, the fundamentals have not changed and they've arguably improved with a surprise bonanza grade hit from Tyche (new discovery), the company able to use high-priced currency (share priced) to consolidate its land package at Ruby Hill with Paycore, and the company just months away from significantly ramping up production at Granite Creek. And, while the market may be ignoring these positive developments today as several juniors continue to trade devoid of fundamentals, I am happy to be patient and focus on the big picture and see this as a rare buying opportunity, and I would be shocked if i-80 Gold Corp. stock remained at these depressed levels much longer.