Investment Thesis

When investing in gold miners, it's more likely that they will burn a hole in your account than be the next big thing. Generally, we are not too fond of companies that are correlated to the price of commodities. However, Kirkland Lake Gold Ltd. (KL) is one of the few exceptions in the industry. We believe that its proven track record of operating efficiently combined with a favorable environment for gold will act as tailwinds for the stock price.

What We Like About Kirkland

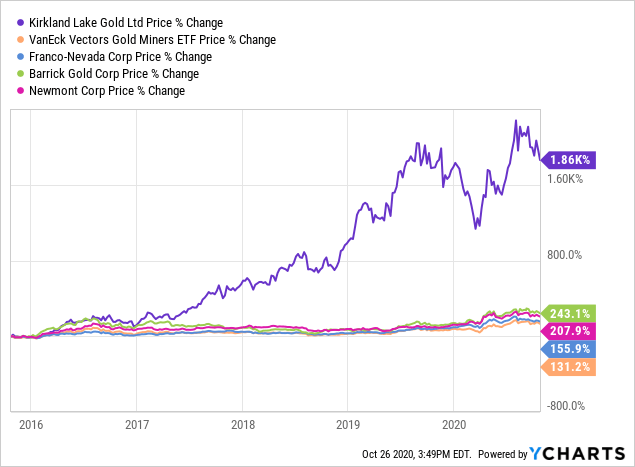

Kirkland is the most well-run mining company on the market. This has been reflected in the company's stock price in the last 5 years. The issue some investors might have with mining companies is that their value is dependent on the price of the commodity they're digging for. Therefore, when gold prices hit a slump, the miners follow. However, Kirkland seems to be an exception. Despite a stagnant gold market between 2016 and the end of 2018, Kirkland's stock price saw an increase of over 1000%.

This growth has been driven by the company's improving fundamentals. Over the years, Kirkland has reduced its all-in sustaining costs per ounce of gold while simultaneously increasing its production, therefore, minimizing the impact of the commodity price. Unsurprisingly, revenue and earnings grew consistently at an explosive pace year-over-year.

The company achieved this while maintaining a clean balance sheet. In a recent announcement, Kirkland mentioned that it had increased its cash position to over $848 million with no debt which gives it plenty of ammunition to explore new potential mines and expand its operations. In addition, the company continues to buy back shares and increase dividends thanks to its strong free cash flow.

Dividend Growth: KL started paying dividends in 2017 at $0.008/share quarterly, according to dividendchannel.com. The company has consistently been increasing its quarterly dividend since then and has one of the fastest dividend growth rates in the industry. It was recently announced that starting in Q4 2020, KL will pay out $0.1875/share quarterly. This represents a 3-year CAGR of about 146% and a 50% increase from its previous dividend rate.

Kirkland currently operates three flagship mines: Macassa, Detour Lake, Fosterville. Both Macassa and Fosterville are considered to be high-grade mines with reserves at 22.1 and 21.8 grams of gold per tonne, respectively. Detour Lake, on the other hand, is considered a low-grade mine with reserves at only 0.97 grams of gold per tonne. What this means is that it is much more expensive to mine the gold at Detour than both Fosterville and Macassa. However, what the Detour mine lacks in quality makes up for it in quantity with a massive reserve of 14.8 million ounces compared to the 2 million at the other two mines. This gives Detour an estimated life of 22 years as well as the ability to generate strong free cash flow.

In addition to the three flagship mines, Kirkland operates a few smaller mines such as the Holt Complex and Robin's Hill with reserves of 700 thousand and 218 thousand ounces, respectively. In total, all their mines combined have 20.5 million ounces of proven and probable reserves.

We like the fact that Kirkland only operates in Canada and Australia. Both countries are very safe and friendly to miners therefore removing risks such as nationalization of industry or violent mine site attacks associated with high-risk countries.

Industry Analysis

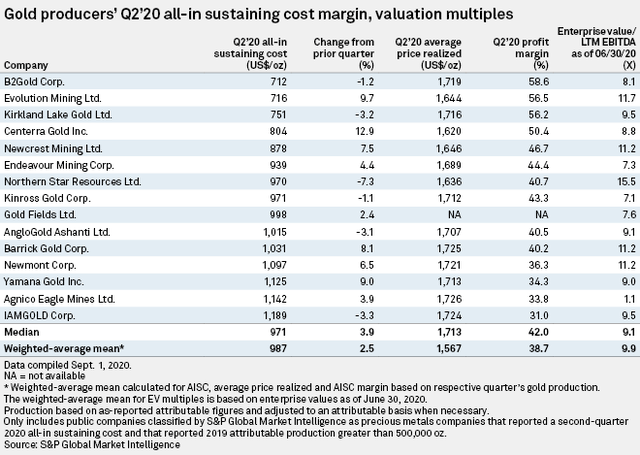

Below you will find a Q2 2020 industry comparison for the top gold miners. According to this chart, KL had the third lowest AISC/oz and the third highest profit margin.

Source: spglobal.com

In terms of gross profit for the last 12 months, Kirkland is ahead of the other miners. You can see this in the image below. Notable companies that are not mentioned in the image below are Barrick Gold Corporation (GOLD), Newmont Corporation (NEM), and Franco-Nevada Corporation (FNV), coming in at 33.6% 48.8%, and 83.4% respectively. Franco-Nevada is a gold royalty rather than a mining company however, so it makes sense that their gross profit margins are very high.

Source: Finbox

KL has also been able to consistently increase its gross profit margin, having a 5y CAGR of 66.3% as you can see below.

Source: Finbox

Next, is Kirkland Lake Gold's last 12 months' buyback yield. With a buyback yield of 3.2%, the company has been buying back its shares more than other mining companies. According to Finbox, other notable stocks such as Barrick Gold, Newmont Corporation, and Franco-Nevada Corporation come in at 0%, 1.7%, and -1%, respectively. More comparisons can be seen in the image below.

Source: Finbox

Kirkland is an industry leader with one of the lowest AISC/oz, high gross and net profit margins, and high buyback yield. This, along with consistent revenue, earnings, and FCF growth, has allowed Kirkland Lake to outperform the industry over the long run.

Data by YCharts

Data by YCharts

Growth Catalysts

The first and most obvious catalyst for growth is the price of gold. The commodity has been on a tear this year having hit new all-time highs at over $2000 per ounce. This has been fueled by investors looking to gold as a safe haven asset during the pandemic and because of the Federal Reserve's strategy of printing massive amounts of money in order to prop up asset prices. Many investors fear that this policy will lead to high inflation because it devalues the US dollar.

Regardless of whether this scenario of hyperinflation comes to fruition or not, betting on gold in one form or another for the long term is still a good idea. Historically speaking, the price of gold has seen a long-term increase as the value of fiat currencies have continued to decline. Therefore, even if inflation remains near 2%, the gold price will eventually continue to rise. A common criticism of investing in gold is that it doesn't produce any income because it simply just sits in a vault. Thus, Kirkland presents itself as an attractive alternative thanks to its increasing dividend and share buyback program.

Kirkland is very well funded to engage in exploration which will lead to increased reserves and the life of its mines. In addition to the 20.5 million ounces that are proven or probable, there are approximately 11 million ounces that have been measured and indicated (resources that can be estimated with sufficient confidence) as well as 6.5 million ounces that have been inferred (estimated using limited geological evidence and sampling information).

Its continued exploration has led to some additional finds with exceptionally high grades of gold being intersected at the Macassa mine. The grades of these discoveries range between 35 g/t to 253 g/t. Although not enough data has been collected yet to make any estimates, it is a very promising sign that the Macassa mine's life can still be extended.

We believe that Kirkland's relatively poor performance so far in 2020 has given investors an opportunity to get in the stock at a favorable moment. Given the current market conditions, the stock is trading below its intrinsic value which should act as a catalyst for value-oriented investors.

Valuation

We estimate the fair value of Kirkland to be around $50/share.

Given that the company's free cash flow is mainly determined by the price of gold and production, we ran a multiple regression to determine a "normalized FCFE" for our valuation model. Using quarterly data, we set the average quarterly price of gold and gold produced as the independent variables. Free cash flow to equity was set as the dependent variable. The multiple regression formula that was returned is as follows:

Normalized FCFE = 126194.9151(Price of Gold) + 447.6096374(Production in oz) - 179922788.9

= 126194.9151(1890) + 447.6096374(1000218) - 179922788.9

= $506,292,816.86

Note: 1,000,218 is the full-year production guidance.

Now that we have our normalized FCFE, we will use a single stage DCF with the following inputs:

| Cost of Equity | 5.63% |

| Growth Rate | 2.00% |

| Price of Gold | 1,890.00 |

| Normalized Beta | 0.8 |

| ERP | 6.00% |

| Risk-Free Rate | 0.83% |

| Shares Outstanding (Diluted) | 277,265,000 |

Value of Kirkland = $506,292,816.86 / (0.0563 - 0.02)

= $50.30/share

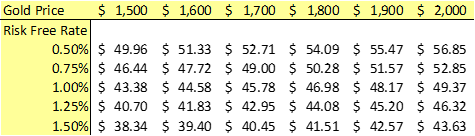

However, given that both the price of gold and the risk-free rate are constantly changing, we prepared the following chart to demonstrate potential valuations under different conditions assuming the company's 2020 production guidance of 1,000,812 ounces:

Source: Author

We believe this valuation is conservative because the company is most likely going to substantially increase its production capabilities going forward in addition to reducing costs which would yield a much higher FCFE.

Risks

Gold price: Although Kirkland is fundamentally sound, there are some risks that are worth mentioning. The most obvious risk is the price of gold. Unlike industries that have predictable demand such as utilities, operational results for gold miners can vary drastically year-over-year depending on the price of gold. Sure, gold does tend to go up over time, and in this low interest rate environment it can keep rising. Nonetheless, it's an extra variable you have to take into consideration if buying this stock.

Exploration: Mining companies are always exploring in order to find more gold because they have limited reserves. If Kirkland is unsuccessful in future exploration attempts, they may start to run low on reserves unless they spend even more on exploration or mergers.

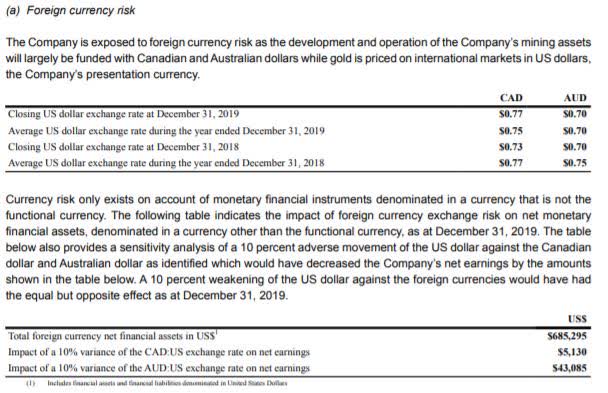

Currency risk: This snippet below from KL's annual report outlines the foreign currency risk associated with the company as they deal with AUD and CAD.

Essentially, KL benefits from a stronger USD in relation to AUD and CAD, with the AUD being more sensitive. Kirkland Lake has no outstanding options, forward or future contracts to manage its price-related exposures, according to its 2019 annual report, thereby increasing this risk.

Essentially, KL benefits from a stronger USD in relation to AUD and CAD, with the AUD being more sensitive. Kirkland Lake has no outstanding options, forward or future contracts to manage its price-related exposures, according to its 2019 annual report, thereby increasing this risk.

Mining Danger: Mining is a dangerous business that can see serious injuries or deaths from time to time. Deaths can temporarily halt operations and cause sharp temporary drops in share price. A recent example of this is with Lundin Mining Corporation (OTCPK:LUNMF). On September 25, Lundin Mining suffered a fatality which caused them to halt some operations. The next day that the stock traded (September 28), it gapped down 51 cents to $5.24/share from $5.75 the previous day, a 9% drop.

Final Thoughts

If you are bullish on the price of gold then betting on Kirkland is one of the best ways to go about it. The company has proven that they can operate efficiently by lowering costs while boosting production. Their 2020 stock price slump has simply provided investors with an opportunity to get in at a discount to intrinsic value should the market conditions remain favorable for gold. Fundamentally, Kirkland remains a clear leader in the industry and should continue leading in the years to come.

Disclosure: I am/we are long KL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.