RE:RE:Excelsior Valuation ScenariosThank you. Valuation is a little like throwing a pair of dirty underwear at a wall to see if they stick...

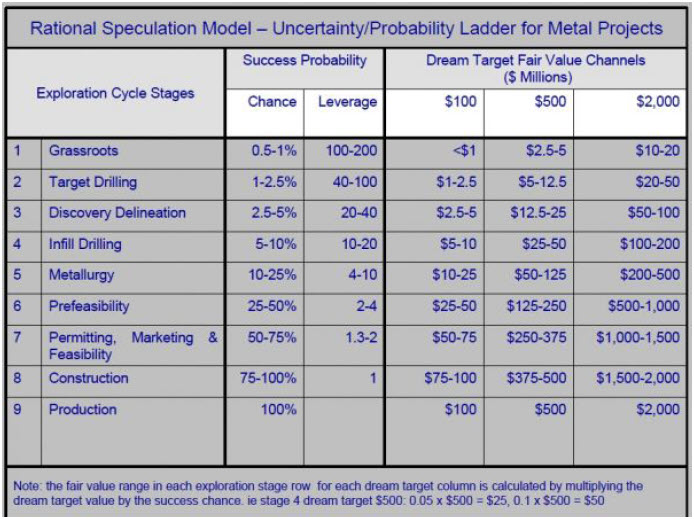

Stage Derisking is related to the amount of risk present at the various stages of mine development. The percentages you note are the discount to full NPV, assuming 100% of NPV valuation is achieved at the point that production is humming along at 100% of the capacity noted in the Feasibility Study.

The waters get a little murky with respect to Excelsior for a couple of reasons:

1. In-Situ Recovery (ISR) is rare in copper mining and the Gunnison Copper Project is the largest ISR operation ever undertaken in the copper mining industry.

2. Excelsior is using a staged approach to work up to the 125MLb/year capacity. Stage 1 was slated to be 25MLb/year, Stage 2 was 75MLb/year and Stage 3 was to be 125MLb/year. The company has indicated a preference to skip directly from Stage 1 to Stage 3, but stated that copper pricing would have to be favorable for this to work.

They elected a staged approach to minimize the degree of financial risk, as ISR at the levels proposed for Gunnison was charting new territory.

I am loosely basing the stage derisking factors on the following chart from Critical Investor along with a lot of windage and subjectivity.

The very bottom line of each of the scenarios is valuation based on annualized "free cash-flows", i.e., earnings; with a P/E factor of 6X, 8X, ..., 12X of earnings.

I hope this helps.

PG