Earlier this week Citigroup made a huge call on the copper price (CPER) for 2021 and 2022, forecasting that it would rise to $10,000 per metric ton "sooner rather than later," adding a "bull case" call for $12,000 per ton copper.

I think many people fail to appreciate the significance of these headlines simply because the forecasts are stated in terms of the price per metric ton rather than the more widely known and used simple price per pound of copper.

A metric ton is 2204.62 pounds, so dividing Citi's forecast numbers by this value gives us their copper price call in terms of pounds: To be precise, the base case is $4.54 per pound of copper, and the bull case is $5.44 per pound. Using round numbers as Citi does, we can call this about $4.50 to $5.50 per pound of copper.

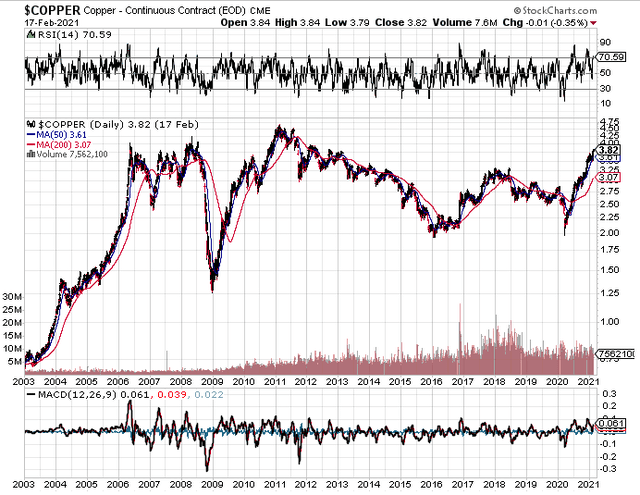

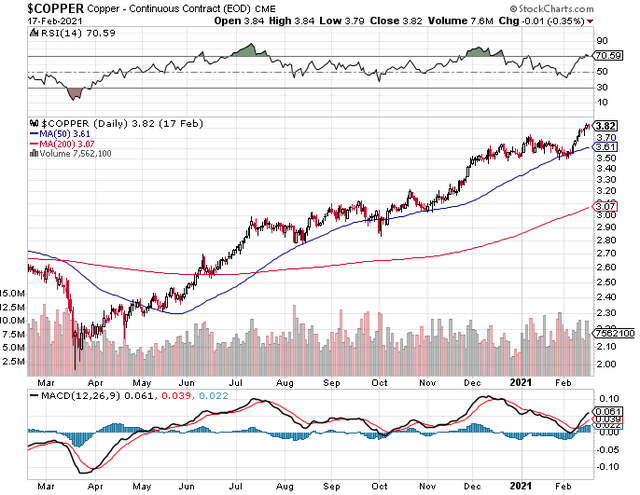

This is a very big deal. The all-time high copper price in early 2011 was in the $4.50-$4.75 / pound range. Before that, the commodity bull market high in 2006-2008 was about $4.00/pound, with a very brief spike to $4.25:

The very fact that Citi would even mention a copper price as high as $5.44, as a "bull case," has great significance. Copper prices over $5.00 per pound are completely uncharted territory in market history.

As is well known in financial markets, "nothing is more bullish than a new all-time high." At that level, there's no more natural level of price resistance to serve as a potential bearish selling point. In all-time high territory, a price has room to run for a while.

Citigroup is one of the biggest banking conglomerates in the world. It's not a commodity market perma-bull that focuses only on metals and miners. When an entity like Citi makes a call on copper that's this extremely bullish, it should grab people's attention.

Groups like Citi are typically cautious and conservative when making price predictions such as these. So if even they are saying $4.50 to $5.50 / pound copper this year or next year, I argue it's actually more likely the copper price will run as high as $5.00 to $6.00 per pound in 2021 and 2022.

The Fundamental Bull Thesis for Copper

The fundamental basis behind the bullish case for copper in the 2020s is fairly well known by now, but it's always useful to review the basic points:

1. General inflationary trends. Global central bank monetary policies are deliberately designed to steadily devalue major global currencies, by means of low, zero, and negative interest rate policy. Now added to this is increased government stimulus spending to restore the global economy to recover from the COVID-19 crisis.

2. Increased global infrastructure spending is particularly bullish for copper and base metals, massive amounts of which will be needed to build these large infrastructure projects.

3. Copper and base metals are essential to numerous new technologies that are in the process of rapid growth and development that will only intensify over the course of this decade. All electrical power requires copper wire to conduct the electricity. Electric vehicles get the most attention recently in this respect, but the growing global demand for electricity goes far beyond just EVs.

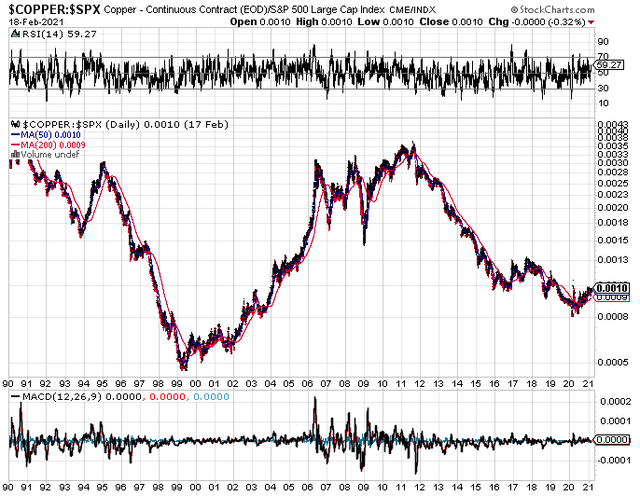

Copper vs. the S&P 500: Long-Term Bullish Cycle Trend Change Favors Copper

As I wrote in a previous article, base metal prices have underperformed the S&P 500 (SPY) for the past decade, but it appears that this trend is changing right now in the long-term cycle that has alternated decade by decade in recent times. Here is the chart of the copper price to S&P 500 ratio over the past 30 years:

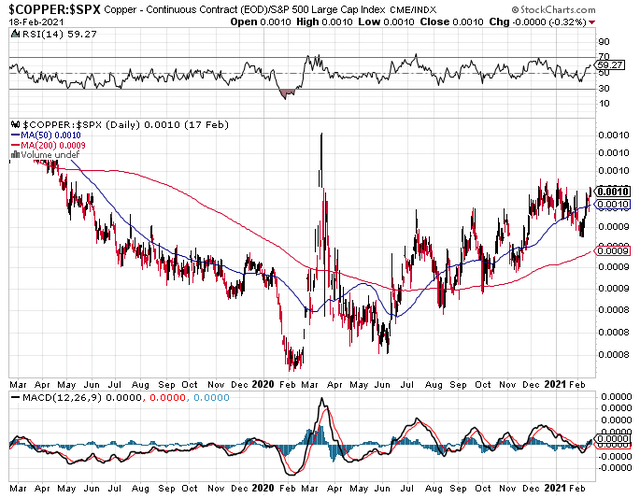

It's also informative to focus on a close-up chart of the past couple of years:

It appears that the February 2020 low may have been the long-term cycle bottom for this ratio, and we are now beginning a new long-term cycle where copper will outperform the broader stock market. It's interesting that the low occurred shortly before the March 2020 crash itself. Of course in March 2020 everything crashed, including both the stock market and the copper price, but copper found a bottom and strong price support around $2.09-$2.10 / pound, quickly bouncing up from $2.00/pound within intraday trading:

The market simply saw so much value and bullish long-term potential for the copper price, that market participants would not allow the copper price to crash below $2.00 per pound. There were just too many eager value buyers at that price, even in the most uncertain moments at the onset of the COVID-19 crisis in March 2020.

Conclusions

As I wrote in my previous article, it's more efficient to invest in copper, zinc, and nickel miner stocks than in the base metals themselves:

There are generic ETFs and funds for this purpose (XME) (PICK) (COPX), which can be useful to avoid single-stock risk (FCX) (TECK), which is a significant issue in the volatile mining sector, where there are numerous risks (social, political, environmental) that go far beyond the simple issue of the amount of mineral resources and the prices of the metals themselves.

In many cases junior copper, zinc, and nickel mine developer stocks may offer the greatest potential value right now. This requires careful research to make the right stock selection in this sector. When it's done right, such stocks may offer extraordinary value to your portfolio in 2021 and in the years and decade ahead.