We could have $20,000 nickel prices and still, our SP most likely

wouldn't budge much.

Compare historical nickel prices vs NCP sp historical prices.

In 2014 nickel spot was high

$18,000's ncp traded $0.70+ cents. Stockhouse 10 yr chart https://stockhouse.com/companies/quote?symbol=t.ncp Historical nickel prices 1 moth scale ( 2000 - 2024 ) https://tradingeconomics.com/commodity/nickel -----------------------------------------------------------------------------

NCP's Valuation Downward decline since late 2015

Excessive shares out vs polishing / unpolishing Wellgreen.

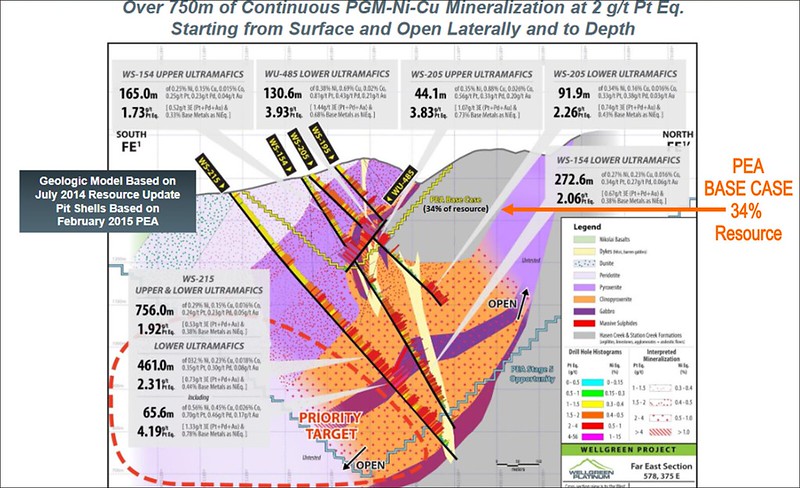

Hole A + B did intersect - peridotites.

These sort of holes ( big stepouts ) broaden the deposit size.

That is... if junior factors the tonnage.

= No assays = no shareholder value.

= How much time spent on Holes A, B and how much monies even geophysics.

You should be asking, How is it Pit 1B only hosts 30.8 million tonnes

3 million mineralized vs 27.8 waste ( lol )

Versus..... yellow pit depth (

2023 runs 900m center depth )

Second image

https://live.staticflickr.com/65535/53655748970_73742cdb34_b.jpg A constraint of, 500m x 500m x 500m x 3 ore weight

= 600,000,000 million ore tonnes

2023 pfs image above shows pit depth of 900+m

While 2023 pfs chart reveals only 30.8 million tonnes in this zone.

WOW

I find it quite interesting the 2023 waste tonnage

- 594.6 million tonnes

= pfs included costs to mine waste

2015's resource size was based on, historical drills.

Majority - inside mine, under mine, stepouts aside of mine.

2023 pfs's pit shell shifted another 200m south of mine.

= more peridotite + more dunite

= with unsuited extraction

Even this 2023 pfs subgrade image does not recognize any high grade

Coloration = peridotite.

versus Johnson's original image and assay grades along drill core tell real story.

It's like....

Sulphides, Gabbs, Cilinopyroxine all removed.

Replaced by peridotite and an extraction that can't handle crystalines.

https://live.staticflickr.com/65535/53655748970_73742cdb34_b.jpg vs

Johnson's assayed image

Even the hasen creek geology increases in tonnage

All around the underground mine.

No plats removed from magnetite ( 2015 / 2016 press said they'd work on it )

No exotics

No iron credit

And these are just a few examples why i press upon,

= redo 2023 pfs

Or separate small shareholders from large.

Buyout small shareholders.

2013 reassaying + new drills

= 2015 resource.

Not this 2023 pitshell, peridotite replacement, pit shift, unsuited extraction.

Wellgreen is a superb project.

Amazing deposit.

Well, back in 2015 it was.

Cheers....