Sat's Good read Copper

Curiously, copper is often overlooked when tallying up the metals required for the transition to clean energy and electrification. There is no shift from fossil fuels to green energy without copper, which has no substitutes for its uses in EVs wind and solar energy, and 5G.

Copper’s widespread use in construction wiring & piping, and electrical transmission lines, make it a key metal for civil infrastructure renewal.

The continued move towards electric vehicles is a huge copper driver. In EVs, copper is a major component used in the electric motor, batteries, inverters, wiring and in charging stations. Electrification includes not only cars, but trucks, trains, delivery vans, construction equipment and two-wheeled vehicles like e-bikes and scooters.

The latest use for copper is in renewable energy, particularly in photovoltaic cells used for solar power, and wind turbines. The base metal is also a key component of the global 5G buildout. Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

The big question is, will there be enough copper for future electrification needs, globally? And remember, in addition to electrification, copper will still be required for all the standard uses, including copper wiring used in construction and telecommunications, copper piping, and copper needed for the core components of airplanes, trains, cars, trucks and boats.

The short answer is no, not without a massive acceleration of copper production worldwide.

A recent research report from Jefferies Research LLC concluded: “The copper market is heading into a multiyear period of deficits and high demand from deployment of renewable energy and electric vehicles. The secular demand driver in copper is electric passenger vehicles, as the average EV is about four times as copper intensive as the average ICE automobile. Renewable power systems are at least five times more copper intensive than conventional power.”

Wood Mackenzie is equally bullish on copper demand for the purpose of electrification and decarbonization. Via Reuters, the metals consultancy estimates that copper demand from renewables, energy storage, electricity transmission and electric vehicles/ charging infrastructure will more than double from to 8.6 million tonnes in 2025, from 2020 levels, under a scenario that limits global warming to 2 degrees C.

The firm forecasts that 15.1Mt will be consumed in energy transition applications by 2030.

Getting more granular, according to BloombergNEF, there are currently about 7 million electric vehicles in the world today. By 2040, they estimate around 30% of the world’s passenger cars will be electric. To me that’s a conservative and reasonable number. It means 500 million EVs will be on the road in 20 years, out of a total vehicle fleet of 1.6 billion. If each EV contains 85 kg of copper, that is 42,500,000,000 kg, or 42,500,000 tonnes of copper, roughly twice the current volume of copper produced by all of the world’s copper mines.

Just so we’re clear — in 20 years, BloombergNEF says copper miners need to double the amount of global copper production, just to meet the demand for a 30% penetration rate of electric vehicles. That means an extra million tonnes a year, over and above what we mine now, every year for the next 20 years!

The world’s copper miners need to discover the equivalent of two Kamoas (referring to Invanhoe Mines’ giant Kamoa-Kakula copper deposit in the DRC which just reached commercial production) at 500,000t, each and every year, while keeping current production at 20Mt.

Remember we still need to cover all the copper demanded by electrical, construction, power generation, charging stations, renewable energy, 5G, high-speed rail, etc., plus infrastructure maintenance/ buildout of new infrastructure.

That might be another 5-7Mt. So not only is there a 20Mt increase in copper usage required for a 30% EV penetration, but another (we estimate) 5-7Mt increase to meet demand for all of copper’s other applications. To keep up, the industry will need to find an additional two to three Kamoas a year, each producing 500,000t, for the next 20 years!

As we have previously reported, over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place. It’s going to be hard enough to maintain the current 20Mt per year, let alone add so much more production.

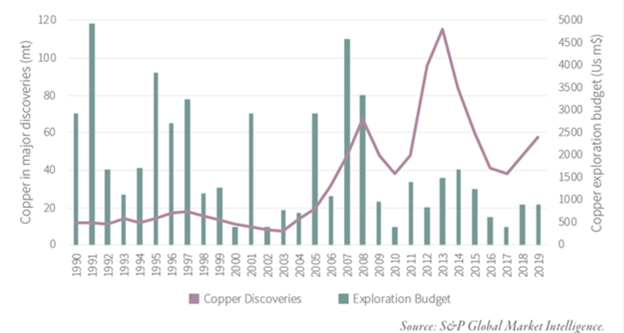

Copper discoveries and capital expenditures

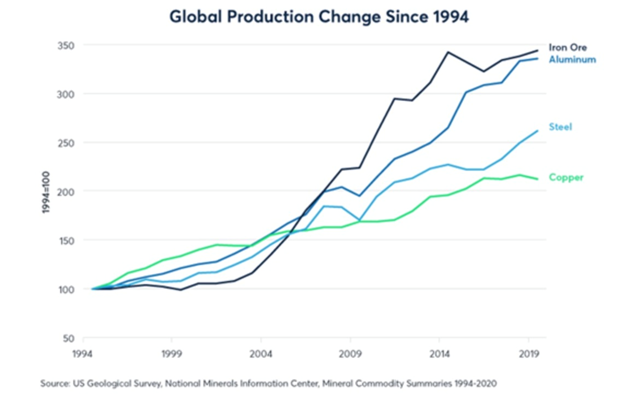

Copper discoveries and capital expenditures  Mined copper supply has grown more slowly than other metals over the past quarter-century.

Mined copper supply has grown more slowly than other metals over the past quarter-century. Where is this new, and replacement, supply going to come from? When copper becomes so rare it hits $10,000 a tonne, what’s going to happen to 30% EV penetration? High-speed rail? 5G? We suggest that without new copper deposits, these well-intentioned plans are in jeopardy.

But copper bulls like me haven’t had to wait that long, to see a price reaction.

New chapters of the copper success story that started in 2020 are being written as the red metal basks in the glory of global climate pledges, and an economic recovery from the pandemic underpinned by strengthened industrial demand.

From one year ago, copper is up more than 150%!

Spot copper price since 2000. Source: Kitco

Spot copper price since 2000. Source: Kitco The main factors driving prices higher are increased Chinese orders amid a strong manufacturing sector, post-pandemic; a return to growth following a disastrous 2020; trillions in promised green and blacktop infrastructure spending particularly in the US, Europe, and China; and supply disruptions resulting from covid-19-related mine closures.

In China, which consumes half of the world’s copper, the government has been trying to dampen rising commodity prices by releasing (or are they just threatening to release?) portions of its stockpiles.

So far it hasn’t worked.

Despite China’s National Food & Strategic Reserves Administration announcing that it intends to sell 20,000 tonnes of copper in the first week of July, copper futures on Wednesday jumped 2.6% from Tuesday’s settlement price, touching $4.34 a pound in mid-day trading.

According to Citigroup, via Bloomberg, Beijing’s measures “target managing expectations and deterring speculators rather than solving supply/demand imbalances.”

“We do not think the rally is over,” the bank said in a note.

Glencore’s CEO Ivan Glasenberg is one of many calling for increased copper production amid expected supply shortages.

The multi-billionaire mining tycoon told the Qatar Economic Forum this week that the copper supply needs to double by 2050.

“Today, the world consumes 30 million tonnes of copper per year and by the year 2050, following this trajectory, we’ve got to produce 60 million tonnes of copper per year,” he said.

“If you look at the historical past 10 years, we’ve only added 500,000 tonnes per year … Do we have the projects? I don’t think so. I think it will be extremely difficult.”

Conclusion

Lithium, graphite, nickel and copper are the building blocks of the new green economy. Politicians can talk about grand designs for carbon reduction in their economies, and business leaders can announce plans for battery factories and new electric vehicle models, but without a steady, reliable supply of raw materials, nothing happens.

The supply chain for batteries, wind turbines, solar panels, electric motors, transmission lines, 5G — everything that is needed for a green economy— starts with metals and mining. Demand for lithium, nickel and graphite on the battery side and copper on the energy side is expected to rise rapidly.

This is old news to us at AOTH. We’ve been banging the drums of electrification and decarbonization since Obama first began setting government funding aside for it in 2009.

What is new is how quickly demand for metals that will feed into these two global trends, is outstripping supply, creating a huge problem for the mining industry but also a once-in-a -ifetime opportunity for savvy resource investors.

Once thought of as an obscure mineral, extracted as a byproduct of potash mining, lithium is now considered “white gasoline”, and for good reason.

Australian bank Macquarie forecasts a global EV penetration rate of 16% by 2025, and 30% by 2030. Even with higher lithium prices, supply is struggling to keep up. Simon Moores of Benchmark Mineral Intelligence predicts a structural lithium deficit could occur as early as later this year and increase to 120,000 tonnes in 2022.

Because of the explosive demand for a particular high-performing lithium-ion battery chemistry — NMC 8-1-1 (80% nickel, 10% manganese, 10% cobalt) — the future of lithium-ion batteries envisions two key raw materials: nickel sulfate and lithium hydroxide.

According to CRU, nickel usage in batteries is expected to grow seven-fold, from 70,000 tonnes in 2017 to 240,000 tonnes in 2023.

Producing nickel-rich battery cathodes requires high-purity nickel, in the form of nickel sulfate, derived from ‘Class 1’ high-grade nickel sulfide deposits.

However, existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically, technically and environmentally feasible? The pickings are slim.

Decades of limited nickel exploration mean a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will therefore be extremely attractive to potential acquirers.

There is no shift from fossil fuels to green energy without copper, which has no substitutes for its uses in EVs (electric motors and wiring, batteries, inverters, charging stations) wind and solar energy, and 5G.

Arguably, the red metal is the most critical of all critical metals, because of its necessity in electrification, and the fact that there is an actual shortage of copper coming.

Mainstream media and the large mining companies are finally catching on to what we at AOTH have been saying for the past two years: the copper market is heading for a severe supply shortage due to a perfect storm of under-exploration/ lack of discovery of new deposits, clashing with a huge increase in demand due to electric vehicles and renewable energy.

The way we’re going, ie., with declining investment in mineral exploration and a lack of new discoveries, we are simply not going to be able to meet demand. If nothing changes the supply-demand gap for a certain group of green metals will keep widening, with the expected knock-on effects on prices, which we expect to stay buoyant.