However, Fitch notes, the demand profile for copper will change as decarbonisation goals accelerate in 2021, and lead to much more demand from the energy and automotive sectors.

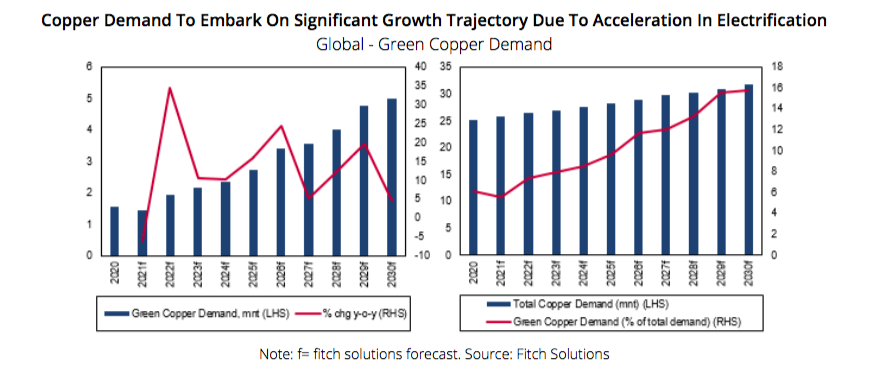

FITCH FORECASTS GREEN COPPER AS A PERCENTAGE OF TOTAL COPPER DEMAND TO RISE FROM APPROXIMATELY 5.6% IN 2021 TO 15.7% IN 2030

Fitch has quantified the impact of the green transition on copper demand, and subsequently revised up its global demand assumptions.

Going forward, Fitch believes that green demand from the power and renewables sector as well as autos will each account for 7.9% of total copper demand by 2030. Estimates are based on forecasts from Fitch’s Power & Renewables and Autos teams.

As a result of greater energy transition, Fitch forecasts green copper as a percentage of total copper demand to rise from approximately 5.6% in 2021 to 15.7% in 2030. Growing from a forecast 1.4mnt in 2021 to 5.4mnt in 2030, Fitchexpects green copper demand to average annual growth of 13.0% y-o-y over the next 10 years.

The two most important areas of green copper demand growth: renewable energy and vehicle electrification.

The renewables sector will account for the strongest green copper demand growth over our forecast period, Fitch says, as it is 12 times more copper intensive than traditional energy systems. The renewable energy sector will account for an average 62% of annual green copper demand between 2021 and 2030 and approximately 7.9% of total copper demand by 2030, up from an estimated 5.1% in 2020. However, Fitch notes, its market share will narrow as EV production continues to scale up towards the end of the decade.

Renewable energy will be the dominant contributor to green copper demand over Fitch’s forecast period, accounting for an average 62% of annual green copper demand between 2021 and 2030.

The renewables sector will boost copper demand via large net capacity additions in wind, hydro and solar power sub- sectors.

According to the Copper Alliance, wind turbines require between 2.5 tonnes and 6.4 tonnes of copper per MW for the generator, cabling and transformers. Photovoltaic solar power systems use approximately 5.5 tonnes of copper per MW.

Fitch‘s Power & Renewables team believes that the largest renewables capacity addition will happen in China, India and the US.

(Read the full report here)