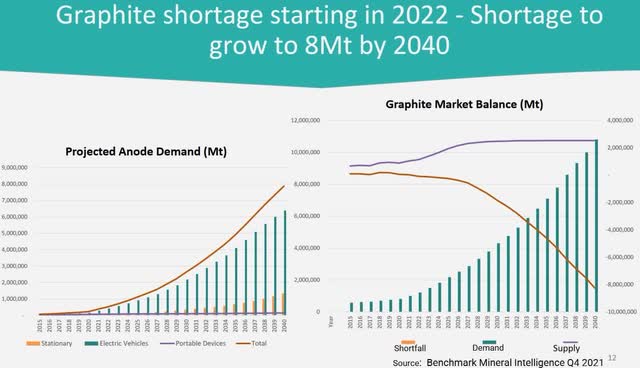

Graphite prices increase BMI forecasts graphite deficits to begin from 2022 as demand for graphite grows strongly

BMI

Graphite market news

On August 4, Investing News reported:

...Graphite prices increased over the first half of 2022 ...Prices for higher-purity 100 mesh flake material, typically used for anodes in the batteries that power EVS, saw a nearly 30 percent increase in the first half of the year... Overall, Benchmark Mineral Intelligence still expects to see a tightly balanced flake graphite market in 2022, leaning towards a supply deficit as demand from the anode industry continues to accelerate... "if recovery from COVID-19 lockdowns in China keeps momentum, then price upside is more likely than price downside, especially with no major volumes from new projects or expansions due to come online before the end of the year," Jennings-Gray said.

On August 25, Mining.com reported:

Tesla's battery metals bill balloons to $100 billion......At today's price Tesla is on the hook for a bit over $100 billion for the 11.1 million tonnes of raw materials it needs to build 20m cars.......As automakers (and the renewable energy sector) scramble for lithium, nickel, cobalt, graphite, rare earths, aluminium, manganese and copper securing supply may ultimately be a bigger issue than costs.......To produce 20m vehicles Tesla alone needs more than the total volume of lithium and natural graphite produced last year, almost a third of the magnet rare earths, 36% of the cobalt, and so on.

Note: Bold emphasis by the author.

Lithium and natural graphite are forecast to have the greatest demand increase by Tesla as they move towards producing 20m EV