With EPS Growth And More, North American Construction Group (TSE:NOA) Is Interesting.

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, ‘If you’ve been playing poker for half an hour and you still don’t know who the patsy is, you’re the patsy.’ When they buy such story stocks, investors are all too often the patsy.

So if you’re like me, you might be more interested in profitable, growing companies, like North American Construction Group (TSE:NOA). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

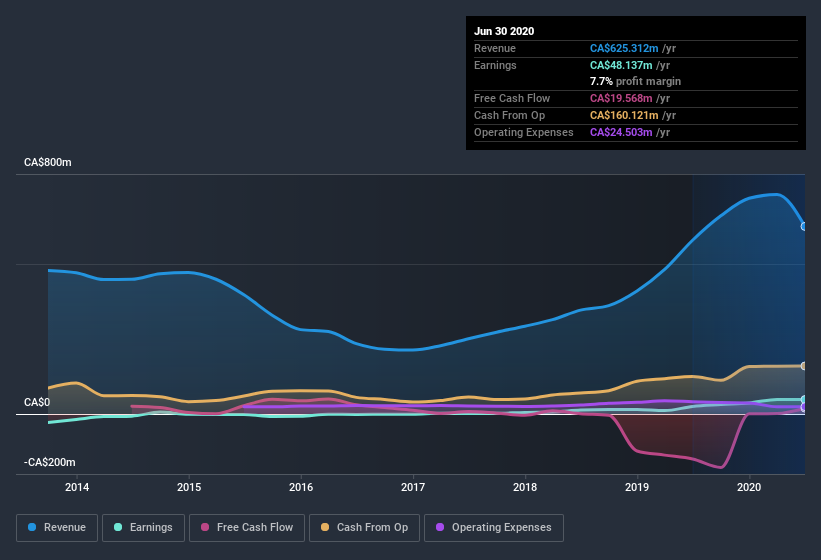

North American Construction Group’s Improving Profits

In the last three years North American Construction Group’s earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn’t tell us much. As a result, I’ll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, North American Construction Group’s EPS shot from CA$1.01 to CA$1.82, over the last year. Year on year growth of 81% is certainly a sight to behold.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). North American Construction Group shareholders can take confidence from the fact that EBIT margins are up from 7.6% to 12%, and revenue is growing. That’s great to see, on both counts.

Are North American Construction Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it North American Construction Group shareholders can gain quiet confidence from the fact that insiders shelled out CA$498k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. We also note that it was the Chairman & CEO, Martin Ferron, who made the biggest single acquisition, paying CA$315k for shares at about CA$13.34 each.

The good news, alongside the insider buying, for North American Construction Group bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have CA$25m worth of shares. That’s a lot of money, and no small incentive to work hard. That amounts to 9.9% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add North American Construction Group To Your Watchlist?

North American Construction Group’s earnings per share have taken off like a rocket aimed right at the moon. What’s more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I’d suggest North American Construction Group belongs on the top of your watchlist.