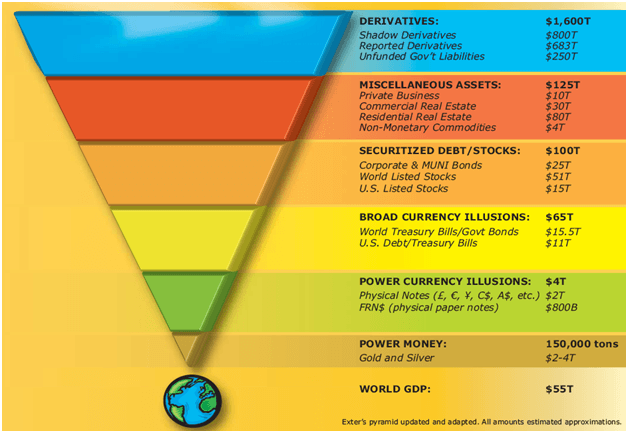

The On and Off Ramps of Exter's PyramidJohn Exter was an advisor to Paul Volcker in his time at the Fed (Chairman of the Board of Fed Governors from 1979 to 1987). His theory on the liquidity of market investments, and how much risk they carry, have often been cited by market observers who wanted to show where money flows to during economic crises.

Exter developed his pyramid, with true money (PMs / Gold) on the bottom and all derivative financial products on top. In his original pyramid, he included junk bonds, illiquid debtors, commercial paper, bankers’ acceptances, developing economies’ debts, CDs, federal government debt, corporate and municipal bond debt and finally paper currencies.

https://static.seekingalpha.com/uploads/2020/3/18/410007-1584572995959862.png

However, is the above pyramid really accurate under today’s reality and value of “financial assets”? And more importantly, how does an investor use it – not just on the way down during a crisis – but on the way back up after the crisis subsides? The way back up is actually more difficult and frightening when one considers what our world may look like when PMs have reached a top.

If you look at the image above, you will soon realize that a trip down to the bottom of the pyramid really appears to be a one-way trip. Where can an investor finally determine where the price of gold has reached a secular top, and then decide to start reallocating his investment money back into the high echelons of the pyramid? Especially when some of the layers may actually be gone. Or if they remain, they will continue to be very unstable? Maybe, one of the difficulties with the original pyramid model is that it is actually not representative.

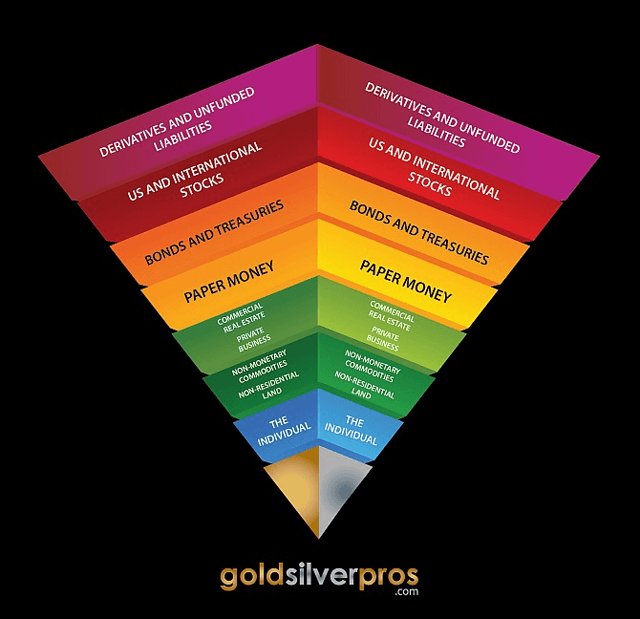

Robert Kientz, author of DropShadow and founder of Gold Silver Pros @ goldsilverpros.com actually

offers a much better version of Exter’s Pyramid that assists investors in more easily navigating into and out of the crisis. As he states:

My primary complaint with Exter’s pyramid is that it approaches financial investments from a central planner’s perspective. However, it fails to advise individual investors how to approach saving and growing their individual estate.

For example, the Founding Fathers of this great country equated land ownership to freedom. They reasoned that not owning land made one the slave or servant of someone else. They were right, but you won’t see that fact reflected in Exter’s pyramid.

Exter’s model is great for the central economic planner that looks at the economy from the top down, addressing with policy only the largest classes of financial vehicles. As investors, we are much more suited to look at investments and risk from the bottom up. We don’t take on the aggregate risk of every investment in the economy with each of our individual decisions.

The first change in the new model is to place people immediately above gold and silver. The collection of skills and talent, along with their labor, make up the value of people. It is safe to say that gold and silver will not get mined, houses will not be built, and derivative contracts will not be written without the labor and expertise of humans. Therefore, I argue that each person forms the second base level of their individual financial system.

So why are people not at the base? Because risk increases as we move up the base, and mined gold and silver reflect past human skills and labor already spent after all risks have been realized.

https://static.seekingalpha.com/uploads/2020/3/18/410007-15845732610715344.png

The differences in the pyramids are immediately obvious. In Exter’s pyramid, physical paper money is listed right above gold and silver. The reason is because we live in a fiat paper system based upon debt. And all central bankers consider the currency to be legitimate accounts of exchange and stores of wealth, though history has disproved this notion thoroughly.

The second major difference are non-monetary commodities. These have a lot of longer-term value, and make good strategic investments especially when you can hold them in physical form. Beware holding funds based on commodities because it may be exposed to paper derivatives that don’t tie directly to their physical counterparts.

Next, I moved private businesses out into its own layer. Individual businesses can generate long-term wealth for their owners. But, it depends on what your business is, and when. Timing is the biggest risk, so it resides just below paper money on the wealth generation pyramid.

Stocks with dividends don’t pay back for an average of about 20-25 years, so you have to be really comfortable holding them for any length of time. Given that business cycle corrections happen every 4-10 years, you are basically guaranteeing two major investment losses over that 20-25 year period that dividend stocks need to be paid fully back. Real inflation almost always dissolves stock gains, which is why gold has outperformed stocks since 2000. Gold prices rise long term by the amount of monetary inflation in the system. That is why it resides at the bottom of the chart.

Lastly, and perhaps most importantly, is the inclusion of the individual in our version of Exter's Pyramid. Most governments and financial pundits will never tell you that you have the keys to your financial success in your own hands. Nor do they counsel you to develop your skills in trade to increase your income. They need to be the experts to make that commission from you, which is one reason you come to Seeking Alpha - to obtain information for your own investment goals.

What I like about the Robert Kientz version of the Pyramid (beyond it’s more realistic categorization of asset values during a crisis) is that it provides a clearer path for investors if they miss the secular tops and bottoms of PMs. Especially the asset layers that lie between PMs at the bottom and cash in the center. And in an indirect way, this version of the model also provides guidance to investors that are prone to extremism.

These interim layers (moving upwards from PMs towards Paper Money / Cash) of the revised model are defined as follows:

Individual People: Placing people immediately above gold and silver. The collection of skills and talent, along with their labor, make up the value of people. It is safe to say that gold and silver will not get mined, houses will not be built, and derivative contracts will not be written without the labor and expertise of humans. So why are people not at the base? Because risk increases as we move up the base, and mined gold and silver reflect past human skills and labor already spent after all risks have been realized.

Non-residential Land: Which includes farm-able and ranch-able land that can produce food, minerals, and commodities. This land does not have buildings or other infrastructure improvements on it which have been financed with debt. Farm and ranch land are limited in supply which often decreases for every property development that springs up over time.

Non-monetary Commodities: Real commodities are also growing increasingly scarce. Therefore, scarcity factors ensure that the base price of commodities will rise over time despite monthly speculative activities of the paper traders.

Private Business: Any business you have set up to generate income. Wouldn’t business income DECREASE during a recession? The trick is to be in a business that will produce in both good times and bad. For example, food is a staple that is always in demand. The coronavirus pandemic has taught many the value of food and staple goods as shelves are being emptied across the nation as shelter in place orders are increasing in more and more local municipalities.

These assets categories lie between the two most significant goal posts in an economic and monetary crisis. To me they represent extremities for investors seeking safety from the crisis.

- Paper or E-Money / Fiat is the asset that represents the ultimate UTILITY. As the recognized medium of exchange, it can be used by the bearer to obtain just about everything in an instant. From food, shelter, automobiles, travel, etc. However, it is also prone to rapidly diminishing value through debasement and excessive systemic debt of the financial system it represents. Ultimately ending up at ZERO VALUE.

- PMs (gold and silver) represent the opposite. They have minimal UTILITY but represent the ultimate store of VALUE. Although they can rarely be used as a medium of exchange, they are recognized as assets that will always retain true value. And this recognition becomes increasingly evident as a crisis deepens.

Which brings me to my main point of the Robert Kientz version of the Pyramid. It offers guidance for investors searching in between the extremities of the two goal posts. These asset classes that are layered between Paper Money offer unique mixes of utility and value. And they will ALWAYS hold onto these two attributes (value and utility) because they are core items in any functioning society and economies (even ones in contraction). They represent the essential activities that sustain life and basic trade.

This is not to suggest that one needs to become a miner, a farmer, or a private businessman, or a skilled tradesman. But it is within these categories where money should be invested. The level of investment conservatism can be gauged by the depth of the crisis, but in the end, it will be very unlikely that an investor loses so much.

For the rabid gold / silver bugs that are positioned fully at the very bottom of the Pyramid awaiting “End Days” to prosper: Your hopes and wishes may be misplaced. You are betting against humanity and that is a misplaced bet. And you are unlikely to survive it.

You are placing your financial survival on your ability to detect the turn in the crisis towards the better. And that may be next to impossible considering the environment at that particular moment in time.

Tx