Novo Resources (OTCQX:NSRPF) is among the most followed and controversial junior resource stocks out there. Bulls are convinced that the company controls one of the largest, if not the largest, gold deposits ever discovered in history and that President and founder Quinton Hennigh will lead them to enormous riches. Bears, including yours truly, are concerned that the conglomerate gold deposits Novo controls are virtually impossible to measure by traditional geostatistical methods, and that the company's shares are grossly overvalued based on its relatively small hard rock deposit. The debate rages on at various forums such as CEO.ca/nvo and will continue to do so for some time to come.

This article will not get into the weeds of that discussion, although I do have an opinion. Instead, I want to point out something that I've seen no mention of, which is the company's cash position, which I believe to be a red flag. We saw the below-the market offering announced on April 14th that caused the stock to crater and for some uneasiness to begin to permeate the fanbase. This follows a reduction of the company's credit line from Sprott Lending announced April 9th: the second tranche ($25 million) of a $60 million credit facility was reduced to $15 million. Bulls assumed that this was due to Novo not needing the money, although this misconception was rudely corrected a few days later. I will get into the real reason below.

Given the company's recent and abrupt financing, the terms of the Sprott loan, and the company's most recent financial statement showing ~C$14 million in working capital (as of December 31, 2020) the company may be short of cash, which is a dangerous state of affairs for a company commissioning a new mining operation.

Let's take a step back and look at the Sprott facility.

The Sprott Facility

Details of the Sprott facility can be found in the company's August 4th press release. I'm surprised there wasn't much commentary beyond the typical "Novo has the backing of a credible outfit like Sprott, which gives Novo credibility." Those who believe that bunk didn't look at the loan-shark terms of the deal.

The first tranche of the loan was stated to be $35 million and paid to Novo in August. According to the August 4th press release the loan carries an interest rate of 8% plus the higher of 3-month LIBOR or 1%, so the interest rate appears to be in the 9% area, which isn't uncommon for a junior mining company just starting production. However, according to this press release (September 8) the $35 million is subject to a ~12.3% cash discount, meaning the company only received $30.7 million while paying ~9% interest on $35 million, on top of owing $35 million, or $4.3 million more than received, when the loan comes due. Finally, the company owes 4.5% to Clarus Securities on all facility drawdowns. It is not clear if this 4.5% is on the full $35 million or just on the received $30.7 million though this reduces cash in by $1.6 million in the first case or $1.4 million in the second case.

(It is worth noting that negative aspects to the Sprott facility such as the lender's cash discount or the Clarus Securities fee are not mentioned in the August 4th PR.)

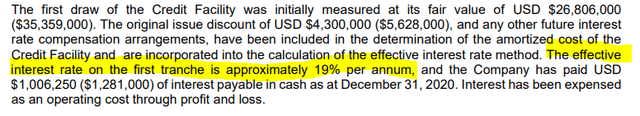

The effective interest rate appears to be punitive. According to the company's annual financial statement its own accountants are estimating that the effective interest rate on the first tranche of the loan is 19%, which includes nearly 1.5 million units (shares plus half-warrants) as "interest" issued to Sprott.

(Source: Novo Resource's annual report filed March 31, 2021, footnote 14. Novo's Sedar filings can be found here)

(Source: Novo Resource's annual report filed March 31, 2021, footnote 14. Novo's Sedar filings can be found here)

The second tranche of the loan, according to the August 4th and September 8th releases, was originally supposed to be $25 million (subject to a 2% "lender's discount" and also to the 4.5% fee owed to Clarus Securities) as well as the same ~9% annual interest rate. The second tranche was also contingent upon Novo delivering a pre-feasibility study ("PFS") on Beaton's Creek. Word-for-word from the August 4th press release:

The funds will be available in two tranches, the first $35 million being available upon closing and the second $25 million available to be drawn until March 31, 2021, at Novo’s sole discretion, upon delivery of a pre-feasibility study on the Beatons Creek Project acceptable to Sprott.

Novo failed to deliver this PFS in time, or at all at this point in time.

(As a side note I should point out that delivering a PFS wasn't just a condition for receiving the 2nd tranche of the Sprott loan: it was promised publicly to the investing community by President Quinton Hennigh on Jay Taylor's show (Jay is a long-time supporter of Novo Resources). (The relevant part of the interview can be found here at ~7 minutes, 30 seconds in, go back 20-30 seconds for more context.)

What Novo did was put out a press release giving highlights of a preliminary economic assessment ("PEA") on March 31st. Briefly, a PEA usually costs significantly less money than a PFS, can incorporate "inferred resources" into its mine plan (inferred resources are the lowest confidence resources that Canadian securities regulators will allow a public company to mention publicly), and has a higher margin of error (typically +/-35% vs +/-25% for a PFS and +/-15% for a full feasibility study).

Additionally, I differentiate between a company releasing a PEA (or any technical economic document), and putting out a press release with the highlights of a PEA. Canadian companies can put out such a press release so long as they file the actual document within 45 days. Novo has yet to file theirs.

Sprott could have easily said "no" to the remaining funds though allowed for drawdown of up to $15 million (vs. the originally proposed $25 million) that is subject to the same ~9% interest rate, 2% lender's fee and 4.5% fee to Clarus Securities. In this sense Novo is lucky, and we'll see the extent of this when calculating the company's cash balance.

Less than a week later, Novo announced its below-the-market financing that saw shares decline 14% on the week.

Novo's Working Capital Position

The company had C$14 million ($11.2 million) in working capital as of the end of 2020, presumably it has drawn down the second tranche of its credit facility, which after fees should be ~$14 million. The most recently announced financing is expected to close in early May so the company doesn't have these funds yet, although assuming 0 broker fees (a generous assumption) and subscription to the overallotment option, the company would bring in C$26.4 million ($21.1 million). This brings the total, optimistically, up to $46.3 million).

We don't know how quickly they've been burning cash, although it isn't cheap to commission a mine. According to long-time Novo shareholder Bob Moriarty, the company's burn rate jumped from $1.5 million per month to $12 million per month when they transitioned from exploration to development and production (WARNING: there is foul language in the linked article). Bob is usually pretty optimistic on Novo and Novo sponsors his website, so I have no reason to believe that this cash-burn figure is an overstatement (in fact, it may be an understatement). Assuming Bob's $12 million per month burn rate is accurate, the company currently has a ($17 million) working capital deficit, or a $4 million working capital surplus if the funds from the recent financing are counted.

Note these figures counter Quinton's explanation for the financing: that the company needs to rush infill drilling in order to upgrade the resource, as they clearly indicate that the company simply doesn't have cash.

While it is possible the working capital gap might be bridged by production, the company is currently processing "lower grade ore" (according to Moriarty) than the grade one would expect given the resource estimate. According to an interview Quinton gave to Al Korelin (around 2:50 in), Novo will take "6 months or so" to ramp up to the cash-flow projections mentioned in the PEA highlights press release. He later suggests that the company may generate cash from production sooner although isn't clear on the amount.

Other Sources of Capital

The company holds securities in several other junior resource companies that it could sell in order to raise capital, notably New Found Gold (OTCPK:NFGFF). Today, the company's New Found shares have a market value of ~C$80 million. Unfortunately New Found Gold shares only trade on average of 250,000-300,000 shares per day, which means Novo would need a long time to liquidate its 15,000,000 shares. Novo also has enough shares to increase the free-trading float of the stock (~28% not in 'tight' hands) by some 35%, which could materially impact the valuation of the shares that Novo is selling. Note also that Novo shareholders often take stakes in other companies that Quinton Hennigh is involved in, and if Novo shows lack of confidence in these by selling then these shareholders may follow suit, especially if they have profits (which pretty much all New Found shareholders have).

Novo has smaller positions in other junior resource companies with low trading volumes that prevent the company from exiting in a meaningful way without materially impacting valuations.

We can only speculate as to why Novo chose to issue shares below the market price instead of liquidating some of its equity holdings, or why the company didn't do a smaller raise and offset the balance by selling equities.

The Bottom Line

Novo Resources appears to need cash, which is likely why it carried out a below-the-market financing, and likely why it accepted loan terms from Sprott Lending that are punitive. As a company developing a mine, Novo is at a point where it is burning cash and where its operation comes with uncertainty and risk that is best mitigated by a cash cushion. The company can clearly access cash: it can sell some of its New Found Gold shares and it can raise money in the equity markets, albeit not on ideal terms. Thus, I wouldn't go so far as to say that the company risks going bankrupt; however the company could be forced to dilute its shareholders at unfavorable prices or liquidate its share holdings at unfavorable prices should the gold price fall, or if Beaton's Creek ramp-up takes longer, or costs more than expected.

Even if you believe in the geology side of the Novo story, you'd be wise to look closely at the company's financials, as well as some of its financial decisions, before taking a long position.