Introduction

Introduction

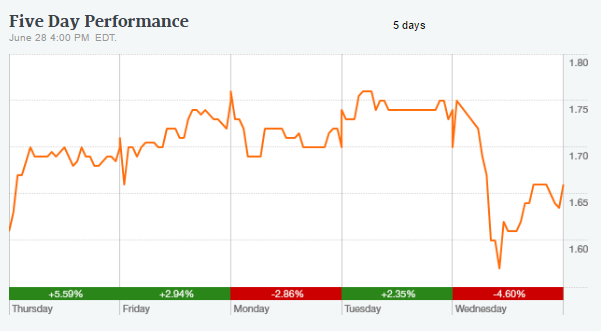

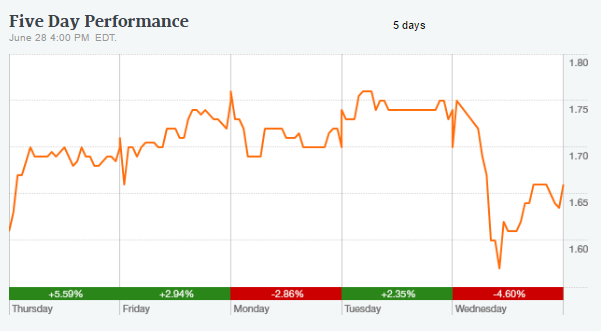

On June 28th, the SEC announced charges against three former finance executives at Penn West Petroleum Ltd, which was recently renamed to Obsidian Energy. This has resulted in a significant drop in the price of shares, despite the news offering nothing materially new for shareholders. This occurred after Penn West Petroleum (PWE) was already one of the better priced E&P companies in Canada. I typically write on the Canadian energy services sector, and I don’t typically write on the E&P companies. However, when an incredibly obvious trade exists, I feel the need to jump on it.

This article will be much shorter than I usually write. This is because few people cover the Canadian energy services sector, and almost nobody writes on the contract drillers or production services companies. On the other hand, there is a wealth of great material already written on Penn West Petroleum/Obsidian energy recently, and I don’t want to beat a dead horse. Instead, today I wanted to focus on the meaning of the SEC charges, and offer a quick overview of why I really like Penn West Petroleum’s valuation today.

SEC Charges

The SEC charges have been known by the market for several years, and Penn West settled a lawsuit for $53 million dollars last year due to damages to shareholders. Penn West, the company, has already dealt with the repercussions of this. The announcement today was stating that the three employees under investigation were formally charged. This is a completely separate issue from the company and should have no bearing for shareholders. In short, Penn West Petroleum just went on a 5% to 10% sale for no reason. This is a classic example of the types of situations that I look for as an investor; there is a scary news article with nothing material for shareholders, resulting in a significant price decline.

Obsidian Energy

I’ll be using the terms Penn West Petroleum and Obsidian Energy interchangeably throughout this article. Penn West had previously announced the change in name to Obsidian Energy, which finally took place a couple of days ago. While their new logo makes me glad that they are not a marketing company, but it shows the lengths that management was willing to go to shed the image of the old Penn West. I’ll assume you are all familiar with Penn West’s history, and understand this rationale.

A New Company

Obsidian Energy has reinvented itself as a new company. I will admit that if you asked me two to three year ago where I thought the company would be today, I would have honestly bet on bankruptcy. There was every indication early in the downturn that they would not be able to pay off their $2 billion plus in debt within the short time frame. Penn West Petroleum responded in a great way by making enormous asset sales throughout the downturn, and were one of the first to put their goods on the market.

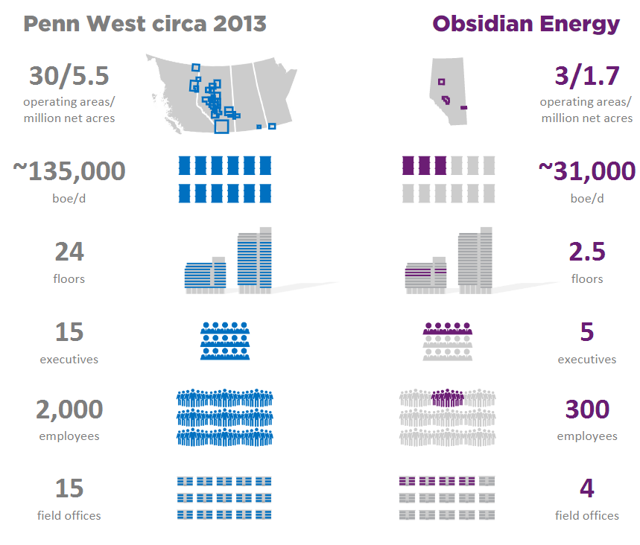

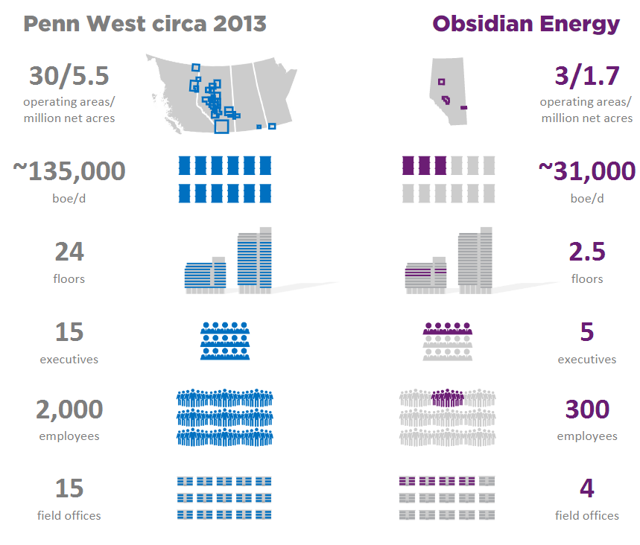

Obsidian completely reorganized the structure of their company, making significant cuts to management and director positions, and getting rid of redundant positions. This allowed the company to significantly cut costs, and improve netbacks to one of the strongest in the country. The focus on low decline wells going forward also offers a number of advantages to staying cash flow positive in the event of another long dip.

The company was also very smart with how they managed their assets in the downturn. They focused on keeping certain high producing areas, while selling off their less efficient or more dispersed wells. This had the effect of lowering costs by concentrating their resources in certain areas, while also dumping some of their less efficient wells. Thus, Penn West currently has one of the highest netbacks in the entire country. When you consider this with the low decline rate, the company is looking great at this point in time. I took a slide from their June investor presentation that offers an overview of the changes over the last four years.

Q1 Results

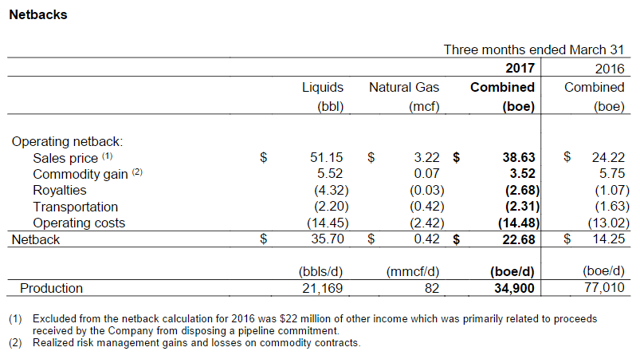

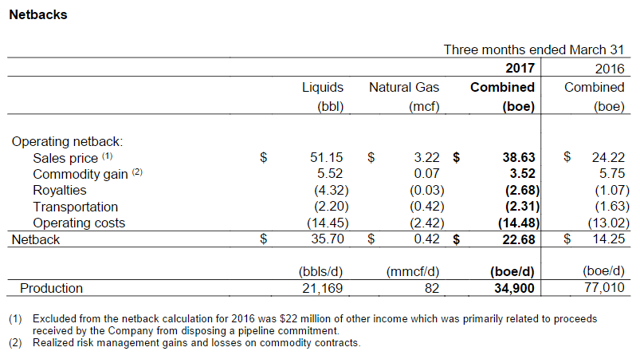

Penn West Petroleum had a great first quarter this year, posting revenue of $132 million and funds flow from operation of $57 million, and net income of $27 million. Oil Production equivalents came in at 34,900, producing a fantastic average netback of $22.68 for the quarter. It is worth noting that when considering the asset sales, the company would have produced a slight net loss for the quarter when controlling for this.

Remaining Debt

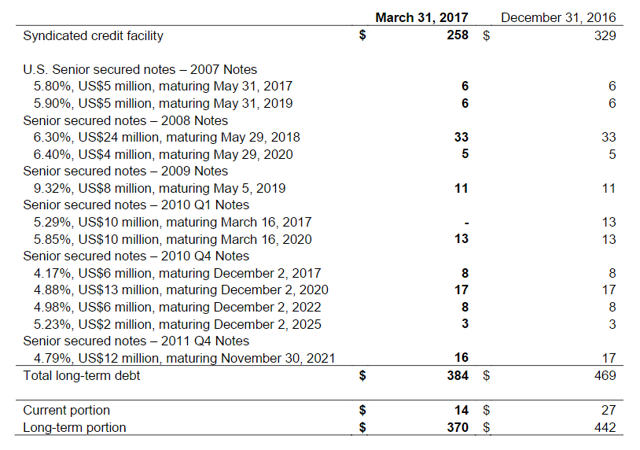

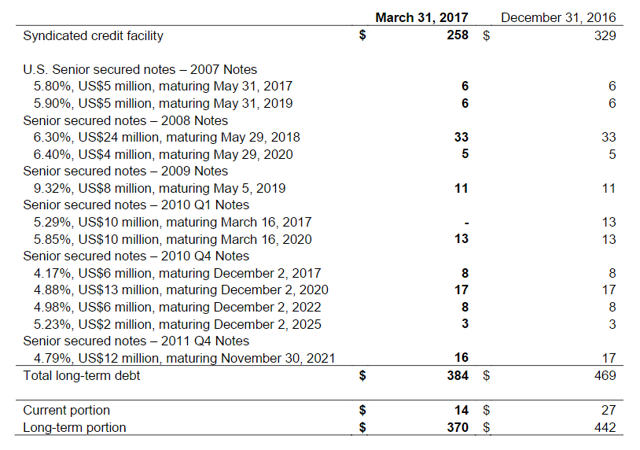

Penn West’s debt levels have come a long way from 2013, but they are not completely out of the water yet. Penn West currently holds $384 million in long term debt. For the first time in several years it actually looks as if Penn West could pay off all of the senior notes through cash flow alone, while most of the syndicated credit facility will likely have to be refinanced as it contains the majority of the long term debt ($258 million).

The company was able to lock in a decent amount of hedges during the last rally, and about half of their oil is hedged at $51 for the year. Considering that the Cardium play alone is expected to contribute $70 million in free cash flow alone this year (increasing to $100 million within 5 years), I would argue that Obsidian shareholders have little to worry about with respect to debt. In fact, when considering the low debt, high netbacks, significant hedges, and strong cash flow, it seems that Obsidian is one of the best positioned oil companies in the downturn. I provided a table showing the debt maturities below.

Valuation

The thing that makes me scratch my head about Obsidian’s current market capitalization, is that it seems cheap no matter what metric we are using for comparison. We could look at netbacks, revenue/market cap, production/market cap, leverage, and cash flow/market cap; Obsidian appears above average in every single one. Now this is not to say that Obsidian stands in a league of their own with respect to valuation, but even before today’s dip, they were one of the cheapest E&P companies in Canada no matter how you tried to analyze it. After the dip, it seems to be a clear buy.

My Position

I currently hold no position in Penn West Petroleum as I work evening shifts and was asleep when this news was announced, therefore I simply have not had time to react to it. I am planning on making a small position in the company at a price near the current market price, and I am going to enter another limit order near their 52 week low just in case the market reacts strongly again tomorrow. I personally think that the market will shrug this information off very quickly, and I doubt my second order will go through.

Conclusion

I have been keeping my eye on Penn West over the last few months. I’ve been waiting patiently to finally pull the trigger on this company, if the situation called for it. I would have considered the company to be in ‘buy’ territory over the last few weeks. Unfortunately, however, the market has done a good job in valuing the mid sized E&P companies, and Penn West only appeared to be somewhat cheaper than peers. However, after today’s (June 28th) event forcing a decline of up to 10% in the price of shares, the company’s valuation has deviated markedly from peers, and it appears to be a strong buy at this point in time.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PWE over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may buy Obsidian Energy on the TSX. All values are in CAD unless otherwise stated.

Today the SEC announced that charges will be filed against three former finance executives of Penn West Petroleum; the market responded with a 5-10% drop in price.

Even before this announcement occurred, Penn West/Obsidian Energy was trading slightly cheaper than peers, and the only possible way I could account for this difference was reputation.

After this decline Obsidian Energy appears to be much cheaper than peers as I believe that this news holds no material value to shareholders.

I believe that now is a fantastic time to buy shares, as the market will likely digest this news within a couple of days, and hopefully reach the same conclusion as I did.

Introduction

Introduction

On June 28th, the SEC announced charges against three former finance executives at Penn West Petroleum Ltd, which was recently renamed to Obsidian Energy. This has resulted in a significant drop in the price of shares, despite the news offering nothing materially new for shareholders. This occurred after Penn West Petroleum (PWE) was already one of the better priced E&P companies in Canada. I typically write on the Canadian energy services sector, and I don’t typically write on the E&P companies. However, when an incredibly obvious trade exists, I feel the need to jump on it.

This article will be much shorter than I usually write. This is because few people cover the Canadian energy services sector, and almost nobody writes on the contract drillers or production services companies. On the other hand, there is a wealth of great material already written on Penn West Petroleum/Obsidian energy recently, and I don’t want to beat a dead horse. Instead, today I wanted to focus on the meaning of the SEC charges, and offer a quick overview of why I really like Penn West Petroleum’s valuation today.

SEC Charges

The SEC charges have been known by the market for several years, and Penn West settled a lawsuit for $53 million dollars last year due to damages to shareholders. Penn West, the company, has already dealt with the repercussions of this. The announcement today was stating that the three employees under investigation were formally charged. This is a completely separate issue from the company and should have no bearing for shareholders. In short, Penn West Petroleum just went on a 5% to 10% sale for no reason. This is a classic example of the types of situations that I look for as an investor; there is a scary news article with nothing material for shareholders, resulting in a significant price decline.

Obsidian Energy

I’ll be using the terms Penn West Petroleum and Obsidian Energy interchangeably throughout this article. Penn West had previously announced the change in name to Obsidian Energy, which finally took place a couple of days ago. While their new logo makes me glad that they are not a marketing company, but it shows the lengths that management was willing to go to shed the image of the old Penn West. I’ll assume you are all familiar with Penn West’s history, and understand this rationale.

A New Company

Obsidian Energy has reinvented itself as a new company. I will admit that if you asked me two to three year ago where I thought the company would be today, I would have honestly bet on bankruptcy. There was every indication early in the downturn that they would not be able to pay off their $2 billion plus in debt within the short time frame. Penn West Petroleum responded in a great way by making enormous asset sales throughout the downturn, and were one of the first to put their goods on the market.

Obsidian completely reorganized the structure of their company, making significant cuts to management and director positions, and getting rid of redundant positions. This allowed the company to significantly cut costs, and improve netbacks to one of the strongest in the country. The focus on low decline wells going forward also offers a number of advantages to staying cash flow positive in the event of another long dip.

The company was also very smart with how they managed their assets in the downturn. They focused on keeping certain high producing areas, while selling off their less efficient or more dispersed wells. This had the effect of lowering costs by concentrating their resources in certain areas, while also dumping some of their less efficient wells. Thus, Penn West currently has one of the highest netbacks in the entire country. When you consider this with the low decline rate, the company is looking great at this point in time. I took a slide from their June investor presentation that offers an overview of the changes over the last four years.

Q1 Results

Penn West Petroleum had a great first quarter this year, posting revenue of $132 million and funds flow from operation of $57 million, and net income of $27 million. Oil Production equivalents came in at 34,900, producing a fantastic average netback of $22.68 for the quarter. It is worth noting that when considering the asset sales, the company would have produced a slight net loss for the quarter when controlling for this.

Remaining Debt

Penn West’s debt levels have come a long way from 2013, but they are not completely out of the water yet. Penn West currently holds $384 million in long term debt. For the first time in several years it actually looks as if Penn West could pay off all of the senior notes through cash flow alone, while most of the syndicated credit facility will likely have to be refinanced as it contains the majority of the long term debt ($258 million).

The company was able to lock in a decent amount of hedges during the last rally, and about half of their oil is hedged at $51 for the year. Considering that the Cardium play alone is expected to contribute $70 million in free cash flow alone this year (increasing to $100 million within 5 years), I would argue that Obsidian shareholders have little to worry about with respect to debt. In fact, when considering the low debt, high netbacks, significant hedges, and strong cash flow, it seems that Obsidian is one of the best positioned oil companies in the downturn. I provided a table showing the debt maturities below.

Valuation

The thing that makes me scratch my head about Obsidian’s current market capitalization, is that it seems cheap no matter what metric we are using for comparison. We could look at netbacks, revenue/market cap, production/market cap, leverage, and cash flow/market cap; Obsidian appears above average in every single one. Now this is not to say that Obsidian stands in a league of their own with respect to valuation, but even before today’s dip, they were one of the cheapest E&P companies in Canada no matter how you tried to analyze it. After the dip, it seems to be a clear buy.

My Position

I currently hold no position in Penn West Petroleum as I work evening shifts and was asleep when this news was announced, therefore I simply have not had time to react to it. I am planning on making a small position in the company at a price near the current market price, and I am going to enter another limit order near their 52 week low just in case the market reacts strongly again tomorrow. I personally think that the market will shrug this information off very quickly, and I doubt my second order will go through.

Conclusion

I have been keeping my eye on Penn West over the last few months. I’ve been waiting patiently to finally pull the trigger on this company, if the situation called for it. I would have considered the company to be in ‘buy’ territory over the last few weeks. Unfortunately, however, the market has done a good job in valuing the mid sized E&P companies, and Penn West only appeared to be somewhat cheaper than peers. However, after today’s (June 28th) event forcing a decline of up to 10% in the price of shares, the company’s valuation has deviated markedly from peers, and it appears to be a strong buy at this point in time.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PWE over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may buy Obsidian Energy on the TSX. All values are in CAD unless otherwise stated.