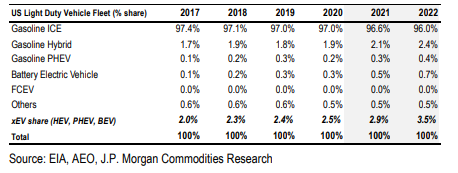

US Light Duty Fleet (EV % share of Market)With all the EV hoopla dragging down the price of oil and oil stocks, it is reassuring as an oil bull to see actually just how slow the pace really is that EV's are replacing ICE vehicles in the US fleet as a percentage. Yes adoption will speed up, but not as fast as the lightning fast spread of Covid:

This data is for the highest EV reported penetration segment, light duty vehicles. It is the most pushed and most subsidized vehicle segment, of which the US is a leader. Yet it does not even include the heavy vehicles of the transportation mix, whose energy use is substantial, and whose transition will be much more difficult and slower. So far that's not even a dent.

Taking it a step further, light duty vehicles as a whole account for only a mere 26% of global oil consumption. The entire transportation sector worldwide contributes only 16% to global emissons. EV adoption is not going to save the world from climate change, nor make much of a drop in global oil consumption in time to make a difference. We need something more like an asteroid.

The key thing to realize is that there are more and more vehicles on the road being added to the fleet in absolute numbers, so the ICE vehicles lost by someone's choice to buy an EV instead are more than offest by the growth in new ICE vehicles added to the fleet, increasing the total numbers. In fact, EIA estimates that the continued growth and use of conventional vehicles will peak around 2038 even with a robust EV transition, this being largely supported by the huge ICE growth in non OECD countries. Thats a lot of ICE growth, and a lot more oil needed to fuel these vehicles:

https://www.eia.gov/todayinenergy/detail.php?id=50096#:~:text=In%20our%20International%20Energy%20Outlook,2.21%20billion%20vehicles%20by%202050. The EV transition is going on at the same time that the demand for oil is growing globally, and also while oil production is decreasing as a whole worldwide. We are still not funding enough exploration and production capex that we need to maintain current levels let alone grow production.

There were 1.31 BILLION light duty vehicles in 2020. In 28 years, in 2050, the forecast is for 2.21 BILLION. That is a whopping growth rate in vehicles, and roads, and all the infrastructure that goes with it. That takes energy to build.

So, contrary to the narrative, I do not buy it. I believe that the amount of oil saved by EV adoption will be less than the decline in oil supply and increase in demand. It will not render oil an obsolete product, even as a fuel. As demand exceeds supply, this means higher future oil prices, and all the world turmoil that goes along with it.

22 years ago we had rampant fears influencing markets leading up to the non event of the Y2K crisis and chaos, and we will soon learn there still is a long future ahead of us in oil. Those holding stocks with decades of long life reserves will experience a big boost, especially coming from such a low valuation point as where most are priced at today.

Personally, I think EVs are a fun toy for the few on the planet fortunate to be able to afford the luxury, and I am even making provisions for a solar EV charging system at my home for a couple of them when the time comes. It is the future we are eventually heading towards, albeit glacial in speed as it pertains to the oil market. I'm presently looking for a new vehicle, but it is far too early to use an EV here in Thailand, and I will buy an ICE model again this time. It is in stock, servicable, and fuel exists everywhere, still at a reasonable price. I'm sure Experienced will enjoy his new EV once it gets built and delivered in a year or so, as North America is more suited for it than most of the rest of the world.

For the long term, I'm waiting for that Y2K moment to come, where there is the realization that the EV will not really bring about the end of oil as expected, no matter how many are sold in the US.

I am holding heavy, long in the decades of reserves oilsand names like MEG, CNQ, CVE, and especially beat up lame dogs like SU as this recession plays out.