EIA: Crude Build +4.5m Gasoline -0.2m Dist +1mLess of a build than API reported, but a build in crude nonetheless.

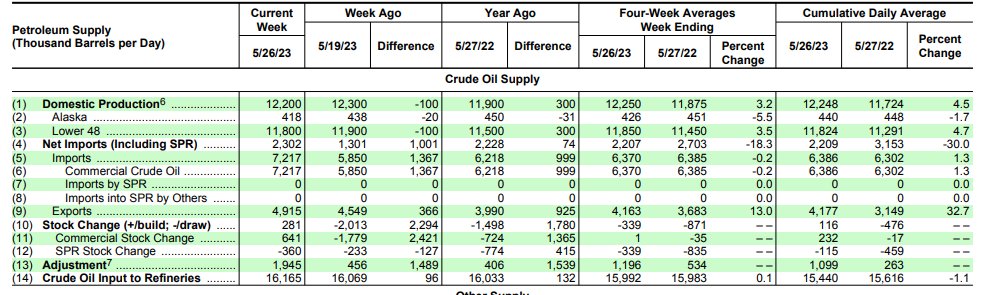

SPR release of 2.5 mm bbls of sweet.

Nearly a 2mm bpd 'adjustment': (+13.615mm bbls) !!! Increase of 1 mm bpd net imports less exports.

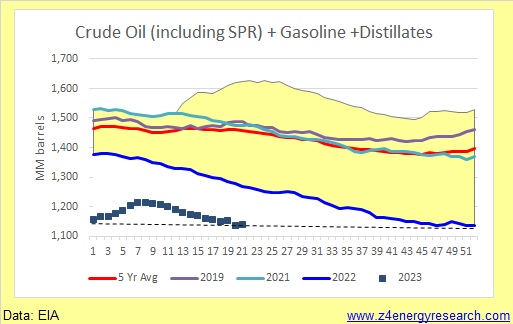

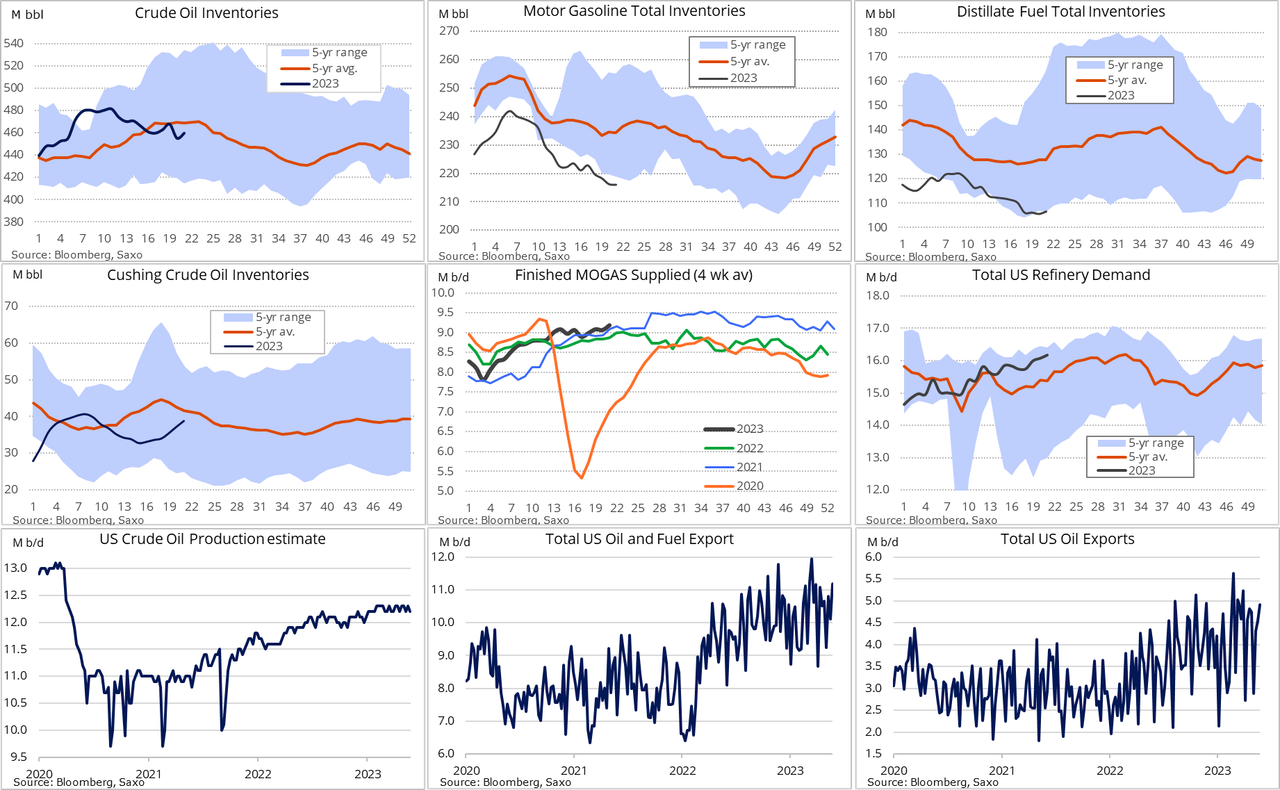

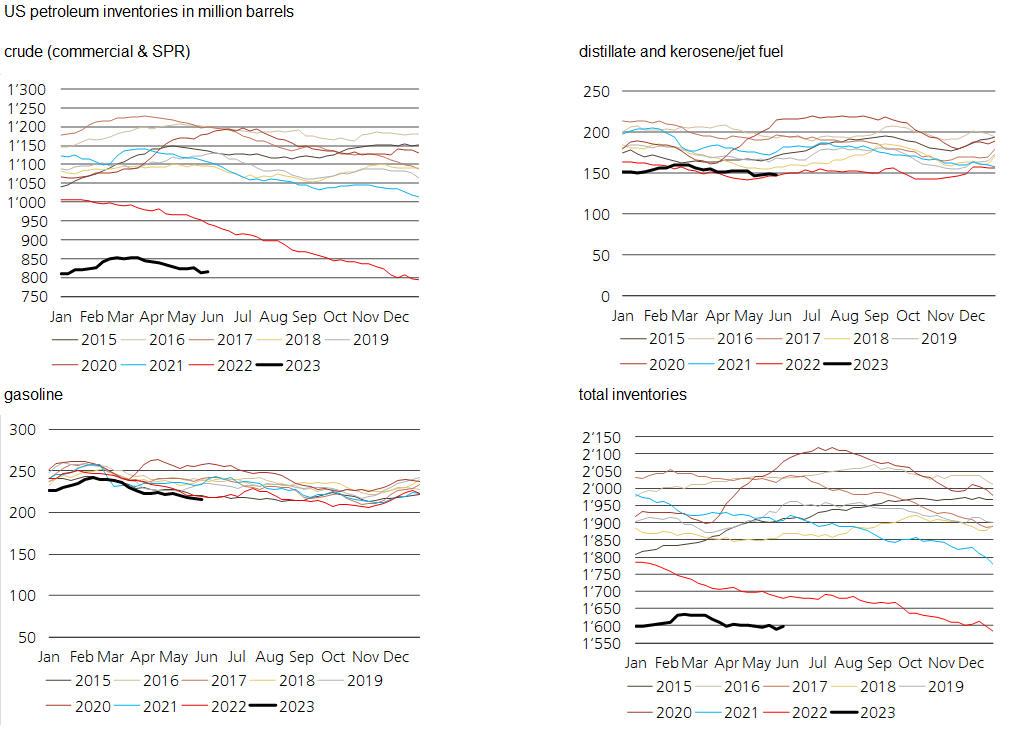

Gasoline storage low, diesel low, crude low, refiinery demand high.

Fundamentals still strong, opposite of what prices are doing. Short covering rally very long overdue.

Nutshell: Neutral. Low quality miss on the headline crude number on the big pop in imports that likely gets reversed in next week’s report. Internals are solid with good refiner throughput (strong 3-2-1 generic crack continues > $30). Production growth remains elusive. Crude Up 4.5 mm barrels (vs -1.4 exp) – SPR released 2.5 mm barrels – throughput – 16.165 mm bopd, new high for 2023. – imports – up nearly 1.4 mm bopd week to week. – exports – up 0.37 mm bopd, to 4.9 mm bopd. US crude imports by origin in kbpd (incl. w/w changes) Canada -118 to 3589 Mexico +256 to 913 Saudi Arabia +322 to 534 Colombia +72 to 286 Iraq -22 to 114 Ecuador +143 to 213 Nigeria +21 to 98 Brazil +7 to 182 Libya +86 to 86 EIA +13.615M adjustment and 2.520M SPR release EIA data, week ending 5/26 Crude oil: +4.5M Domestic prod: 12.2MMbpd SPR: -0.7M Cushing: +1.7M Gasoline: -0.2M Impld mogas demand: 9.10Mbpd Distillates: +1.0M Refiner utilz: 93.1% Total exports: 11.19MMbpd EIA (wk ending 26 May) Crude: 4.488M Cushing: 1.628M Gasoline: -0.207M Distillates: 0.985M

Nutshell: Neutral. Low quality miss on the headline crude number on the big pop in imports that likely gets reversed in next week’s report. Internals are solid with good refiner throughput (strong 3-2-1 generic crack continues > $30). Production growth remains elusive. Crude Up 4.5 mm barrels (vs -1.4 exp) – SPR released 2.5 mm barrels – throughput – 16.165 mm bopd, new high for 2023. – imports – up nearly 1.4 mm bopd week to week. – exports – up 0.37 mm bopd, to 4.9 mm bopd. US crude imports by origin in kbpd (incl. w/w changes) Canada -118 to 3589 Mexico +256 to 913 Saudi Arabia +322 to 534 Colombia +72 to 286 Iraq -22 to 114 Ecuador +143 to 213 Nigeria +21 to 98 Brazil +7 to 182 Libya +86 to 86 EIA +13.615M adjustment and 2.520M SPR release EIA data, week ending 5/26 Crude oil: +4.5M Domestic prod: 12.2MMbpd SPR: -0.7M Cushing: +1.7M Gasoline: -0.2M Impld mogas demand: 9.10Mbpd Distillates: +1.0M Refiner utilz: 93.1% Total exports: 11.19MMbpd EIA (wk ending 26 May) Crude: 4.488M Cushing: 1.628M Gasoline: -0.207M Distillates: 0.985M

US petroleum (crude, SPR, refined products) inventories rose by 8.811mb w/w to 1,598.350mb last week - EIA