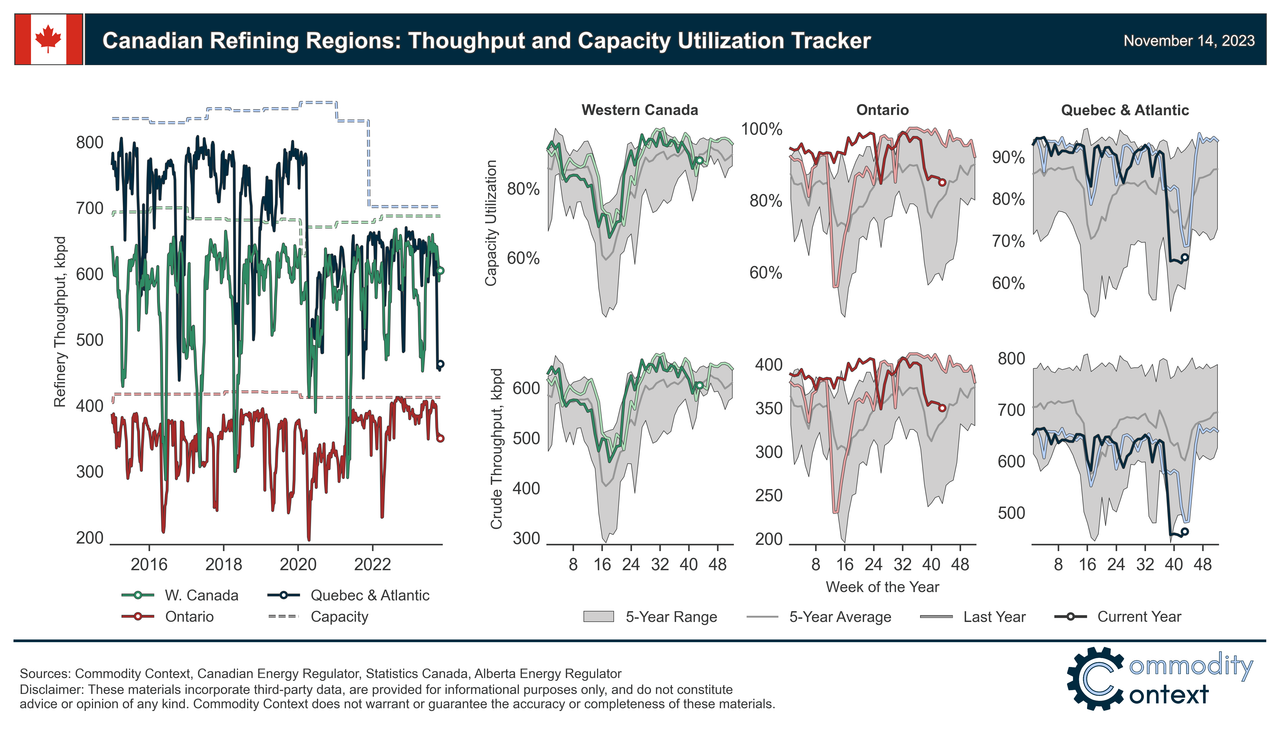

I found some great information from Rory Johnson regarding Canadian refining and utilization rates comparative to historical numbers.

In a nutshell, Quebec and Atlantic refining has pulled back considerably, while Ontario dropped a bit, but the West is still strong. Quebec and the East uses mostly imported oil, while the west uses exclusively our Canadian oil feedstock.

From this data, it would seem that further decreases in crude consumption in Eastern Canada where power is 10x cheaper than in the west, and EVs are making inroads, will hurt the Saudis a lot more than it will the Western Oilsands players, where the market and egress grows and remains strong.

I don't have access to further data behind the paywall, but I would expect it to be equally as informative, and in a lot more detail.

https://www.commoditycontext.com/p/canadian-refining-regionalism Canadian Refining Regionalism

Digging into the unique features of Canada’s key refining regions—where they are, where they get their crude, what they’re producing, and why they remain critical to Canada's ongoing energy security.

-

Canada’s roughly 1.8 MMbpd capacity refining fleet can be divided into three key regions—Western Canada, Ontario, and Quebec & Atlantic Canada—each which is unique in terms of the types and origins of crude feedstock sourcing, as well as the balance of products refineries in each region produced.

-

The bulk of Canada’s refining fleet is best suited for processing lighter crude blends, which make up nearly three-quarters of total charged feedstock nationally.

-

Western Canadian refineries process entirely domestically sourced crude oils (largely upgraded synthetic crude), while Ontario processes largely Western Canadian crude with some US feed mixed in, and Quebec and Atlantic Canada are much more dependent on imported crude, with much of it coming from OPEC countries.

-

Canada’s import dependence has been steadily declining, however, as more Western Canadian crude makes its way east and import-intensive facilities close their doors; even more, that import sourcing is shifting closer to home and the US now accounts for more than half of the seaborne total.

-

Canadian refineries have benefited greatly from the recent refining market crisis, especially diesel-rich Albertan facilities, and capacity utilization has been running especially hot for the past two years in an effort to capture that crack spread.

Fuel prices are once again topping the political agenda given considerable volatility over the past eighteen months. In Canada, high consumer prices have even led the Federal Government to reverse course on, arguably, the signature legislation of the governing Liberals, announcing just recently a 3-year exemption for home heating oil (effectively diesel used in home boilers in the role typically reserved for natural gas) from the national carbon tax.

There’s no doubt that the ongoing refining crisis remains one of the largest contributing factors. While oil prices remain moderately high, crack spreads (i.e., refining margins) on fuels like diesel have been far, far higher. While oil refining is immensely complex, a macro overview of a country’s refining industry is reasonably approachable given the relatively small number of refining facilities in the scheme of the broader industry. That’s especially true in Canada, where you can nearly count the number of oil refineries from coast to coast to coast on two hands.