West Fraser Timber Co. Ltd. (NYSE: WFG) is a Canadian public company, which according to its official website focuses on the production of wood-based products, including timber and plywood, among others. It is currently both publicly-traded in Canada via the Toronto Stock Exchange (TSX), and in the United States through the New York Stock Exchange (NYSE).

West Fraser conducts business primarily in the construction industry in both countries and is considered as one of the industry leaders in timber production, according to the Financial Post. Its clients then use these products in construction projects more likely not including megaprojects such as skyscrapers, megastructures, and industrial-level scale due to these industries requiring steel instead of wood. Nonetheless, with economic activity being disrupted by the COVID-19 pandemic in 2020, the potential investor needs to examine how much was the impact on the business’s model and books to effectively gauge its ability to recover and create growth even in economic downturns. This article takes a look into the company’s books and makes sense of what these numbers mean for its prospects. Also, the focus of this analysis is the NYSE-listed stock of the company and its potential movements.

Previous Years

West Timber’s reporting in the four previous years had mostly featured net profits, aside from the net loss it said it suffered in 2019. To put into perspective its ascent over this period, its net income increased to C$810mn for the whole of 2018, Two years ago, net annual income for 2016 was just at C$326mn. (Henceforth, all figures reported are in Canadian Dollars unless indicated). 2019 represented a blip for the company as it recorded a net loss of $150mn, which the company attributed to in their financial report as being caused by higher costs and weaker demand. The effect of the latter is glaringly highlighted by a 20.28 percent decline in the annual revenue of the firm in 2019, with sales down to $4.88bn from 2018’s $6.12bn annual figures. EPS was another indicator where the declines were more pronounced. In 2018, basic EPS was 10.88, which was a huge rise from 2016’s 4.06. In 2019, since the company made a net loss, the EPS was at -2.18. This was also the situation with regards to the balance sheet of the company, with total assets increasing from $3.6bn in 2016 to $4.79bn in 2018, before decreasing to $4.67bn in 2019. A large increase in short-term debt was also seen in 2019 as the highest rate of rising in its liabilities in four years was recorded. Meanwhile, cash levels plummeted from $160mn to 16mn in the same year. Net Operating Cash Flow was at $877mn for 2018 and was still in the black for 2019. However, it was not exempt from a massive decline to $72mn. Free Cash Flow, which was also in positive territory for the three years from 2016 to 2018, swung into negative territory in 2019 to $338mn, a -167 percent reversal from 2018’s $507mn.

Income Statement

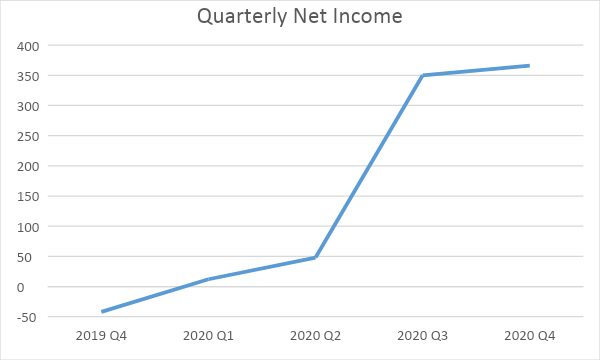

West Timber is in a position of strength, with the company reporting that both its annual net income for 2020 and quarterly net income for 2020 Q4 increased in value. Another accomplishment that it was able to achieve is being profitable for all four quarters in the year 2020. After reporting a $42mn net loss in the last quarter of 2019, it managed to turn its books around and had a net profit of $366mn, according to its income statement at year-end of 2020. On an annual front, from a net loss of $150mn in 2019, the company reported a net profit of $776mn, exhibiting the ability to create growth in 2020. Sales were impressive especially in 2020 Q3 as they increased by 32.45 percent to $1.69bn, from the previous quarter at $1.28bn. Even with a slight decline in sales for 2020 Q4, net income improved to $366mn in the same period, from $350mn in 2020 Q3. This came in even with a higher cost of goods sold, from $1.08bn in 2020 Q3 to $1.15bn as no interest expense was recorded in 2020 Q4, versus $11mn in the previous quarter. The third quarter of 2020 also saw EPS increasing to 5.1, which in turn moved upward to 5.33 in 2020 Q4. These positive developments in both annual and quarterly statements signal that 2020 would be remembered as a year wherein demand was sustained and even rose. A report by Bloomberg suggested that the pandemic encouraged people to conduct renovations and build their homes as the general population stayed away from their workplaces. This environment helped West Fraser as it was presented with a way to exploit the opportunity that unexpectedly resulted from the pandemic. The 2020 financial report of the company also alluded to the impact of demand in helping it record a net profit despite the circumstances. More importantly, it was also a sign that the people leading the company are nimble and adaptable as they exhibited the ability to spot and make the most of the situation. Woodworking Network, a website specializing in wood-related industry and a publisher of industry-related magazines, reported as early as June 2020 that West Fraser had already restarted its production of lumber and plywood. Moving forward, if and when the economy and the communities reopen, the firm will emerge as an even stronger company than where it was in 2019. Aiding it on that journey is the acquisition of Norbord Inc. in November 2020, which per a Bloomberg report is the global leader in producing oriental strand board, and which will help the company expand its capital, products, and reach. A Reuters report on the same acquisition said that West Fraser will get Norbord’s plants located in Europe, giving the company a foothold in a new market. Also included in the deal is a stipulation to list West Fraser shares on the NYSE.

Considering these developments in 2020, the outlook for the company is looking upward. The effects of the acquisition such as opening a new market in Europe has not been fully realized in 2020 yet. Thus, as economies around the world reopen and as its home markets in North America consolidate its gains, the company stands to continue its upward trajectory. One possible downside is that the company does not manage to replicate its previous successes and instead underwhelms in its European venture. Nonetheless, the net profit from North America is in a healthy state even as it battles on from a year of economic downturns.

Source: MarketWatch

Balance Sheet and Cash Flow

There is a staggering difference in West Fraser’s 2020 year-end assets versus its liabilities, which makes for pleasant reading for potential investors. Total assets for 2020 Q4 were at $5.32bn, which was an increase from its 2019 Q4 level at $4.67bn. This was also up by 6.98 percent from the previous quarter, driven by a huge rise in its cash holdings and raw material inventory. Its cash rose by 87.54 percent quarter-on-quarter, with 2020 Q4 cash at $587mn compared to 2020 Q3’s 313mn. Inventory held in the form of raw materials also increased to $240mn, from the previous quarter’s $175mn. While this may signal a lack of demand, the biggest portion of total inventories was held in finished goods at $343mn, which helps to abet concerns that demand may have dried up. It also maintained its position of sitting on large receivables, as even with a 12.95 percent quarter-on-quarter decline, accounts receivable was still at $363mn at year-end 2020.

On the liabilities side, total liabilities were at $2.17bn at year-end 2020, slightly lower than the level reported at year-end 2019. This figure represents 40 percent of West Fraser’s assets. The company showed it can afford to service its short-term debts, erasing a 2020 Q2 short-term debt worth $358mn. Some concerning areas to look at are the accounts payable, income tax payable, long-term debt, and deferred taxes. Although the accounts payable was reduced quarter-on-quarter, it is still at $495mn, a number that is larger than its receivables. Long-term debt, meanwhile, was reduced to $637mn in year-end 2020, from 2020 Q1’s $710mn, though it remains at a high level. This figure represents 29 percent of the firm’s entire liabilities; thus it would be a positive development of the reduction of long-term debt to continue into 2021. Finally, the firm’s combined tax liabilities are at $448mn, with Income Tax Payable at $124mn and Deferred Tax at $324mn.

It is also noteworthy to see the total common equity of the firm rising to $3.16bn for 2020 Q4, compared to $2.82bn in the previous quarter. This is an effect of the NYSE listing in November 2020 as required by the Norbord acquisition, and is a boost to the value of the company as it seeks to expand further into new markets. As the NYSE-listed stocks are appreciated in 2021 Q1, this will provide an upside push in the shareholders’ equity front.

As previously referred to in both the income statement and balance sheet, West Fraser has had a strong 2020. Both its net profit and higher cash level had increased levels in the annual and quarterly perspective. Thus there will be no surprises that the company’s cash flow statements show a positive picture for the company. With Net income at $366mn, it has carried the bulk of the net operating cash flow of 2020 Q4 which was at $353mn. This enormous level has helped the company to produce a net addition of $274mn in its cash level. The area of concern of this statement is that net operating cash flow was down to $353mn, from $609mn. Free Cash Flow was $291mn, down from $549mn in the previous quarter. The silver lining is that it has managed to stay as a net inflow for the third straight quarter. These areas need to be monitored for the next quarterly reporting to check for signs of heaviness in costs or weakness in demand for sales.

Source: MarketWatch

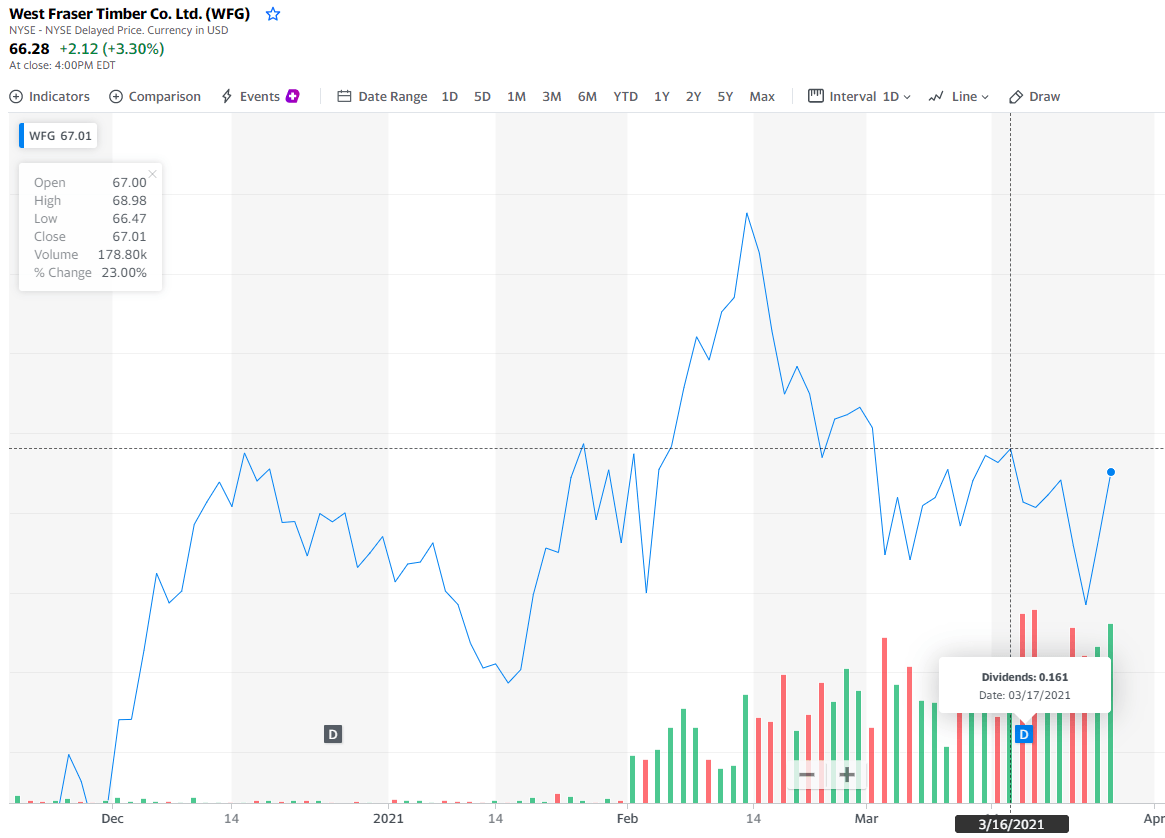

Stock Price

The NYSE-listed shares of West Fraser have gained year-to-date so far in 2021, with the close price for 26 March 2021 at $66.28. With the EPS at 5.33 and the P/E ratio at 12.44x, this implies that the stock still has potential for upside and that there is an expectation of future growth in the company’s income. The price-to-book ratio, meanwhile, is at 1.45, with the book value of the company at $45.78. While this amount is below the latest close price and may raise concerns of overvaluation, buying the stock can still be done as the P/B ratio is still close to the tolerable level with regards to considering whether a stock is over or undervalued. For conservative investors, it may be a put-off that the date required to hold the stock to receive a dividend has already passed. For more risk-tolerant investors, once the stock decides which way to trend in the last few days is established, an informed decision could be made. If the current rebound is a real and continuous rise, then this signifies the time to move in. However, if the rebound tapers off, the investor needs to watch whether the stock will move sideways or shed more of its 2021 gains. There might even be a possible entry point if such a correction happens, which would close the gap between the book value and the market price.

Verdict

The prospective investor should take note of the positives the company has done on three fronts and should monitor three concerns as well. Among the plus points for West Fraser is that it has managed to stay relevant and thrived in 2020, a year where a lot of other firms have struggled. It has emerged stronger and better positioned to expand its gains in 2021. The second is that it has widened the gap between its assets and liabilities. While managing to cut the liabilities it holds, the assets (especially cash) that it has under its account has boosted its assets further. It also sends a signal that the demand for its products and the ability for it to deliver the physical products demanded is continuing to be present. Finally, the acquisition of Norbord opens up frontiers in two markets. Norbord’s integration into West Fraser will help open up the European market for the company, thus expanding its business base and creating the potential for even more profitability. At the same time, it has already been exhibited that the listing of its shares in the NYSE has added to its capitalization. As the price of its stock increases, the better reputation and capital it can use to aid and expand its operations. While the price might be currently higher than the book value, there is possible further upside. Therefore, West Fraser’s stock should be a buy for investors seeking more value. For short to medium-term investors, there is a need to confirm whether the stock will end its rally and pare gains. Nonetheless, the stock looks to continue its current year-to-date gains in 2021.