NYSEAM:UEC - Post by User

Post by

mangoeon Feb 04, 2024 6:36pm

150 Views

Post# 35862171

⚡️As Justin points out👇the rapid rise of Spot #Uranium ❓

⚡️As Justin points out👇the rapid rise of Spot #Uranium ❓ Starting to see the first Corporate Presentations imputing $100/lb. uranium. Much more of this is coming from all developing companies AND from analysts w/ updated price targets. A new uranium price paradigm is upon us.

As Justin points out

As Justin points out the rapid rise of Spot #Uranium to over $100/lb is now beginning to be recognized by companies & analysts as a new base Spot price level

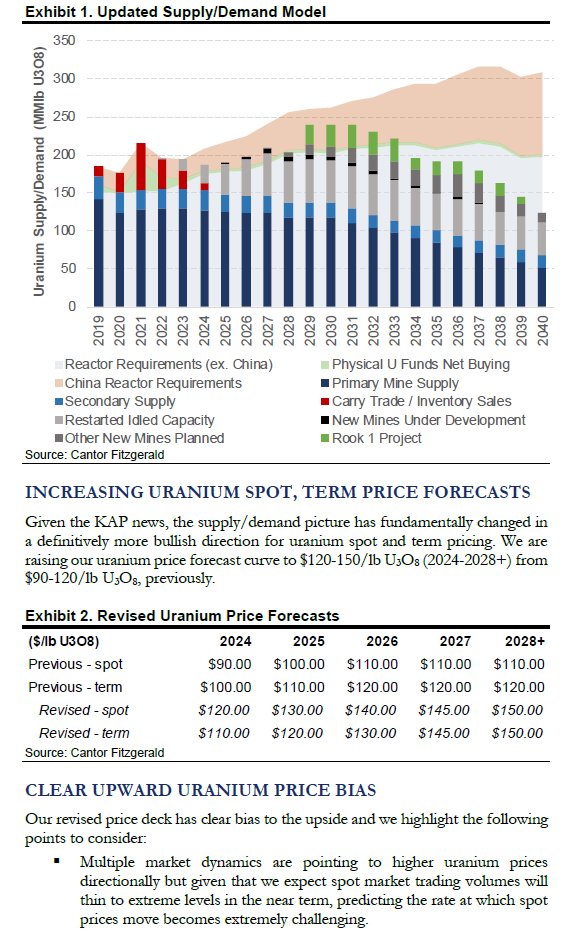

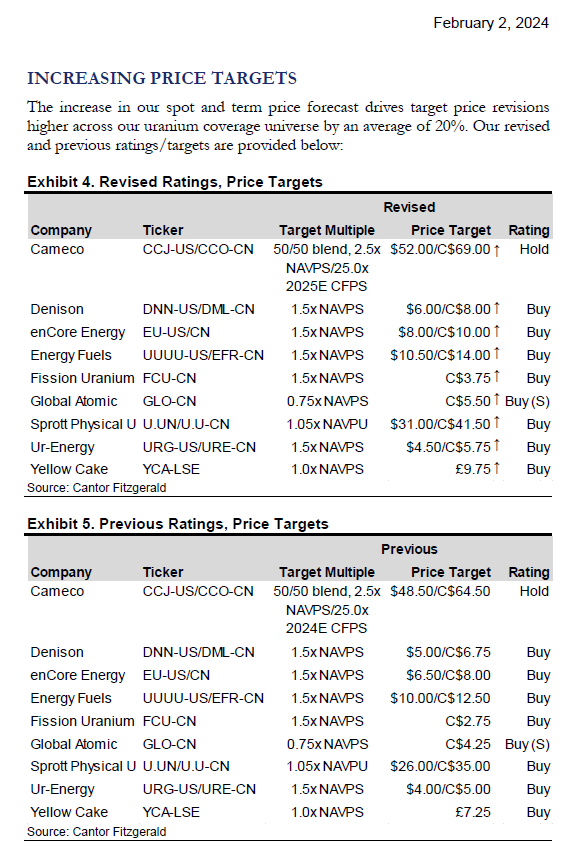

the rapid rise of Spot #Uranium to over $100/lb is now beginning to be recognized by companies & analysts as a new base Spot price level as this bull market enters its next upward phase.

as this bull market enters its next upward phase.

As happens for all spikes to new base levels, there's a necessary period of psychological adjustment in the minds of the observers who need time to process the change and adjust their outlooks going forward.

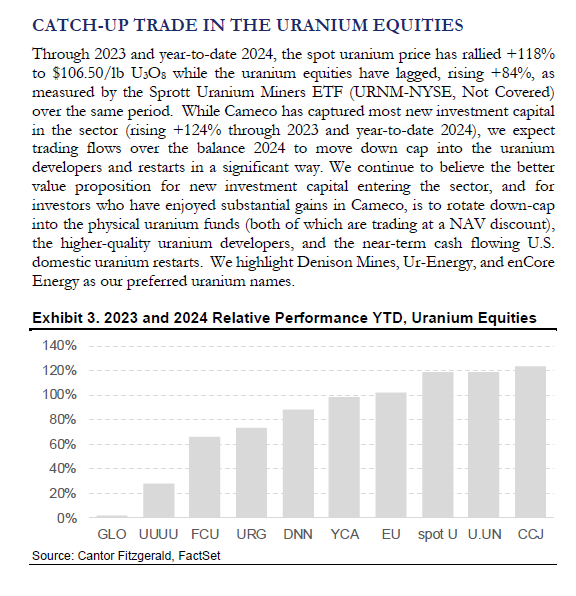

Consequently, the equities will usually lag

Consequently, the equities will usually lag as investors wait for analysts to digest the commodity price action, assess the new supply vs demand fundamentals, re-evaluate the in-ground uranium assets & NPV of future cash flow, and re-rate higher their Price Targets for the U mining stocks they cover.

as investors wait for analysts to digest the commodity price action, assess the new supply vs demand fundamentals, re-evaluate the in-ground uranium assets & NPV of future cash flow, and re-rate higher their Price Targets for the U mining stocks they cover.

The psychological process in coming to accept and embrace the new $100+ price level as the base price going forward is in a way similar to condo owners and buyers in the real estate market.

Having heard that the condo upstairs has just sold for $1 Million comes as a shock to condo owners who paid half that price a few years ago. There is disbelief and of course fears in the minds of potential sellers that this might just be an anomaly followed by falling prices in a blow-off top.

There is disbelief and of course fears in the minds of potential sellers that this might just be an anomaly followed by falling prices in a blow-off top.

Buyers are equally shocked by the prospect that they will have to pay a Million bucks for that condo they were hoping to buy at far lower prices. Both buyers and sellers will need time and data to get their heads wrapped around this seismic shift in price expectations, backing off from the market to see where prices settle out.

Both buyers and sellers will need time and data to get their heads wrapped around this seismic shift in price expectations, backing off from the market to see where prices settle out.

Then, other condos in the building begin to sell in similar Million dollar deals with prices inching higher.

Sellers begin to list their units at even higher Ask prices while buyers are making appointments with Mortgage Brokers to raise the bid limit on their pre-approved mortgages. The process of coming to accept that a Million bucks is the new minimum purchase/sales price is beginning to take hold. Minds are adjusting and with them their future price expectations.

Sellers begin to list their units at even higher Ask prices while buyers are making appointments with Mortgage Brokers to raise the bid limit on their pre-approved mortgages. The process of coming to accept that a Million bucks is the new minimum purchase/sales price is beginning to take hold. Minds are adjusting and with them their future price expectations.

Meanwhile, helping to solidify a Million bucks as the new base price for condos, a new entity as arrived on the scene that will buy whatever condos come onto the market at whatever price being asked, sight unseen: the Airbnb corporate enterprise buyer. These are the big companies looking to take large numbers of condos out of the homeowner's market and move them to the short-term rental income market

These are the big companies looking to take large numbers of condos out of the homeowner's market and move them to the short-term rental income market reducing liquidity and exacerbating the current housing crunch for those 'end-users' looking to buy a place to call home.

reducing liquidity and exacerbating the current housing crunch for those 'end-users' looking to buy a place to call home.

Over time, the Real Estate market reaches a new paradigm where Million dollar condos are the accepted norm.

What started out as Million dollar prices for the penthouse suites owned by the big guns (Cameco & SPUT) will gradually work its way down thru the building to the lower floors and eventually to even the most unattractive ground floor units.

What started out as Million dollar prices for the penthouse suites owned by the big guns (Cameco & SPUT) will gradually work its way down thru the building to the lower floors and eventually to even the most unattractive ground floor units.

That's the way things are headed now, imho, as SPUT, $YCA, hedge funds and other buyers of Spot #U3O8 support the new $100/lb base price as they take lbs out of the Nuclear fuel market to hold for investment income that exacerbates the reactor fuel supply crunch

driving prices higher with volatility along the way.

driving prices higher with volatility along the way.

Adjusting one's psyche to rapidly rising uranium prices takes time... so be patient. The big guns like Cameco & SPUT will move first as we have seen so far in this bull rally, but as the Spot price continues moving higher, or rests for a while near the $100/lb plateau, we will see investors in U mining stocks come to recognize the upside potential on offer and bid up the developers and explorers to catch up with the leaders. It's happened before in bull markets and will play out that way again in this one, in my humble opinion.

The big guns like Cameco & SPUT will move first as we have seen so far in this bull rally, but as the Spot price continues moving higher, or rests for a while near the $100/lb plateau, we will see investors in U mining stocks come to recognize the upside potential on offer and bid up the developers and explorers to catch up with the leaders. It's happened before in bull markets and will play out that way again in this one, in my humble opinion. Stay long and prosper!

Stay long and prosper!