|

Figure 1.Subject Company's Logo

|

Abcourt Mines Inc. (TSX-V:ABI)

Abcourt Mines Inc. is a Canadian-based mineral exploration mining company listed on the TSX Venture Exchange (ticker symbol ABI) (US Listing: ABMBF) (Frankfurt: AML). The Company has come to our attention due, in part, to the exceptional opportunity afforded shareholders as ABI.V advances two near term production scenarios in northwestern Quebec, Canada.

Abcourt has plans to take back into production both the once producing open-pit Abcourt-Barvue Silver-Zinc Mine and the once producing underground Elder gold mine. The Elder gold project is the priority as it is relatively low capex and a very near-term cash flow scenario. Production at the silver-zinc operation was put on hold in 1990 when silver prices were falling and there was an anticipated drop in zinc prices. The Elder Gold mine too had a similar occurrence when gold metal prices faulted in the late 80s, some equipment was sold and some was mothballed at both mines for a timely reemergence. It now appears that conditions are in place for a highly profitable operation at both mines. The current infrastructure value (replacement value) alone on Abcourt's two past producing projects is over CAD$20M; the current market cap of ABI.V is close to its infrastructure valuation alone, ignoring the sizeable economically recoverable resource deposits (1 billion+ dollars in Zinc and silver alone) that are wide open for expansion, and the 215K+ oz gold resources at Elder. The Company has no long term debt and has managed to maintain and upgrade its properties, equipment, and resources during the hiatus.

Summary of Abcourt Mines Inc.'s current resources at all its properties:

(NOTE: the Elder gold mine project is expected to have a revised resource calculation by the end of March 2012)

|

Description 43-101

|

Tonnes

|

Au

g/T

|

Ag

g/T

|

Cu

%

|

Zn

%

|

Gold

ounces

|

Silver

ounces

|

Copper

M.T.

|

Zinc

M.T.

|

|

Elder, M & I (to be revised soon)

|

805,028

|

6.5

|

---

|

---

|

---

|

168,137

|

---

|

---

|

---

|

|

Elder, Inferred (to be revised soon)

|

237,289

|

6.1

|

---

|

---

|

---

|

46,722

|

---

|

---

|

---

|

|

Abcourt-barvue, M & I

|

7,018,969

|

0.138

|

61.19

|

---

|

3.33

|

31,145

|

13,810,000

|

---

|

234,000

|

|

Abcourt-Barvue, Inferred

|

1,505,687

|

0.138

|

120.53

|

---

|

2.98

|

6,681

|

5,835,384

|

---

|

45,000

|

|

Description

Historic Resources

|

Short tons

|

Au

oz/T

|

Ag

oz/T

|

Cu

%

|

Zn

%

|

Gold

ounces

|

Silver

ounces

|

Copper

M.T.

|

Zinc

M.T.

|

|

Vendome-Barvalee

|

903,000

|

0.036

|

1.73

|

0.48

|

8.07

|

32,500

|

1,562,000

|

4,000

|

66,000

|

|

Aldermac-old mine

|

623,480

|

---

|

---

|

1.60

|

2.00+/-

|

---

|

---

|

9,000

|

11,000

|

|

Aldermac - new orebody

|

1,150,000

|

n/a

|

n/a

|

1.50

|

4.13

|

---

|

---

|

16,000

|

43,000

|

|

Jonpol

|

2,807,000

|

n/a

|

1.11

|

1.12

|

0.96

|

---

|

3,116,000

|

29,000

|

24,000

|

|

Total historical

|

5,483,480

|

n/a

|

0.85

|

1.15

|

2.91

|

32,500

|

4,678,000

|

58,000

|

144,000

|

Mining MarketWatch Journal provides insight into both of the Abcourt's main projects below.

Project Overviews

1) Elder Gold Mine Project (& adjacent Tagami gold property), Quebec - 100% owned

From 1944 to 1964, the Elder Gold Mine produced 350,000 ounces of gold, it is now poised to go back into production as a priority for Abcourt. By the end of this March both dewatering of the mine and a new resource calculation are expected to be complete, within ~1 month thereafter a preliminary economic assessment (PEA) is expected. Subject to a favorable PEA, Elder Gold Mine may only require nominal development costs (~$10M possibly) to access the new ore at these levels and begin extracting ore for processing at local custom mill(s) generating substantial revenue with a capex payback of close to 1 year. Mining MarketWatch Journal projects (~135,000 tonnes per year at a grade of 6+ g/T) 22,500+ oz gold per annum at a cash cost of ~US$650.

|

Click To Enlarge Image of the Region

|

Click To Enlarge Image Showing ABI's Orientation

|

Location: The Elder mine property is located 10 kilometres northwest of Rouyn-Noranda, Quebec. The property comprises 24 contiguous claims and a mining concession covering an area of 587 hectares. There are several small royalties payable on different parts of the Elder property.

|

|

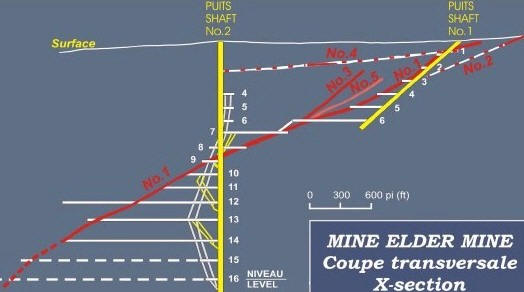

Figure 4. Elder Gold Project Near Rouyn-Noranda, Quebec. The mine is equipped with functional buildings and most of the surface and underground equipment with a 2,600-ft shaft and 16 levels.

|

|

Infrastructure:

Surface installations include an office, a service building, a hoist room with a 6-foot hoist and a shaft building. The mine is serviced to a depth of 792 meters (2,600 feet) by two shafts and 14 levels. All mining facilities are in place and about 50% of the mining equipment is available. The re-opening of the mine could be done rapidly.

|

NI 43-101 Gold Resource Estimate on Elder Gold Mine:

Note this will change soon as a new resource calc is expected by the end of March 2012

Measured and Indicated resources: (3.8 grams/tonne Au cut off grade) 805,028 tonnes @ 6.5 grams/t. Au

Inferred resources: (3.8 grams/tonne Au cut off grade) 237,289 tonnes @ 6.1 grams/t. Au

Figure 5.Levels of Elder Gold Mine

It is expected Abcourt will begin first by extracting ore from the limit of the old 5th, 6th, 7th, 8th and 9th levels of the mine where the bulk of the ore is.

|

Click To Image to Enlarge [PDF]

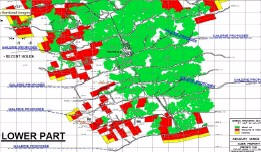

Upper section of Elder Mine colour coded according to resource category

(Measured & Indicated in red, Inferred in yellow)

|

Click To Image to Enlarge [PDF]

Lower section of Elder Mine colour coded according to resource category

(Measured & Indicated in red, Inferred in yellow)

|

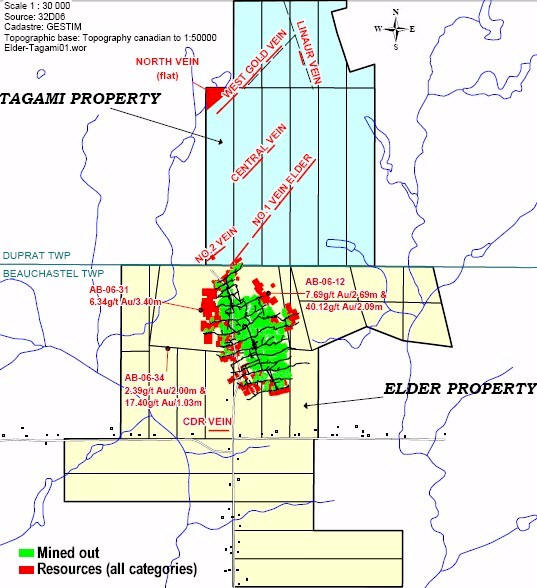

Figure 7.Abcourt's Elder & adjacent Tagami property

The upcoming resource calculation should be noticeably higher (Mining MarketWatch Journal projects north of 350,000 ounces in all categories) as it will incorporate a lower cut-off grade and include recent drilling, including 36 holes drilled on the north-eastern half of the West gold zone which indicates a potential of 225,000 tonnes with a grade of 8.12 grams of gold per tonne above a depth of 150 meters.

In 2011 Abcourt drilled ~5000 metres on Elder and the adjoining Tagami property. On Tagami ABI.V found a new zone (now called the number 7 zone now) parallel with the number 1 zone. This new zone represents a significant find for the company and is expected to yield interesting values in the future as the Company tracks and drills it from the existing levels underground once dewatering is complete.

Related releases regarding 2011 drilling and activities on Abcourt's Elder & Tagami

January 26, 2012 "The dewatering of the Elder mine will be completed in 2 months and a revised 43-101 resources estimate will be available also in 2 months"

July 5, 2011 news release "Four holes drilled by abcourt on Tagami property intersected excellent gold values"

May 16, 2011 news release "Additional excellent drilling results obtained at the eastern end of Elder mine and a new mineralized zone discovered 165 meters below the main zone"

May 12, 2011 news release "The Dewatering of the Elder Mine was started at the beginning of May"

March 4, 2011 news release "Diamond Drilling at the West End of the Elder Mine Extends the Main Vein and Several Holes Intersects More Than One Zone of Mineralization".

January 17, 2011 news release "Abcourt Continues to Expand Mineralized System at Elder Drilling Intersects 6.07 g/t Gold Over 10.9 Meters".

Metallurgy - 95% recoveries on gold at Elder

In the 1980s Abcourt had some lab test done. It had 3 bulk samples, 2 were shipped to the Cambior mill and the other was sent to Noranda as flux; cyanidation showed 95 % recoveries on gold.

Elder Gold Mine Economics

-

The Elder mine can be brought back into full production in the near term, within 6 - 15 months following a favorable PEA.

-

Production rate, based on the existing 43-101 resources, is foreseen at 135,000 tpy, thus producing about 25,000 ounces of recoverable gold per year over a period of 8 to 9 years using the current M & I numbers, however the new upcoming resource calculation (with its lower cut-off and addition of recent drilling numbers) is expected to considerably increase the mine life.

-

At the beginning, the ore could be shipped to a number of potential mills. Mining MarketWatch Journal has confirmed with Abcourt that they have been actively courted by local mills recently for samples of Elder ore -- there is ample unused milling capacity within a 150 km radius of Elder.

-

Projected cash cost is estimated at US$600-650 per ounce of gold. Cash flows with gold at US $1,300/ounce and a rate of exchange of CAN $1 = US $1.00 are estimated at about CAN $17.0M per year for a period of more than 8 years using the current resource (longer using the upcoming).

-

Payback on capex to period at the above gold price would be about 1 year. Eventually Abcourt would want to build a mill if justified (add ~$15M).

Elder Mine Geological Context

• The Elder mine is located in one of the two granite/diorite batholiths located north/north-west of Rouyn-Noranda where several gold zones have been found and mined.

• The area is cut by several major faults.

• The ore is found in subsidiary shears or fractures, often associated with an altered diorite dyke.

• The junction of faults, shears or fractures is often the site of enlargement and enrichment of the veins.

Large resource growth potential: The Elder property has very large resource expansion potential, in fact very good values over substantial widths were intersected on the bottom levels of the mine in 1989 (see values here) before the mine was closed. Consequently, the ore potential at depth is very good and needs to be tested. Dewatering the mine will allow drilling in drifts on the lower levels, Abcourt is able to dewater for the purposes of drilling the lower levels using flow-through dollars -- serendipitously this also opens up the vein as is necessary for readying the mine for going into production. Elder is currently developed to ~2000 feet and has large resource expansion potential; it is open at depth and along strike, plus 2011 drilling revealed a new gold zone just under the old one. Greenstone belts run deep, there are mines at 8,000 – 10,000+ feet and statistically over the life of the mine many produce ~8 times the original estimates.

Estimated capital costs required to take Elder to production:

|

1- Dewatering of mine, new resource calculation, and PEA

|

CDN$ 1.6M

|

|

2- Lateral development and underground diamond drilling

|

CDN$ 10 M

|

|

3- Purchase of equipment and working capital

|

CDN$ 4.9 M

|

(If the mill Abcourt uses has a 1000 TPD capacity then Abcourt will need to stockpile ~30,000 tonnes in order to begin supplying the mill)

------ ------ ------ ------ ------ ------

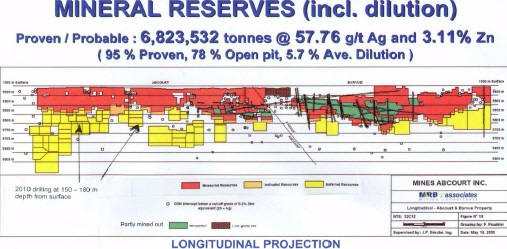

2) Abcourt-Barvue Silver-Zinc Mine Project (& Satellite Properties) - 100% owned

Abcourt-Barvue is an advanced past producing open pit silver-zinc mine project. Abcourt-Barvue Mine's total production from open pit (1952-57) & underground (1985-90) operations was 8.87M oz Ag and 198,850 t Zn.

The Abcourt-Barvue project is an advanced past producing open pit silver-zinc mine project with infrastructure in place and a resource of 19,644,354 ounces Silver, 278,820 Metric Tonnes Zinc (in all categories). A feasibility study is in place on a 500 million lb. Zn, 13+ million ounce Ag orebody over a 13 year minelife based on a 650,000 TPY (tonnes per year) operation. Abcourt has plans to improve on the this to 1 million TPY operation. To take this project to production Abcourt will require ~CDN65M for completion of its programs to upgrade and augment its already sizeable silver and zinc resources, ready the pit, and build a 1M TPY processing facility.

Location: The Abcourt-Barvue property unifies two past producers located at Barraute, 60 kilometers (35 miles) north of the mining community of Val-d'Or, Quebec. It covers 3,452 hectares with 85 claims and two (2) mining concessions.

Resource:

|

Abcourt-Barvue & base metal satellite properties

diversified mineral resources, 43-101 and historic:

|

366,065 tm Zn; 24 M oz Ag; 66,000 oz Au; 55,500 tm Cu

|

|

Abcourt-Barvue proven & probable ore reserves:

|

6,823,532 t grading 3.11 % Zn and 57.76 g/t Ag

|

|

Abcourt-Barvue measured & indicated resources:

|

562,748 t grading 3.76 % Zn and 71.26 g/t Ag

|

|

Abcourt-Barvue inferred resources:

|

1,505,678 t grading 2.98 % Zn and 120.53 g/t Ag

|

Figure 9. (above) Abcourt-Barvue proven & probable ore reserves Click image to enlarge as PDF.

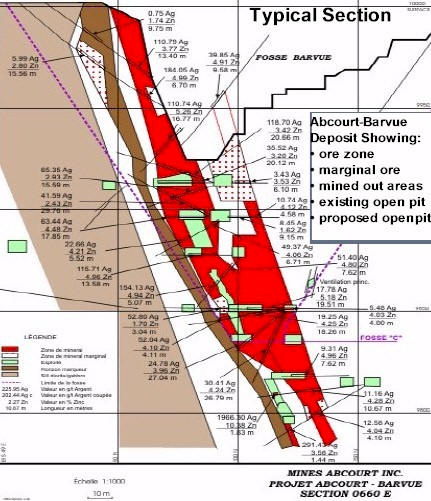

Figure 10. (above) Typical Section Abcourt-Barvue Deposit, showing ore zone, marginal ore, mined ore, mined out areas, existing open pit, proposed open pit.

Feasibility Study in Place for 13 yr mine life

A feasibility study was completed in 2007 for the building of a mill and the opening of an open pit mine at Abcourt-Barvue mine at Barraute, north of Val-d'Or, Quebec, Canada.

|

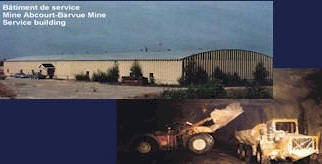

Figure 11. Existing infrastructures are evaluated at CAD$12M (service building, decline, shaft, underground drifts and equipment)

|

Figure 12. Proposed Facility. Pre-production capital costs are estimated at $46.1 - $60M. A few years ago Abcourt purchased a used 2500 TPD mill, dismantled parts of it and moved the equipment over to its Abcourt-Barvue site in order to help accelerate matters when the go ahead is given to proceed. Abcourt will also save on pouring concrete for the foundation as the old mill foundation is still usable. Once capitalized to proceed (either via IPO, JV, or debt) the mill operation could be completed and ready for production in ~2 years.

|

The feasibility study was based on an orebody of 500 million lb. Zn and 13+ million ounce Ag over a 13 year minelife, however drilling since to upgrade and augment the resource along with improved metrics and the acquisition of Xstrata's interest in the nearby Vendome property appear to justify upgrading the original plans of building for a 650,000 TPY (tonnes per year) operation to 1 million TPY (2,740 TPD). Increasing the operation to a 1 million TPY operation has the benefit of reducing the total overall operating costs by ~$5 per tonne. The increased capacity also allows Abcourt to process the marginal material (there is a zone with ~4M tonnes with a grade of 1.6% zinc and 1/2 an ounce of silver). Under the 650,000 TPY scenario it would have been necessary to sequester the marginal material which involves long term environmental concerns and costs, but with increased capacity ABI.V can simply run it through the mill and deal with it, extract revenue from it without having to be selective in the pit, and can have a large drill pattern.

The acquisition of Xstrata's interest in the nearby Vendome property (See related February 28, 2011 release entitled "Abcourt Purchases an Interest in the Vendome Base Metal and Gold Property at Barraute, Quebec") is key to the plan as it contains a massive to semi-massive ore zone with what is believed to be over a million tonnes of resources (non 43-101 compliant), the copper, silver, and gold byproducts alone on the Vendome would total ~$90 per tonne (at Q1 2012 market prices) plus there is the ~8% zinc. This is only 13 km away from the Abcourt-Barvue Silver-Zinc Mine. Add Vendome to the Abcourt-Barvue project and it improves the economics quite a bit; in simulations (non NI 43-101 compliant) the internal rate of return goes from 25% to 33%.

Recent Drilling

Recent drilling at Abcourt-Barvue to augment and expand the resource support the belief the 13 year minelife can now be expanded to support a 1 million TPY (2740 TPD) operation. Abcourt is essentially at the point where it could rework numbers for a new improved feasibility to take to the marketplace.

Related releases regarding drilling on Abcout-Barvue-Vendome

February 15, 2012 news release "Abcourt Intersects 1,386.16 g/t Silver, 5.57% Zinc over 4.7 meters on past producing Abcourt-Barvue Property"

November 21, 2011 news release "Diamond drilling at Abcourt-Barvue property continues to intersect excellent silver values"

August 9, 2011 news release "High grade values intersected at Vendome property in four holes confirm historical data"

August 2, 2011 news release "Diamond drilling at abcourt-Barvue property continues to intersect excellent silver values"

June 16, 2011 news release "Hole AB11-31 Drilled at Abcourt-Barvue intersected 4.5 meters grading 239.43 grams of silver per Tonne and 2.09% Zinc"

May 25, 2011 news release "Abcourt Mines: Hole AB11-24 Drilled at Abcourt-Barvue Intersected 4.9 Meters Grading 300.99 Grammes of Silver Per Tonne and 3.05% Zinc",

April 26, 2011 news release "Drilling at Abcourt-Barvue Continues to Intersect Two Bands of Mineralization With Excellent Values in Silver and Zinc"

February 15, 2011 news release "Drilling at Abcourt-Barvue Continues to Intersect Two Bands of Mineralization With Excellent Values in Silver and Zinc Over Good Widths"

Abcourt is in possession of permits for dewatering the Abcourt-Barvue open pit and building a water treatment plant. The technical team has also selected a site for the tailings pond which was approved by the government and Abcourt has a lease on the tail end of the orebody (the ore body exceeds the limit of the main mining concession so Abcourt has a lease for the remaining part of the orebody).

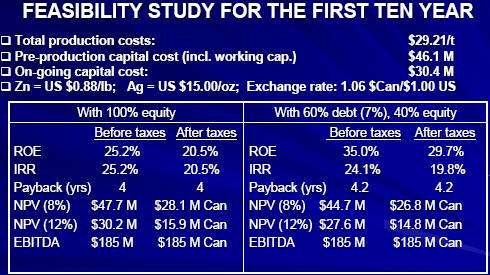

Feasibility Metrics: (variations of the feasibility study and within the sensitivity analysis)

Note: When looking at the number below remember the feasibility was prepared in 2007 using US

.88/lb zinc and US$15/oz silver. Since then silver has risen dramatically to the point that if the ore body was mined (in operation) now it would be exceptionally more so profitable as there is 13+ million ounces of silver pegged for extraction in this feasibility. The silver in the orebody is as valuable as the zinc now. As far as the zinc prices are concerned, there are not a lot of zinc properties in Canada (maybe 5 zinc juniors), it is a limited space and the main rebound in zinc will come as a result of availability; many zinc projects are closing globally and it is generally agreed amongst experts there will be a contraction in supply which should translate to rise in price.

Estimate for 650,000 TPY:

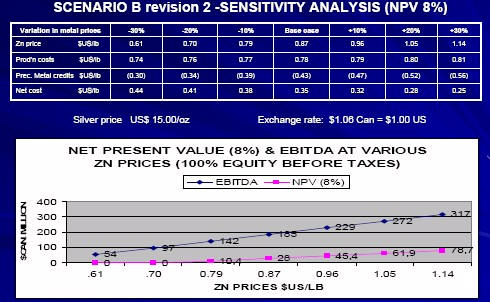

Scenario B revision 2 - sensitivity analysis (NPV 8%):

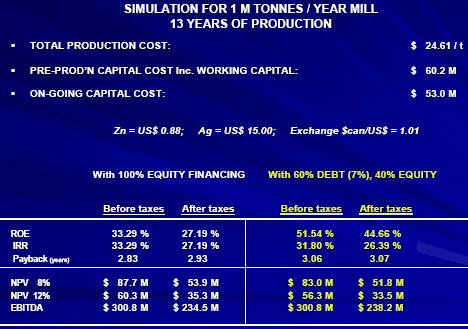

Simulation for 1M TPY mill - 13 years of production:

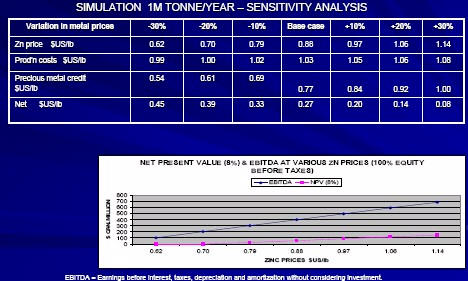

Simulation 1M Tonne/Year - Sensitivity Analysis:

History of the Property

In 1950, zinc was discovered on surface on the Barvue claims. An intensive drill program soon confirmed an important zinc-silver ore body. From 1952 to 1957, an open pit mine was operated by Barvue Mines Limited and produced 3,200 metric tonnes per day. The open pit reached a depth of 76 m (250 feet) and preparation work for underground mining was well advanced by the excavation of a ramp and sub-levels at 15-meter (50-foot) intervals between the 76-meter (250-foot) and the 152-meter (500-foot) depth.

Barvue Mines, which later became Manitou-Barvue Mines Limited, spent about $11 million to open the mine and produced 5,500,000 short tons of ore grading 1.13 ounces of silver per short ton and 2.98% zinc (equivalent to 6,200,000 ounces of silver and 164,000 tons of zinc). Following a drop in the price of zinc, the mine was closed. The Barvue property was purchased by Abcourt in 1983. A

.25 per short ton royalty is payable to a former owner.

The original Abcourt property is adjacent to the Barvue property and is on strike with the ore zone.

The joint Abcourt-Barvue property, was placed into production by Abcourt in 1985 after an expenditure of $20 M. At that time, the ore was extracted underground and hauled by trucks to Matagami, a distance of 250 km (150 miles) to be custom milled by Noranda Mines Ltd. In 1990, with falling prices for silver and an anticipated drop in the price of zinc, production was stopped. Abcourt produced 697,016 short tons of ore grading 3.84 ounces of silver per short ton and 5.04% zinc representing 2.67 M ounces of silver and 34,850 tons of zinc.

Select Observations on the Orebody

The ore at the Abcourt-Barvue mine is found in several ore shoots over a distance of 2.2 km (7,000 feet) in a major corridor of deformation that runs across the property in an east-west direction. The ore is found in altered volcanic rocks and dips at approximately 75 degrees to the north. This mine has barely been explored below the 300-meter (1,000-foot) depth, and within the Abitibi region, similar deposits have reached depths ranging from 1,000 to 2,000 meters (3,300 to 6,600 feet).

The resources at Abcourt-Barvue were revised in 2006 by an independant qualified engineer in accordance with National Instrument 43-101. Open pit measured and indicated resources are 5,126,129 metric tons with a grade of 46.65 g/t silver and 3.30% zinc for a total of 7.7 M ounces of silver and 169,352 tonnes of zinc. The underground measured and indicated resources total 1,389,734 tonnes with a grade of 101.36 g/t silver and 3.40% zinc. In addition, there are 1,505,687 tonnes of inferred resources with a grade of 120.33 g/t silver and 2.98% zinc.

The Abcourt-Barvue deposit is characterised by some high grade silver values (mainly in the Abcourt zone), requiring that a high grade assay cutting value be established in order to reduce the risks of overestimating the total silver content of the deposit. The high grade assay cutting value has been established by ABCOURT. A high grade cutting value of 15 oz/s.t. Ag was used by ABCOURT during previous mining operations (between 1985 and 1990) and in previous resource estimates. For zinc, no cutting value was used.

Based on $10.00 US per ounce for silver, $1.00 US per pound for zinc and a rate of exchange of

.86 US per $1.00 Can, it was found by ABCOURT that 1 ounce of silver in the ore is equivalent to 0.65% zinc. With the prices indicated above and estimated mining costs, the following cut-off grades were established by Abcourt for different mine sectors:

Abcourt open pit = 2.4% zinc equivalent

Barvue open pit = 2.55% zinc equivalent

Underground = 3.20% zinc equivalent

Mining-Friendly Jurisdiction & Neighborhood

Quebec is unanimously agreed in the mining community to be a stable, mining friendly region and is ranked the #3 jurisdiction by the Fraser Institute for Current Mineral Potential assuming current regulations and land use restrictions, and #1 in the entire world under the policy index alone; Ranking within the Fraser Institute's Annual Survey of Mining Companies released April 2010 may be viewed here.

Abcourt's key properties are located along Quebec's Cadillac Fault in the prolific Val D'Or (Valley of Gold) District of Quebec. Val D'Or is in the hub of mining in Eastern Canada. The Val D'Or district, with the exception of Nevada, is considered by many industry professionals as the most mining-friendly district in North America. The Province of Quebec is judicially expedient in facilitating mining permits and provides colossal tax incentives for exploration and tax concessions for off-periods. Abcourt is the beneficiary of such exploration tax credits and concessions; having taken advantage of exploration incentives (35 cents credit for every $1 spent) and been allowed a tax-loss carry-forward (from when they mothballed operations in 1990 until present) that may be credited towards profits when they reopen - several millions will be added to the bottom line in Abcourt's case.

Several large mining players are in the vicinity of Abcourt. Either producing or developing miners in this mineral rich area include the likes of Agnico Eagle, IAMGold, Richmont, Breakwater and Xstrata.

: Skip to top

Renaud Hinse, P. Eng., President, Director, CEO, Mining Engineer

Renaud Hinse has extensively worked within the Quebec mining industry for over 50 years. Mr. Hinse has received his degree as mining engineer from Laval University Quebec, Canada and metallurgical sciences certificate from the Royal Technical College Glasgow, Scotland.

Dr. C. Jens Zinke, Ph.d., Director

Dr. C. Jens Zinke graduated as a Mining Engineer specializing in geophysics. He obtained a Ph.D. in Geophysics from the University of Frankfurt, Germany and completed post doctorate work with Stanford University in California, U.S.A. Dr. Zinke is currently employed as the Vice President Business Development and Concentrate Marketing of Canadian Royalties Inc., a company that is developing a copper-nickel project in Québec, Canada. Canadian Royalties Inc. is now majority owned by Jilin Jien of China but was previously a public company that traded on the Toronto Stock Exchange. In addition to his current role, during his tenure with Canadian Royalties, Dr. Zinke held various senior management positions including Vice President Business Development and Interim Chief Financial Officer. Dr. Zinke has also been, since June 2003, a director of Golden Valley Mines Ltd.

Glen Mullan, BSc., Director

Mr. Mullan obtained a Bachelor of Science degree in geology from Concordia University in Montreal, in 1992. He is a member of the Order of Geologists of Quebec. From 1998 to 2009, Mr. Mullan served as Chairman of the Board and as Interim President of Canadian Royalties Inc and he was instrumental in the development of a major copper-nickel project in Northern Quebec. Mr. Mullan is also an officer of a few junior exploration companies.

Marc Filion, Ph. D, M.B.A., Director - Consultant

Marc Filion has more than 30 years of experience in the development and management of capital intensive world-class industrial projects in joint venture with international business partners including the negotiation, start-up and management of international projects as well as in marketing engineering and construction projects in the energy, light and heavy industrial and environmental sectors in Canada, Europe, Southeast Asia, the Middle East, Africa and South America. His career path includes lengthy assignments in Great Britian, France Niger and Thailand, thus providing experience in project management, strategic planning at home and foreign markets and in the development of business in culturally different environments.

Charles Bélanger, P. Eng., M.B.A., Consultant

Charles Bélanger brings over 30 years of mining experience primarily in north-western Quebec.

Jean-Pierre Bérubé, P. Eng., Geological Engineer, consultant

Jean-Pierre Bérubé is a geological engineer with 25 years experience in mines and mining exploration, mainly in Quebec, Canada as well in the USA, Guyana and Honduras.

Note: This list is not intended to be a complete overview of Abcourt Mines Inc. or a complete listing of Abcourt' projects, Mining MarketWatch urges the reader to contact the subject company and has identified the following sources for information on Abcourt Mines Inc.:

For more information contact Abcourt 's head office at: Ph

819.768.2857

Company's web site:https://www.abcourt.comSEDAR Filings:URL

|

|

|

|

|

|

|

Welcome to Mining MarketWatch

We provide insight into resource companies, many which are so often overlooked gems and can provide exceptional potential to richly reward investors. The companies we select offer outstanding properties, management and experience in the mining/exploration industry.

O Free Newsletter/Membership

| Sector NewswireTM Editorials:

|

Sector NewswireTM Top News Stories:

Europe’s Woes Show in TradeFebruary-17-12 6:00:11 PM

Total global exports were higher in 2011 than before the credit crisis, but European countries in general still lag while some ...

Google Tracking iPhone Users?February-17-12 6:00:08 PM

Data mining has become a touchy issue for big tech and advertising companies that have found themselves walking a tightrope ...

Dumping China for American Job ShopsFebruary-17-12 6:00:07 PM

U.S. small businesses that initially rushed to Chinese factories to get their products made are now dumping them for American ...

|

/www.kitco.com"> www.kitco.com]" border="0" height="124" src="https://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif" width="172" />

/www.kitco.com"> www.kitco.com]" border="0" height="124" src="https://www.kitconet.com/charts/metals/silver/t24_ag_en_euoz_2.gif" width="172" />

/www.kitco.com"> www.kitco.com]" border="0" height="124" src="https://www.kitconet.com/charts/metals/platinum/tny_pt_en_caoz_2.gif" width="172" />

/www.kitco.com"> www.kitco.com]" border="0" height="124" src="https://www.kitconet.com/charts/metals/palladium/t24_pd_en_bpoz_2.gif" width="172" />

|

|