The bullion banks are using today’s orchestrated takedown in gold to cover shorts.

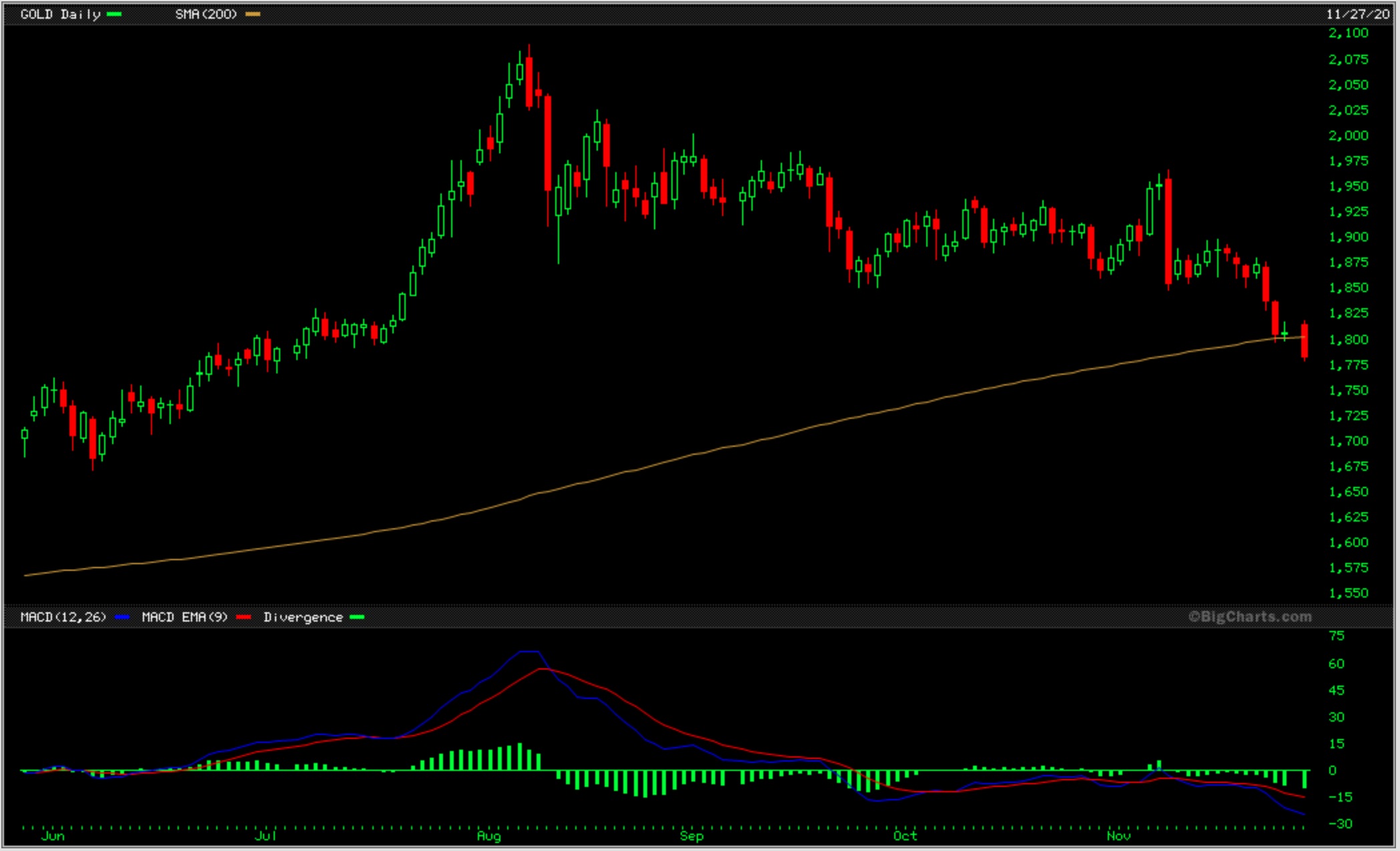

November 27 (King World News) – KWN warned global readers three days ago that the bullion banks would take the price of gold below the 200 day moving average ($1,798) in order to trigger sell stops and create additional technical selling. Today we are seeing that expected takedown in the gold market as the price of gold has already tumbled $33 to $1,773 (see chart below).

You can be sure the bullion banks are using today’s orchestrated takedown to cover gold shorts. This type of takedown is almost always short and sharp before reversing higher, allowing just enough time for bullion banks to cover gold short positions…

US Dollar Close To Hitting New Lows

It is also worth noting that this plunge in the gold market is taking place with the US dollar very close to hitting new lows (see chart below).