In looking at Hexo's (HEXO) most recent financials, it is easy to discard the company as a viable investment given how its net loss had increased by 785% from the prior year. Dig deeper into the numbers and investors will see there are a few areas that are in Hexo's favor.

In looking at Hexo's (HEXO) most recent financials, it is easy to discard the company as a viable investment given how its net loss had increased by 785% from the prior year. Dig deeper into the numbers and investors will see there are a few areas that are in Hexo's favor.

My thesis of Hexo being a long-term investment continues. Despite a pandemic and a weak economy, Hexo is still a worthwhile investment for patient investors.

Hexo Sales Had Improved Under a Recession/Pandemic

Q4-2020 marked a turning point as its net revenue per gram for adult use cannabis showed an increase of $2.95 from $2.22 the prior quarter:

(Source: Hexo's 2020 Annual Report)

Its adult-use (beverage) shows a drop in revenue per gram but management has stated it has to do with how accounting is measuring the revenue. As Hexo reaches economies of scale, its net revenue per gram will inch upwards.

Medical cannabis saw its net revenue per gram decrease but medical cannabis sales never contributed much to Hexo's bottom line anyway.

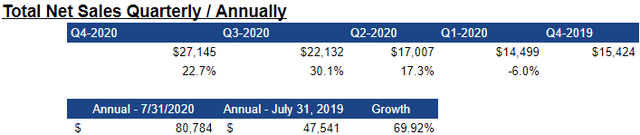

On a consolidated basis, Q4-2020 saw an increase of 22.7% in sales over the prior quarter. This was the quarter when businesses were forced to shut down because of the pandemic and when the economy fell of a cliff. So a 22.7% increase of sales compared to the prior quarter of 30.7% is not a bad figure:

(Source: Hexo's 2020 Annual Report)

On an annual basis, its sales had actually increased by 69.9%.

Another reason why the net loss was particularly bad this year is because of the large impairment cost Hexo took in Q4-2020. Taking a huge impairment charge hits the accounting books but it also means inventory will be more realistic to the current market going forward:

(Source: Hexo 2020 Annual Report

Backing out this impairment charge adds back almost $200 million to Hexo's bottom line. So the loss would be closer to $346 million vs. the current reported figure of $546 million.

Truss (Adult-Use Beverage) Has First Mover's Advantage

Another highlight is its adult-use beverage business, since Oct 2018 when Hexo had launched Truss in a partnership with Molson Coors (TAP), Hexo has been spending on research and adapting its Belleville facility to launch a cannabis beverage. Q4-2020 marked its first full quarter of selling adult-use beverages and we are only starting to see the full benefits:

- As reported by management, it has sold more beverages than any single competitor in Canada.

- Its partnership with Molson Coors is reaping huge dividends because Molson Coors has the market reach to sell its beverages across the country. An advantage other smaller producers do not have.

- It appears management had planned out its production capacity for the next 5 years because it doesn't seem like it will hit its production limit any time soon.

These factors have given Hexo a first mover's advantage and over the longer term, it is going to help accelerate its beverage sales. Also, I believe Hexo's success in the beverage business has spurred its competition to act. In early November, Aphria (OTC:APHA) purchased an Atlanta beermaker SweetWater for $300 million. In Aphria management's words, the intent of the acquisition was to:

"Our 420 brand offerings and SweetWater 420 Fest complement Aphria’s cannabis business and create mutual opportunities for accelerated expansion into other cannabis- and beverage-related products in the U.S. and Canada..."

In a way, I see Aphria's purchase of SweetWater as a validation of Hexo's beverage strategy. In the short term, I see Hexo or Truss maintaining an advantage in the beverage space as other competitors try to catch up.

Hexo's Renewed Focus on Internal Processes

In recent months, we have heard Hexo management state growth will either come from partnerships and through process improvements. While other cannabis producers are merging and making acquisitions, Hexo has focused on improving its supply chain and develop a better product.

This type of strategy has its advantages and disadvantages. Acquiring another company could give the buyer access to new technology and an instant boost to production capabilities, like Aphria's purchase of SweetWater.

However, the downside of an acquisition is there could be more problems than benefits. Hexo saw this firsthand when it purchased Newstrike. In about a year after Hexo's purchase, there were reports that a Newstrike facility was growing cannabis without a license, there was also a lawsuit from MediPharm to former Newstrike claiming $9.8 million of unpaid bills, and the eventual sale of Hexo's former Newstrike's Niagara facility for $10.25 million made it seem like Hexo may have overpaid for Newstrike when it purchased it at $263 million.

This explains why Hexo has decided to focus mainly on developing its own internal processes.

Hexo Continues to Rely on Equity Funding

There are a lot of reasons to be optimistic in Hexo's business. Its sales are increasing and its Belleville facility allows different cannabis product customization.

The one area where Hexo continues to show weakness is its finances. For now, Hexo has the cash to continue operating. There is $223 million of working capital with $184 million of it in cash. But the bottom line is it is still operating at a loss.

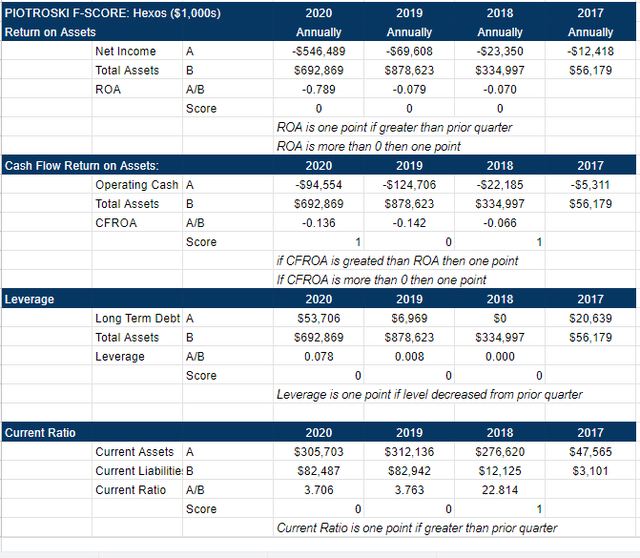

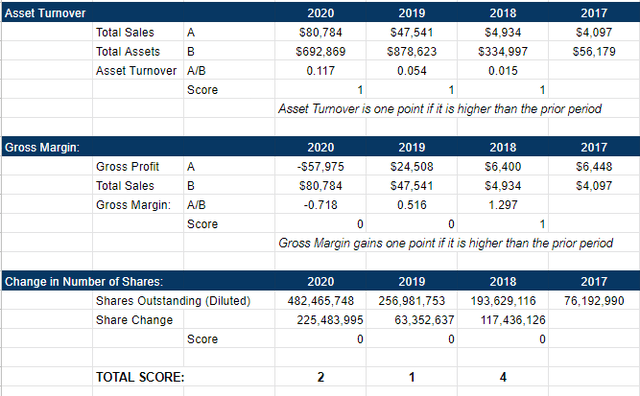

The F-Score measures a company's financial position with a score of 1 implying the weakest financial position and a score of 9 being the strongest. Hexo for its 2020 year-end has a score of 2. In 2019, it was a score of 1:

(Source: Hexo's Financial Statements)

What is driving the low score is the revenue-driving metrics continue to be negative. The return on assets and operating cash flow return on assets shows a decline from the prior year. One of the reasons for this drop is the impairment charge.

However, the company continues to have low levels of long-term debt at 7.8% of total assets. Its current ratio also continues to be healthy at 3.7. What investors need to also understand is that the low levels of debt and high current ratio is attributed to the equity financing Hexo did throughout 2020. Hexo had raised approximately $208 million CDN and $45 million USD:

(Source: Hexo's 2020 Annual Report)

Investing in Hexo is Like Playing the Long Game

Investors need to be patient here as I don't really see any events in the short term to really propel the stock price upwards. Its business has upward momentum but it is going to be slow. There is a clear demand for its products but the recession is likely going to put a damper on its stock price movement.

In the past, investors were burned when management provided profit guidance and missed. Nowadays, management is more cautious in what it reveals to the public.

Like every other company, Hexo is going through the recession and it continues to be aggressive in trying to be the top 3 cannabis producers in Canada. Hexo is learning from some of its past mistakes and its strategy to continuously improve its own products is working. Even in a pandemic and a recession, Hexo continues to move forward.

It's hard not to be bullish here.