As every investor would know, not every swing hits the sweet spot. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Calyx Ventures Inc. (CVE:CYX); the share price is down a whopping 86% in the last three years. That would certainly shake our confidence in the decision to own the stock. And over the last year the share price fell 71%, so we doubt many shareholders are delighted. Furthermore, it’s down 60% in about a quarter. That’s not much fun for holders.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don’t have to lose the lesson.

See our latest analysis for Calyx Ventures

Calyx Ventures hasn’t yet reported any revenue, so it’s as much a business idea as an actual business. You have to wonder why venture capitalists aren’t funding it. As a result, we think it’s unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. Investors will be hoping that Calyx Ventures can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress – and share price – will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some Calyx Ventures investors have already had a taste of the bitterness stocks like this can leave in the mouth.

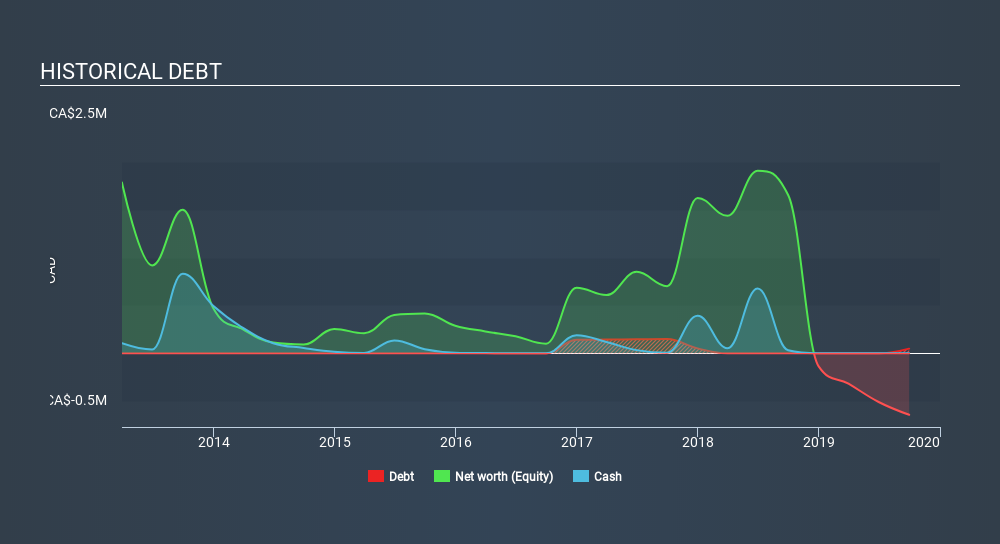

Calyx Ventures had liabilities exceeding cash by CA$892k when it last reported in September 2019, according to our data. That makes it extremely high risk, in our view. But with the share price diving 48% per year, over 3 years , it’s probably fair to say that some shareholders no longer believe the company will succeed. You can see in the image below, how Calyx Ventures’s cash levels have changed over time (click to see the values). You can click on the image below to see (in greater detail) how Calyx Ventures’s cash levels have changed over time.

TSXV:CYX Historical Debt, February 6th 2020

TSXV:CYX Historical Debt, February 6th 2020 Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? It would bother me, that’s for sure. You can click here to see if there are insiders selling.

A Different Perspective

Investors in Calyx Ventures had a tough year, with a total loss of 71%, against a market gain of about 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year’s performance may indicate unresolved challenges, given that it was worse than the annualised loss of 20% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It’s always interesting to track share price performance over the longer term. But to understand Calyx Ventures better, we need to consider many other factors. Case in point: We’ve spotted 6 warning signs for Calyx Ventures you should be aware of, and 3 of them shouldn’t be ignored.