https://seekingalpha.com/article/4199610-cypress-development-corp-promising-lithium-clay-developer-usa?page=1

This article first appeared on Trend Investing on July 18; therefore all data is as of that date.

Cypress Development Corp. [TSXV:CYP] [GR:C1Z1] (CYDVF) - Price = CAD 0.33, USD = 0.25

Cypress Development Corp. is optioned to 100% own their flagship Dean & Glory Project in Nevada, USA. The project is located immediately east of Albemarle’s Silver Peak mine. Cypress has discovered an extensive deposit of lithium-bearing claystone adjacent to the brine field. The clay is from volcanic ash that fell into a lake bed and metamorphozed into clay.

Note: Some final small payments are due to the land owner (US$30K in September 2018, US$75K in January 2019 and US$50k in September 2019. Remaining share issuance related to the option agreements amount to 800,000 shares staged over 3 releases between now and September 2019). There is a 3% NSR to the land seller (with a 2% buy out option for $2 million in favor the original property vendor).

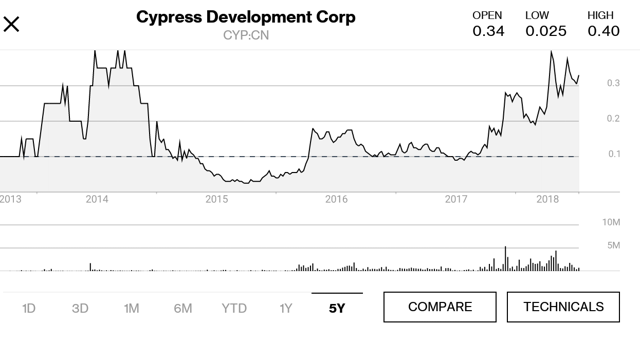

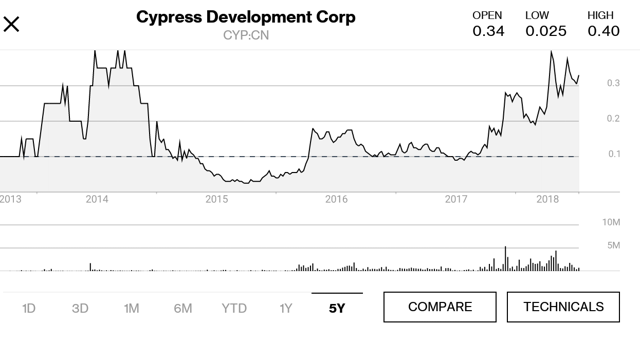

Cypress Development Corp. 5 year price graph

Source: Bloomberg

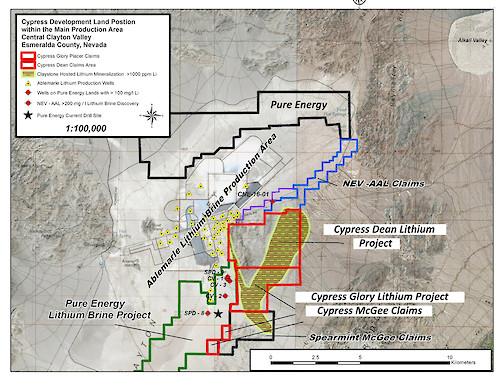

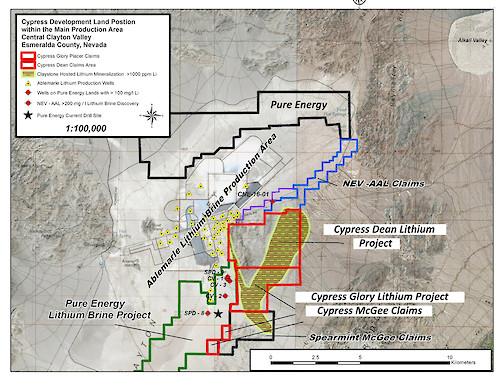

Cypress Development Corp. projects

Lithium projects

- Glory Lithium Project, Clayton Valley, Nevada, USA (flagship project) - Includes a 100% interest in the 1,520 acre Glory Project totaling 76 placer/lode claims located in the heart of the Clayton Valley lithium production and exploration area of Esmeralda County, Nevada.

- Dean Lithium Project in Clayton Valley, Nevada, USA - Includes a 100% interest in the 2,700 acre (35 association placer and lode claims) adjacent to the Glory project mentioned above.

Zinc and silver projects

- Gunman Zinc/Silver Project, Nevada - Includes a 100% interest in its approximately 1,100 acre Gunman Zinc-Silver Project located in White Pine County, northeast of Eureka, Nevada. Five RC drill programs totaling approx. 50,000 feet have been completed by Cypress on the Gunman project with significant near surface grades up to 35% per ton zinc and up to 15.0 oz per ton silver over considerable widths encountered.

Note: In December 2017, Cypress entered into an agreement Pasinex Resources Limited whereas Pasinex can earn up to an 80% interest in Cypress' Gunman Project. Total consideration to acquire the 80% interest is staged over four years and includes US$675,000 in cash payments and 4.8 million Pasinex common shares. In addition, Pasinex must incur minimum exploration expenditures totaling US$2,950,000 over the same four-year period.

You can read more details on each of the above projects here.

Cypress Development's Glory Lithium & Dean Lithium Projects tenements - Clayton Valley, Nevada, USA

Source

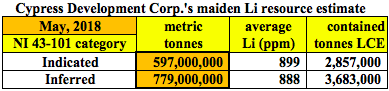

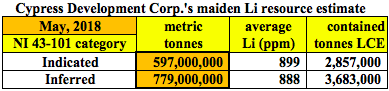

Cypress Development's Lithium resource

The Indicated & Inferred resource is very large with 6.54MT of contained lithium carbonate equivalent [LCE] @888mg/L in clay ore. This grade would be considered very good when comparing to lithium brine projects. The resource it is at or near surface with an extremely low strip ratio.

Source

Metallurgy

Metallurgical tests have shown the claystone (illite and montmorillonite clays) is weak acid leachable with lithium extractions over 80% in 4 to 8 hours. With mineralization tested by drilling over a seven kilometer trend. Cost of production should be competitive and I expect it to be similar to their larger market cap neighbor Global Geoscience at around ~$US3,500/t-4,500/t LCE (to the lower end if they build their own acid plant for ~$50m). Their clay ore will require no roasting, just an acid leach is required, and only ~8 hours to produce either lithium carbonate or lithium hydroxide. CapEx is not yet known, but my estimate is ~USD 300m (assumes they have their own acid plant).

CEO Bill Willoughby says that while their grades are not as high as some clay peers, their ore is easier to mine and process than others (requires less acid), which brings them back to being highly competitive. Also due to being a soft clay (not hectorite clay) there is no need for expensive roasting.

Infrastructure and access

Access is good with a road running through the property.

Power costs will be reasonable at an estimated ~6c/kWh. Water is a concern. The Company state: "Until we have the PEA in hand and additional funds to pursue our options, we aren't actively looking to acquire water rights at this time. Instead, we're identifying ways to minimize use, including reclaiming process water and opting for dry-stack tailings as opposed to a tailings pond."

Development stage

Cypress Development Corp. is an early stage explorer/developer.

The Company is currently working on their Preliminary Economic Assessment [PEA] which is due out July/August 2018. Following this will be further metallurgical work, a DFS, permitting, then the FS/BFS/DFS. The Company is still a bit early stage, so does not yet have any off-take agreements in place.

Management

William Willoughby, PhD, PE - Director, CEO

Bill Willoughby, PhD, PE serves as a Director and Chief Executive Officer of Cypress Development Corp. Dr. Willoughby is a mining engineer with 38 years of experience in all aspects of natural resources development. Since 2014, he has been principal and owner of consulting firm Willoughby & Associates, PLLC. Prior to that, he was President and COO of International Enexco Ltd., which was acquired by Denison Mines in 2014. He previously held various positions with Teck (Cominco). Dr. Willoughby has been a Professional Engineer since 1985 and received his Doctorate in Mining Engineering & Metallurgy from the University of Idaho in 1989.

Donald C. Huston - Chairman, President

Don Huston serves as Chairman of the Board and President of Cypress Development Corp. Mr. Huston has been associated with the mineral exploration industry for over 30 years and has extensive experience as a financier and in-field manager of numerous mineral exploration projects in North America. He was born and raised in Red Lake, Ontario and spent 15 years as a geophysical contractor with C.D. Huston & Sons Ltd. as mineral exploration consultants in northern Ontario, Manitoba and Saskatchewan. Mr. Huston serves as a director of four Canadian public resource companies.

Daniel W. Kalmbach, CPG - Consulting Geologist, Qualified Person

Daniel Kalmbach, CPG serves as a consulting geologist for Cypress Development Corp. and is a Qualified Person. Mr. Kalmbach is a professional geologist with 19 years of experience in natural resources exploration, development, production and environmental compliance in underground and surface locales. Mr. Kalmbach began his career at Barrick Gold Corp. in production geology and later was Senior Geologist of International Enexco Ltd., until acquired by Denison Mines in 2014. He currently is an associate with Willoughby & Associates, PLLC. Mr. Kalmbach has familiarity with gold, silver, copper, zinc, lead, uranium, lithium, zeolite and phosphate mineralization. He holds a Bachelor of Science in Geology from the University of Idaho, and is a Certified Professional Geologist with AIPG.

Simon Dyakowski, CFA, MBA - Strategic Advisor

Simon Dyakowski serves as Strategic Advisor for Cypress Development Corp. Mr. Dyakowski has over ten years of corporate finance, corporate development and capital markets advisory experience. He holds an MBA in Finance from the University of British Columbia, is a CFA charterholder and holds an undergraduate Finance degree from the University of Western Ontario. He advises venture stage and growth-oriented public market issuers on deal structuring, capital markets, and corporate development strategies. His professional experience is in equity research and equity sales coverage with previous positions held at Salman Partners and Leede Financial.

Largest Shareholders and insider ownership

Source

Valuation

Cash on hand as of June 2018 was $C800,000, with no debt, and as discussed earlier some small tenement payments due.

Current market cap is C$20m, with 61m shares issued.

My preliminary price target based only on their lithium project is C$2.91 (8.8x higher) by end 2021/22. This assumes production of 20ktpa LCE, selling price of US$12,000/t, cost price of US$4,000/t, CapEx US$300m, 21% company tax rate, no federal or state royalties, 3% NSR to the land seller.

Note: Further upside to my target if production volume is later increased, or from the other project.

I was unable to find any analyst price targets.

Catalysts

- July/August 2018 - Preliminary Economic Assessment [PEA]. My preliminary model is estimating a post-tax NPV of ~CAD 900m.

- H2 2018 - Further metallurgical test results

- H2, 2018 - Preliminary Feasibility Study [PFS].

- 2019 - Permitting, DFS/BFS

- 2021/2022 - Possible 20ktpa+ LCE producer.

Competitors

Risks

- Lithium prices falling.

- The usual mining risks - Exploration risks, funding risks, production risks.

- Extracting lithium at scale is still unproven, and remains to be seen if it can be economical. Several new lithium miners such as Lithium Americas [TSX:LAC] (OTC:LAC) and Global Geoscience [ASX:GSC] are also pushing forward with quite similar lithium clay projects.

- Management and currency risks.

- Sovereign risk - Minimal as the project is in USA.

- Stock market risks - Dilution, lack of liquidity (best to buy on local exchange), market sentiment.

Further reading

Conclusion

The positives for Cypress Development Corp. is their large resource, mining friendly Nevada USA location, good access, and potential to rapidly produce either lithium hydroxide or carbonate from their soft (non-hectorite) clay.

The negatives are that they are at an early stage (no permitting, water rights etc), and the fact lithium has never been produced from clay at scale before.

Valuation for such a large lithium resource looks extremely attractive relative to all lithium peers. The C$20m market cap looks very appealing given my NPV forecast and price target. The PEA is due out by end July/August so this can be a large catalyst.

I rate Cypress Development a high risk/very high reward lithium junior for those with a 5 year plus time frame.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to go to the next level, sign up for Trend Investing, my Marketplace service. I share my best investing ideas and latest articles on the latest trends. You will also get access to exclusive CEO interviews and chat room access to me, and to other sophisticated investors. You can benefit from the hundreds of hours of work I've done to analyze the best opportunities in emerging industries, especially the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Recent Subscriber Feedback On Trend Investing", or sign up here.

My latest Trend Investing articles are:

Disclosure: I am/we are long Cypress Development Corp. [TSXV:CYP], Lithium Americas [TSX:LAC].

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

https://seekingalpha.com/article/4199610-cypress-development-corp-promising-lithium-clay-developer-usa?page=1

Summary

Cypress Development Corp. has a large lithium clay project in Clayton Valley, Nevada, USA.

Several near term catalysts include a PEA due out by July/August 2018.

Risk revolves around producing lithium from clay economically at scale; however several competitors are also moving forward in this direction.

A high risk/very high reward lithium junior and possible lithium producer by 2021/22.

Members of my private investing community, Trend Investing, receive access to my breaking news coverage of this idea. Get started today >>

This article first appeared on Trend Investing on July 18; therefore all data is as of that date.

Cypress Development Corp. [TSXV:CYP] [GR:C1Z1] (CYDVF) - Price = CAD 0.33, USD = 0.25

Cypress Development Corp. is optioned to 100% own their flagship Dean & Glory Project in Nevada, USA. The project is located immediately east of Albemarle’s Silver Peak mine. Cypress has discovered an extensive deposit of lithium-bearing claystone adjacent to the brine field. The clay is from volcanic ash that fell into a lake bed and metamorphozed into clay.

Note: Some final small payments are due to the land owner (US$30K in September 2018, US$75K in January 2019 and US$50k in September 2019. Remaining share issuance related to the option agreements amount to 800,000 shares staged over 3 releases between now and September 2019). There is a 3% NSR to the land seller (with a 2% buy out option for $2 million in favor the original property vendor).

Cypress Development Corp. 5 year price graph

Source: Bloomberg

Cypress Development Corp. projects

Lithium projects

- Glory Lithium Project, Clayton Valley, Nevada, USA (flagship project) - Includes a 100% interest in the 1,520 acre Glory Project totaling 76 placer/lode claims located in the heart of the Clayton Valley lithium production and exploration area of Esmeralda County, Nevada.

- Dean Lithium Project in Clayton Valley, Nevada, USA - Includes a 100% interest in the 2,700 acre (35 association placer and lode claims) adjacent to the Glory project mentioned above.

Zinc and silver projects

- Gunman Zinc/Silver Project, Nevada - Includes a 100% interest in its approximately 1,100 acre Gunman Zinc-Silver Project located in White Pine County, northeast of Eureka, Nevada. Five RC drill programs totaling approx. 50,000 feet have been completed by Cypress on the Gunman project with significant near surface grades up to 35% per ton zinc and up to 15.0 oz per ton silver over considerable widths encountered.

Note: In December 2017, Cypress entered into an agreement Pasinex Resources Limited whereas Pasinex can earn up to an 80% interest in Cypress' Gunman Project. Total consideration to acquire the 80% interest is staged over four years and includes US$675,000 in cash payments and 4.8 million Pasinex common shares. In addition, Pasinex must incur minimum exploration expenditures totaling US$2,950,000 over the same four-year period.

You can read more details on each of the above projects here.

Cypress Development's Glory Lithium & Dean Lithium Projects tenements - Clayton Valley, Nevada, USA

Source

Cypress Development's Lithium resource

The Indicated & Inferred resource is very large with 6.54MT of contained lithium carbonate equivalent [LCE] @888mg/L in clay ore. This grade would be considered very good when comparing to lithium brine projects. The resource it is at or near surface with an extremely low strip ratio.

Source

Metallurgy

Metallurgical tests have shown the claystone (illite and montmorillonite clays) is weak acid leachable with lithium extractions over 80% in 4 to 8 hours. With mineralization tested by drilling over a seven kilometer trend. Cost of production should be competitive and I expect it to be similar to their larger market cap neighbor Global Geoscience at around ~$US3,500/t-4,500/t LCE (to the lower end if they build their own acid plant for ~$50m). Their clay ore will require no roasting, just an acid leach is required, and only ~8 hours to produce either lithium carbonate or lithium hydroxide. CapEx is not yet known, but my estimate is ~USD 300m (assumes they have their own acid plant).

CEO Bill Willoughby says that while their grades are not as high as some clay peers, their ore is easier to mine and process than others (requires less acid), which brings them back to being highly competitive. Also due to being a soft clay (not hectorite clay) there is no need for expensive roasting.

Infrastructure and access

Access is good with a road running through the property.

Power costs will be reasonable at an estimated ~6c/kWh. Water is a concern. The Company state: "Until we have the PEA in hand and additional funds to pursue our options, we aren't actively looking to acquire water rights at this time. Instead, we're identifying ways to minimize use, including reclaiming process water and opting for dry-stack tailings as opposed to a tailings pond."

Development stage

Cypress Development Corp. is an early stage explorer/developer.

The Company is currently working on their Preliminary Economic Assessment [PEA] which is due out July/August 2018. Following this will be further metallurgical work, a DFS, permitting, then the FS/BFS/DFS. The Company is still a bit early stage, so does not yet have any off-take agreements in place.

Management

William Willoughby, PhD, PE - Director, CEO

Bill Willoughby, PhD, PE serves as a Director and Chief Executive Officer of Cypress Development Corp. Dr. Willoughby is a mining engineer with 38 years of experience in all aspects of natural resources development. Since 2014, he has been principal and owner of consulting firm Willoughby & Associates, PLLC. Prior to that, he was President and COO of International Enexco Ltd., which was acquired by Denison Mines in 2014. He previously held various positions with Teck (Cominco). Dr. Willoughby has been a Professional Engineer since 1985 and received his Doctorate in Mining Engineering & Metallurgy from the University of Idaho in 1989.

Donald C. Huston - Chairman, President

Don Huston serves as Chairman of the Board and President of Cypress Development Corp. Mr. Huston has been associated with the mineral exploration industry for over 30 years and has extensive experience as a financier and in-field manager of numerous mineral exploration projects in North America. He was born and raised in Red Lake, Ontario and spent 15 years as a geophysical contractor with C.D. Huston & Sons Ltd. as mineral exploration consultants in northern Ontario, Manitoba and Saskatchewan. Mr. Huston serves as a director of four Canadian public resource companies.

Daniel W. Kalmbach, CPG - Consulting Geologist, Qualified Person

Daniel Kalmbach, CPG serves as a consulting geologist for Cypress Development Corp. and is a Qualified Person. Mr. Kalmbach is a professional geologist with 19 years of experience in natural resources exploration, development, production and environmental compliance in underground and surface locales. Mr. Kalmbach began his career at Barrick Gold Corp. in production geology and later was Senior Geologist of International Enexco Ltd., until acquired by Denison Mines in 2014. He currently is an associate with Willoughby & Associates, PLLC. Mr. Kalmbach has familiarity with gold, silver, copper, zinc, lead, uranium, lithium, zeolite and phosphate mineralization. He holds a Bachelor of Science in Geology from the University of Idaho, and is a Certified Professional Geologist with AIPG.

Simon Dyakowski, CFA, MBA - Strategic Advisor

Simon Dyakowski serves as Strategic Advisor for Cypress Development Corp. Mr. Dyakowski has over ten years of corporate finance, corporate development and capital markets advisory experience. He holds an MBA in Finance from the University of British Columbia, is a CFA charterholder and holds an undergraduate Finance degree from the University of Western Ontario. He advises venture stage and growth-oriented public market issuers on deal structuring, capital markets, and corporate development strategies. His professional experience is in equity research and equity sales coverage with previous positions held at Salman Partners and Leede Financial.

Largest Shareholders and insider ownership

Source

Valuation

Cash on hand as of June 2018 was $C800,000, with no debt, and as discussed earlier some small tenement payments due.

Current market cap is C$20m, with 61m shares issued.

My preliminary price target based only on their lithium project is C$2.91 (8.8x higher) by end 2021/22. This assumes production of 20ktpa LCE, selling price of US$12,000/t, cost price of US$4,000/t, CapEx US$300m, 21% company tax rate, no federal or state royalties, 3% NSR to the land seller.

Note: Further upside to my target if production volume is later increased, or from the other project.

I was unable to find any analyst price targets.

Catalysts

- July/August 2018 - Preliminary Economic Assessment [PEA]. My preliminary model is estimating a post-tax NPV of ~CAD 900m.

- H2 2018 - Further metallurgical test results

- H2, 2018 - Preliminary Feasibility Study [PFS].

- 2019 - Permitting, DFS/BFS

- 2021/2022 - Possible 20ktpa+ LCE producer.

Competitors

Risks

- Lithium prices falling.

- The usual mining risks - Exploration risks, funding risks, production risks.

- Extracting lithium at scale is still unproven, and remains to be seen if it can be economical. Several new lithium miners such as Lithium Americas [TSX:LAC] (OTC:LAC) and Global Geoscience [ASX:GSC] are also pushing forward with quite similar lithium clay projects.

- Management and currency risks.

- Sovereign risk - Minimal as the project is in USA.

- Stock market risks - Dilution, lack of liquidity (best to buy on local exchange), market sentiment.

Further reading

Conclusion

The positives for Cypress Development Corp. is their large resource, mining friendly Nevada USA location, good access, and potential to rapidly produce either lithium hydroxide or carbonate from their soft (non-hectorite) clay.

The negatives are that they are at an early stage (no permitting, water rights etc), and the fact lithium has never been produced from clay at scale before.

Valuation for such a large lithium resource looks extremely attractive relative to all lithium peers. The C$20m market cap looks very appealing given my NPV forecast and price target. The PEA is due out by end July/August so this can be a large catalyst.

I rate Cypress Development a high risk/very high reward lithium junior for those with a 5 year plus time frame.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to go to the next level, sign up for Trend Investing, my Marketplace service. I share my best investing ideas and latest articles on the latest trends. You will also get access to exclusive CEO interviews and chat room access to me, and to other sophisticated investors. You can benefit from the hundreds of hours of work I've done to analyze the best opportunities in emerging industries, especially the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Recent Subscriber Feedback On Trend Investing", or sign up here.

My latest Trend Investing articles are:

Disclosure: I am/we are long Cypress Development Corp. [TSXV:CYP], Lithium Americas [TSX:LAC].

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.