niphon/iStock via Getty Images

niphon/iStock via Getty Images "The stock market is a device for transferring money from the impatient to the patient." - Warren Buffett

Previously, I presented a long thesis on Lion One Metals (OTCQX:LOMLF), an advanced-stage gold explorer operating in Fiji, on the ground of its asymmetric risk-reward profile.

Lion One returned 240% from late July 2019 to early August 2020 on the back of successful testing of the deep feeder zone and thanks to strengthening gold price. However, the stock began to lose altitude in August 2020 and has continued to descend ever since. As a result, the stock returned only 63% from the publication of my previous article to date, which lags behind the other mining unicorn prospects I submitted to you (e.g., see here, here, here, here, and here).

Although I do not expect my stock picks to rise along the N45°E straight line, the recent 50% decline of Lion One got me thinking, which resulted in this article.

The Navilawa project

Two of the grievances voiced by Lion One investors are (1) Lion One failed to put out frequent news releases to keep the market abreast of the progress of the project, (2) the management has not done enough to tell the Lion One story. The impatience of these shareholders probably results from their under-appreciation of the true nature of the Navilawa project.

So, what's the Navilawa project?

Navilawa is a district-scale, advanced-stage, alkalic-type low-sulfidation epithermal gold project on the remote island of Viti Levu, Fiji, in the South Pacific Ocean.

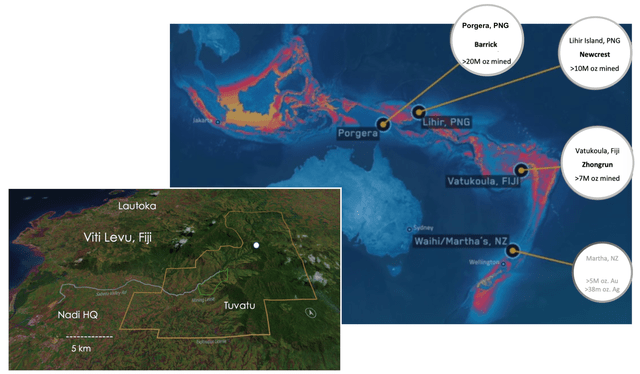

Firstly, the Navilawa project is located in the northwestern part of the Viti Levu Island, Fiji, where the rainy season lasts from November through April. In the wet season, it's difficult to move heavy equipment between drilling sites in the mountainous area (Fig. 1). That's why surface drilling is usually done from May to October, not year round as in much of North America.

Fig. 1. A bird's eye view of the Navilawa project of Lion One Metals in Viti Levu, Fiji and its position in the South Pacific part of the circum-Pacific ring of fire, modified from this source.

Fig. 1. A bird's eye view of the Navilawa project of Lion One Metals in Viti Levu, Fiji and its position in the South Pacific part of the circum-Pacific ring of fire, modified from this source.

Secondly, although the Navilawa project is only 17km from the Nadi International Airport by a service road, it's costly and time-consuming to bring in drill rigs to remote Fiji from, and ship drill core samples to assay and metallurgical labs in, the nearest mining center - Australia.

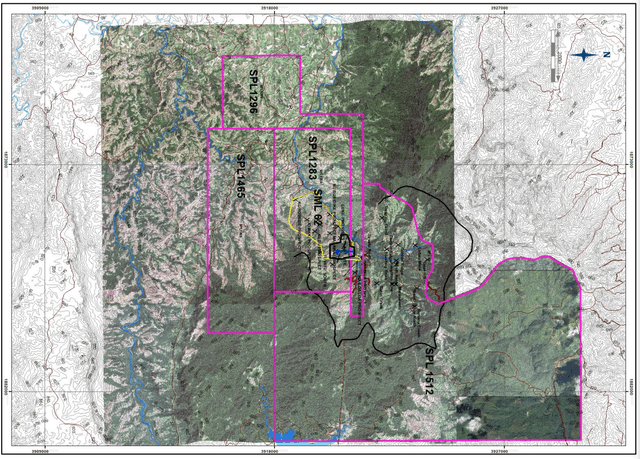

Thirdly, the 21,170.5-ha project area, encompassing the entire 7km-diameter Navilawa caldera, consists of SML 62 that hosts the Tuvatu deposit, and four Special Prospecting Licenses (SPL 1283, 1296, 1465, and 1512). Although SPLs 1283, 1296, and 1465 were granted in 2013 and SML 62 in 2015, SPL 1512 - which covers the majority of the caldera - was not granted until May 2019. In other words, it has only been two years since Lion One had consolidated the entire land package (Fig. 2). A systematic exploration of the entire district entails a significant amount of work.

Fig. 2. A topographic map showing the Navilawa project including SML 62, and SPL 1283, 1296, 1465, and 1512, from this source.

Fig. 2. A topographic map showing the Navilawa project including SML 62, and SPL 1283, 1296, 1465, and 1512, from this source.

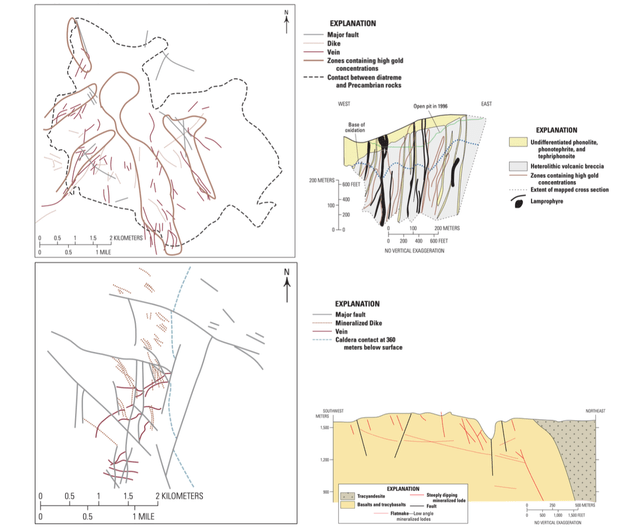

Fourthly, mineralization in the Navilawa project is characterized as an alkalic gold system hosted in the Navilawa caldera (see here). Alkalic-type gold systems are known to occur in vein-controlled high-grade zones, and can extend to >1km depths of the caldera (Fig. 3). Delineation of a deep gold system naturally takes a long time.

Fig. 3. Maps and cross-sections of the Cripple Creek (upper) and Vatukoula (lower) alkalic gold districts, modified from this source.

Fig. 3. Maps and cross-sections of the Cripple Creek (upper) and Vatukoula (lower) alkalic gold districts, modified from this source.

Fifthly, Lion One was viewed in the initial investment thesis as a barbell investment play, following a dual track of the development of and production from the Tuvatu starter mine and blue-sky exploration elsewhere in the land package - self-funded and without undue equity dilution.

However, that strategy has not panned out as planned so far. Securing funds from western financiers with only a preliminary economic assessment (or PEA) was out of the question, while two letters of intent signed with Chinese concerns went nowhere. During much of 2020, Lion One focused on testing the Tuvatu deep feeder zone (see, e.g., here). The success in deep drilling indeed made it possible for the company to raise some C$40 million in a private placement at the recent gold price high, along with accelerated warrant exercise, Lion One now boasts C$57 million of cash in hand.

Lastly, the COVID-19 pandemic has slowed down the work program of Lion One. The first COVID case in Fiji was reported on March 19, 2020, in a city north of Nadi. A travel ban was first announced over passengers from some countries, which was quickly followed by the closing of all borders and ports to nonresidents in March 2020. A curfew was imposed nationwide, and lockdowns in Lautoka and Suva, which helped prevent local COVID breakout for over a year. In April 2021, Fiji relaxed its COVID restrictions. However, on April 19, 2021, the first community infection was confirmed, leading to the lockdown of Nadi and Lautoka, which was lifted in June 2021. The second wave of Covid infections occurs mostly on the southern coast of Viti Levu. Going forward, COVID may continue to add uncertainty to Lion One operations in the country.

In summary, in the two years since Lion One consolidated the land package, the company has had to overcome a plethora of difficulties including seasonal rains, the COVID pandemic, limited availability of drill rigs, and lack of a nearby assay lab.

Preparing Lion One

For an exploration play to succeed, I believe it must possess at least the following essential elements:

- A geological model, or a hypothesis that predicts a large volume of mineral resources in the project area, to be tested in a well-designed exploration program;

- Access to geotechnical capabilities to carry out the exploration program;

- Access to sufficient funds;

- A supportive operating environment, including mining-friendly host governments, and local communities;

- And at the core of the operation, a management team that is able to shepherd the program toward completion.

Theoretical preparation

Exploration in the Navilawa area started in 1906 and continued intermittently ever since, mostly for porphyry copper.

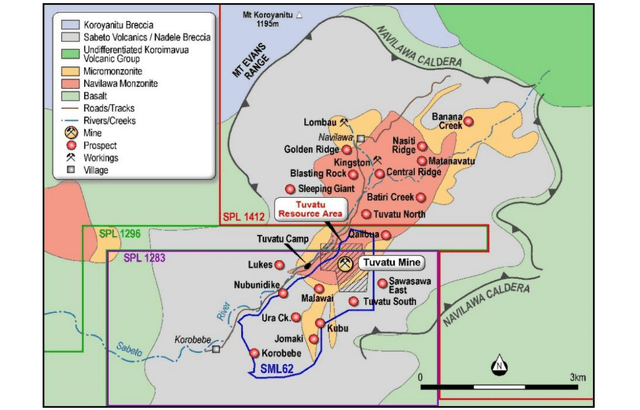

Outside the Tuvatu mine, a total of 52 holes had been drilled, and geophysical surveys (including heliborne and ground magnetic, radiometric, and induced polarization surveys) had been acquired, with a lew of prospects identified, including

- The Kingston Mine (a 2.4km x 0.45km anomaly with grades up to 176.27 g/t Au, 130.05 g/t Ag, and 40.6% Cu, as well as 60m at 0.7g/t Au),

- Banana Creek (a 1km x 0.3km gold anomaly with, e.g., a 0.4m vein grading 23.4 g/t Au),

- And Matanavatu (11.85 g/t Au, 7.0 g/t Ag, and 0.37% Cu), Batiri Creek (7.09 g/t Au, 4.4 g/t Ag, 0.32% Pb, and 0.8% Zn), Nasiti Ridge (soil anomaly up to 2.42 g/t Au, with veins returning 9.54 g/t Au, 4.7 g/t Ag, and 3.1% Cu), Central Ridge (9.25 g/t Au and 14.9 g/t Ag), Tuvatu North, Tuvatu South, Malawai, Nubunidike, Kubu, Jomaki Ridge, Ura Creek, and so on (Fig. 4).

Fig. 4. A geological map showing prospects in the Navilawa area, from this source.

Fig. 4. A geological map showing prospects in the Navilawa area, from this source.

In the Tuvatu area, a total of 1,341m of decline, strike, and rise has been developed, including a 600m exploration decline reaching 240m below surface. Lodes were mapped in the decline, and 112 underground drill holes were completed for a total of 13,408m, which resulted in 446 Koz of historical resources grading >7.9 g/t gold.

This historical exploration at Tuvatu prior to Lion One taking operatorship led to the understanding that gold mineralization is structurally controlled and occurs as interconnected narrow (individually measuring 1-200mm in width) veinlets mostly consisting of potassium feldspar, carbonate, and characteristically roscoelite, that the lodes - zones of veining - are up to 500m in strike length, >300m in depth, and up to 5m in width, either sub-vertical, north and NNE striking or shallow-dipping, and that gold occurs as either visible gold, gold tellurides, or gold-bearing sulfides, without deleterious elements.

In 2006, N.L. Scherbarth and P.G. Spry described in detail the geology and geochemistry of the Tuvatu deposit in a peer-reviewed article entitled "Mineralogical, Petrological, Stable Isotope, and Fluid Inclusion Characteristics of the Tuvatu Gold-Silver Telluride Deposit, Fiji: Comparisons with the Emperor Deposit," observing that the fluids associated with gold precipitation have a magmatic origin and that the Tuvatu deposit is rich in tellurium and vanadium (roscoelite). The authors concluded that Tuvatu is an alkalic gold system (a low-sulfidation gold deposit hosted within an alkaline magmatic caldera) and that Tuvatu shares geologic affinities with numerous other giant gold deposits in the southwest Pacific, e.g., the Vatukoula (Emperor) mine in Fiji, Porgera, Mt. Kare, and Lihir mines in Papua New Guinea, and Acupan in The Philippines.

The characterization of Navilawa as an alkalic gold system has implications for expanding the gold resources at Tuvatu in specific and Navilawa in general. The mineralization in the aforementioned geological analogs of Tuvatu typically extends to >1,000m depths and measures in multi-million ounces (Fig. 1). In March 2019, on the eve of officially consolidating the entire Navilawa caldera under its operatorship and ahead of the start of the dry season, Lion One appointed the appointment of Quinton Hennigh as a technical advisor, who went on to apply the alkalic gold characterization to develop an aggressive exploration program to fully define the extent of gold mineralization at Navilawa:

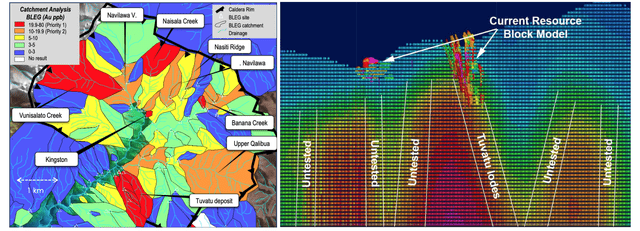

- Stream sediment sampling using a technique called bulk leach extractable gold (aka, BLEG) over the entire concession area, for target identification (Fig. 5);

- Controlled-source audio-frequency magnetotellurics (or CSAMT) to identify mineralized structural zones in the depths of up to 1,000m (Fig. 5);

Fig. 5. A map showing BLEG of catchments in the Navilawa caldera (left), and a cross-section showing CSAMT gradients with interpreted deep-rooted feeder pathways shown (right), from this source.

Fig. 5. A map showing BLEG of catchments in the Navilawa caldera (left), and a cross-section showing CSAMT gradients with interpreted deep-rooted feeder pathways shown (right), from this source.

Since then, Lion One came to adopt an exploration plan with three prongs, i.e., testing deep high-grade feeders under the Tuvatu resources, testing for similar feeder structures elsewhere along the 7km highly prospective gold corridor across the Navilawa caldera, and intense infill drilling in shallow parts of the Tuvatu resources in advance of mine development. The goal is to test the hypothesis that Navilawa contains multi-million ounces of gold la its geological analogs Vatukoula, Porgera, and Lihir while advancing Tuvatu to production.

Technical capability preparation

The remote location of Fiji in the southwest Pacific, far away from any major mining centers, means Lion One faces logistical challenges in carrying out the planned exploration program. It's expensive enough to mobilize contracted drill rigs from Australia to Fiji. On top of that, it's unclear what to do with the contactor rigs in the six-month wet seasons.

Lion One's solution is to have a fleet of its own drill rigs, including underground rigs. At Tuvatu, underground drilling has the advantages of decreasing the length of holes needed to reach target depth, more favorable angles at which deep, steep high-grade structures can be intersected, and year-round drilling without being interrupted by the rainy seasons.

- Lion One purchased Nadi-based drilling company Geodrill in January 2019, thus starting a fleet of one surface diamond drill rig capable of drilling up to 800m in HQ-sized (63.5mm diameter) drill core, and one underground diamond drill rig capable of drilling >100m in NQ sized (47.6mm diameter) drill core.

- Surface rig #3, capable of drilling to 1,500m depth in NQ-sized core, was purchased from South Korea in April 2020 and arrived in Fiji in mid-2020, which was joining by the fourth rig with a 200m depth capacity (see here).

- In late 2020, Lion One purchased two new Canadian-built Zinex drill rigs and related equipment, which arrived at the Port of Lautoka in Fiji in early February 2021. These two Zinex rigs have a 1,000m depth capacity and can be utilized from the surface or underground.

To save time on shipping core samples to Australian assay labs, Lion One built its own Geochemical Assay and Metallurgical Laboratory located at its Nadi headquarters, Fiji. The new lab is equipped for gold analysis by fire assay with atomic absorption spectrometry finish. Geochemical assaying for a large range of other elements will be tested through Inductively Coupled Plasma Optical Emission Spectrometry. The lab has a processing capacity of 400 samples per day. The facility also will be utilized to conduct metallurgical optimization test work including flotation and leaching.

- As Fiji does not currently have any commercial lab facilities for geochemical and metallurgical analysis, Lion One plans to have the lab internationally certified for commercial operations in the near future to also service local industries.

Financing preparation

Lion One seems to be extremely prudent in raising money in the capital market.

- While executing the new exploration program, Lion One went ahead and raised C$11.5 million on Dec. 6, 2019, by closing a private placement of 14,375,000 units at C$0.80 per unit, with each unit consisting of one common share and one common share purchase warrant exercisable C$1.20 until June 6, 2021. Lion One exercised its acceleration right on these warrants in August 2020, collecting C$17.25 million in October 2020 as a result.

- On Aug. 21, 2020, Lion One raised C$39,789,708 through the completion of a bought deal private placement and concurrent non-brokered private placement of an aggregate of 13,529,750 units at C$1.70 per unit for C$23,000,575, and 8,189,821 units at C$2.05 per unit for C$16,789,133. Each C$1.70 unit is comprised of one common share and 1/2 of one warrant exercisable at C$2.35, while each C$2.05 unit consists of one common share and one warrant exercisable at C$2.75, both until August 21, 2021. On Dec. 31, 2020, those 4,045,496 C$2.75 warrants were listed for trading on TSX-V under the symbol LIO.WT, which seems to be approaching zero. The 6,764,875 C$2.35 warrants are currently deeply out of the money; Lion One may extend these warrants or allow them to expire.

- It's worth noting Lion One timed the ~C$40 million raise perfectly. The private placement was completed at the previous peak of gold, since when the yellow metal has been in a protracted correction.

As of recently, Lion One had C$57 million in the coffers to fund the exploration program. The company may even deploy part of the funds to the construction of the Tuvatu mine. The initial capital cost was estimated at US$66.8 million, according to the updated the PEA of September 2020.

Organizational preparation

As I stated earlier, Lion One has a dual-track strategy of building the Tuvatu starter mine on the one hand and carrying out the exploration of the Navilawa concession on the other hand. While the company has made good progress in exploration, it has had little to show for the development of Tuvatu.

However, that assessment may be good only until June 2, 2021, when Lion One announced adding experienced mine builder/operator Patrick Hickey to its operational team as COO. A Colorado School of Mines alumnus, Hickey built the Batu Hijau copper-gold mine in Indonesia for Newmont Mining from 2004 to 2008, managed the Ambatovy nickel-cobalt mine in Madagascar for Sherritt International from 2008 to 2010, and served as CEO-African Operations at Kinross Gold from 2010 to 2014, in charge of projects such as the Tasiast gold mine in Mauritania, and the Chirano gold mines in Ghana. He has a proven track record of building mines and managing large-scale projects in remote locations. He will relocate to Fiji to oversee the development of Tuvatu.

Along with Hickey, Lion One also appointed Sergio Cattalani as SVP-Exploration, replacing Managing Director Stephen Mann. Cattalani has expertise in advanced drill-out campaigns. In 2016-2018, he oversaw a 40,000m drill program at the Castle Mountain gold project in California for Newcastle Gold/Equinox Gold. Cattalani will be running Lion One's exploration program on-site.

Welcoming Hickey and Cattalani to Fiji will be newly appointed senior geologist Will Ostrenga, who as a consultant has the experience of managing drilling programs for client companies such as Kinross Gold and Sumitomo over the past eight years.

In summary, over the last two years, Lion One has completed a series of preparatory steps to put the Navilawa project on a trajectory to success. It consolidated the land package over the entire Navilawa caldera. It adopted an aggressive exploration program based on a new geological model, it built a self-owned fleet of six surface and underground drill rigs and an on-site assay lab to enable year-round operations in the remote location, it loaded up cash to fund the programs, it installed an operational team on-site to oversee the development of Tuvatu and manage the drilling campaign, all these in spite of the COVID-19 pandemic.

What to expect in the near term

With all six drill rigs turning, the countrywide COVID-19 lockdown lifted, and Fiji in the dry season, there's a lot to expect from Lion One in the near term.

In order to bring Tuvatu into production, the company currently is deploying two shallow-capacity surface drill rigs and two underground rigs to infill drilling at Tuvatu. By conducting intense infill drilling, Lion One probably aims to upgrade more inferred resources to the indicated category so that they can be included in a pre-feasibility study (or PFS). Although the market seems to have been numb to news releases of high-grade intercepts in infill holes (e.g., here, here, here, and here), an updated and expanded mineral resource estimate (or MRE) and a PFS can significantly de-risk the mine building project and generate some real excitement.

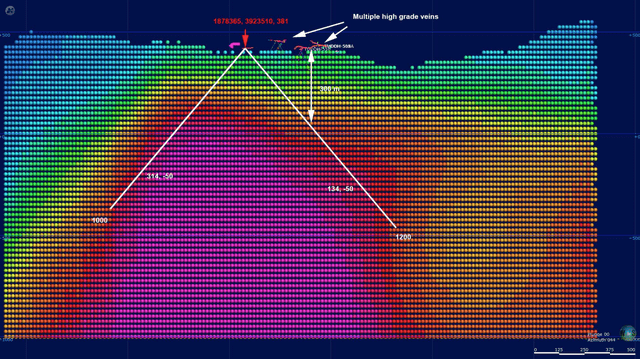

- Lion One also is delineating the deep root from the exploration decline using the new deep-capacity underground drill rigs. Underground drilling can be carried out through the wet season and year-round (see here). Deep drilling will likely help expand the Tuvatu MRE substantially.

The CSAMT has helped identify numerous deep-seated targets in the project area, with Banana Creek being the first target to drill (Fig. 6). With high-grade gold encountered on the surface in the Banana Creek area, the chance is good drilling may lead to the discovery of a Tuvatu lookalike.

Fig. 6. A cross-section overlain on CSAMT, showing planned drill holes in the Banana Creek area, from the same source as Fig. 6.

Fig. 6. A cross-section overlain on CSAMT, showing planned drill holes in the Banana Creek area, from the same source as Fig. 6.

Once the operational team (Hickey, Cattalani, and Ostrenga) settled in at Nadi, I expect an announcement with regard to the timeline of the Tuvatu development project, including the expected MRE update, possibly a PFS, Tuvatu starter mine construction, and the first gold pour and commercial production. We also may learn more about the mine and pilot plant design.

If Lion One delivers an expanded MRE and a PFS, it will be much better positioned to secure finance for mine construction from, e.g., royalty firms.

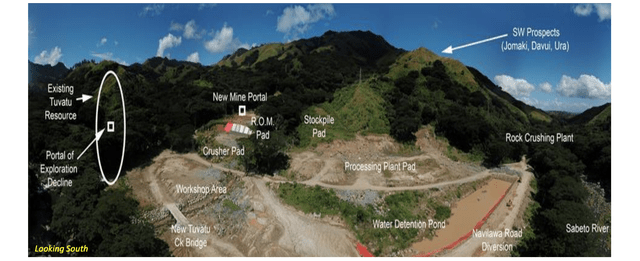

Given the bulk earthworks have been completed, if things go as I expect, Lion One may pour the first gold as early as late 2023 (see Fig. 7).

Fig. 7. A panoramic view of the future Tuvatu plant site, from the same source as Fig. 5.

Fig. 7. A panoramic view of the future Tuvatu plant site, from the same source as Fig. 5.

Risk vs. reward

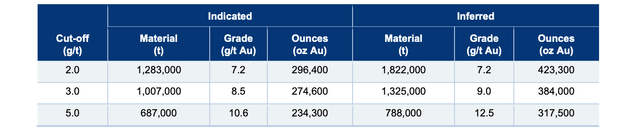

Lion One has 658.6 Koz of indicated and inferred gold resources and an after-tax NPV-5 of US$121.7 million according to the 2018 MRE update (Table 1). The US$93 million enterprise value as of late June 2021 thus defines an EV/MRE multiple of US$141/oz Au, and a P/NAV multiple of 0.8X.

Table 1. Tuvatu mineral resource estimate above various cut-offs, from the same source as Fig. 2.

Table 1. Tuvatu mineral resource estimate above various cut-offs, from the same source as Fig. 2.

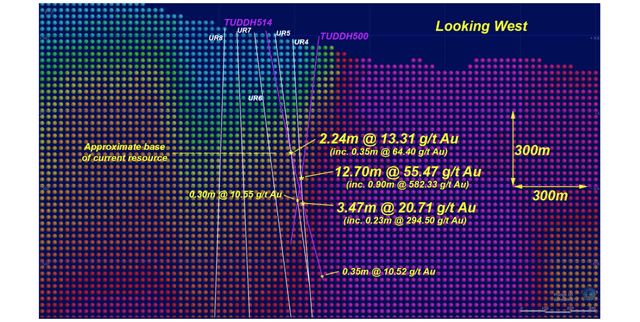

However, the above multiples have not given any credit to the deep gold encountered in recent drilling beneath the 2018 mineral resource area. Holes, e.g., TUDDH500 and TUDDH514, have more than doubled the maximum depth of the mineralization, while the veins remain open toward greater depths (Fig. 8). Ceteris paribus, the deep root of the Tuvatu deposit may have doubled the MRE pending further delineation. If that's the case, we will be looking at an adjusted EV/MRE of US$71/oz Au, which is more or less in line with development-stage peers.

Fig. 8. A cross-section looking west, overlain on CSAMT, from this source.

Fig. 8. A cross-section looking west, overlain on CSAMT, from this source.

Then, there's the blue-sky exploration upside as hidden in the regional prospects. I believe Lion One may end up finding half a dozen, if not more, Tuvatu lookalikes in the huge land package, thus raising Navilawa to the same MRE magnitude of its geological analogs in the southwestern Pacific. Such a growth prospect makes Lion One a unicorn candidate (Fig. 4).

With such an upside potential comes a plethora of risk factors:

- In the near term, the COVID-19 pandemic may deteriorate in Fiji, causing temporary delays in the exploration program of Lion One. So far, the vast majority of the COVID-19 infections occur on the southeastern, i.e., the opposite, side of the Viti Levu island, where local lockdowns have been enforced, while the sparsely-populated Nagado, Nalotawa, and Sebeto medical zones where Lion One operates are COVID-free at this time (see here and here). A lockdown of the entire island has been ruled out by the government.

- Subsurface uncertainties do exist. It's possible Lion One may not find as much gold as expected at Navilawa even though investors do have the Tuvatu deposit to fall back on.

- Whether Tuvatu can be profitably mined won't have the definitive answer until the completion of the starter mine, which is at least two years out. However, if the Tuvatu pilot project is a success, the cash flow generated thereby will help offset exploration capital expenditures and minimize equity dilution for existing shareholders.

- I'm not worried about political risk in Fiji as some seem to. I view Fiji as a politically stable, mining-friendly jurisdiction.

- Lion One trades on both TSX and OTCQX (the top tier of the three marketplaces for the over-the-counter trading of stocks) with adequate liquidity.

Investor takeaway

Stars are finally lining up at Lion One, following two years of painstaking preparation. Drilling beneath the Tuvatu resource area has proven the existence of deep-seated gold as predicted by the alkalic gold characterization, paving the way for testing Tuvatu look-alike targets throughout the expansive Navilawa land package. The pragmatic management was able to put in place a fleet of six self-owned drill rigs and an on-site assay lab, loaded up the cash coffers, and installed an on-site operational team. Local COVID-19 situation permitting, Lion One seems ready to generate a stream of exciting news regarding regional exploration as well as the expansion and development of Tuvatu. Therefore, I think it's time for investors who are still watching on the sidelines to consider building a starter position on the recent capitulation of the stock and adding to that position as positive news flows in.

Investing in Lion One certainly entails taking a fair amount of risk, which is, however, cushioned by the Tuvatu deposit. It's incredible Lion One trades today at the same share price as before the exciting discovery of deep-seated gold zones beneath the known Tuvatu orebodies, even though the company has an additional ~C$50 cash in the treasury and the gold price has risen by some US$300 (Fig. 9).

Fig. 9. The share price of Lion One Metals, as compared with the gold price, modified from this source.

Fig. 9. The share price of Lion One Metals, as compared with the gold price, modified from this source.

Based on what I presented in this article, I believe those who deserted Lion One in recent months fail to understand how many preparatory steps the management has had to take to put the stock on a launchpad, where I think it currently is. To those investors who do not appreciate the mining wisdom of Lion One Chairman and CEO Walter Berukoff, who mistake his calculated aplomb and proactive patience as lethargy, I venture to point out this is someone who acquired the Tuvatu project at the very bottom of the last gold bear market, who accomplished the consolidation of the Navilawa land package just before the gold bull market swung in earnest, and who filled up the company coffers with a perfectly-timed private placement right before gold entered a lengthy correction.

That's why I believe Lion One offers a unicorn-caliber upside at a moderate risk to discerning investors who are in want of exposure to a high-quality junior gold exploration play.