Holy Moly: Molybdenum Price On The RiseGreat News as a valuable offset, and boy do we have alot!!!

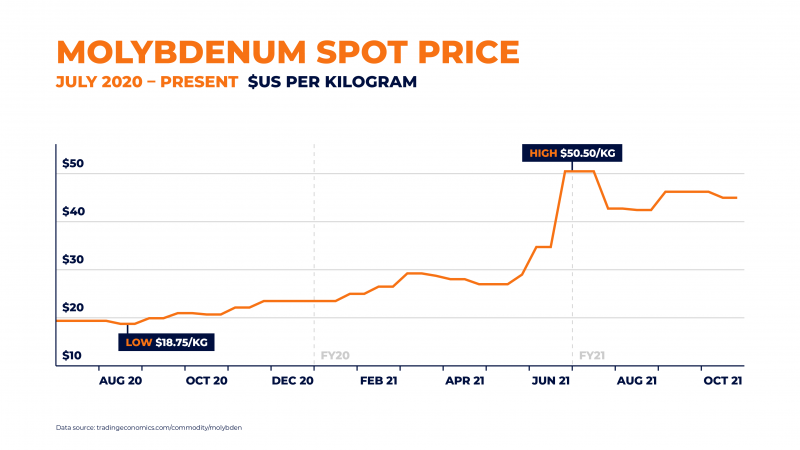

- Molybdenum has had a remarkable recent price run, rising from under US$20 (A$26.62) per kg in July 2020 to around US$45 (A$60) per kg in October 2021

- Mined mostly as a by-product of other metals and used mostly as an alloy, it’s molybdenum’s close links to steel that have helped drive this price increase

- China has been buying up huge amounts of molybdenum over the past 12 months as it turns to infrastructure to support its COVID-19 recovery

- Further, demand for molybdenum is being supported by the metal’s applications in energy creation, defence products, and new applications powering electric vehicles

- For investors, this means now could be a crucial time to get on top of the trend before global markets wake up to the future of the molybdenum market

The past 12 months have seen soaring commodity prices in global markets.

Yet, while lithium, gold, and iron ore have hogged the spotlight, one hard-to-pronounce material has been quietly but steadily increasing in value: molybdenum.

Often shortened to ‘moly’, molybdenum is not well known nor widely traded, but its spot price has risen from just under US$20 (A$26.62) per kilogram in July 2020 to around US$45 (A$60) per kilogram in October 2021.