Shutter2U/iStock via Getty Images

Shutter2U/iStock via Getty Images

Introduction

Newfoundland was steadily gaining notoriety as a gold mining province with the onset of production at Anaconda Mining’s (OTCQX:ANXGF) Point Rousse project. That was followed by two development projects by Marathon Gold (OTCQX:MGDPF) and Maritime Resources (OTCPK:MRTMF). Both of which are now headed to production.

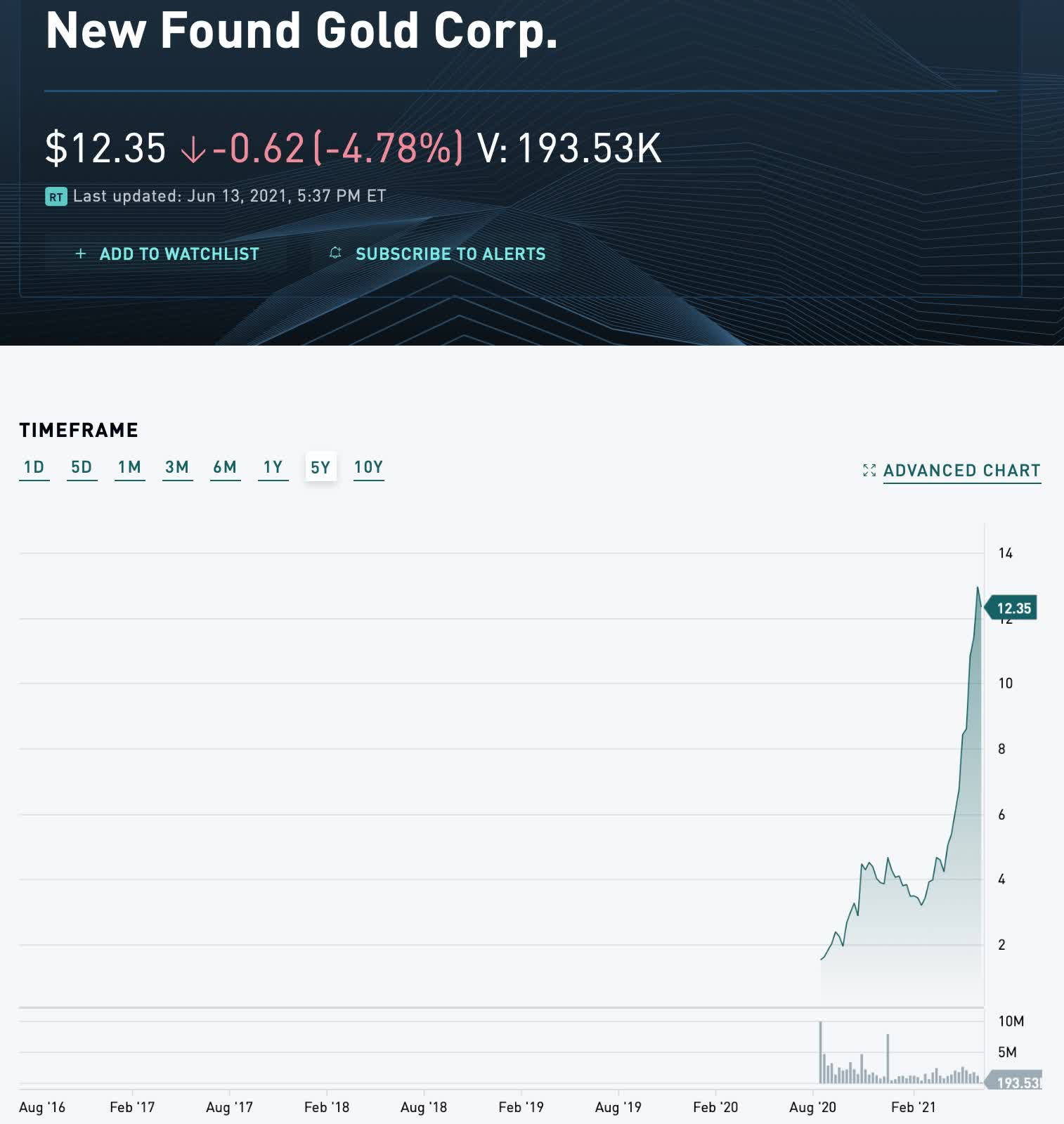

However, those three companies were just the warmup story. The big discovery was made by New Found Gold (OTCPK:NFGFF) at their large Queensway property (250,000 acres). They drilled a hole of 19 meters at 92 gpt. Since that hole, their market has exploded to a FD market cap of $1.5 billion.

New Found Gold was formed in 2020 with its initial IPO in August 2020. So, this discovery was unexpected and very recent. The IPO raised $20 million, and they began a 100,000 meter drill program that has since been expanded to 200,000 meters. Last month, they had a drill hole of 18 meters at 124 gpt, which is their biggest drill hole to date.

Incredibly, Eric Sprott, who was one of the original investors, bought more shares last week at these lofty prices (see chart below in Canadian dollars). The IPO was $1.30 Canadian. He clearly thinks that New Found Gold has a long way to run.

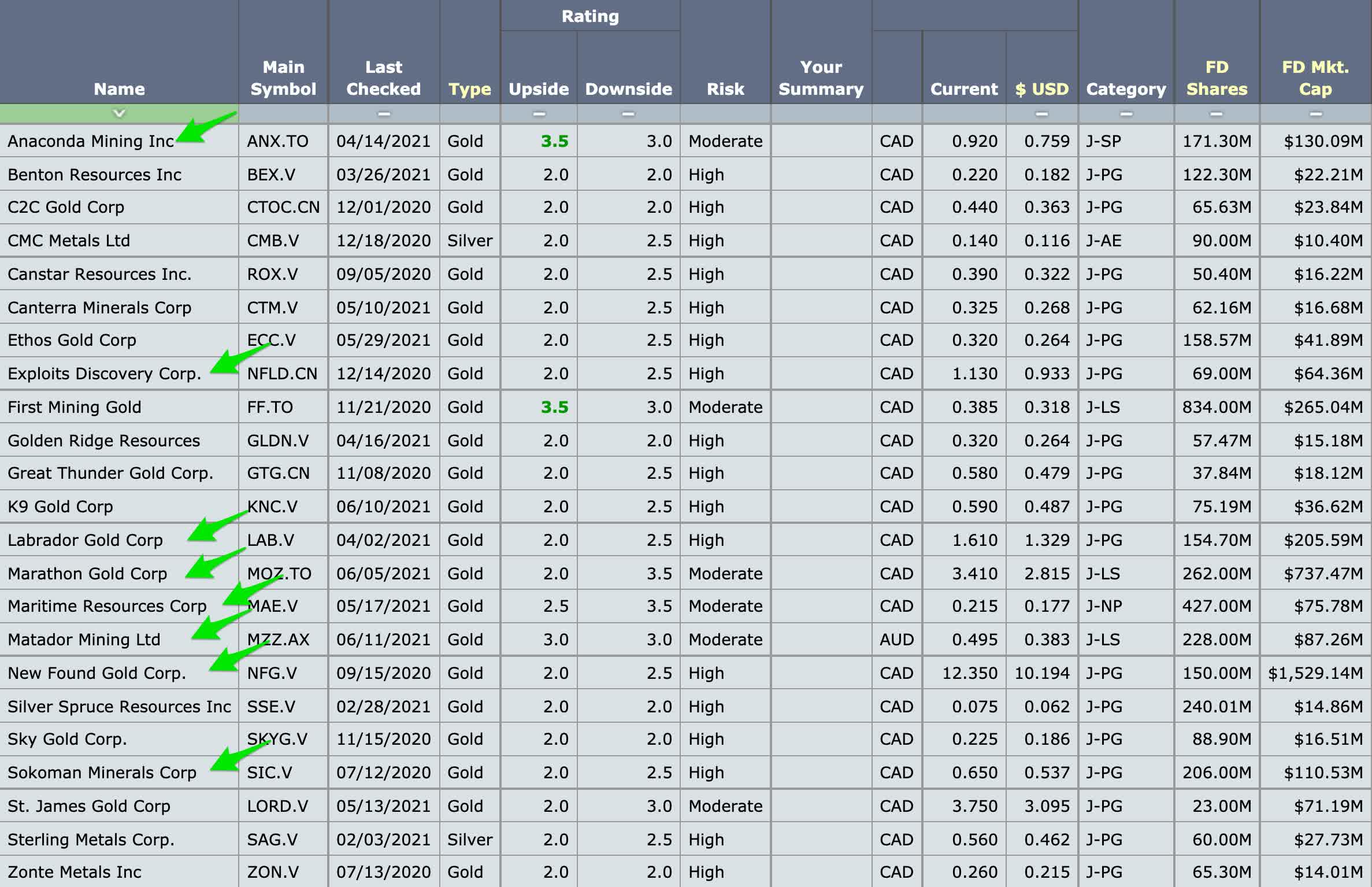

This large discovery is bringing a lot of money into gold exploration in Newfoundland. The list below (click on the image to increase its size) includes most of the players with a FD market caps over $10 million. Those with arrows are the companies that I think are the best positioned at this time to benefit from this gold rush in Newfoundland. However, it is early, and other players could arise.

In addition to those marked with an arrow, there are a lot of small caps on that list that look interesting. A few of these are likely to break out. These include Canstar (OTCPK:CSRNF), Canterra (OTCQB:CTMCF), Great Thunder (OTCPK:GTGFF), K9 Gold (OTCPK:WDFCF), Sky Gold (OTCPK:SRKZF), and Sterling Metals (OTCQB:SAGGF). These should be on your watch list.

Let’s look at the top 8, who each received a green arrow.

///////////////////////////////

Anaconda Mining

| Stock Name | Symbol (US) | Type | Category | Share Price (US) | FD Shares | FD Mkt Cap (6/10/2021) |

| Anaconda Mining | OTCQX:ANXGF | Gold | Small Producer | $0.74 | 171M | $127M |

Anaconda Mining is a small producer with 3 properties in Newfoundland. They are producing about 20,000 oz. per year at their Point Rousse project, with all-in costs around $1250 to $1300 per oz. They are currently marginally profitable, which provides some cash flow. They only have $2 million in debt and about $10 million in cash. Point Rousse is a small open pit deposit with about 50,000 oz. of reserves, but they have 15,000 acres and 35 targets to drill on 5 deposits. They think they can find at least 300,000 oz.

Their next mine is Goldboro, which is targeted for production around 2023. The capex is $70 million to produce 40,000 oz. annually. A feasibility study is due in 2022, then once it is permitted, it will be built.

Their long-term goal is to become a 150,000 oz. producer on their current properties. They could reach it because their properties have significant exploration potential.

Scorecard (1 to 10)

Properties/Projects: 7

Costs/Grade/Economics: 7

People/Management: 7

Cash/Debt: 7

Location Risk: 9

Risk-Reward: 7.5

Upside Potential: 8

Production Growth Potential/Exploration: 8

Overall Rating: 7.5

Strengths/Weaknesses

Strengths: Excellent location. Planned growth. Significant upside potential.

Weaknesses: Currently low free cash flow. Management still needs to prove its ability to grow. Low cash balance.

Investment Thesis

Still cheap with a lot of upside potential. Looks like a slam dunk as long as gold prices trend higher. There not many red flags, and if they become a 100,000 oz. producer at higher gold prices, it should fly.

//////////////////////////////////

Exploits Discovery

| Stock Name | Symbol (US) | Type | Category | Share Price (US) | FD Shares | FD Mkt Cap (6/10/2021) |

| Exploits Discovery | OTCQB:NFLDF | Gold | Project Generator | $0.93 | 69M | $64M |

Exploits Discovery has 7 properties in Newfoundland on 500,000 acres. Their properties surround New Found Gold's Queensway project. That is why it has a $64 million FD market cap without any drill holes. They plan to drill this summer.

They are cashed up and won't have trouble raising money in the near term. Insiders own 30% of the company, which is always a good sign and prevents hostile takeovers. It's a stock to watch, but it's probably a good idea to wait for a discovery hole.

I was going to leave them off this list because of the lack of drilling, but their properties are simply too big to ignore. They must have a plethora of drill targets.

Scorecard (1 to 10)

Properties/Projects: 7

Costs/Grade/Economics: 6

People/Management: 6

Cash/Debt: 6

Location Risk: 9

Risk-Reward: 6

Upside Potential: 6.5

Production Growth Potential/Exploration: 7

Overall Rating: 6

Strengths/Weaknesses

Strengths: Excellent location. Exploration potential.

Weaknesses: Likely share dilution. No guarantee that they will find a large mine.

Investment Thesis

No drill holes yet, so that adds a lot of risk. However, it might be the best spec bet on this list because of its current low valuation and quality location near Queensway. It seems to be under the radar. A few good holes and could easily double.

//////////////////////////

Labrador Gold

| Stock Name | Symbol (US) | Type | Category | Share Price (US) | FD Shares | FD Mkt Cap (6/10/2021) |

| Labrador Gold | OTCQX:NKOSF | Gold | Project Generator | $0.38 | 154M | $205M |

They have 3 early exploration projects in Newfoundland. All their properties are large: Hopedale (115,000 acres); Borden Lake (8,000 acres); Kingsway (17,000 acres). Last week they had a discovery hole at their Kingsway property of 3.6 meters at 20 gpt. That is not a stellar hole, but investors got excited since it came so early in their drill 20,000 meter drill program.

They raised $20 million in April and May before the discovery hole. So, they will have no problem raising more money. Incredibly it has a FD market cap of $205 million this early into their drilling. It is evident that Labrador is going to punch a lot of holes in their properties. At this time, they would seem to be positioned to be the next big thing in Newfoundland after New Found Gold.

Scorecard (1 to 10)

Properties/Projects: 7

Costs/Grade/Economics: 6

People/Management: 6

Cash/Debt: 6

Location Risk: 9

Risk-Reward: 6.5

Upside Potential: 7

Production Growth Potential/Exploration: 7.5

Overall Rating: 6.5

Strengths/Weaknesses

Strengths: Excellent location. Strong exploration potential.

Weaknesses: Likely share dilution. No guarantee that they will find a large mine.

Investment Thesis

A bit pricey and perhaps currently overvalued. That said, they just released their best drill hole and will probably find better holes. It's not a bad spec bet, but there is a lot of risk at this valuation. Usually, you don't want to buy drill stories at this valuation unless you are sure they have found a big mine. That said, it could be cheap if they keep finding high-grade gold with nice intercepts.

///////////////////////////

Marathon Gold

| Stock Name | Symbol (US) | Type | Category | Share Price (US) | FD Shares | FD Mkt Cap (6/10/2021) |

| Marathon Gold | OTCQX:MGDPF | Gold | Late Stage Development | $2.85 | 262M | $748M |

Marathon Gold is developing its Valentine Lake project. It is a 4.5 million oz. (open pit / underground) at 1.5 gpt deposit. Plus, it should grow in size. The exploration potential looks very good, according to their guidance. In 2019, they had drill holes of 41 meters at 4.4 gpt and 24 meters at 6.9 gpt.

Their FD market cap has exploded from $18 million in 2016 to $748. It has a feasibility study, and they are currently completing permitting. The after-tax IRR is 40% at $1300 per oz, so it is highly economic. All-in costs (break even) should be around $1,150 per oz. They have high insider holdings (50% owned by High New Worth investors) to prevent an unfriendly takeover.

The only red flag is the size of the project, which is like a magnet for majors. Plus, production isn't until 2023, with construction planned for 2022. If Marathon makes it to first pour without getting taken out, then they will likely become the first mid-tier producer in Newfoundland.

Scorecard (1 to 10)

Properties/Projects: 8

Costs/Grade/Economics: 8

People/Management: 7

Cash/Debt: 7

Location Risk: 9

Risk-Reward: 7

Upside Potential: 7

Production Growth Potential/Exploration: 7

Overall Rating: 7

Strengths/Weaknesses

Strengths: Excellent location. Strong exploration potential.

Weaknesses: A bit pricey. Takeover target.

//////////////////////////

Investment Thesis

A bit pricey, but still a long way to run if gold prices run. It is perhaps the highest quality miner in Newfoundland. They are likely to acquire at least one of the other stocks on this list. This is one I own and glad that I do. I just hope they do not get acquired. I want them to be the shark and not the bait.

Maritime Resources

| Stock Name | Symbol (US) | Type | Category | Share Price (US) | FD Shares | FD Mkt Cap (6/11/2021) |

| Maritime Resources | OTCPK:MRTMF | Gold | Near-Term Producer | $0.17 | 427M | $75M |

Maritime Resources is about 1 year away from restarting production (if they obtain financing). They completed a PFS in 2017, and it is economic with about a 35% after-tax IRR at $1,300 gold. Cash costs are forecast to be only $500 to $600 per oz. The capex is around $57 million to produce 60,000 oz. annually.

A feasibility study is due in Q4 2021. Permits are due in 2021. Production is possible in 2022. The Greenbay project has two deposits: Hammerdown and Orion. They plan to begin production at Hammerdown for the first 5 years and then expand to Orion. The deposit is 1 million oz at 6 gpt (500,000 oz. M&I).

It is 2,000 acres with exploration potential, so they could extend the mine life. Drill results have been strong at Orion (4 meters at 26 gpt near surface), and their FD market cap has jumped from $21 million in 2020 to $75 million today.

They recently acquired another property next to Green Bay called Whisker Valley (on 50,000 acres). This gives them significant exploration potential to extend the mine life. I like their chances. Anaconda Mining attempted a hostile takeover in 2018 and failed due to high insider ownership. I think this is a good sign of management's commitment to shareholders.

One red flag is their high share dilution. To build the mine, you can expect them to dilute about $20 million in shares. That's about 100 million shares if their share price does not rise. Plus, companies tend to want a bit of extra cash as a reserve, which could add another 50 million shares. The good news is they are finding gold. If they can double their resources, the dilution won't matter.

Scorecard (1 to 10)

Properties/Projects: 7

Costs/Grade/Economics: 7.5

People/Management: 7

Cash/Debt: 6.5

Location Risk: 9

Risk-Reward: 7

Upside Potential: 7

Production Growth Potential/Exploration: 7

Overall Rating: 7

Strengths/Weaknesses

Strengths: Excellent location. Exploration potential. Undervalued.

Weaknesses: Low resources to become a mid-tier producer. Takeover target. Timeline until production. Long wait to become a mid-tier producer. Management is unproven.

Investment Thesis

This is the best risk/reward stock on the list. I'm surprised it is so cheap. All they need is to find more gold and extend their mine life, which seems easy in Newfoundland. They are probably the ripest target for a takeover because of their low valuation.

/////////////////////////////

Matador Mining

| Stock Name | Symbol (US) | Type | Category | Share Price (US) | FD Shares | FD Mkt Cap (6/11/2021) |

| Matador Mining | OTCQX:MZZMF | Gold | Late Stage Development | $0.38 | 217M | $83M |

Matador Mining is developing its Cape Ray project. It is an 800,000 oz. (2 gpt) deposit. They plan to mine 80,000 annually, with cash costs projected at around $700 per oz. It’s a high-grade open pit at 2 gpt. The mine life is short, but they expect to find a lot more gold to extend it. I’m confident that will be the result.

The capex is $100 million, which will require significant share dilution to finance. They are currently permitting the project. An EIS (Environmental Impact Study) will be submitted in 2021 or 2022. The bad news is that it will take 18-24 months to be approved after the submission. That means it will not be construction-ready until late 2023 or 2024. We can’t expect production until 2025.

This long wait for first pour is why it is so cheap. The good news is that management is very strong. The CEO led Gold Road Resources (OTCPK:ELKMF) and DRDGOLD Ltd (NYSE:DRD) successfully. He knows how to build mines and how to find more gold. I expect him to make this a much larger resource. So, while it is a development project, it is also an exciting drill story. They have 30 new targets on their 50-kilometer trend. That exploration potential alone makes this an interesting company.

Scorecard (1 to 10)

Properties/Projects: 7

Costs/Grade/Economics: 7.5

People/Management: 7.5

Cash/Debt: 6.5

Location Risk: 9

Risk-Reward: 7

Upside Potential: 7

Production Growth Potential/Exploration: 7.5

Overall Rating: 7

Strengths/Weaknesses

Strengths: Excellent location. Exploration potential. Undervalued. Good economics.

Weaknesses: Low resources to become a mid-tier producer. Takeover target. Timeline until production. Likely share dilution.

Investment Thesis

This might be might favorite stock on the list. It has higher risk than some of the others, but I like the fact that they already have a nice-sized discovery that is being developed, plus huge exploration potential. And I like the CEO, who knows how to build large mining companies.

//////////////////////////////

New Found Gold

| Stock Name | Symbol (US) | Type | Category | Share Price (US) | FD Shares | FD Mkt Cap (6/11/2021) |

| New Found Gold | OTCPK:NFGFF | Gold | Project Generator | $10.19 | 150M | $1.5B |

New Found Gold is a new project generator. They have a large property (Queensway) on 250,000 acres. The company was recently formed using an IPO in August 2020, where they raised $20 million. With that money, they began a 100,000 meter drill plan that has now been expanded to 200,000 meters.

On their initial drill program, they had a discovery hold of 19 meters at 92 gpt. Subsequently, they have had many high-grade intercepts. Their market cap has exploded to $1.5 billion without an initial resource or estimated resource size. All investors know is that this is a large high-grade mine that appears to be increasing in size.

Last month, they had a drill hole of 18 meters at 124 gpt, which is the biggest drill hole to date. Also, Eric Sprott, who was part of the original IPO, bought more shares at $10 last week. His investing strategy is well known, and he does not invest for small returns. He clearly thinks Queensway is going to get a lot bigger in size.

Scorecard (1 to 10)

Properties/Projects: 7

Costs/Grade/Economics: 7.5

People/Management: 6.5

Cash/Debt: 6.5

Location Risk: 9

Risk-Reward: 6

Upside Potential: 6

Production Growth Potential/Exploration: 8

Overall Rating: 6

Strengths/Weaknesses

Strengths: Excellent location. Exploration potential. High-grade.

Weaknesses: Pricey. Management ability to build/operate mines. Unknown future exploration success.

Investment Thesis

Pricey, but could go a lot higher. They will drill a lot more holes and find a lot more gold. If Newfoundland's gold rush is going to have legs, this is likely the stock that leads the way. There is even a chance they could try to consolidate the area and make a few acquisitions. This appears to be a drill story, and I don't anticipate them considering becoming a developer/operator. But that is never out of the question.

//////////////////////////////////

Sokoman Minerals

| Stock Name | Symbol (US) | Type | Category | Share Price (US) | FD Shares | FD Mkt Cap (6/11/2021) |

| Sokoman Minerals | OTCQB:SICNF | Gold | Project Generator | $0.53 | 206M | $110M |

Sokoman Minerals has seven gold properties in Newfoundland (425,000 acres). Although two of the properties were optioned, and three are 50/50 JVs with Benton Resources (OTCPK:BNTRF). But they kept their two flagship properties (Moosehead and Fleur de Lys).

They are emblematic of the Newfoundland gold rush. In 2018, their FD market cap was $5 million. Today it is $110 million. And all they have are a few high-grade drill holes. Although, those drill holes have been pretty good. Last month, they reported two more high-grade drill holes of 4 meters at 22 gpt at Moosehead. They have strong insiders, including 15% ownership by Eric Sprott.

Investors are excited about their Moosehead property, with high-grade drill holes of 17 meters at 11 gpt and 16 meters at 14 gpt. Moosehead looks like a mine, but it is still early exploration.

Scorecard (1 to 10)

Properties/Projects: 7

Costs/Grade/Economics: 7

People/Management: 6

Cash/Debt: 6.5

Location Risk: 9

Risk-Reward: 6

Upside Potential: 6

Production Growth Potential/Exploration: 7

Overall Rating: 6

Strengths/Weaknesses

Strengths: Excellent location. Exploration potential. High-grade.

Weaknesses: Pricey. Management ability to build/operate mines. Unknown future exploration success.

Investment Thesis

Earlier, I said that Exploits Discovery might be the best spec bet on this list. However, Sokoman looks just as good. They also have a lot of properties to drill, plus they already have a discovery (Moosehead). It's too early to know which companies will find large mines in Newfoundland, but Sokoman is definitely in the running.

///////////////////

Conclusion

Clearly, there is a gold rush occurring in Newfoundland. Money is flowing in, and drilling is massive. There will be more drilled in Newfoundland in 2021 than all of the other Canadian provinces combined. And with the recent success of the seven miners I have listed, plus the other 20+ companies that are likely to drill in 2021, this gold rush is not over.

We are going to see a lot of gold mined in Newfoundland. The only question is how much, and how much more gold will they find? I think it is still early, but expectations could be too high. Many of these stocks could be pricey. In fact, I expect a correction soon in the gold price as fallout from a general stock market correction. So, buyers today could be underwater in the near term. I will probably wait and buy the coming correction. That said, I might be late to the party. It’s your call.

Disclosure: I am/we are long ANXGF, MGDPF, NFGFF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this articl