TOP 10 Reason to TRO in your Portfolio:Investors must have 'Reasons' to invest, in particular Jr Exploration where there are 1000s of choices, many who don't know what they are doing, are 'paper' companies and don't do anything, are 'pump & dump' - every few years cycle, lifestyle job for CEO, etc, troubled jurisdiction, to many shares outstanding, unfocused, poor strategy, or inept! As readers study these facts, are there any comments that resonate with StockHouse readers? Comments welcomed for this un-promoted company that has the: People, Project, Price, and Potential.

#1: The 1st 'Reason' to buy TRO is like . . . understanding the strength & experience of the Leadership = PEOPLE:

Directors

> John Gardiner (Exploration and Mining Geologist, Denver, Colorado)

• CEO & President • Veteran explorer worked with Placer Dome Inc., Noranda Mines, Echo Bay Mines and Cameco Corporation.

• Explored and managed many exploration projects that were subsequently developed into mines including Cortez & Detour Lake; discovery and exploration at several major mines: Wesdome, Detour Lake, Dome, Lupin, GECO, Prairie Creek and more.

• P. Geo., QP British Columbia, a Canadian

> Bo McCloskey (Mining Engineer, Toronto, Ontario)

• Involvement with many mining and resource development companies including Baffinland.

> Thomas Gardiner (Corporate Development, Denver, Colorado)

• ESG Director, a Canadian

• Business and Banking background

• Has been extensively involved in exploration and permitting in Finland and British Columbia.

> Gary McDonald (Vancouver, B.C.)

• CFO with long exposure to mining and exploration companies.

> Glenn Yeadon (Securities Lawyer, Vancouver, B.C.)

• Securities lawyer involved with many successful junior mining companies.

Taranis knows that it doesn't know what it doesn't know, so work with the best advisors, mining support and engineering companies during the last two decades - with the SAME BoD. That is why "PEOPLE" - and in particular these PEOPLE are my #1 Reason to hold TRO. (I have since 2007 & we have some very accomplished Can/USA investors backing the project) #2: The 2nd 'Reason' to buy TRO is like . . . understanding the THOR Project, in SE BC 8km N of Trout Lake which is S of Revelstoke in a small valley E of Arrow Lake.

A New Porphyry District is Emerging in B.C. –The Thor Project is the Elephant in the Room!

Location, History & Overview:

• Location • Good -to -excellent Infrastructure including year -round plowed highways. • Deposit located at 1,700 m ASL with property access by old mining and logging roads. • Local communities are well-versed in mining and are favorable to exploration and development.

• History • Shallow underground mines were explored and mined at a small scale as early as 1895. • These mines follow a northwesterly trending series of near -surface epithermal deposits called the Silver Cup Mining District. • The Thor project includes five historical mines that were identified beginning in 1896.

• Overview • Taranis’ holding of real property at Thor is “grandfathered” as a Fee Simple interest in land via mining Crown grants circa 1896 -1914. The Province does not own the minerals in the ground, and some of the surface rights – Taranis owns these. • Gold, silver, zinc, lead and copper occur in the Thor deposit and are likely to occur within other major exploration targets at Thor like the “Elephant” target – which was delineated via airborne survey in Spring 2022 and explained herein. • The deposit is known to contain economically recoverable amounts of copper, antimony, indium, nickel and cobalt.

• 100% Taranis owned.

• Classified as a precious metal deposit with base and by-product metals (RPA Cash Flow evaluation, 2013).

• 27 mining Crown grants (1890, early 1900’s) purchased from Eaton Family in 2006, many with surface and even water rights. This is the only known instance in British Columbia where a complete mineral deposit is privately held in Fee-Simple.

• Additional 3,100 hectares of overlapping and surrounding Mineral Tenures in good standing to 2028+

Thor: Strategic Plan

Taranis Has Proven There is an Epithermal Mineral Resource at Thor

• Deposit drilled out to NI-43-101 standards over 2.1 km with ~250 drill holes.

• 16.7 M. Oz. Ag equivalent (2013 RPA), and roughly double that with the company’s internal polygonal estimate done in December 2021.

• There is an intrusive that underlies the epithermal system, and the intrusive body has a large zone of thermal alteration around it. Taranis has Discovered this Historic Silver District to Possibly be a New Porphyry District in British Columbia

• A linked epithermal-porphyry deposit similar to Toodoggone (B.C.) and Lepanto (Philippines).

• Taranis has identified some opportunities related to infrastructure and other areas that can be combined to create a major, cost effective, and profitable mine.

Taranis Has Now Split its Exploration into Two Main Directives:

• Existing: Continuing to follow the epithermal deposit along what appears to be a 4 km strike length.

• New: Follow-up exploration, permitting and drilling of Elephant porphyry target. Follow-up exploration, permitting and drilling of FeNiCo and other large disseminated targets outlined by airborne survey.

Taranis Is Set to Capitalize on an Exceptional Knowledge Database of the Area Developed Over 15 years:

• Discretionary: Update old 2013 Resource estimate to increase market value of the company.

• Create explosive growth by drilling a porphyry deposit and other large disseminated-type deposits. #3: The 3rd 'Reason' to buy TRO is like . . . making money - the POTENTIAL is "Our Elephant" : Your Opportunity they are calling it: OUR 'ELEPHANT'; YOUR OPPORTUNITY [see PowerPoint on website]

#4: The 4th 'Reason' to buy TRO is like building a business from the ground up! With the right People and Plan on the right Project the Potential for hundreds of times gain is huge! IMO, "HIGH QUALITY" wins, and I'm glad, in the midst of 1000s of Jrs, this is my largest holdings. In the ups & downs of the exploration cycle, and often the difficulty in raising money (causing great dilution which leads to our lower equity and often 5:1 & 10:1 consolidations (killing our/your equity) - which Taranis has NEVER needed to do) Taranis has survived & thrived!

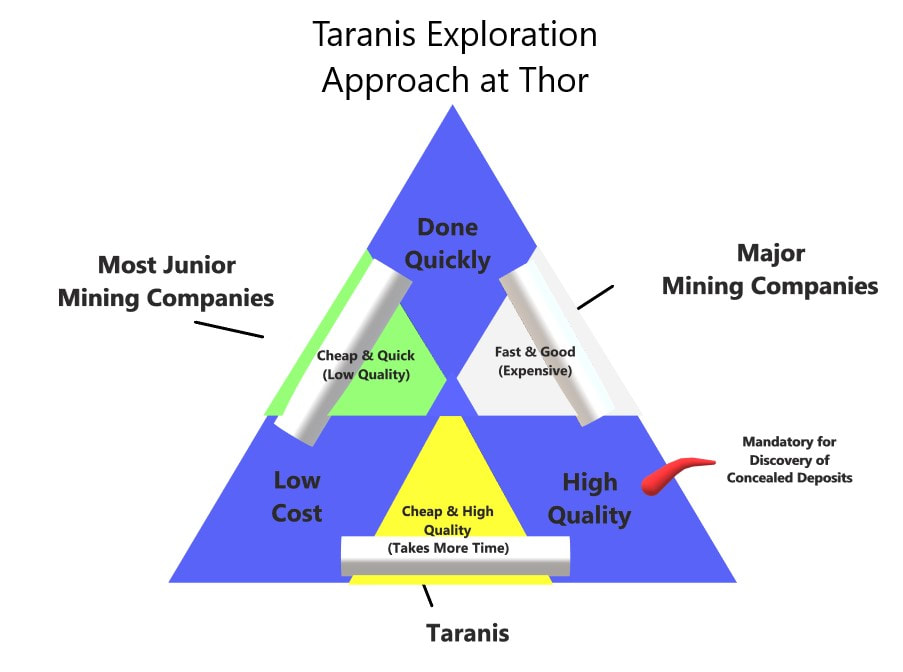

From: https://taranisresources.com/ ===> "Corporate" heading on right side of 'Home' ===> "Triple Constraint" we see an incredible picture of folding in a rock at the THOR Project site & this common sense, frugally careful and responsible approach to 'taking' investors $$$ and investing (not spending/wasting) wisely into the project for the GREATEST RETURNS for shareholders (while rewarding themselves with a future big payout) and the future mine or huge buyout. The philosophy is: OUR EXPLORATION APPROACH AT THOR

Graphic Description showing Taranis Exploration at Thor | In any exploration program, there are restraints that an exploration company needs to be aware. Serious mineral exploration companies in British Columbia and elsewhere know that certain metallogenic terrains are capable of concealing sizeable, undiscovered mineral deposits. This means that they will often be exploring in old mining districts that provide surface indications that may be connected to larger hidden deposits. With any ‘brownfield’ type exploration, the search for concealed deposits brings with it an exponential increase in the amount of work and capital required to identify these types of targets. The fact is, it costs money, time and sweat equity to find these targets, and most of the entrenched junior mining company approaches do not work. For these reasons, Taranis constructed a different approach to exploration at Thor – one that enabled a small company to explore for large deposits – and do it in the context of maintaining shareholder value. |

Small companies like Taranis do not have the luxury of randomly drilling expensive deep holes to test for the presence of concealed porphyry-type systems, and the targeting needs to be surgical. It is difficult for junior mining companies to undertake such work because the scope and quality of work that is required is typically found only within larger mining companies.

Exploration companies choose from three available approaches: “Done Quickly” “Low-Cost” and “High Quality” – Only two of these approaches can be applied to any exploration project in general, and all mineral exploration fits somewhere into the “triple-constraint triangle”. As a small-cap junior exploration company, Taranis has a “Low-Cost” constraint chosen for us – allowing Taranis to choose between “Done Quickly” or “High Quality” as the remaining approach. The fact is that difficult to find concealed targets will not be found with “Done Quickly” – and the delineation of these types of targets by necessity is “High Quality”.

At Thor, Taranis has spent in excess of $8M defining a portion of an epithermal deposit, but always remained conscious that there is likely something much larger under the near-surface epithermal deposit. Using this “High Quality” approach, Taranis was able to discover the Thunder Zone concealed under a rockslide at the north end of the Thor epithermal deposit, and we believe the next step in this exploration approach is the discovery of an underlying porphyry deposit at Thor.

#5: I like & prefer 'skin-in-the-game' by my preferred stocks with big committments from Management & Board of Directors - showing EACH one involved - is REALLY involved & REALLY committed. The advancement of a company is paramount that INSIDERS take risks - AND continue to up their stake! How do Jr companies expect the retail investor to take risks - if they don't? With all investments there are risks . . . and rewards, and to me this fact reduces my risk.

Looking up the "Ownership" category on StockHouse shows the following high ownership of 32.57% from 5 BoD, led by Taranis CEO/Geo John Gardiner. If you dig further with additional DD on filings on SEDAR+, reading the FS & MD&A there's an additional ~10% of related companies, thus totalling 42% for a handfull of BoD/Mgmt. I have read in the past, that a few dozen control ~80% of the stock - showing BIG committments.

The Taranis BoD don't rely on Options either - that many un-committed Jrs do! #6: VERY, VERY, VERY LOW G&A! All current and future shareholders take comfort knowing that Taranis puts the funds raised INTO THE GROUND, not the pockets of Insiders, BoD fees, wasted marketing, fancy rent, etc.

The beauty of disclosure on SEDARPlus.ca is that we little investors get to see where the money goes - like the Jerry Maquire movie: "Show me the money". Do your own DD to see other comparisons. Little Taranis with a superb BoD with very high ownership (= skin-in-the-game) has a little Market Cap of $12M, 95M Shares Outstanding & Hi/Low of $0.24/0.105, is very undervalued because of lack of promotion,

#7: MRE VALUE! In 2013, Roscoe Postle Associates Inc. completed the first-ever Resource Estimate on the Thor deposit. [current P&E updated 2024 MRE that includes the epithermal deposit only & open]

#8: Connections! When the Western tectonic plates hit the main North American plate mountain ranges were formed. When volcanics occured cracking occured and we have a string of valuable PM and base mines from Argentina to Mexico to Utah Yukon/Alaska.

If we run a line from Bingham Canyon, Utah, the world's largest opeh-pit mine, established in 1906 and currently down to 1,200 meters and 4,000 meters width, all the way to the Brucejack Mine in the Golden Triangle, via all the Boise Idaho mines, who can see the connection to BC projects, including Taranis at Trout Lake, in SE BC.

While you are at the comparisons, look at the geothermal activity in the larger hot springs in BC & AB - in particular #5 at Halycion, and #6 at Nakusp: https://landscapes-revealed.net/why-are-there-so-many-hot-springs-in-southeastern-british-columbia/#:~:text=The%20gradient%20is%20about%2025,where%20the%20temperature%20is%20hot. #9: Thor project (Blue Bell, True Fissure, St. Elmo, Broadview and Great Northern) saw extensive Underground exploration, but only minimal mining.

A Forgotten District

The Silver Cup Mining District is located east of Upper Arrow Lake, in an area of very rugged terrain. The District is a cluster of deposits and mineral occurrences that is approximately 40 miles in length, and starts southeast of Revelstoke on the Trans-Canada Highway and extends to the southeast end of Trout Lake. The District consists of three mineral belts. The largest, and most important is the Central Mineral Belt, and this includes a number of old prospects and mines, the largest being the Meridian/Eva, True Fissure (Thor), Silver Cup and Triune mines. Both the Silver Cup and Triune saw significant production history, and the old workings that constitute the Thor project (Blue Bell, True Fissure, St. Elmo, Broadview and Great Northern) saw extensive Underground exploration, but only minimal mining.

#10: Limited dilution since Inc in 2001. Started THOR Project in SE BC in 2006 gaining 5-historical mines with Crown Grants - from T. Eaton Estate (due to long-term family relationship).

NO rollbacks or consolidations in company's history. A major accomplishment in the years of up & down Jr Exploration cycles.

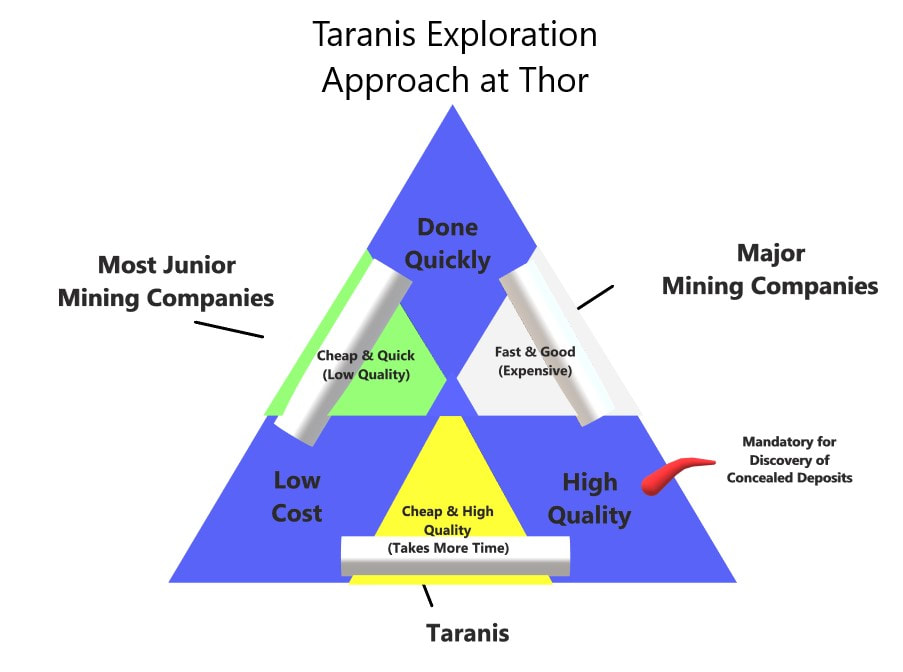

As of July 31/2023, Taranis currently has 93,537,104 shares issued and outstanding (108,212,104 shares on a fully diluted basis). [currently ~97M SO] OUR EXPLORATION APPROACH AT THOR

Graphic Description showing Taranis Exploration at Thor | In any exploration program, there are restraints that an exploration company needs to be aware. Serious mineral exploration companies in British Columbia and elsewhere know that certain metallogenic terrains are capable of concealing sizeable, undiscovered mineral deposits. This means that they will often be exploring in old mining districts that provide surface indications that may be connected to larger hidden deposits. With any ‘brownfield’ type exploration, the search for concealed deposits brings with it an exponential increase in the amount of work and capital required to identify these types of targets. The fact is, it costs money, time and sweat equity to find these targets, and most of the entrenched junior mining company approaches do not work. For these reasons, Taranis constructed a different approach to exploration at Thor – one that enabled a small company to explore for large deposits – and do it in the context of maintaining shareholder value. |

Small companies like Taranis do not have the luxury of randomly drilling expensive deep holes to test for the presence of concealed porphyry-type systems, and the targeting needs to be surgical. It is difficult for junior mining companies to undertake such work because the scope and quality of work that is required is typically found only within larger mining companies.

Exploration companies choose from three available approaches: “Done Quickly” “Low-Cost” and “High Quality” – Only two of these approaches can be applied to any exploration project in general, and all mineral exploration fits somewhere into the “triple-constraint triangle”. As a small-cap junior exploration company, Taranis has a “Low-Cost” constraint chosen for us – allowing Taranis to choose between “Done Quickly” or “High Quality” as the remaining approach. The fact is that difficult to find concealed targets will not be found with “Done Quickly” – and the delineation of these types of targets by necessity is “High Quality”.

At Thor, Taranis has spent in excess of $8M defining a portion of an epithermal deposit, but always remained conscious that there is likely something much larger under the near-surface epithermal deposit. Using this “High Quality” approach, Taranis was able to discover the Thunder Zone concealed under a rockslide at the north end of the Thor epithermal deposit, and we believe the next step in this exploration approach is the discovery of an underlying porphyry deposit at Thor.

[note to readers: this is my viewpoint taken off of the website & was posted in 2023. I'm not a geo, or advisor, just a long time investor. E&OE]