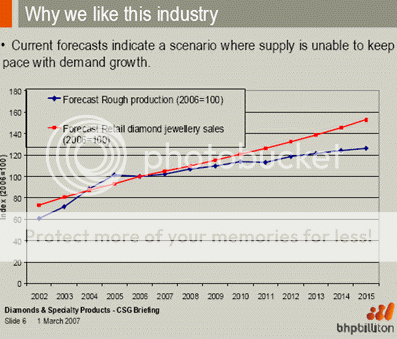

RE: $2.24 billion in H1In my opinion... pfn43 post (and answer to jcja – “So” question) was demonstrating the demand vs. supply of ruff diamonds is widening because the world markets are getting more self-economic.... and in simple terms, this means more can afford the same fringe benefits.

USA was the biggest market for diamonds, and remains so, but today as these emerging economies develop we see many changes that are shaping today’s markets, See the note below: and as it relates to exploration/mine timelines remember Iciena is 5 to 6 years advanced.

Author: Tessa Kruger

Posted: Thursday , 24 May 2007

Johannesburg -

The gap between diamond demand and supply is set to widen from mid-2008 as demand from India and China will grow but no major new mines are expected to come on stream in the next three years.

Major producers are experiencing good demand for better qualities of rough diamonds and expect this trend to continue as growth in major world economies remains robust and new markets for jewellery develop, said diamond analyst Des Kilalea in his recent RBC report on the diamond industry.

Retail demand for diamond jewellery in 2007 is robust and the major producers expect growing demand from oil-producing states, and from India and China Jewellery sales grew in excess of 5% in 2006.

This robust outlook is despite the fact that short-term obstacles exist in the form of rising interest rates and the fate of house prices in the United States.

According to De Beers, the size of the diamond consuming market in India and China is expected to grow at 7% compound every year - from 33 million consumers today to 65 million by 2015.

But new diamond production has been relatively static since the opening of the Diavik Mine (60% owned by Rio Tinto and 40% by Aber) in Canada in January 2003. This is despite the fact that more than $1 billion was spent on exploration in Canada alone since 2003.

Metals Economic Group says that the total budget for exploration on diamonds has risen to $850m from $247 million in 2002. This represents 12% of global exploration budgets.

The fact that not a single new mine was opened as result of the exploration spend, is testimony to the difficulty in discovering a new economic diamond mine.

Moreover, many of the diamond mines still in operation are beyond their production peaks. Mines that expect lower production in the years ahead include BHP Billiton's Ekati mine in Canada, Rio Tinto's Argyle mine in Australia and the majority of De Beers' South African mines.

The forecast shortage of gem diamonds and firmer prices have also stimulated exploration spend by a host of juniors; many with majors as joint venture partners.

Economic kimberlites tend to be clustered and therefore exploration is focused on known producing countries, particularly in Africa. Most companies are now concentrating their efforts in southern and central Africa, notably Botswana, Angola and the Democratic Republic of the Congo (DRC).

But exploration is difficult and expensive and history shows it takes at least five years from discovery of a kimberlite to the development of a mine.

And although exploration spend is expected to continue to be high, the prospect of a major mine to come on stream in the next three years is remote. Only African Diamonds' AK6 pipe in Botswana and possibly BHP Billiton and Petra Diamonds' Alto Cuilo are likely to add meaningfully to world diamond production in the next five years.

The production of more mature producers is declining and the world would need something like a new Ekati - the BHP Billiton mine that delivers 4% of world production by weight and 6% by value - every year in five years' time.

Gem quality diamonds dictate the returns of diamond miners as gem and near-gem diamonds account for 96% of total volume of rough diamonds consumed worldwide. Gems are consumed in jewellery manufacturing.