Lou Basenese, The Associate Editor of the Oxford Club is a respected friend and colleague. With his permission, I want to share what he recently wrote on the pharmaceuticals (drug companies). He has some very interesting observations and recommendations that we should all take to heart. His trading services are very worthwhile and I am an enthusiastic subscriber.

• • •

What the Heck Happened to this Sector?

By Louis Basenese, Oxford Club (www.OxfordClub.com) Associate Investment Director

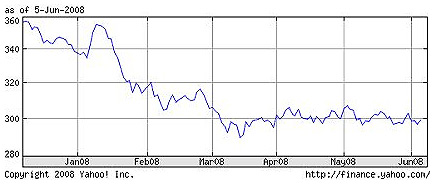

This chart should leave you dumbfounded...

Why?

Because since 1945, the industry (depicted above) recorded the smallest declines during a recession. Not happening.

It also outperformed the S&P 500 five out of six times since 1974, when the Fed started cutting rates. Not happening either.

And it's historically one of the best performers in the six months leading up to and into each of the last four recessions since 1980. Again, not happening.

Plainly stated, this perennial go-to defensive industry - with annual sales topping $643 billion - should be torching the markets right now. Official recession or not. And yet it's lagging.

The lifeless chart above represents the AMEX Pharmaceutical Index. So why are drugs such a bad investment this time around?

Two reasons. The pipelines of most Big Pharmas are bone dry. And post-Vioxx, the FDA's on new-approval lockdown. Last year, it approved the lowest number of new drugs (19) since 1983.

With that in that mind, the nosedive above seems plausible. It's even reason to consider avoiding the industry altogether. But we know better. Opportunity always lurks in the wreckage. And this time is no exception.

One Big Pharma, in particular, is being unfairly punished. I say that because it doesn't suffer from an empty pipeline. It's launched more drugs globally than any other firm in the past seven years. It has more than 100 projects in phase II (or later) trials. And it expects to file at least six new drug applications this year alone.

Plus, its products cover all bases, from vaccines to specialized drugs to generics to eye-care products, even animal health items. And most are enjoying rapidly expanding sales.

Moreover, the company maintains a fortress-like financial position that includes a $10.8 billion cash horde. Management keeps raising the dividend, for 11 years and counting. And it recently announced a massive $9 billion stock-repurchase plan, too. Hardly the hallmarks of a sickly stock.

And that's exactly why Novartis (NYSE: NVS) - the world's fifth-largest pharmaceutical company - is part of our portfolio.

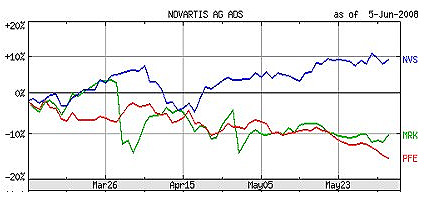

Here's the thing. In the February mid-month Communiqué, we told you a divergence was setting up. That Novartis would shake off the selling pressure and break away from the pack because of its superior fundamentals.

Well, I'm happy to report it's happening. Since April 14, the stock's up roughly 15%, leaving peers Pfizer and Merck in the dust.

We can attribute the recent outperformance to a confluence of events...

First and foremost, investor distaste for big pharma stocks simply pushed Novartis shares down too far. At one point, they were trading below their five-year average price-to-earnings ratio. A snapback was inevitable.

But Novartis did its part to encourage a rebound, too...

In early April, it announced an acquisition of Nestlé's 77% stake in eye-care product company Alcon for $39 billion. A nice bolt-on acquisition, certain to enhance its near-term growth opportunities.

Shortly after that, Morgan Stanley made a prescient call. It upgraded the stock based on increased expectations for the company's vaccine business. Recall in 2005, Novartis purchased Chiron, making it a major competitor in the vaccine market - a high-margin industry, expected to grow by at least 20% per year for the next five years.

And sure enough, when Novartis reported earnings a few days later, it beat expectations. Net income rose 7% to $2.32 billion, thanks in large part to accelerating sales for its vaccines.

After that, Novartis turned what many expected to be a non-event- the annual meeting of the American Society of Clinical Oncology - into a PR manager's dream. It stole the show with what looks to be a sure-fire new drug (RAD001) for kidney cancer patients. We also got word that its bone drug Zometa reduced the risk of breast cancer recurring by 35% in an 1,800 person trial.

The favorable news earned Novartis another upgrade, this time from Cowen & Co.

To cap things off, Novartis announced another acquisition, just this week. It's buying a closely held biotech company, Protez Pharmaceuticals for $400 million.

The move brings PZ-601 into Novartis' line-up. PZ-601 is an antibiotic used to combat potentially fatal drug-resistant infections, or superbugs such as MRSA (methicillin-resistant Staphylococcus aureus).

In the end, the string of promising developments and the resulting price action make it time to move Novartis back to a "Buy." Recall we put it on "Hold" earlier in the year as the industry downdraft put shares perilously close to our trailing stop.

But with a clean break established, and the best pipeline in the business, Novartis stands out as the only Big Pharma worth owning. By my estimates, shares could reasonably trade at $80 or higher in the next year. So get back to buying.

Good investing,

Louis Basenese