The investment thesis on ABB is relatively straightforward. ABB has smartly positioned itself as an “energy efficiency” solution provider. Its products & services can be found at every node of the energy value spectrum, resource production, transportation, por generation, por transmission & distribution, and even consumption. Here is a sampling of the types of solutions that ABB offers:

- motors that efficiently por deep-sea drilling rigs

- marine propulsion systems that transport the oil

- substations, circuit breakers, capacitors used in electricity generation

- high, medium, low voltage transformers used to transmit and distribute energy across

- power grid automation, robotics, and variable speed drives/motors that drastically reduce industrial consumption

ABB is well positioned competitively to maintain its leadership status in most of the markets it serves. An enormous installed base, economies of scale, and a core competency in efficiency solutions provides the company with an enviable competitive moat. It's industry leading R&D budget that has generated a voluminous portfolio of intellectual property and innovative new products has galvanized this edge over the competition. Lastly its global footprint positions ABB favorably to benefit from rapidly growing emerging markets. Only 15% of revenues are generated in the US, and almost 40% from fast growing emerging markets. Interestingly, its leading market share in Asia is likely remain firm, as customers in that part of the world place greater emphasis on business relationships, and are more likely to award new contracts to their existing network of suppliers, a Chinese social custom known as Guanxi.

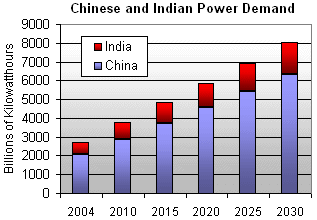

New Infrastructure needs to be built to support electricity demand in emerging markets-

As a provider of infrastructure & energy efficiency, ABB finds itself in a “perfect storm” of end-market demand. Emerging market electricity demand is expected to grow from 8B kilowatts per hour to 16B kw/h over the next 20 years. As population and GDP grows in these parts of the world, new infrastructure will be required to provide the energy to fuel that growth.

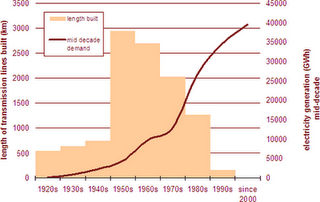

Existing Infrastructure in developed markets needs to be replaced -

Wall St. as ll as the entire northeastern US remember the summer of 2005 power outage in that left more than 20% of the US population in the dark for nearly 24 hours. A huge capital investment cycle in the 1960’s and 1970’s followed by a long period of neglect has left the US power grid in brittle condition, and as the head of the EIA describes, “one or two heat waves” away from crisis. The average US transformer is over 40 years old, ll beyond the average life expectancy for that type of equipment.

Energy Efficiency

– The low hanging fruit of the green movement. While less “sexy” than other green investment opportunities, efficiency improvements are the low hanging fruit of the energy problem. 65% of energy use and CO2 pollution can be attributed to motors and engines. ABB’s variable speed drives and motors can significantly lor energy consumption and pollutants, yet in the US are used marginally (only 5% penetration). For perspective, consider that the installed base of these drives/motors in Europe has reduced annual consumption of energy to a level equivalent to 32mm households (1/3 US households!) and reduced yearly CO2 tonnage by the amount that the entire country of Ireland emits on an annual basis. Throughout the energy value chain, ABB believes it can reduce waste by about 20%, generating low-risk, high return on investment opportunities that businesses and governments will find hard to walk away from.

Renewable Momentum

Remote energy sources (solar/wind) will require transmission

Renewables – Public and legislative momentum as economic parity with traditional coal, gas, and nuclear fired power plants is stimulating demand for renewable energy sources around the globe. While wind and solar power have become a meaningful part of the European power grid, the US still only generates about 2% of its electricity needs from such sources. Because renewable power sources are often great distances from the population centers that they serve (think Arizona!), infrastructure such as high voltage transformers must be used to effectively distribute the energy. ABB is the #1 player in this type of equipment.

Catalysts & Low Expectations

May drive upside surprise for investors

In addition to these growth drivers, ABB has a great balance sheet, which could be a catalyst for the stock. The company has paid off most of its debt and now boasts a net cash position of over $6B, which can be used as competitive ammunition, for strategic M&A, or simply can be returned to shareholders through dividend or share buybacks. Expectations are modest relative to recent results, and believe the 10% earnings growth that Wall St. is anticipating will be easily surpassed. A closer look at the company backlog reveals a visible stream of high margin revenue yet to be realized.

Fundamentals & Valuation very attractive – Price target of $43

Returns for the company have been strong. Margins have grown from 5% to almost 12%, and the company sees 18% margins down the road as internal goals are met. Return on invested capital is ll over 20% highlighting quality management and focus on creating shareholder value.

Valuation is reasonable

For a company growing earnings at a 20% rate over the long term, a P/E of 18 represents a fair value in our opinion. This is a 20% premium to the market, but would argue growth prospects and profitability deserve an even greater premium. I am also comforted by the free cash flow yield of just over 4%, and annual free cash flow generation of about $4B. Using relatively modest assumptions (about 10% long term growth) and a 8% discount rate, I arrived at an intrinsic value of about $43 for the shares.

In conclusion, I found it difficult to poke holes in this investment case. While the world adjusts to $130 oil, terrorism, and a rapidly growing population, ABB’s products and services address some very real problems. While we may not be able to find more energy, and it may take several years to find alternatives, ABB offers solutions to get much more out of what have, today.

Disclosure: None