Gold Outperform Other AssetsGold Continues to Outperform Other Assets

by: Mark O'Byrne March 23, 2009

Last week was a historic week, with the Federal Reserve opting for the “nuclear option” of money creation on a trillion dollar scale.

Gold and silver rose 2.7% and 4.5% respectively. The gains would have been much more but for an unusual and unexplained very sharp selloff in the precious metals immediately prior to the Federal Reserve’s dramatic and historic emergency announcement.

Commodities and stocks also reacted positively but less so and the major US indices finished the week marginally higher (DJIA +0.75%, S&P +1.6% and Nasdaq +1.8%).

The US Treasury’s latest toxic asset plan will cost another $1 trillion plus and US deficits are surging as Wall Street’s toxic losses are socialised and foisted on already hard pressed tax payers. The US budget deficit will hit $1.8 trillion this year, a record amount, according to US Congress estimates. The CBO also predicted that President Obama’s budget would result in a total deficit of $9.3tn over 2010-2019, worse than the White House had anticipated. The massive deficit forecasts come after President Obama’s $3.55 trillion budget plan for the 2010 financial year.

click to enlarge

Bailouts, stimulus packages and deficit spending are now surging internationally (Japanese Prime Minister Taro Aso’s next stimulus package is set to exceed 10 trillion yen) and this will likely see not just the dollar but all fiat paper currencies falling against the finite currency and monetary asset that is gold.

While institutions and central banks are increasingly looking to gold’s safe haven attributes as portfolio insurance, retail investor sentiment remains lukewarm with only a minority of the investment public having any allocation to gold whatsoever and the vast majority of the mainstream media almost completely ignoring gold’s continuing outperformance of other assets and extremely strong fundamentals.

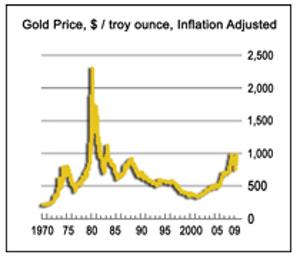

Media coverage of gold continues to be lukewarm and focuses on the fact that gold has not yet surpassed its record nominal high of $1,030/oz, which is pointed out repeatedly.

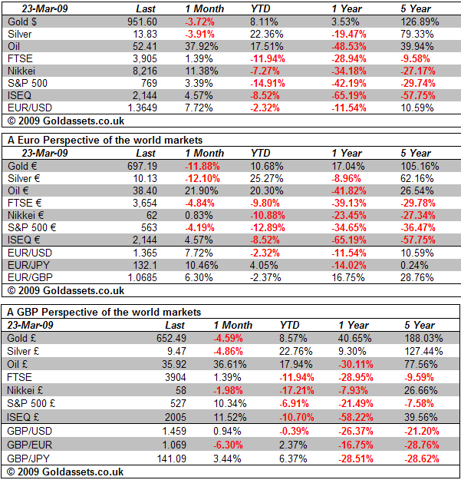

What is rarely pointed out is that gold rose in nearly all currencies in 2007, in 2008 and is up some 8% in dollar terms (more in euro and sterling and far more in other smaller currencies many of which have fallen very sharply) so far in 2009 in stark contrast to equity markets (see Performance tables below).