A solid perspective [Part 1]From Quackaphobe

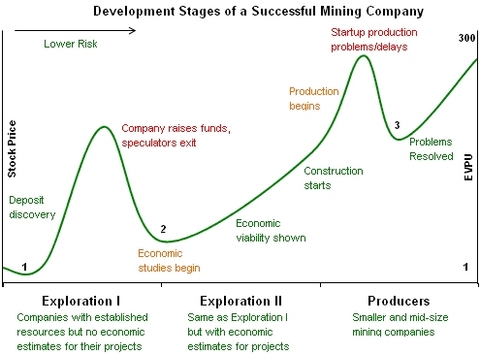

Mining companies go through a series of stages from listing on a stock exchange to becoming a producer. A chart of a successful mining stock typically looks as follows:

There are three ways to profit based on the above cycles. First (point 1) – find a lucky junior exploration company that will make a discovery. Second (point 2) – buy undervalued shares of stock with established resources for cheap and ride it to production. Third (point 3) – pinpoint a troubled junior producer at the moment of an operational turnaround.

In our view, the second approach is certainly safer than the first and has more upside than the third approach given the project is economically viable and the management has what it takes to capitalize on that.

Sounds easy? Not really, because after months of little news or visible progress by the company, it is difficult to get into a stock that is falling for no comprehensible reason. One can’t help but start hesitating. Let’s first examine why it is typical to see a stock give up most of its post-discovery gains.

When the speculative new discovery-related hype is over (first peak on the chart), a waiting period begins. Speculators take profits anticipating that the company will use the high stock price to issue new shares and raise cash.

The stock starts falling and even the loyal shareholders lose patience: why is the stock price falling when the company seems to be putting in its best effort to advance its discovery to development? More and more doubts surface and many shareholders get out. New investors are scared to buy, seeing a falling price.

The main reason stocks often lose most or even all of their discovery gains is the high demand for cash required for preliminary economic and feasibility programs, at the time of zero cash flow and little or no substantive news.

But these quality companies are making progress behind the scenes. They are issuing technical reports, upgrading resources and piecing together various project development studies. The time approaches for a patient and shrewd investor to find exceptional value.